- >News

- >Scam Cryptos Are Still Booming: How to Spot Fake Coins

Scam Cryptos Are Still Booming: How to Spot Fake Coins

Nearly a quarter of all new cryptocurrencies could be fraudulent rug pulls, according to new research from Chainalysis. The blockchain forensics and security firm has published its 2023 Crypto Crime Report, with its data revealing that 24% of newly launched tokens experience price declines of as much as 90% within their first week of being listed on exchanges. This suggests that their creators have dumped their holdings onto unsuspecting retail investors, with Chainalysis’ research also finding that a small group of issuers are responsible for around a quarter of all suspected scams.

This should sound alarm bells for most retail cryptocurrency investors, especially those that focus on smaller cap and newer coins in the hope of outperforming the market. Because what Chainalysis’ research finds is that a significantly large proportion of new coins are launched not with the intent of providing a useful decentralized platform or cryptocurrency, but with the intent of fleecing retail investors out of money. In other words, many are not real projects with real intentions, but rather outright scams built on overblown claims and hype.

Accordingly, this article will help traders avoid being sucked into the next too-good-to-be-true cryptocurrency, offering tips on how to spot potential crypto rug pulls.

Chainalysis Report Reveals Industry of Rug Pulling

Saved for the final section of its 100-page report into cryptocurrency-related crime, Chainalysis’ detailing of the behavior of rug pulls and pump and dump scams makes for some instructive reading.

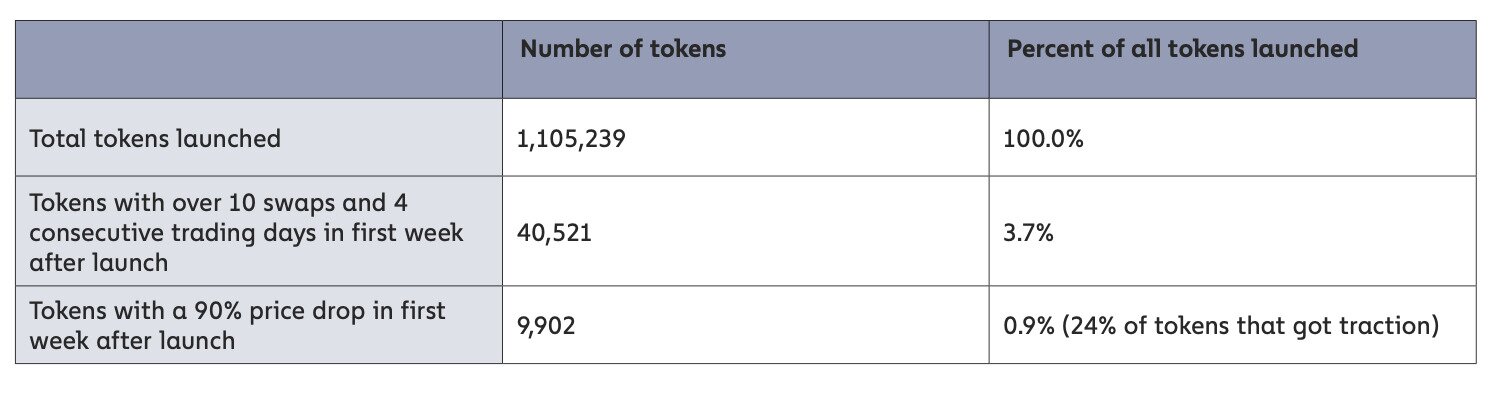

Table showing the total number of tokens launched in 2022, along with the percentage of such tokens involved in 90% price drops. Source: Chainalysis

Its main finding was that, of the 40,521 tokens launched in 2022 that gained meaningful traction, 9,902 witnessed a 90% price decline within the first week of becoming tradable. For Chainalysis, such a steep drop is “indicative of possible pump and dump activity,” meaning that the 9,902 coins it tracked were likely created with the sole intention of defrauding investors.

It’s arguable that more may have actually been rug pulls, seeing as how Chainalysis requires a 90% drop, which is a pretty high threshold. Most investors would still feel pretty shortchanged if the new coin they bought dropped by 80%, 70% or 60% within the first week or so of listing, so a critic could argue that the problem may be even worse that Chainalysis portrays.

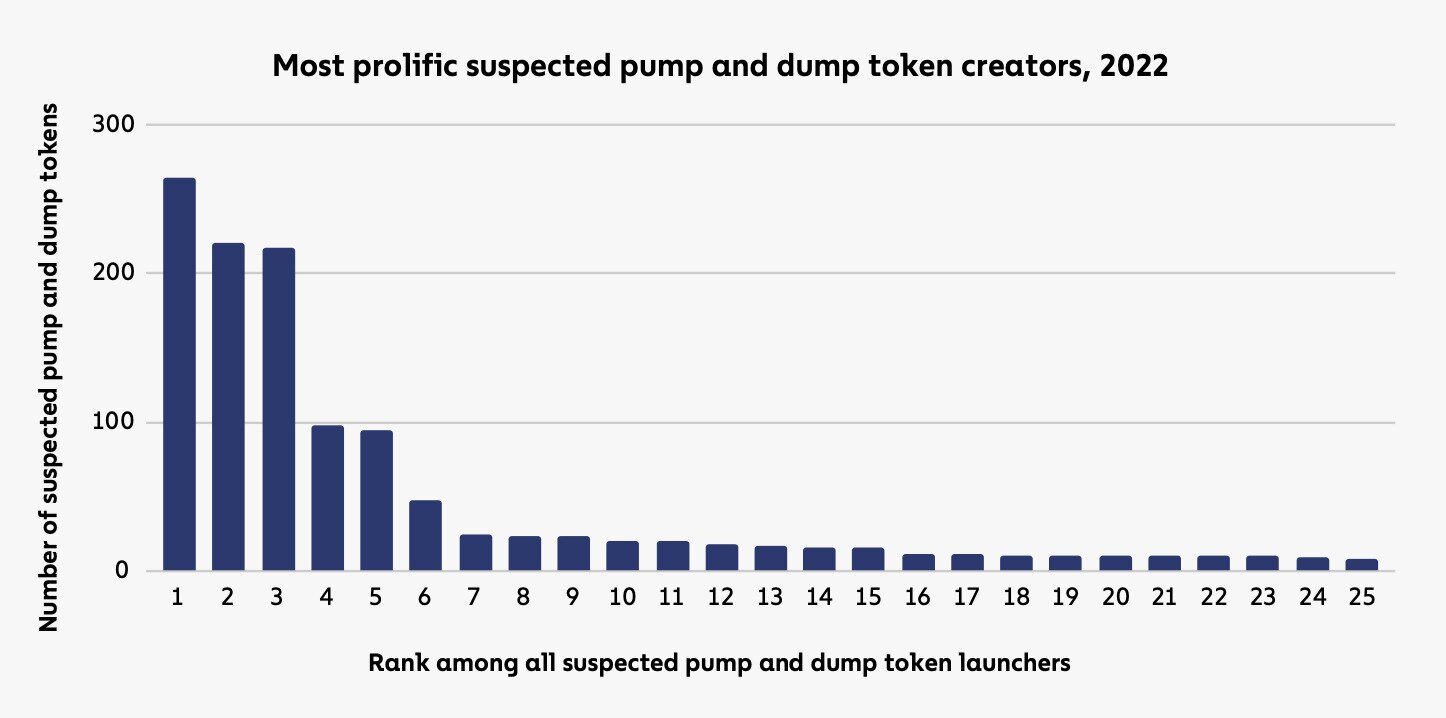

Interestingly, the analysis firm’s report also found that a surprising number of people or groups spend much of their time launching multiple fraudulent tokens. In fact, 445 individuals or groups were responsible for 24% of the 9,902 suspected pump and dump tokens launched in 2022. Even more astonishingly , a single creator was responsible for 264 rug-pull tokens launched last year, with two other parties launching just over 200 scammy cryptocurrencies, and another two launching nearly 100 each.

Source: Chainalysis

Basically, there is a mini-industry of people who launch impressive-looking tokens that they then dump on the market as soon as they receive listings. They hold initial public offerings and token sales for these new cryptocurrencies, while also sharing an ambitious roadmap which appears to suggest that the corresponding project has lofty goals. However, in far too many cases creators have no intention of supporting their coins beyond their initial exchange listings, leaving a trail of disappointed investors in their wake.

According to Chainalyis, retail investors spent a grand total of $4.6 billion worth of cryptocurrency acquiring some of the 9,902 suspected rug pulls they identified. The firm also estimates that the issuers of the flagged tokens made a total of $30 million in profits, having dumped their bags onto retail investors before the prices of their creations crashed to Earth.

How to Detect Potential Rug Pulls

Of the 9,902 new tokens they identified, Chainalysis double-checked 25 of them with biggest first-week price drops on Token Sniffer, a service which provides automated contract auditing and scam detection. All 25 of them scored zero out of 100, indicating that “they were almost certainly designed for a pump and dump.”

As such, retail traders may wish to check with Token Sniffer in the future, before investing in any new token that’s due to list soon. The service has recently cited by the US Department of the Treasury and in testimony before the Senate Banking Committee, with Token Sniffer boasting that it’s an “established authority on smart contract scams screening.”

From a more general perspective, retail investors can detect potential rug pulls in a variety of ways. These include the following:

- Check the roadmap, business model and overall design. Of the many new tokens this particular author comes across on a regular basis, quite a large portion of them are far too ambitious and grandiose for their own good. That is, they claim they’re going to solve a big problem or revolutionize a large area of human activity, something which is probably far too difficult for 99% of tiny startups to achieve.

- Look at the team, check for pedigree. If a project doesn’t make its principal founders and team members public — and if said individuals do not have a detailed resume/backstory that can be corroborated from multiple sources (e.g. LinkedIn, company websites, university websites) — then there’s a very good chance it’s a scam. This is possibly the most important thing to check for.

- Exchange support. If a coin is set to be listed on only one or two small trading platforms or decentralized exchanges, it will be ripe for a massive fall soon after listing. At the same time, support from a larger number of (reputable) exchanges suggest that industry insiders have vetted the coin and that, relative to others in the market, it’s pretty safe.

These are the three main things investors should consider if they encounter a new project (perhaps holding a presale). Together with checking a coin on Token Sniffer, they should provide a robust method for weeding out suspect projects.

Of course, it needs to be pointed out that pump and dumps are a general phenomena within the cryptocurrency market, and it’s not only soon-to-be-listed tokens that traders need to be careful with. For this reason, always remember the tried-and-true adage: do your own research.