- >News

- >Bitcoin Trounces Apple, Tesla, S&P 500 with 11,775% Growth in Five Years

Bitcoin Trounces Apple, Tesla, S&P 500 with 11,775% Growth in Five Years

We all know that bitcoin has performed very well over the past few months, not to mention over the time since it launched in January 2009. The question is: just how well has it performed, when compared to other high-growth stocks and assets?

Thanks to the wonders of the internet, we can easily compare bitcoin’s past performance with that of other financial assets. And yes, as you might have already imagined, bitcoin outperforms almost every major asset over almost every significant timeframe.

While past performance is certainly no guarantee of the future, this bodes well for bitcoin’s future. This is particularly the case in the medium term, when the lingering effects of the Covid-19 recession will drive savers and investors towards bitcoin, at the expense of the US dollar and other companies still struggling with economic stagnation.

Bitcoin vs. Apple and Big Tech

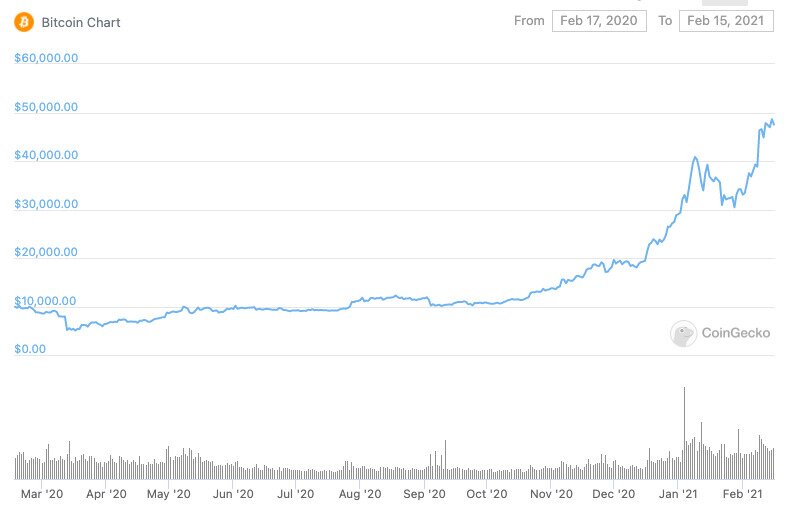

Let’s start with the past 12 months, just in case it wasn’t already clear. Bitcoin has appreciated by around 360% since last February, rising from about $9,940 to $47,500 (as of writing). This means that a $1,000 investment in BTC over this period would have increased to about $4,600.

Source: CoinGecko

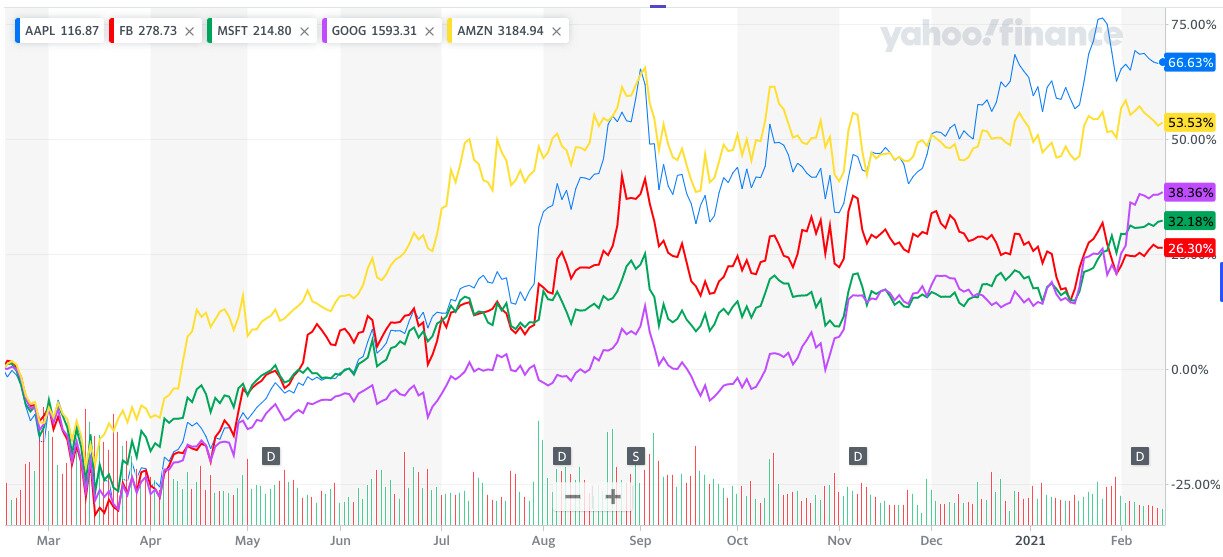

This is a hard act to follow. Apple — as well as other FAANG stocks — haven’t really come close to matching bitcoin, even if they’ve outperformed the wider stock market.

As the table below shows, Apple has risen by 66.6% across the past year, while Amazon, Google, Microsoft and Facebook have increased by 55.5%, 38%, 32% and 26% (respectively). These percentages would have resulted in your $1,000 investment expanding to $1,666 in the case of Apple, and to roughly $1,555 (Amazon), $1,380 (Google), $1,320 (Microsoft) and $1,260 (Facebook) in the other four cases.

Apple stock price (blue), Amazon (yellow), Google (purple), Microsoft (green), and Facebook (red). Source: Yahoo! Finance

If you narrow things down and look at shorter timeframes, bitcoin looks even better. It has risen by 183% over the past three months, meaning $1,000 invested in BTC over the past quarter would now be equal to $2,830.

The above stocks have witnessed only modest gains (at best) by comparison. Google is the best of the rest at 18%, with Apple coming second at 13.5%. Meanwhile, the other three Big Tech stocks have risen by 13% (Microsoft), 4% (Amazon) and -2.37% (Facebook).

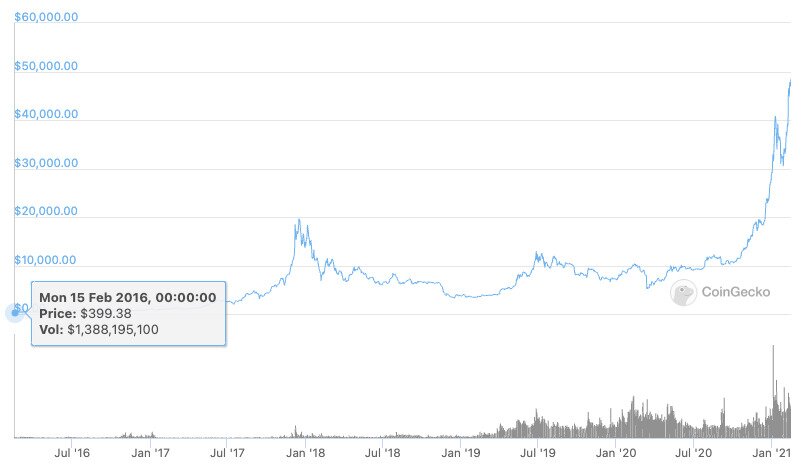

Looking at the bigger picture, bitcoin’s superior performance compared to popular high-growth stocks becomes even more apparent. Five years ago, bitcoin was worth roughly $400, so with a current price of $47,500, this suggests it has ballooned by 11,775%. In other words, $1,000 invested in BTC in February 2016 would now be worth $118,750. Where’s my time machine?

Source: CoinGecko

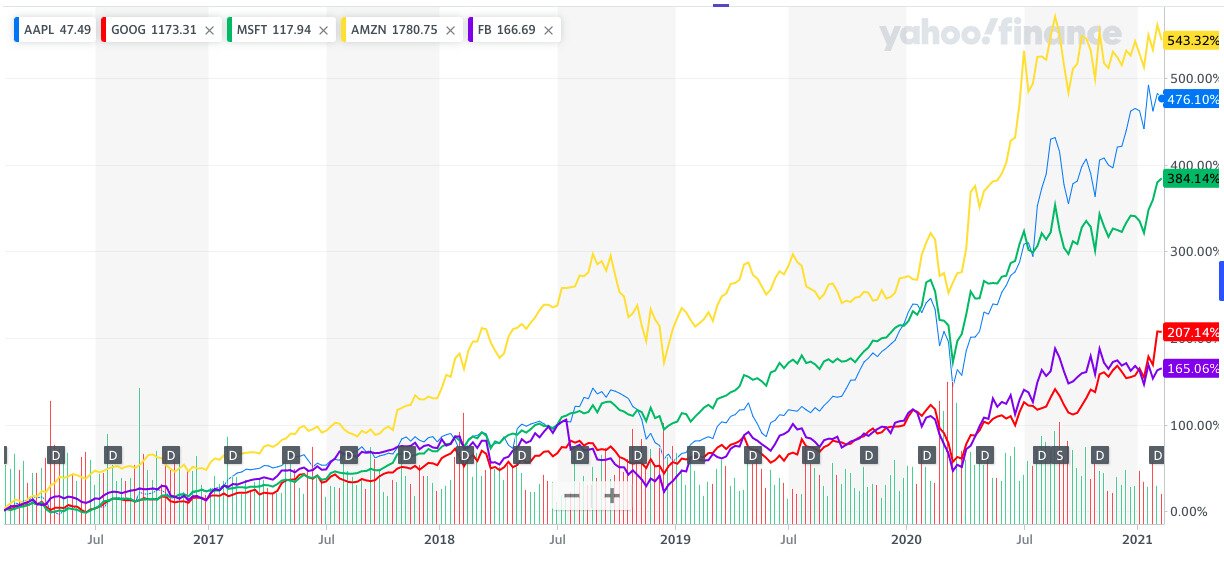

In case you were wondering, no Big Tech stock has come close to bitcoin over the past half a decade. Amazon has risen by 543% over this period, with Apple (476%), Microsoft (384%), Google (207%) and Facebook (165%) bringing up the rear. $1,000 invested in Amazon five years ago would now be worth $6,430.

Amazon (yellow), Apple (blue), Microsoft (green), Google (red), Facebook (purple). Source: Yahoo! Finance

Needless to say, bitcoin has started from a very low base, which has helped it rise so impressively. However, so too have all of these stocks: shares in Facebook are in fact younger than Bitcoin, having launched in May 2012 at a price of $38. In May 2012, bitcoin was already priced at $135.

What About Tesla?

As an aside to this discussion of Big Tech, Tesla — which had its IPO in June 2010 (at $17 per share) — has risen by 2,601% across the past five years. This increase would have turned $1,000 to about $27,000. Even though this far outperforms the FAANGs, it’s still short of bitcoin.

That said, Tesla has in fact outperformed bitcoin over the past 12 months. It has risen by 407%, while (as mentioned above) bitcoin has risen by around 360%.

However, it has risen by ‘only’ 99% over the past quarter, while bitcoin has appreciated by 183%. Bitcoin is therefore outdoing it over most timeframes, but Tesla is still giving it a run for its money, depending on your perspective.

It’s also worth pointing out that the fates of Tesla and bitcoin’s price are now relatively intertwined, after the carmaker bought $1.5 billion of the cryptocurrency. This could potentially mean that the two assets will become more correlated in the future, falling and rising together more often than usual.

Bitcoin Beats Gold

And yes, bitcoin gets the best of gold over most periods. Over the past year, gold has risen in value by 15.3%. Over the past quarter, it has in fact declined by 3%. And over the previous five years, it has increased by 47%. So $1,000 invested in gold five years ago would now entitle you to around $1,470.

Source: Kitco

This arguably makes it a good store of value, but if you’re thinking of buying $1,000 in the hope of a large profit, you’d almost certainly end up disappointed.

It’s also arguable that this will increasingly be the case in the future, given that bitcoin is fast earning a reputation as ‘digital gold’ and is eating into gold’s market as a store of value.

S&P 500, Dow Jones and the Nasdaq

When analysts talk about the US ‘stock market’ they ordinarily mean the S&P 500, which is an index of the 500 largest publicly listed companies in America. Investing in an index fund which tracks the S&P 500 is usually a very safe way of appreciating your savings over the long-term, since fluctuations and volatility experienced by individual companies are ironed out across the entire market.

Unfortunately, safety doesn’t necessarily equal outstanding performance. The S&P 500 has risen by 16% over the last 12 months, while it has climbed by 8.5% across the previous quarter. As for the previous five years, it has increased by 111%, meaning that $1,000 invested in the 500 would now be worth $2,110.

S&P 500 (blue) over the past five years, and the Nasdaq (red) and Dow Jones (green). Source: Yahoo! Finance

As the table above indicates, the Nasdaq — an index of the 100 largest non-financial companies in the US — performs a little better than the S&P 500 over the same three timeframes. It rose by 223% over the past five years, 44% over the previous year, and 18.6% over the past three months. Still, this is barely a ripple on bitcoin’s all-consuming pond.

The Long Term

Ten years ago, one bitcoin was worth roughly $1. This means that $1,000 would have bought you 1,000 BTC, which is now valued at around $47.5 million, representing an appreciation of approximately 4.75 million percent.

However, while bitcoin is pretty much the undisputed champion asset of the past ten years, it hasn’t outperformed other assets in every year of its existence.

Bitcoin fell across the 12 months of 2014 and also those of 2018, by about 59% and 74% respectively. Likewise, it rose by ‘only’ 38% between January 2015 and January 2016, so even its good years aren’t always spectacular.

These exceptions reinforce the idea that, as with most investments, bitcoin should really be undertaken only for the long term. You can never be sure whether any given year will end with bitcoin being up, but as the above hopefully shows, the cryptocurrency is likely to be worth more in the more distant future than it is now.