How Your Personality Type Impacts Crypto Habits

Key Takeaways

- Extroverts are 28% more likely to invest in crypto than stocks.

- Feelers are 15% more likely than thinkers to get addicted to crypto trading.

- Extroverts gained the most from crypto investing in the last year ($896.98).

- Introverts are the most likely to invest during a recession (79%).

The Psychology of Crypto

Can a personality test predict how well your cryptocurrency investments will do? We uncovered how personality traits correlate with crypto trading choices, outcomes, and returns on investment (ROIs). Read on to find out where your investments might stand based on your personality.

Investing According to Your Personality Type

First, we used a set of questions to assess respondents' personality traits. Then, we used a list of eight personality types to assign one to each investor. Let's look at what the different personality types might tell us about their crypto investment habits.

We identified four pairs of opposing personalities. Which one do you identify with the most?

- Extroverts are sociable, assertive, and often cheerful. They're prone to seeking novelty and excitement. Introverts are thoughtful, reserved, and can be less impulsive than their counterparts.

- Feelers are subjective, tending to follow their hearts and feelings, while thinkers are more objective and make decisions based on logic.

- Sensors are practical and present in the moment, taking most things at face value. Their counterparts, Intuitives are imaginative, abstract thinkers who read between the lines.

- Judgers value sequence, organization, and order, while perceivers are more adaptable and flexible. They can be risk-takers who thrive on the unexpected.

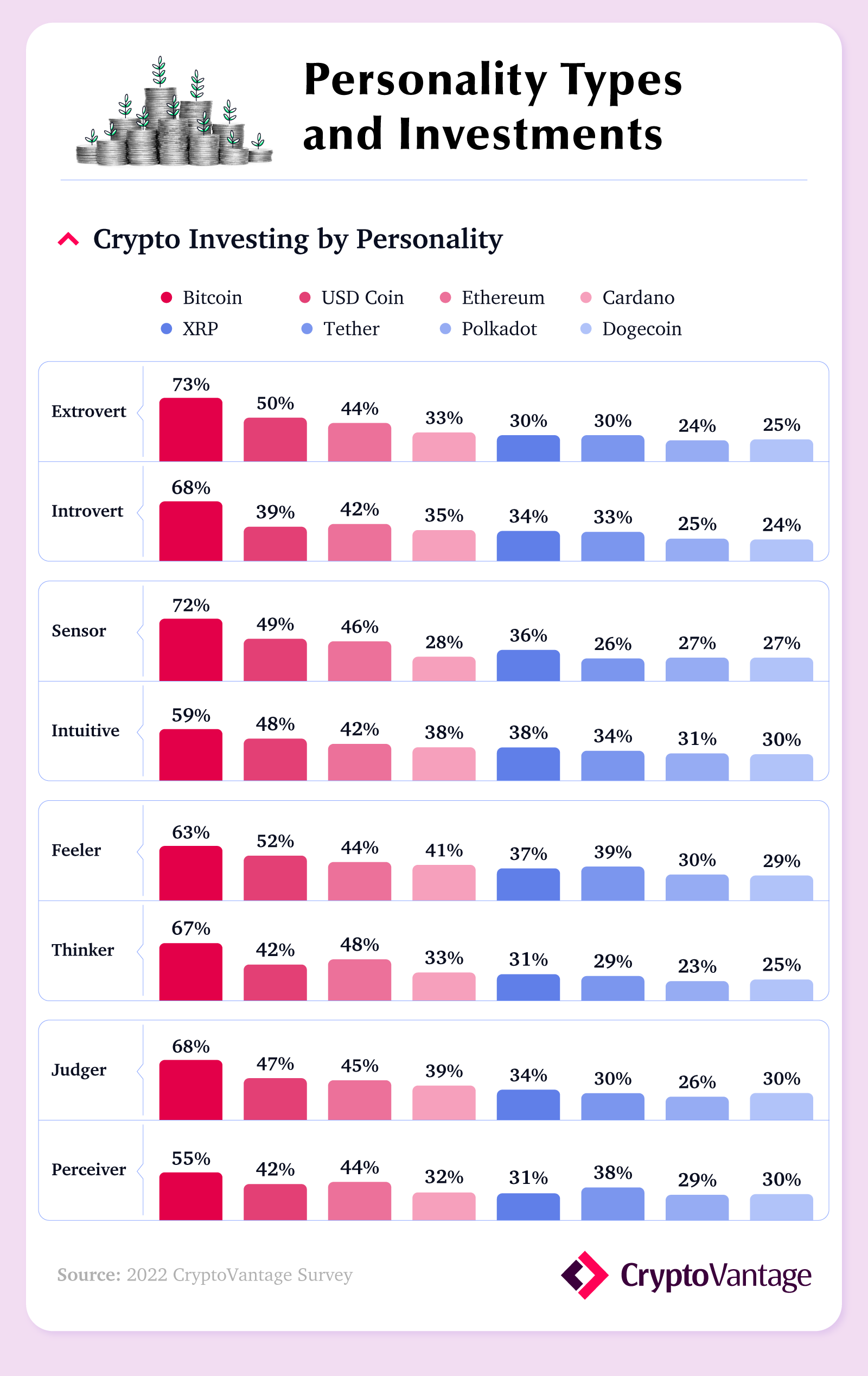

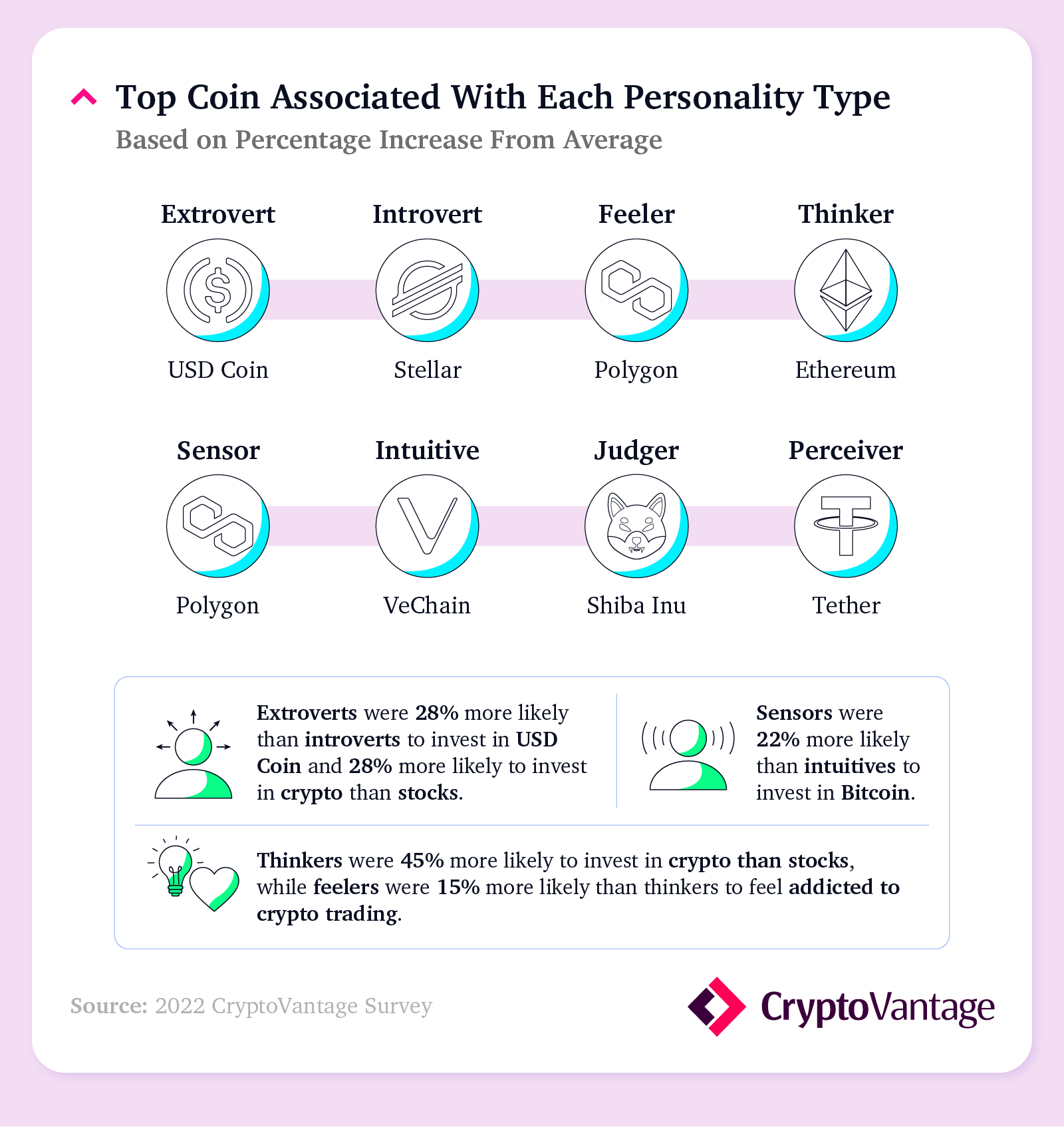

The risky nature of USD Coin could be why most of our respondents who were drawn to it were also extroverts, who are known to be thrill-seekers. Extroverts were also 28% more likely than introverts to be interested in this currency, and also more likely to invest in crypto over traditional stocks by the same degree (28%). Thinkers agreed; they were 45% more likely than the average investor to favor crypto over stocks, but they were more attracted to Ethereum. This currency's potential for long-term growth might be what attracts logic-oriented thinkers more than other personalities.

Some types were also more likely to get hooked on crypto trading than others. Feelers were 15% more likely than thinkers to become addicted to it, but intuitives were the most likely of all (79%). Do your personal quirks similarly impact your crypto obsession (or lack thereof)?

Knowing Is Half the Battle

Now that we have a baseline for what someone's personality can mean for their crypto trading, let's look at what the data says about their investment success.

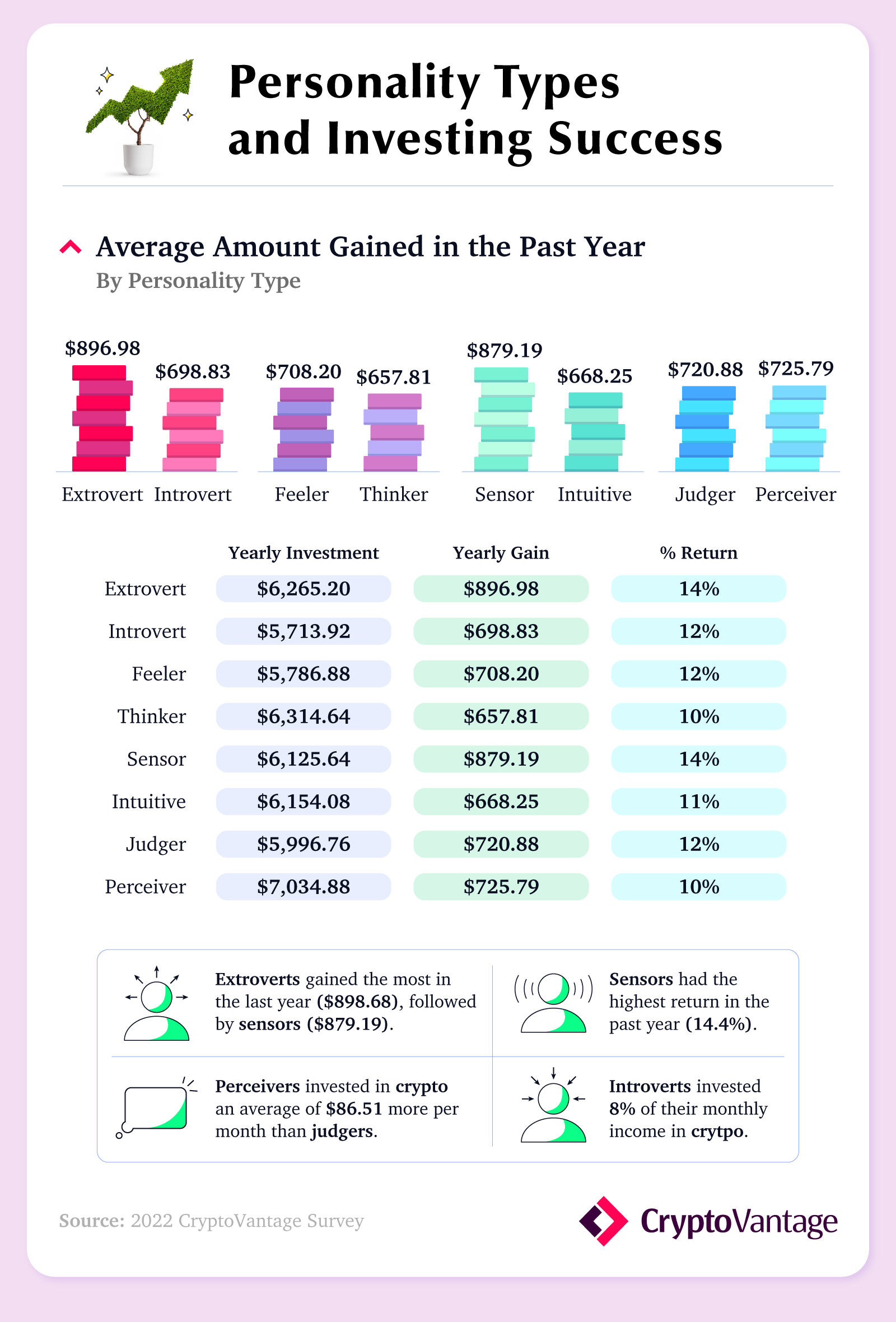

Personality didn't just affect how people invested in crypto; it also influenced how much they made on their returns. We saw a substantial difference between extroverts and introverts in both the yearly amount they invested and the percentage returned: Perceivers invested $86.51 more per month than judgers but had the lowest return rate at just 10%.

Extroverts earned the most on their investments in the past year, gaining an average of $896.98 ROI. Introverts, on the other hand, averaged just $698.83. This difference could be due to extroverts being more willing to take risks. Big risks can lead to big rewards!

What We Do When the Chips Are Down

Next, we looked at how different personality traits affect investing strategies. During periods of increasing inflation, it's important to understand how much to invest and when to hold the line.

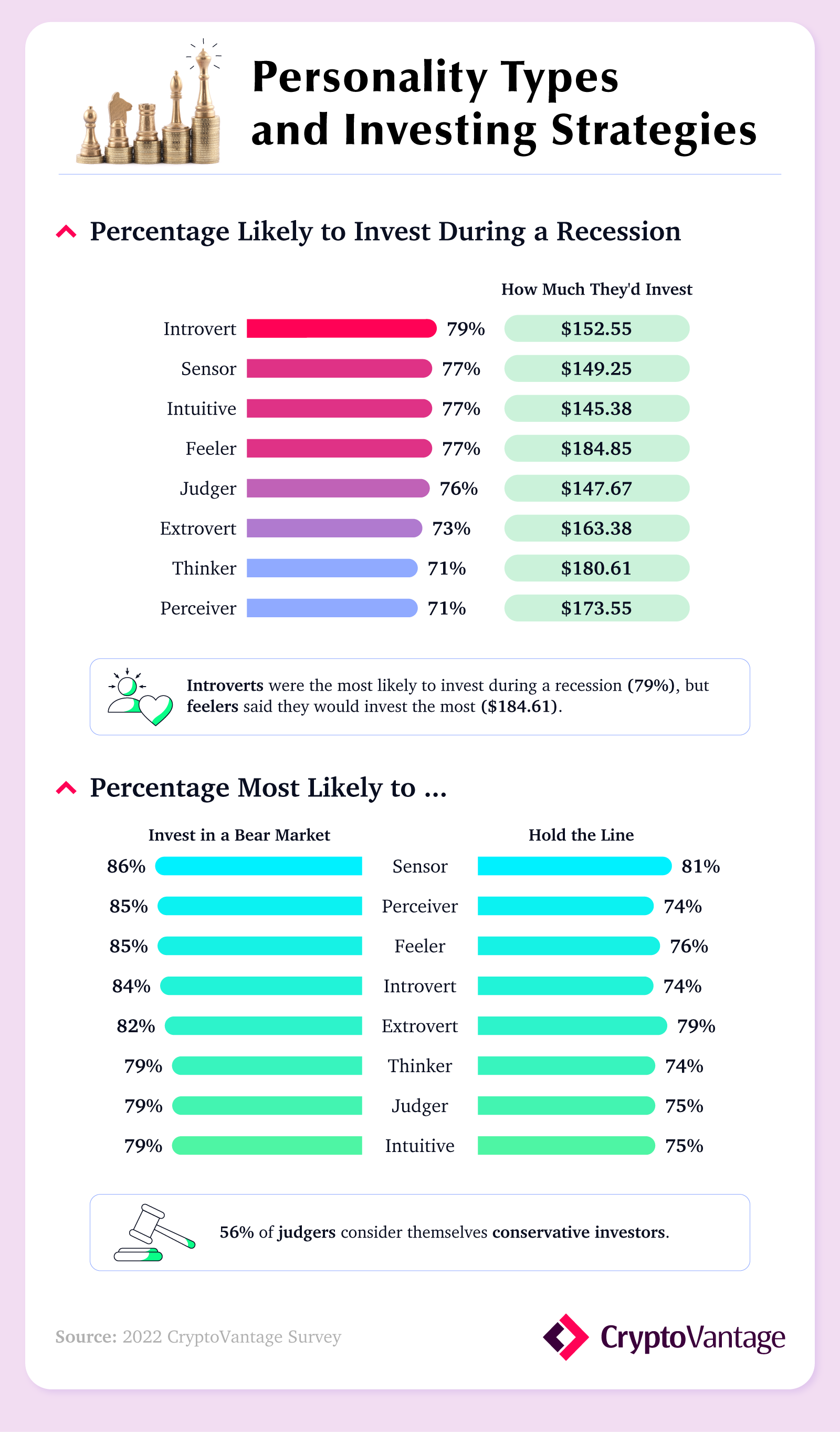

Budgets are typically tighter during an economic downturn, but many respondents reported that they would still invest in crypto during a recession. Surprisingly, cautious introverts (79%) were more likely than extroverts to say they would, though they would invest less ($152.55 versus $163.38, respectively).

Over 7 in 10 sensors, intuitives, and feelers also said they would invest during a downturn, but feelers were willing to put down the most money of all ($184.85). Thinkers and perceivers were the least likely to invest during hard times, but if they did, they'd both be likely to invest more money than introverts or extroverts under the same circumstances.

Sensors were the group most likely to invest in a bear market (86%), exhibiting an action-oriented mindset despite an economic decline. More than half of judgers (56%) claimed to be conservative investors, which tracks with the amount they said they'd invest during a recession: $147.67 (the second to least amount of all personality types).

Sensors were also the personality most likely to hold the line, with 81% willing to wait for their investments to return a profit before selling. Extroverts were the second most likely to do this, coming in just a couple of percentage points behind at 79%. It's no surprise that sensors and extroverts were the most steadfast investors, given their propensity for assertiveness and practicality. On the other hand, perceivers, introverts, and thinkers all tied for last place with a 74% likelihood to hold.

Using What You Know to Your Benefit

Understanding your personality type can tell you valuable things about why you invest the way you do and how your traits can benefit your investments. Of course, everyone is unique, and people can change – but knowing your tendencies and thought patterns could provide insight into your investing decisions.

Do any of these data points sound like you? How might your personality affect your own money management? And, more importantly, now that you have this information, how will you use it to inform your next investment?

Methodology

CryptoVantage conducted a survey of 1,000 cryptocurrency investors about their investing habits. Of them, 60% of respondents were male, and 40% were female. We assessed respondents' personality traits through a set of questions and scored them to determine their personality type.

About CryptoVantage

CryptoVantage simplifies investing, making it easy for you to get started with cryptocurrency.

Fair Use Statement

See something you want to share with a friend or colleague? Anyone can share this article for noncommercial purposes if they provide a link to this page.