What is a Fork?

Bitcoin works through consensus. Consensus only may happen if my code exactly matches yours, his, theirs, and the other thousands of nodes running the bitcoin code (or other cryptocurrency). So, what happens when someone changes their code? What happens if they rearrange balances, alter the protocol, or any other number of things?

At the point in time they do this, you can imagine a “fork” in the blockchain, where Bitcoin Core will keep on running, and BitcoinCore.myfork will become its own chain at the block the update was created. The success of bitcoincore.myfork will largely be determined by the amount of miners I can get to switch over to my new code and support my network, and how many users I can get to use and transact on it. This “rallying” or recruitment process of forked chains trying to get user and miner support is an important social aspect of forks that is demonstrated later.

Anybody can create a fork, and for the most part they will either be extremely tiny, or nobody will mine them at all and so they will cease existing shortly after they are created.

Why Do Forks Exist In The First Place?

I opened with the example of democracy and differing beliefs because those are the same forces at play in open-source blockchains such as bitcoin.

When a major party differs in how they think the chain should progress into the future, they will propose an update that fundamentally differs from the current blockchain code and try to recruit people to support this. Most often, this vision will be implemented as an update to the blockchain, which they will attempt to have the majority of miners switch to (which would technically make it the dominant bitcoin chain), and which has yet to happen successfully.

At the bottom of this article there is a link to failedforks.com which shows the amount of nodes running various forks, which start off quite strong during the “rallying” period, and then usually fade from existence as the miners switch back to Bitcoin Core. However, sometimes there is an “intentional” fork that will become well supported because of desirable changes it makes to the protocol (or history, as we will see in the case of Ethereum’s fork in 2016), thus continuing to exist, and are examined below.

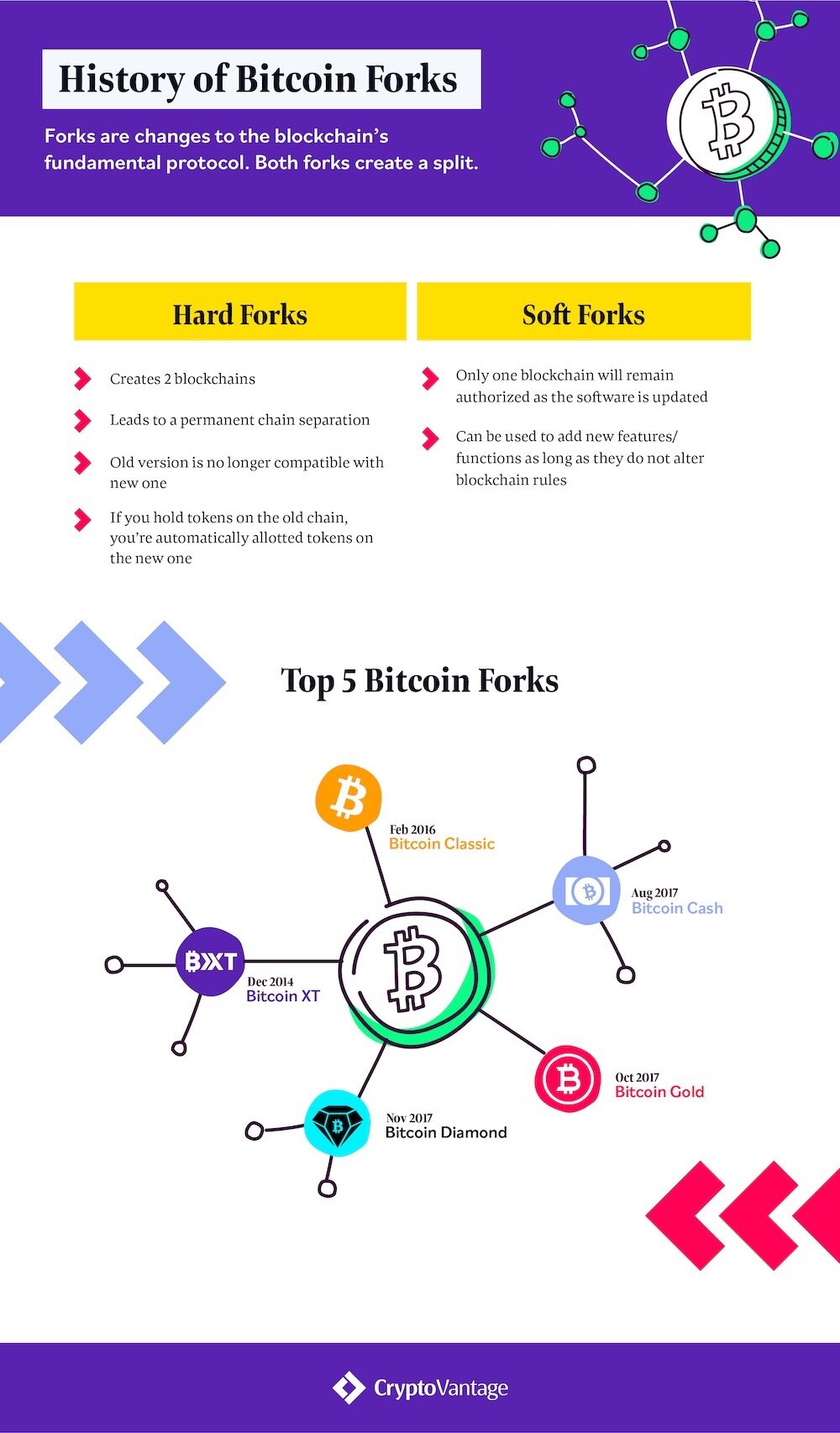

Hard Forks vs. Soft Forks

Hard forks and soft forks are the two types of updates, or protocol changes, that can happen on a blockchain. Pretty straightforward, a hard fork leads to an entirely new chain being created, and a soft fork is more of an optional update that is backwards compatible.

Backwards compatibility is really what creates the hard fork because miners creating blocks based on the new update will not have these blocks accepted by those miners running the old chain, thus forking into a new independent chain. Hard Forks are usually protocol changes (rule changes) and soft forks are more optimizations (see SegWit). A soft fork doesn’t lead to any new chain.

What Happens To My Cryptocurrency in Case of A Fork?

In a soft fork, since no new chain is created, there is no difference. But, depending on the update, you may not be able to transact with those wallets that have the new update without updating your own wallet first. In the case of many bitcoin wallet providers, this isn’t a problem.

In a Hard Fork, since the chain is forked in two, you have your same balances on the old chain and it is business as usual, but now you also have the equivalent amount of a new coin (such as those listed below) on the new chain. In the instance of Bitcoin and Bitcoin Cash, if you were holding Bitcoin on August 1st, 2017, then you were also holding an equivalent amount of Bitcoin Cash after the fork took place.

Famous Forks

To understand famous forks correctly, we need to understand their environment. None of these forks happened without strong differing opinions in the community, so the fork is usually bigger than just the protocol level.

Bitcoin forks are largely motivated by the “Bitcoin Scalability Problem”. This debate largely boils down to the fact that the bitcoin core block size is currently limited to 1 MB, therefore limiting transactional throughput to 7 tx/s. This is compared to 2000 tx/s for Visa – the usual reference point. The forks below will take you through a brief history and some of the key players of this debate, and the forks that have resulted from it.

Bitcoin XT

Bitcoin XT was formed in 2014 by Mike Hearn as a fork of bitcoin core that created protocol optimizations completely unrelated to block sizes.

The large adoption and public support of Bitcoin XT came in mid 2015 when Gavin Andreesen, one of the first developers working on bitcoin core with Satoshi, proposed BIP 101 amid the increasing attention and transaction volume of bitcoin core in 2015. BIP 101 proposed a block size increase from 1 – 8 MB, and then steadily increase thereafter to 24 tx/s. This change needed 75% of the network’s support for ~1000 blocks at the beginning of 2016. Understandably, it did not achieve this, and the change was not implemented. They instead implemented bitcoin classic’s 2 MB increase.

Bitcoin Gold

Due to the large monopoly of Bitcoin mining, particularly in China, Bitcoin Gold was forked in October 2017 to create a new Bitcoin that used a different protocol preventing large miners from switching.

It uses equihash (created by Zcash) that doesn’t allow the hardware big miners use (ASICs) to run it profitably. It has suffered repeated DDOS attacks, and even the infamous 51% attack where a malicious miner took over 51% of the network in 2018 and began rearranging the blockchain at their discretion (largely minting coins).

Bitcoin Cash

Bitcoin Cash is easily the most recognized, promoted, and widely supported split from bitcoin core on August 1, 2017. It carried on the back of Mike Hearn’s work in 2014, proposing to support BIP 91 in order to increase the block limit to 8 MB, and then steadily to a new 32 MB cap. Other than this, it is largely the exact same.

It achieved such great coverage because it was supported, and politicized, by some of the largest players in bitcoin, such as Jihan Wu, CEO of Bitmain, the largest mining company, Roger Ver, an early investor and advocate of bitcoin (now bitcoin cash) and Craig Wright, who alleges he is the creator of bitcoin without substantial evidence. Their political platform was to create larger block sizes in order to better reflect Satoshi’s original vision of a peer-to-peer electronic cash system, which was becoming less of a reality with longer transaction wait times on bitcoin core in 2017 (~20 minutes with fee).

Bitcoin SV

As you may infer, there was further conflict about what “Satoshi’s Vision” actually entailed, and so in 2018 Craight Wright, with the support of Calvin Ayre, forked Bitcoin Cash again (“we need to go deeper…” – a fork within a fork).

Their revised block size limit is 128 MB. Although Bitcoin SV created the potential for much larger block sizes, due to lack of transaction volume, block sizes for the most part are the same as bitcoin core.

Is It Possible For A Coin To Fork Twice?

Yes, since this new chain is its own unique blockchain, it maintains all the same properties and abilities as an unforked chain, including soft forks and hard forks.

Other Famous Forks

Litecoin

The first ever bitcoin fork was in October, 2011 to create Litecoin. Created by Charlie Lee, the largest differences are a more lightweight algorithm (scrypt instead of SHA-256), faster block times (2.5 minutes) and higher number of total coins (84m). Litecoin was also the first to implement protocol changes designed to help scale bitcoin, Segregated Witness and Lightning Network.

Segwit has enabled bitcoin to optimize/rearrange transactions so block sizes are now effectively ~1.3 MB, even though the limit is 1 MB. Lightning Network uses payment channels and enabled Litecoin to send a microtransaction from Zurich to San Fransisco in <1 second. Litecoin is a fork of the bitcoin codebase, not the running network, meaning, that you did not inherit any coins from the fork if you were holding bitcoin at the time that Litecoin was created. The creator of Litecoin modified the codebase, and started a new network from block 0.

Ethereum

The most infamous of them all… the great DAO crash. Before the boom, before the ICO bubble, there was the pioneer of ICO’s, the DAO, held on Ethereum. In 2016 the DAO raised $150m in ethereum from investors (users) and then due to oversight and hasty development, suffered a fatal hack that stole $50m.

The community was divided about how to continue, some saying it was Ethereum’s responsibility to make investors whole by rolling back the blockchain, and others argued this violated some fundamental principles of open-source blockchains and would jeopardize the network. Despite the risks, the network hard forked on July 20th, 2016 and rolled back the transactions (effectively rearranging balances, if we think of my examples earlier), and then had to fork twice again that year to prevent DDOS and spam attacks. The new chain was supported by the Ethereum foundation and titled Ethereum, while the old chain where the DAO hack is still present, is called Ethereum Classic, and is still supported as the “original” Ethereum.

Monero

Monero has had multiple forks to better “Secure” the network, such as making it ASIC resistant, improving the privacy and anonymity, removing block caps, and removing total supply caps. Monero has a total of 4 forked chains that are still running to this day.

Are forks inherently bad?

No. Although they are most politicized and talked about in contentious issues, hard forks are a fundamental aspect of updating a blockchain. Most chains such as Ethereum regularly undergo protocol upgrades that require a fork, however the difference is, they are mostly unanimous and the old chain will quickly die off and be unsupported.

Some miners may be left behind, but are incentivized to mine the new chain which contains the coin that holds value. When forks lead to two different chains being supported, and community division, often there is high price volatility and conflict within the community. However, done in a professional manner, this debate and conflict resolution is what helps push blockchain forward.