- >News

- >PayPal Bitcoin Is Big News for Crypto, But Exchanges Have a Big Edge

PayPal Bitcoin Is Big News for Crypto, But Exchanges Have a Big Edge

If you have even the vaguest of interest in crypto, you will have heard that PayPal is launching a cryptocurrency service. Starting from now and expanding further in the coming weeks and months, PayPal’s customers will be able to buy and sell bitcoin and other major cryptocurrencies, as well as use crypto to pay for goods with 26 million merchants worldwide.

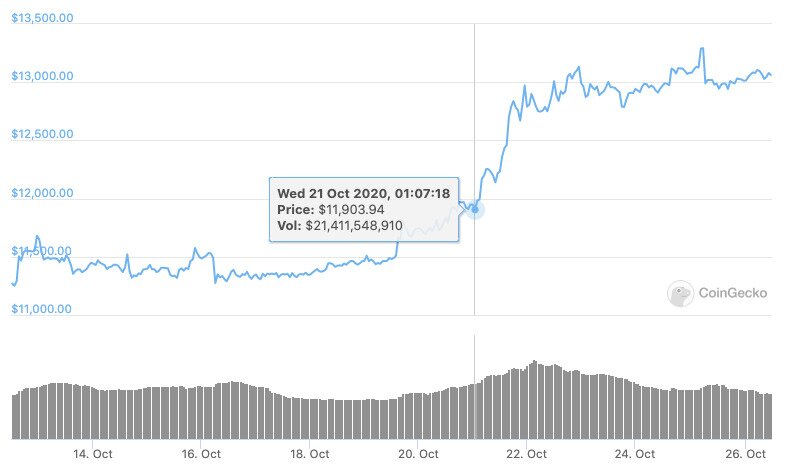

Whatever way you look at it, this is big news for the cryptocurrency industry. The price of bitcoin shot up in response to PayPal’s announcement on October 21, rising from just $12,000 to around $13,000 in a matter of days. The prices of other cryptocurrencies soon followed, driven by the sense that crypto is finally entering the mainstream in a substantial, meaningful way.

The reality, however, is somewhat mixed. PayPal’s existing 300 million-plus customers will indeed be able to invest in cryptocurrencies and push up their prices, becoming participants in the crypto market via PayPal’s user-friendly platform.

But without the ability to withdraw their crypto from PayPal, and with ‘crypto purchases’ actually involving a pre-conversion to fiat, it’s clear that PayPal’s move isn’t the full mainstream acceptance that some commentators believe it is. Likewise, with dedicated crypto-exchanges improving their interfaces all the time, it’s also clear that people who really are interested in holding and trading crypto would be better off looking elsewhere.

PayPal = Crypto For Those Who Don’t Know Where Else to Look

Just to recap what PayPal has actually announced, its October 21 press release “announced the launch of a new service enabling its customers to buy, hold and sell cryptocurrency directly from their PayPal account.” It also announced that customers would be able to use their crypto holdings as “a funding source for purchases at its 26 million merchants worldwide.”

The cryptocurrencies supported by PayPal’s new service are currently very limited, comprising only bitcoin, ethereum, bitcoin cash, and litecoin. Also, the service will be rolled out initially only in the United States, with the rest of the world to follow in an incremental fashion.

Unsurprisingly, figures within the wider crypto community are thrilled by the news.

Source: Twitter

Many commentators also believe that PayPal’s announcement is effectively the trigger which ignites Bitcoin’s flight to the Moon. Not only will its price skyrocket, but other payment service providers — and also banks — will follow PayPal’s lead in offering crypto services.

Source: Twitter

The cryptocurrency market appears to largely agree with such judgments, as indicated by the price chart below for bitcoin.

Source: CoinGecko

Yes, But…

It’s hard to argue that PayPal’s announcement isn’t bullish for bitcoin and other cryptocurrencies, especially in conjunction with other recent news concerning institutional and corporate adoption. That said, it’s not as bullish for crypto as you might think, at least not in the short-to-medium term.

Why? Let’s ask a hypothetical question: how many existing PayPal customers are currently interested in crypto, but not interested enough to open an account with a dedicated crypto-trading service?

It’s hard to imagine that anyone tech-savvy enough to open an account with PayPal can’t already do the same with, say, Coinbase, Kraken, Paxos, Gemini, or any other regulated exchange. So let’s just say that only 10% of PayPal’s 346 million customers fall into this category, making for some 34 million people who may take the opportunity to buy bitcoin or ethereum through PayPal, having refrained from doing so elsewhere.

But this number may be even smaller in actuality, since PayPal’s cryptocurrency services — which will be provided in partnership with Paxos — come with a number of important limitations.

‘Owning’ Crypto on PayPal Will Have Serious Limitations

Users will not be able to withdraw the cryptocurrency they buy via PayPal, with PayPal explaining in its FAQ that users will not be provided with the private keys to their crypto holdings. Any crypto you buy using PayPal will have to stay in your PayPal account, so you won’t be able to transfer it to your own hardware wallet. This is something which may put these holdings at risk, given the fact that PayPal isn’t immune to security vulnerabilities.

PayPal is also imposing a purchase limit, with customers capable of spending a maximum of $10,000 on crypto in a single week, and $50,000 in a year. Put differently, this isn’t a service for wealthier customers, or corporate or institutional accounts.

Taken together, these two restrictions indicate that users will lack a significant measure of control over their crypto, particularly in comparison to specialized exchanges. This may end being a deterrence to a portion of users who are interested in buying up bitcoin (or ethereum, or bitcoin cash, or litecoin) and sitting on it for a prolonged period of time, so that it can appreciate significantly in value.

Such long-term holding is common in crypto, with 61% of the total bitcoin supply not moving in over a year. Anyone who is serious about holding a significant amount of crypto and letting it appreciate may feel uncomfortable about leaving it in a third-party account.

Basically, the point is that anyone really serious about gaining exposure to crypto would be much better off doing so via a more established crypto-exchange. But then again, PayPal may be hoping that a significant portion of its customer base doesn’t know any better.

Not Really Purchases

Another point worth making about PayPal’s new service is that it doesn’t really let you purchase items online using crypto. What happens is that, when you make a ‘purchase’ using crypto, your crypto funds are sold for U.S. dollars (via Paxos), which are then sent on to the relevant merchant.

This might seem like a minor point, but it highlights how PayPal’s announcement doesn’t represent the long-awaited point at which crypto becomes mainstream as a means of payment. Merchants will not be accepting crypto via PayPal.

This nitpicking aside, PayPal’s news is obviously positive for crypto overall, with the industry likely to be forced to improve its UX to compete with the payments giant. Also, by providing PayPal’s existing customers with the ability to buy crypto, we may find that millions of these customers are encouraged to purchase bitcoin and/or ethereum for the first time during future rallies.

This presumes that rallies will largely originate elsewhere, but PayPal’s customers may end up acting as catalysts for stronger bull runs in the future, helping to push the price of crypto even further. And with PayPal acting as an example to other payment service providers and banks, its announcement will surely end up becoming a significant piece of the puzzle in the coming years.