- >Best Crypto Exchanges

- >Bitstamp Exchange Review

Bitstamp Review

- Serves over 3 million customers globally

- One of the longest-standing Bitcoin exchanges

- Regulated in the EU and USA

- Easy to understand for new users with iOS and Android apps

Meet Our Reviewing Team

General Overview

Pros

Proponent of regulation and compliance

Beginner-friendly interface

Offers iOS/Android mobile apps

Audited by one of the Big Four

Cons

Intrusive KYC examination

No withdrawals without KYC completed

Possible account termination after suspicious activity

No deposits directly on the app

Comparing Bitstamp to Other Leading Exchanges

In this Bitstamp review, we will take a look at what makes this cryptocurrency exchange different from the rest. Bitstamp has an excellent reputation among users and is renowned for its advanced trading features, reliability, and performance. We hope that by contrasting Bitstamp with other well-known exchanges, you will be able to see why this platform is a good fit for traders of all skill levels. As we compare Bitstamp to its rivals, you’ll learn about all the great things about it.

Crypto Exchange

Why Use This Exchange

Our rating

Visit

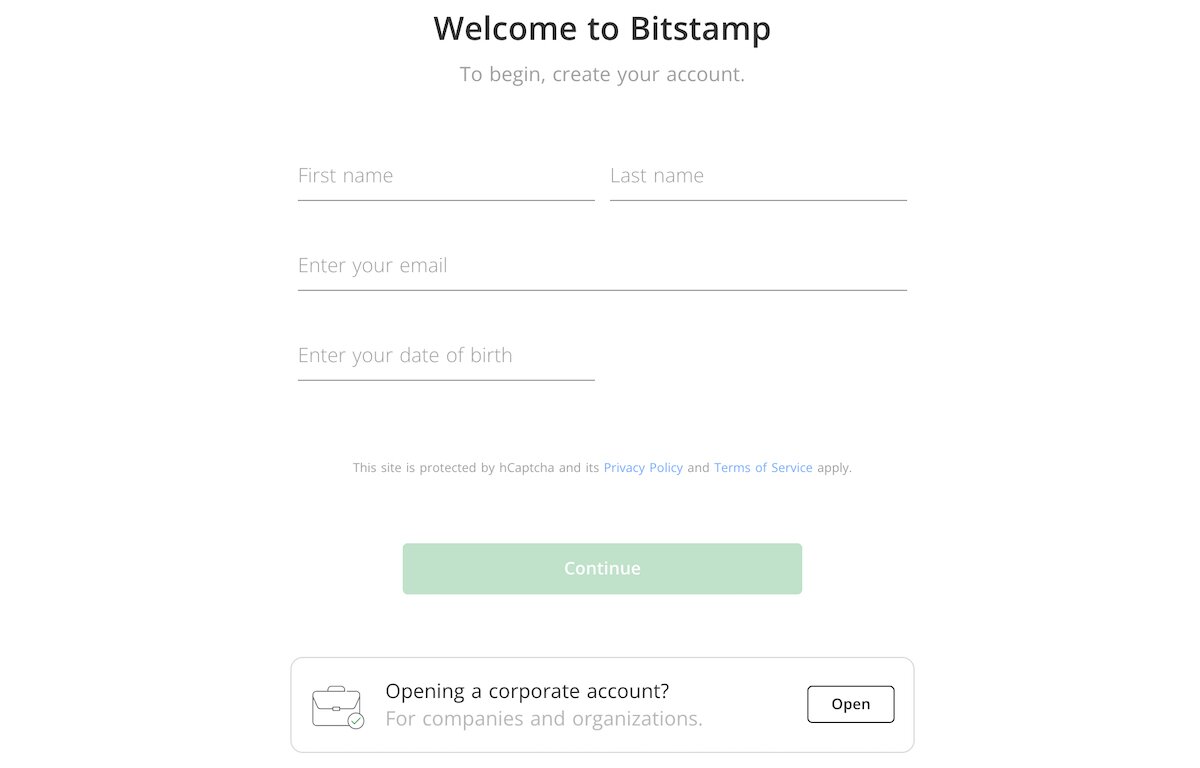

Sign-Up Process

The sign-up process with Bitstamp is very much similar to the processes on other exchanges. But one thing about this exchange attracts a good deal of criticism from crypto enthusiasts.

During the KYC process, Bitstamp requires extensive personal data, including your home address, phone number and an ID.

Moreover, if you read a few customer reviews on the web, you will find complaints of people whose accounts and funds were terminated and frozen, respectively, because of problems with verification.

In response to those complaints, the exchange always asks their users to pay attention to the terms of use where “Bitstamp expressly reserves the right to cancel and/or terminate Accounts that have not been verified by a Member despite efforts made in good faith by Bitstamp to contact said Member to obtain such verification (“Unverified Accounts”).”

Such an extensive KYC procedure is justified by the exchange’s efforts to comply with the EU & US regulations, however, it might place libertarian-minded crypto enthusiasts under some stress.

Here is what the process looks like:

- “Register”

- Enter your email, first name, last name and agree to Terms of Use and Privacy Policy

- Check your inbox

- Enter your password

- Get verified

- Enter your info

- Upload documents

- Enable extra security

Available Cryptocurrencies

BitStamp does have relatively few markets, considering its size and daily volume. With 54+ digital assets, you can access the dominant cryptocurrencies. However altcoin traders may feel like the list is a little short.

The range of markets covers the most prominent cryptocurrencies, such as BTC, LTC, ETH, BCH, XRP and XLM, and even some slightly lesser-known coins such as LINK, MATIC and DAI.

One of the significant advantages of this trading platform is that on top of Bitstamp, you can trade crypto against fiat: USD, EUR and even GBP, which is perfect for all novice traders out there, but is not a real cincher for sophisticated cryptonians.

Is Bitstamp Safe?

The exchange suffered hacks in 2014 and 2015, and the attackers looted 19,000 BTC. Bitstamp has ramped up their security along with many other exchanges, and now has email verification, two-factor authentication and multi-sig wallets implemented on their hot storage. In their hot wallet, they store only a small portion of crypto assets, while the majority of funds are kept offline in cold-storage systems.

Despite all the safety measures the exchange provides, while being a crypto holder, you should keep in mind that it’s your own responsibility to keep your money safe. Use a hardware wallet or any other cold storage in order to make sure that nobody except you has got access to your funds.

Supported Applications

If you’re one of those people who love trading while being stuck in traffic, Bitstamp’s iOS and Android apps are for you.

Within the dashboard, you can check your crypto and fiat balances, send crypto using the QR-code system, choose from diverse order types and secure your funds with a multisig wallet. Some users report problems with depositing funds directly on the app. However, on the web version that fits both, season traders and newbies, everything works fine.

Bitstamp Fees

Compared to other exchanges, the fees on top of Bitstamp are within the competitive range. On Coinbase, for example, Taker and Maker fees are $0.25 and $0.15, respectively, if the amount is less than $200K. Bitstamp offers %0.22 in both cases. Credit and debit card purchases are lower with Coinbase and charged 3.99% as of writing while Bitstamp will require a 5% fee.

History of Bitstamp

For Bitstamp, everything started nine years ago in Kranj, a well-preserved medieval old town in Slovenia. Damian Merlak, a young developer and a proud owner of two bitcoins, entered a hardware store.

He said he wanted to buy two graphics cards, the most powerful ones out there. One thing led to another, and a few minutes later Nejc Kodric, an owner of the shop himself, was firing questions at the client, trying to understand why, for crying out loud, this weird guy wanted to connect two powerful graphics cards with the slowest processor and the worst memory card ever existing.

But the answer was simple. Damian wanted to mine Bitcoin. And soon after, Nejc joined him in a garage to hang out, to debate about the future of the cryptocurrency world and, last but not least, launch Bitstamp, a better version of Mt.Gox that was pretty popular in 2011.

In 2014, Pantera Capital, the U.S. Bitcoin investment firm, invested $10 million in Bitstamp, but according to Nejc, they had always been in profit.

Alternatives to Bitstamp

If you’re just getting started with cryptocurrency than Coinbase is always one of the easiest exchanges to recommend, especially for Americans. The interface is one of the simplest and you won’t get bogged down by an overwhelming number of features. New crypto users will also like the fact that Coinbase is one of the most regulated crypto exchanges in the world and is even a publicly-traded company in the USA. The downside is that it doesn’t have near the same amount of assets. Coinbase Pro does have a large amount of assets but it’s also a little more complicated to use.

Meanwhile Bittrex is another good option for crypto users looking for a slightly more advanced exchange. Bittrex has offices in Seattle, WA, and Lichtenstein with a large number of assets available.

Here’s a complete breakdown if you’re looking to compare exchanges:

- Superior option for experienced crypto traders

- Dramatically lower trading fees

- More powerful platform for trading

- Same diverse selection of coins as regular Coinbase

- Great option for experienced cryptocurrency traders

- Relatively low fees

- Very high level of security

- Launched by former Microsoft and Amazon employees

Bitstamp Frequently Asked Questions

Founded in 2011, Bitstamp is one of the oldest cryptocurrency exchanges in the niche. Other trading venues worth mentioning are Kraken and Vircurex that were also founded in 2011.

Yes, in April 2019, The United States subsidiary of Bitstamp was granted a virtual currency license from the New York Department of Financial Services (NYDFS).

The markets and fees presented on these two exchanges are different, where Binance gives you a head start in terms of both.

Binance is well-suited for professional traders and beginners at the same time while Bitstamp is targeting mostly beginners.

Binance is more popular and its trading volumes are more significant, but Bitstamp is well-reputed and easy enough for you to start learning about crypto.

Both exchanges have subsidiaries in the U.S. and both exchanges offer a thorough KYC procedure.

Yes, Bitstamp accepts Visa, Mastercard and Maestro.

There’s no maximum withdrawal limit for verified users.

Yes, twice, in 2014 and 2015. The amount looted was 19,000 BTC.

It’s a European exchange based in Luxembourg but the company operates around the globe.

No. But you can stake coins on top of Kraken, Bitfinex or Binance, for example.