- >News

- >Here’s Why the Bitcoin Market Has Turned Bearish

Here’s Why the Bitcoin Market Has Turned Bearish

Bitcoin’s Christmas has officially ended. It may still be more than 56% higher than its former (December 2017) high of $19,783, but after reaching the dizzying heights of $41,940 on January 8, a price between $30,000 and $33,000 seems like something of a comedown.

Bitcoin has officially entered a bear market, with its price falling by over 20% since the current $41,940 ATH. The indicators of this are clear, since aside from the price decline, incoming data shows a drop in bitcoin’s futures basis (the difference between current and futures prices) and also a decline in the Grayscale Bitcoin Trust premium, among other things.

However, what’s less clear is why bitcoin has entered a bear market. Well, numerous factors have converged to cause a ‘perfect storm’ in market sentiment, from bitcoin being overcrowded to miners selling more of their inventory, while an increase in FUD certainly hasn’t helped either.

Bitcoin Bear Market, The Indicators

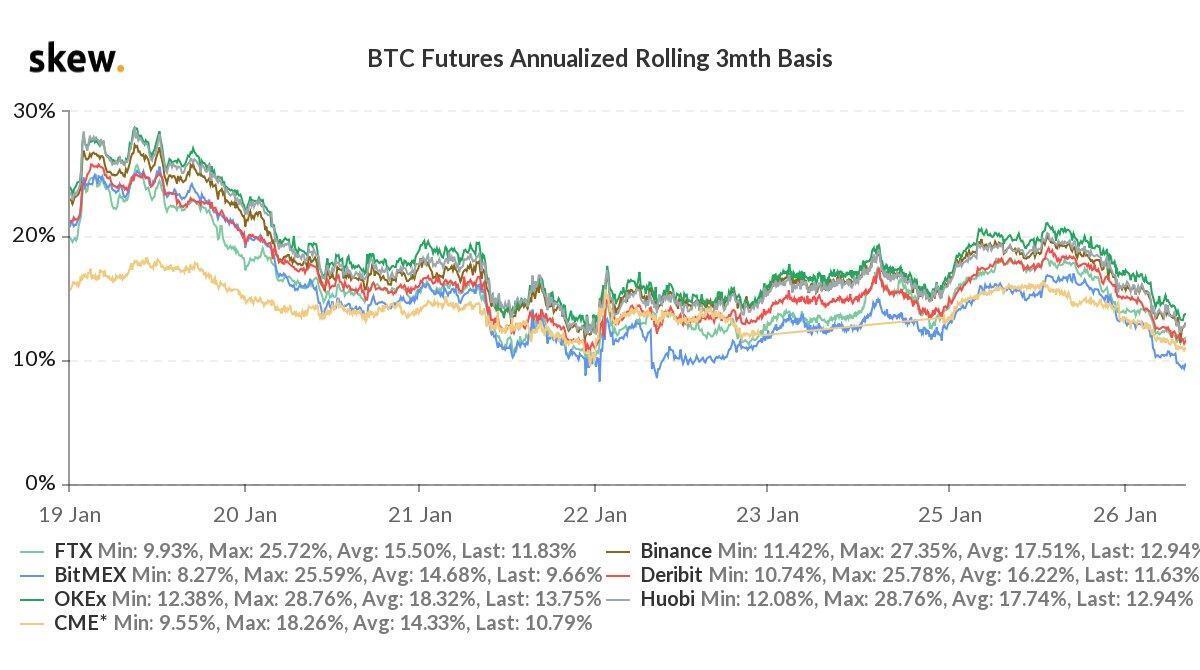

If you want a clear indication that bitcoin has entered a bear market, you need look no further than bitcoin’s future basis. This measures the difference, in percentage terms, between the current spot price of bitcoin and the strike prices of futures contracts.

If this percentage is high, it suggests that more of the market is convinced the price of bitcoin is going up. If its low and/or declining, it suggests that the market is becoming less confident in bitcoin’s price growth.

Data from London-based analytics firm skew shows that the three-month rolling futures basis is indeed falling, sliding from 30% as of January 19 to only 10% a week later, on January 26.

Source: skew/Twitter

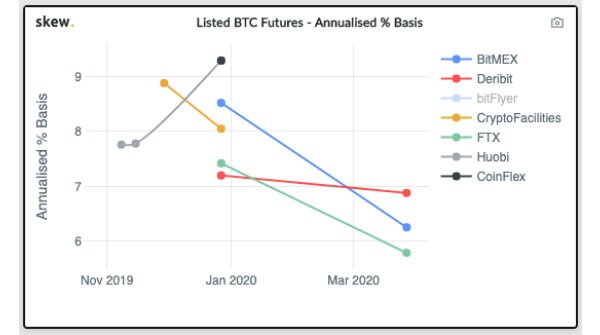

To put this in some perspective, when skew launched its futures basis metric back in November 2019 — when the bitcoin price was heading from above $8,000 to $7,000 — was a little below 10% for most exchanges offering futures. That’s how bearish things are right now.

Source: skew/Twitter

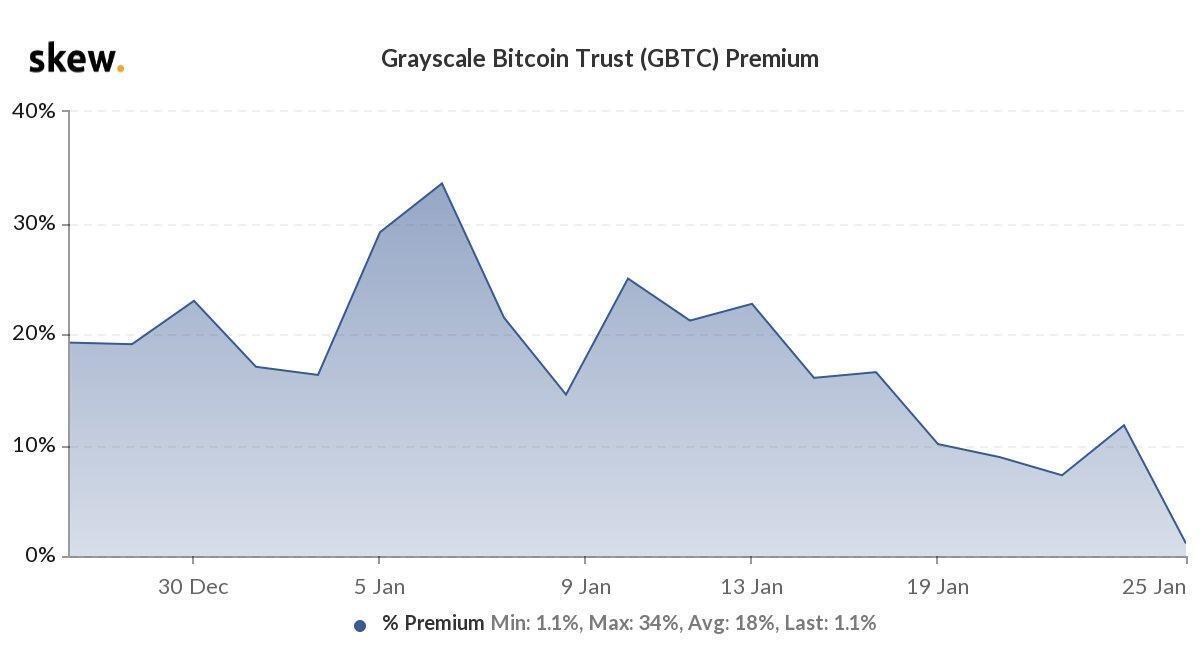

Another indicator which tells a similar story is the Grayscale Bitcoin Trust premium, which represents how much more expensive a share in GBTC is than an actual bitcoin. This now stands at only 1.1%, close to the lowest (-0.3%) it has ever been, and some way off its all-time high of 132.6% (set in May 2017).

Source: skew/Twitter

Some commentators have in fact argued that the decline in the GBTC premium is a very good thing, in that it represents a maturing market and a growth in other, competing bitcoin funds. This is true in the medium- to long-term, but for now it shows that the market is cooling off, with fewer people willing to pay premiums because they no longer think that bitcoin is likely to rise in the short-term.

This impression is further reinforced by bitcoin’s fear and greed index, which has declined relative to levels witnessed at the end of 2020 and beginning of 2021. At 78 (as of writing) it still indicates greed, but compared to scores (out of 100) of 95 on December 31, it again shows a cooling off.

Source: alternative.me

Why the Market Has Turned Bearish

This all begs the question: what’s happening?

There are several factors at play here, with the first being the simple fact that the bitcoin market has been overcrowded for several weeks now. This has been underlined by a survey published by Bank of America on January 20, showing that 36% of fund managers believe that bitcoin is the most crowded trade you can find anywhere right now. It’s even more overcrowded than big tech, which had previously held the top spot since October 2019.

In other words, not only is bitcoin running out (at least for now) of new buyers who can continue pushing or propping up its price, but the crowdedness of the bitcoin market raises the risk of big price drops if investors suddenly lose faith in bitcoin. Because the bitcoin market is already crowded, there will be few people to sell to for reasonable prices should investors want to exit the market. As such, it’s likely they’ll be forced to sell for discounted prices in order to offload.

And in fact, something like this has happened, particularly as bitcoin holders have sought to take profits in recent weeks. That this is largely responsible for the current bear market is the view of numerous analysts, including Alex Krüger.

Source: Twitter

Miners have recently begun playing a part in this profit-taking selloff, with data from CryptoQuant revealing that the Bitcoin Miners’ Position Index — which measures the “ratio of BTC leaving all miners’ wallets to its 1-year moving average” — has hit an eight-year high. According to CryptoQuant CEO Ki Young Ju, miners have “been moving an unusual amount of Bitcoins lately.”

Source: Twitter/CryptoQuant

With a score of 2.88, the above chart shows that most miners are selling their inventory of bitcoin (any score above 2 indicates that more are selling than holding), and that the rate of their selling is rising.

Of course, it’s all well-and-good saying that holders and miners are selling and taking profits. But why are they selling now? Why didn’t they hold off and wait until bitcoin hits $45,000, $50,000, or even higher?

This question brings us to our next factor: negative sentiment. Given the arrival of the Biden administration, and given the remarks of certain members of this administration, the market has now become a little unsure as to where bitcoin is headed in the short-to-medium term.

With Treasury Secretary Janet Yellen announcing that the use of many cryptocurrencies must (in some ill-defined way) be ‘curtailed,’ the market is obviously spooked that restrictive legislation/regulation may be on its way.

Traders — including miners — are therefore unsure which way the bitcoin market will go next. Given the possibility of legislation, some may obviously have suspected that $40,000 is the best bitcoin can hope for in the medium term. Hence, they sold up, and took profits.

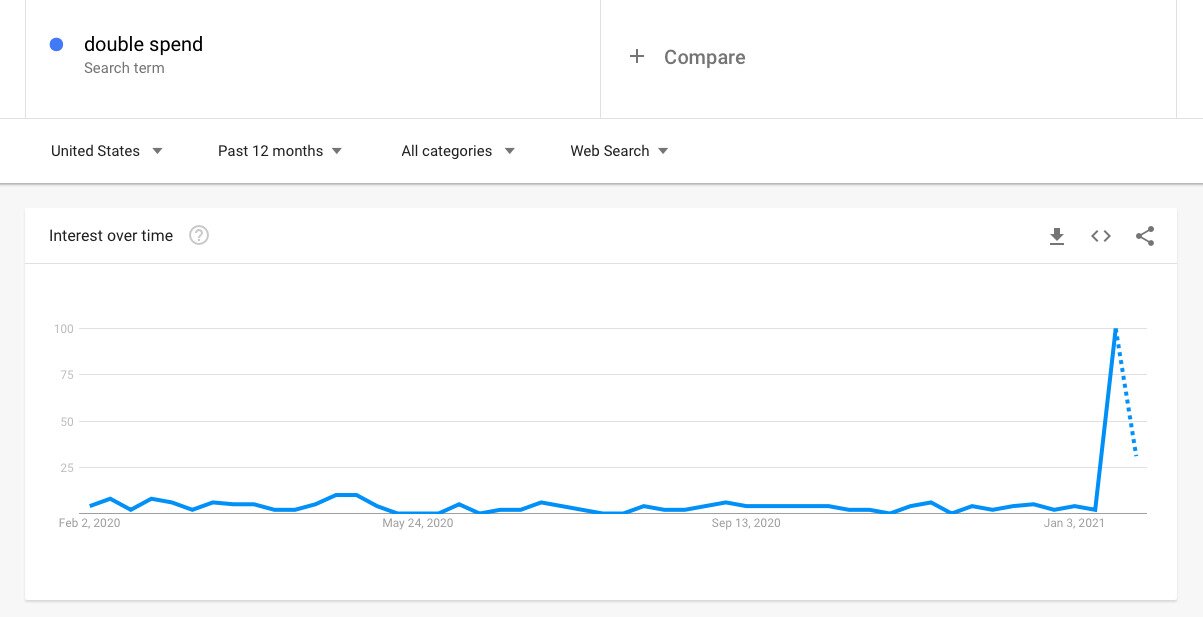

Lastly, this lack of short-term confidence hasn’t been helped by a spike in FUD (fear, uncertainty and doubt). On January 21, certain publications published a report from BitMex which suggested that a double-spend had occurred on the Bitcoin blockchain. This report was mistaken and roundly debunked by various experts, although it didn’t stop searches for “double spend” from hitting an all-time high.

Source: Google Trends

It also didn’t stop the price of bitcoin from falling from over $34,000 to under $30,000 in about a day.

So yes, even though things no longer look as spectacular for bitcoin right now as it did a few weeks ago, there are plenty of fairly mundane reasons as to why this is the case. And while the short-term picture may be somewhat rocky, the fundamental case for bitcoin still hasn’t changed.