- >Best Crypto Trading Bots

- >TradeSanta Review

- Great entry-level trading bot platform

- Completely automates the trading experience

- Several pre-set strategies for trading

- Virtual bot available to see how it all works without risking your own money

How Trading Bots Can Help Elevate Your Investments

A trading bot is software that allows you to automate trading of various investment assets such as cryptocurrencies, but they can also be used with traditional markets. A trading bot works by operating under a set of parameters that are either created by the user or preprogrammed. It then executes trades on your behalf on the exchange of your choice, based upon those parameters by using your API key. We’ll cover more of this under the “How to Sign Up for TradeSanta” section.

What is TradeSanta? Here's What You Need To Know

TradeSanta is a cloud trading software platform that allows users to automate trading across multiple crypto exchanges from a single interface. Users can create and deploy up to 49 trading bots using TradeSanta’s cheapest plan, with unlimited available for their “Maximum” plan. You can set up bots for exchanges such as Binance, Coinbase, Kraken, and more, and execute trades across all those platforms automatically using TradeSanta’s software.

TradeSanta has Grid and Dollar Cost Averaging bots available, while also offering futures bots for their Maximum plan. Copy Trading is also available where users can copy bots created by professional traders.

Take Your Trades to the Next Level with TradeSanta's Smart Bot Tools

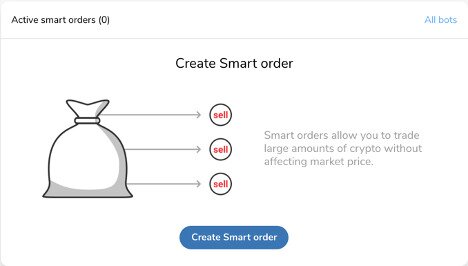

Smart Orders

Smart Orders are for those of us who have lots of cryptocurrency, but do not always know how to use it. If you’re selling large quantities of cryptocurrency at once, you may not get the amount back that you were expecting. There may not be enough buyers on the market for your $1 billion dollar sell order. Instead of selling your stash all at once, a smart order drips smaller chunks of the total amount into the market over a period of time. This ensures you get much closer to the total amount you were looking for.

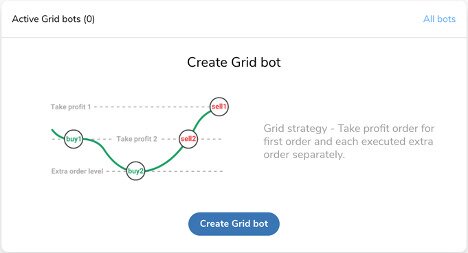

Grid Bot

The grid bot is more ongoing than the smart order bot. You give the grid bot profit targets, and the parameters that it needs to achieve those results. When you turn it on, the grid bot looks for opportunities within the market. If it finds any, then the bot will buy an amount from the market. The bot won’t sell the amount until it knows it can achieve the desired profit target. The grid bot is not greedy, in the sense that it won’t stay in the market on the chance that it will go higher. The grid bot takes the profits that it was told to take.

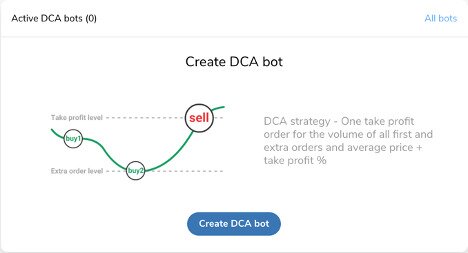

Dollar Cost Averaging

Dollar Cost Averaging is a lot like the grid strategy, only you’re telling the bot to sell more than one order at a single higher price. The grid bot treats individual trades separately, whereas dollar cost averaging combines them. This strategy is more greedy than grid bot.

Copy Trading Bots

TradeSanta has copy trading bots available through their marketplace. In the marketplace you can see bots created by other traders and the bot’s performance. You can simply find a bot that is performing well for the assets you’re interested in and copy that strategy, with a portion of profits going to the trader you’re copying.

How to Sign Up for TradeSanta: A Step-By-Step Guide

Step 1: Pick Your Plan

The first step to signing up for TradeSanta is to navigate to their platform and pick a plan that you think may suit your needs. All three plan options have a free trial, so you can try the most powerful version if you want to.

Step 2: Sign Up

Once you have picked a plan that fits your needs, you just need to sign up for the platform.

Step 3: Connect an Exchange

Before you can start using any of the trading bots, you’ll need to connect an exchange to TradeSanta. This is done by using your API keys from the exchange you want to connect.

An API is simply just one or two pieces of text that allows TradeSanta to act on your behalf. This means that TradeSanta can read your balances, and place orders. Most exchanges allow you to configure the API key to limit the actions that the user of the key can take.

For example, you can turn on or off the ability to execute orders. It is very important that you never grant withdrawal access to anyone. If withdrawal access is enabled on your API key, then anyone with the key may steal your funds. TradeSanta explicitly instructs the user to not have withdrawal access.

Supported Exchanges

Step 4: Set Up Your Bots and Start Trading

After you’ve connected the exchange(s) you want to TradeSanta, you can set up your bots. You configure the bot parameters by choosing a trading pair, a crypto bot strategy (long or short), take profit level, and more.

The TradeSanta Wizard will guide you through the whole process and you can use TradeSanta Bot templates to help you start with automated crypto trading. There are also Virtual Bots that you can use to test before actually using real funds.

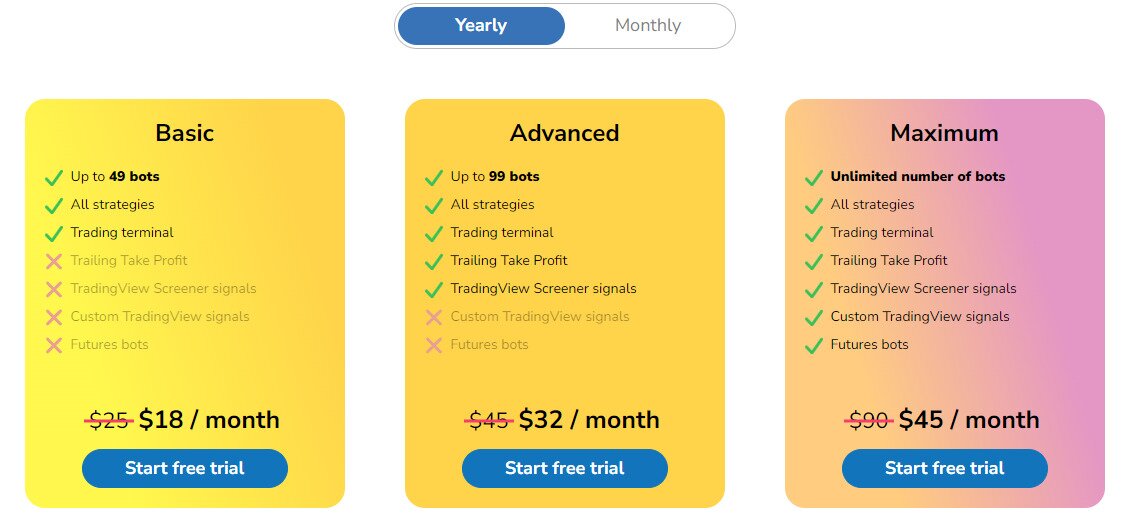

TradeSanta Pricing Breakdown: Start Your Journey Now

TradeSanta has both yearly and monthly pricing plans available for their services, with a free trial available for any of the plans. The pricing for the pay by year plans is cheaper than if you pay by month, with the latter starting at $25/month for their basic plan and the former being $18. Prices are in USD.

There are three different plans available, with each offering more features than the last, including things such as trading signals and futures bots (see image below). TradeSanta accepts both fiat and crypto assets as payment for their services.

Can You Trust TradeSanta With Your Data?

Yes, TradeSanta is safe. The platform can only execute trades on your behalf using your various API keys, and none of your funds are ever stored on TradeSanta. The API keys only allow for trades to be executed and not for funds to be withdrawn, ensuring that your funds stay in your control.

The Verdict: Our Final Take on TradeSanta

Our TradeSanta review has found that it’s a great trading bot platform for new and experienced users alike. They offer strong bots and copy trading, with a good variety of plans available to suit various needs. The platform has been running since 2018 with no issues and their trading bots can be used with as little as $10 in funds.