- >News

- >How to Turn $0.002 into $69,000: The Five Biggest Crypto Gainers in History

How to Turn $0.002 into $69,000: The Five Biggest Crypto Gainers in History

Every cryptocurrency investor dreams of making big profits. Yes, some hope that blockchain tech will one day transform society, but for most people crypto’s primary purpose remains financial investment and speculation. This is evident in how media coverage and social mentions for crypto spike in tandem with significant rallies, and also in how each new bear market causes some commentators to declare, yet again, that crypto ‘is dead.’

But just how high can crypto gains go? In this article, we round up the five biggest crypto gainers of all-time. This means identifying which coins posted the biggest percentage gains between their all-time recorded lows and their all-time recorded highs. And it also means unpacking the context of such gains, so as to understand the conditions that contributed to them and the question of whether they may happen again.

Bitcoin: 62,759,999,900% Gain Between May 2010 and November 2021

Bitcoin (BTC) may be overly familiar by now, and it may have had some of its luster stolen by newer coins at the times, yet it still registers on any list of the biggest crypto gainers of all-time.

This is based on its earliest reliably recorded price, which was $0.0025 in May 2010. This was when programmer Laszlo Hanyecz paid 10,000 BTC for two pizzas, which were worth about $25. Even Hanyecz himself wouldn’t have predicted that the cryptocurrency he spent at that time would have risen so astronomically in price, since if he had, he wouldn’t have spent it.

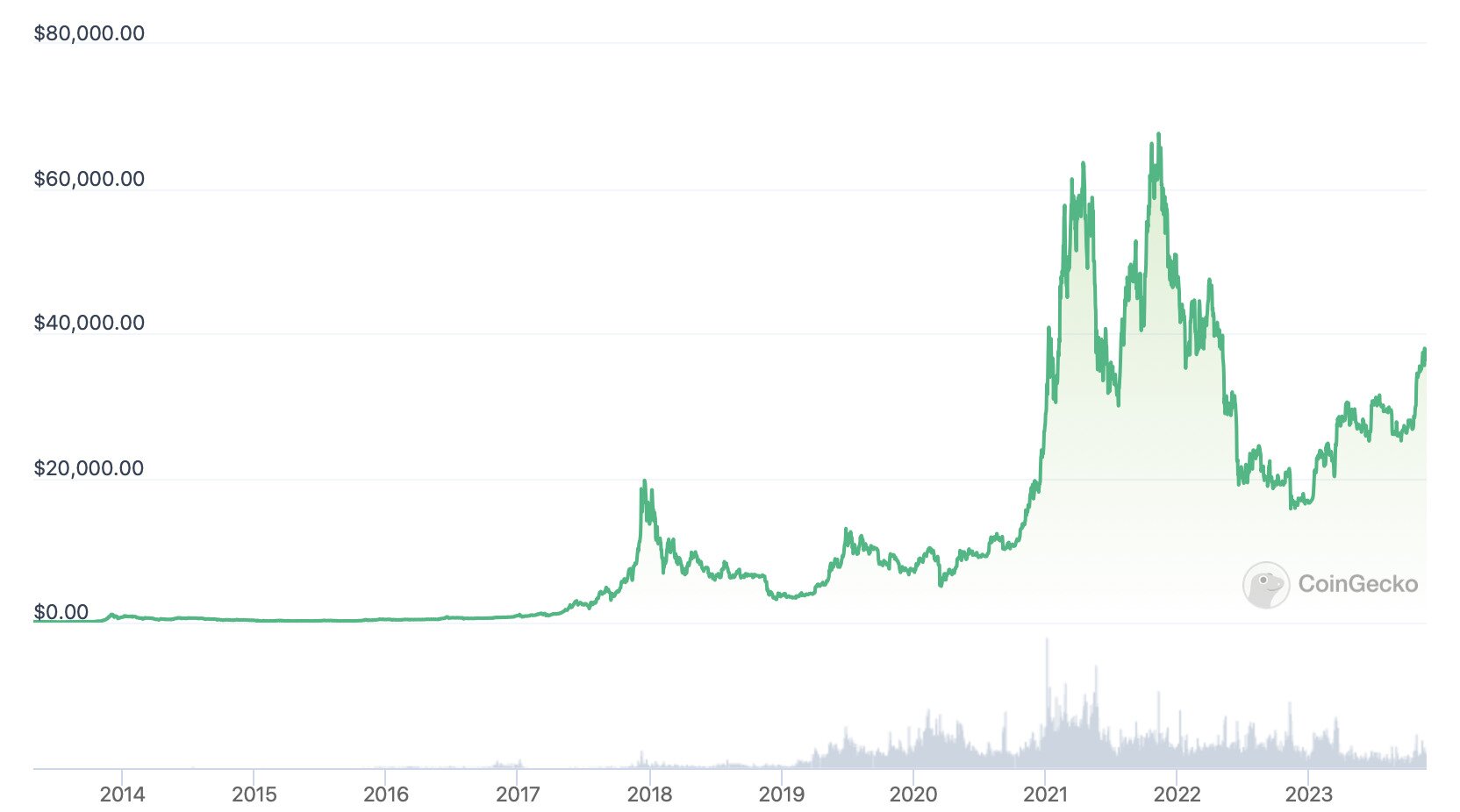

Bitcoin’s price history since 2013. Source: CoinGecko

But rise astronomically it did, with BTC reaching an all-time high of $69,000 in November 2021, at the height of the cryptocurrency market’s most recent bull run. What this means is that, between May 2010 and November 2021, BTC recorded a return of roughly 62.76 billion percent, a gain which continues to stand as the biggest of all-time.

And it’s likely to stand as the biggest ever gain until bitcoin itself exceeds its record high during the next bull market. Sure, some naysayers would be tempted to suggest that the cryptocurrency market will struggle to reclaim its former heights, but if one token is ever going to pass the price of $69,000, it’s going to be BTC. It continues to attract exchange-traded fund applications from major institutions, and once any of these are approved, it’s going to be leading the next bull market.

Shiba Inu: 152,858,005% Gain Between November 2020 and October 2021

Representing not only one of the biggest gains of all-time, but also one of the fastest, upstart meme token Shiba Inu rose astronomically in price between November 2020 and October 2021. These two points represent the coin’s lowest and highest recorded prices to date, and if anyone had bought in November and sold in October, they would have made a return of an astonishing 152.86 million percent.

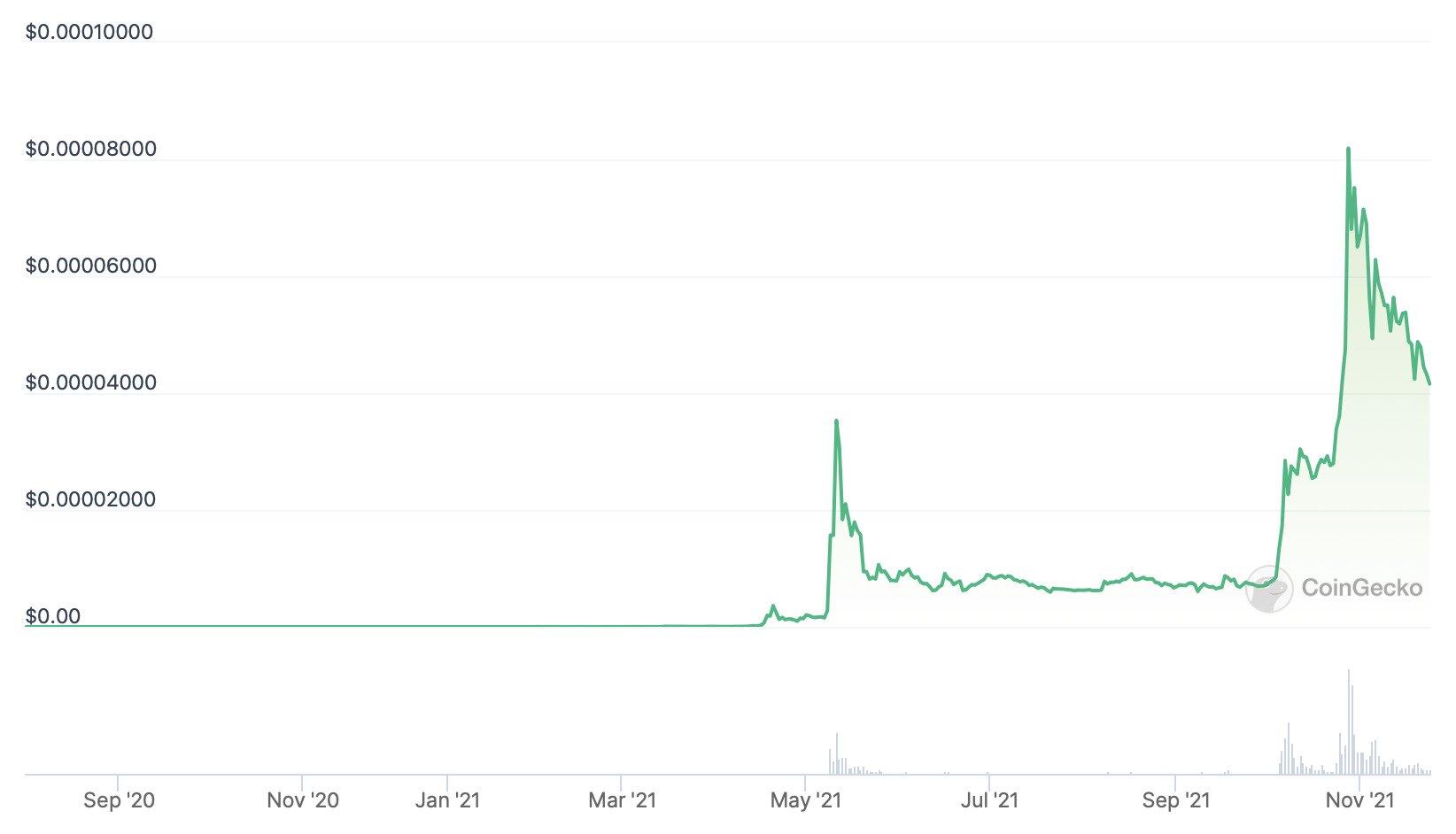

Shiba Inu price between summer 2020 and November 2021. Source: CoinGecko

What’s interesting about Shiba Inu (SHIB) is that it was designed intentionally as another jokey meme token that would start with a disproportionately rock-bottom price. Clearly, the idea was that, through hype and virality, this rock-bottom price would rise quickly, helped along by a 1% daily burn of the existing SHIB supply.

And funnily enough, this is exactly what happened, with SHIB reaching an ATH of $0.00008616 on October 28, 2021. However, the meme token remains 90% down from this record as of writing, in contrast to other major tokens (e.g. BTC and ETH are 46% and 58% down from their respective highs). Recent attempts at improving its utility (e.g. Shibarium) haven’t done that much to improve this situation either, raising the possibility that SHIB’s days of eye-poppingly massive gains may be over.

BNB: 1,722,751% Gain Between October 2017 and May 2021

Coming in third in this list of the biggest crypto gainers of all-time is BNB, which launched as Binance’s native exchange token in July 2017. Like many tokens at that time, it had its own initial coin offering (ICO), during which it sold at a price of $0.15.

However, not too long after launching, it dipped to what remains an all-time low of $0.03981770, recorded on October 19, 2017.

Anyone looking at the token at this particular time may not have been particularly impressed, but Binance was able to ride the bull market of December 2017 and then, later, of 2020 and 2021 to become the biggest exchange in the world. Its growth increased demand for BNB, which affords holders discounts on its trading fee, meaning that demand for cryptocurrency trading increased demand for the token.

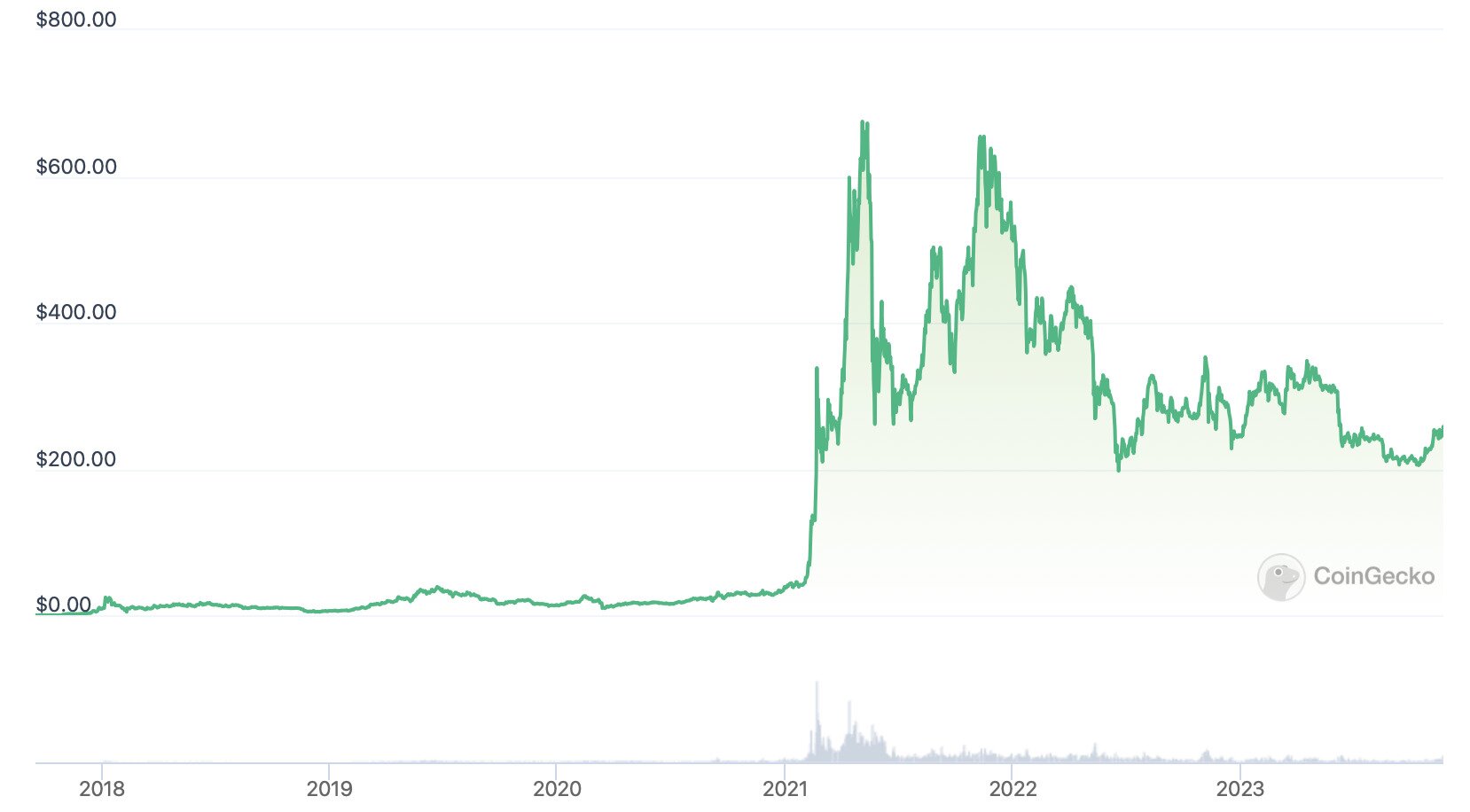

BNB’s price chart since late 2017. Source: CoinGecko

Accordingly, BNB reached its ATH of $686 on May 10, 2021, capping a 1.7 million percent return over its all-time low. As for whether BNB is likely to break its record high in the next bull market, this could depend on whether Binance is able to successfully defend itself against the legal actions it’s currently facing in the US.

Ethereum: 1,573,448% Gain Between 2014 and November 2021

Revealed in 2013 as “a next-generation smart contract and decentralized application platform,’ Ethereum held its initial coin offering in 2014 and went live in July 2015. It was during its ICO that it sold for a price of approximately $0.31, although participants paid using bitcoin rather than US dollars.

Given just how different Ethereum was at the time to Bitcoin and its forks, it would have taken a confident individual to predict that it would become the second-biggest cryptocurrency in the market. Yet this is exactly what it did, with its native token reaching a record high of $4,878 on November 10, 2021, just as its network reached a total value locked in of around $108 billion.

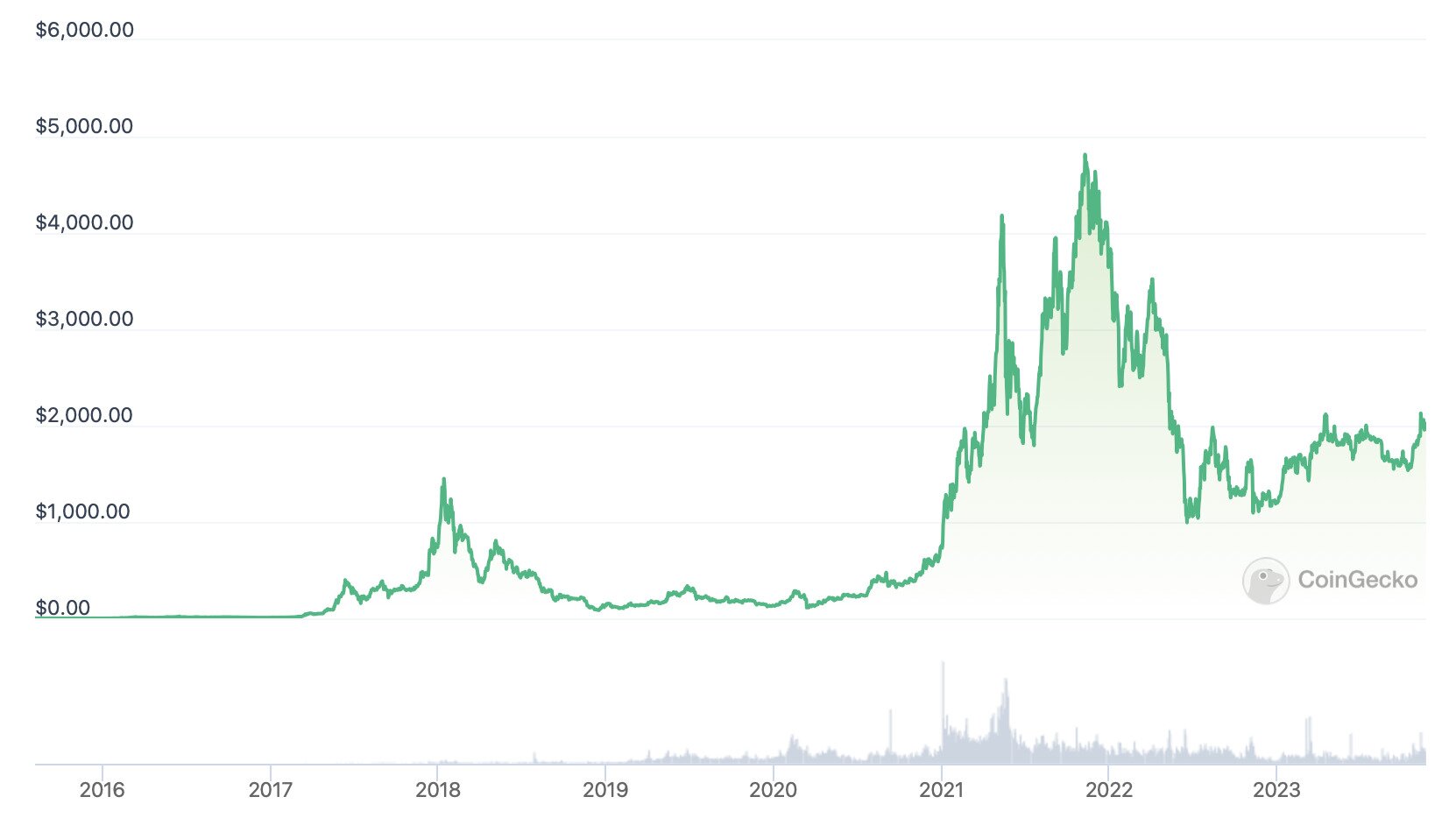

Ethereum’s price since late 2015. Source: CoinGecko

This record high marked a 1.57 million percent gain from its ICO price, netting any of the coin’s earliest investors a massive return. And given that Ethereum continues to dominate the cryptocurrency sector in terms of usage and TVL, it’s likely that the next bull market will help ETH beat its current record, extending its percentage gain from its 2014 ICO even further.

Dogecoin: 841,761% Gain Between May 2015 and May 2021

The original meme token, Dogecoin was launched in 2014 and quickly became an “accidental crypto-movement that makes people smile.” Its founders intended it as a lighthearted alternative to the existing cryptocurrencies of the time, which were (and probably still are) regarded as overly serious endeavors undertaken by unrelatable nerds and outsiders.

Its philosophy seemed to catch on, albeit quite slowly, since DOGE reached a then-record high of only $0.017586 in January 2018. This represented ‘only’ a 20,000 gain over its lowest ever price of $0.00008690, which was recorded on May 6, 2015.

Dogecoin’s price history since 2014. Source: CoinGecko

However, the next bull market saw Dogecoin rise to new heights, boosted substantially by regular cheerleading from Tesla CEO and SpaceX founder Elon Musk. Coinciding to the day with Musk’s appearance as a guest host of Saturday Night Live, it reached its current record high of $0.731578 .

This represents an impressive 841,000% gain over its record low, and while DOGE lacks the fundamentals that would guarantee new record highs soon enough, the remote possibility of X (formerly Twitter) bringing in Dogecoin payments could one day see it jump aggressively again.