- >News

- >The Stunning Highs and Lows of the 5 Richest People in Crypto

The Stunning Highs and Lows of the 5 Richest People in Crypto

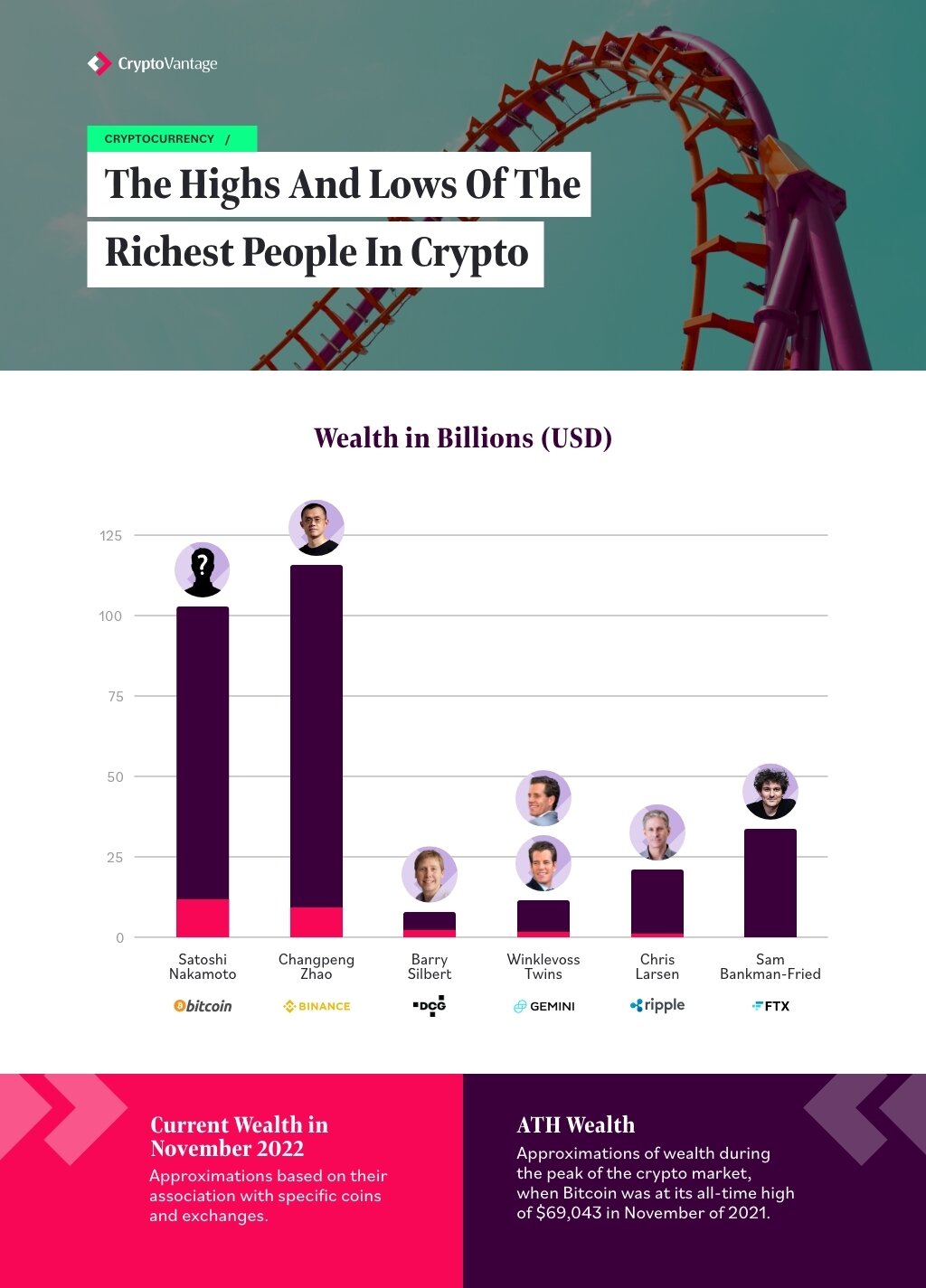

Cryptocurrency revolves around wealth. One of Bitcoin’s selling points is it’s the “best store of value in history,” while much of the wider ecosystem is defined by DeFi platforms that aim to democratize access to finance. At the same time, the whole sector is represented by the wealthy and influential individuals at the helm of its exchanges, apps and projects. These are the people who personify crypto to the wider public, inspiring future investors and entrepreneurs to jump into the ecosystem in the hopes of amassing their own fortunes. They also move prices more than anyone else in the market.

Of course, not everyone who ever involved themselves with cryptocurrency is rich, but there are more wealthy people working in the sector than can be named in a single article. That’s why this report focuses on the six richest people in crypto, breaking down just how exactly their wealth is composed. It looks at their cryptocurrency holdings, income and other assets, providing a broad overview of the potential money that can be made if you identify an opportunity and move before anyone else.

But with the cryptocurrency market remaining so volatile, this feature will also highlight just how much the wealth of the five richest people in crypto can fluctuate. It will cover the all-time highs of their respective personal fortunes, their current lows, and will also show how many have risen to their current position precisely because they accumulated cryptocurrency during market lulls.

Who is Crypto's 1%?

Without further ado, here’s a look at the alleged top six wealthiest people in crypto.

This list was generated using publicly available numbers and should be considered more of a loose estimate (based on the price of crypto at the time of publication) rather than a definitive document. Still, it gives a good idea about the massive fluctuations in wealth in the crypto industry.

1. Satoshi Nakamoto

Estimated Current Wealth: $18.946 billion

All-Time High Wealth: $79.317 billion

The pseudonymous Satoshi Nakamoto is famously the creator of Bitcoin, which he revealed via the publication of a now-iconic whitepaper on October 31, 2008. With the help of a number of collaborators (mostly experts in cryptography), he launched Bitcoin on January 3, 2009.

Between this date and January 25, 2010, Satoshi Nakamoto mined 1,814,400 bitcoin, according to a 2013 study by cryptocurrency and security researcher Sergio Lerner. 37% of this haul was transferred to other parties, leaving Nakamoto with a fortune of 1,148,800 BTC.

As stated above, this fortune was worth approx. $79.3 billion when bitcoin reached its current all-time high of $69,043 on November 10, 2021. Now, with BTC worth roughly $16,800 (as of writing), it’s worth ‘only’ $18.9 billion.

This makes Satoshi Nakamoto the richest person in crypto. Needless to say, given Nakamoto’s anonymity and disappearance in 2011, there’s no certainty the Bitcoin creator is a single individual. If ‘he’ is actually a group (something which has been suggested by some commentators), then the stash of bitcoin would obviously have to be divided between more than one individual, diluting any one person’s wealth.

It’s also worth pointing out that, while the market cap of Satoshi’s BTC is currently north of $18 billion, this doesn’t represent realizable wealth. Indeed, if Nakamoto were to attempt the sale of over one million bitcoins, there’s little doubt he would crash the cryptocurrency’s price in the process, leaving himself with much less cash than $18 billion.

Of course, using the market value of held assets is a common practice in wealth reporting (e.g. Elon Musk’s personal wealth is based largely in his ownership of Tesla stock), so it doesn’t invalidate the use of it here in the context of the richest people in crypto. Still, it offers a reminder that we shouldn’t think that, just because someone owns crypto with a market cap of $X billion, they actually have that amount of cash sitting in the bank.

Since Nakamoto mysteriously disappeared, there has been little sign of him reemerging again, despite the unproven claims of Australian entrepreneur Craig S. Wright that he’s Bitcoin’s elusive creator. The closest the ecosystem has had to a return is the movement of some 50 BTC from a wallet that had been dormant since 2009, yet the identity of the person moving this sum has never been confirmed.

2. Changpeng ‘CZ’ Zhao

Current Wealth: $15.6 billion

ATH Wealth: $95.8 billion

Changpeng Zhao is the CEO and founder of Binance, the world’s largest crypto-exchange in terms of trading volume. His personal wealth consists largely in his shares in Binance, which remains a private company, meaning it doesn’t publicly share its valuation. He also holds some bitcoin — bought largely in 2014 — as well as BNB and some other coins, although he hasn’t disclosed exact quantities.

While CZ’s wealth is kept under wraps, Bloomberg used Binance’s market valuation to arrive at an estimate of $95.8 billion in January 2022. This is based on evidence which suggests Zhao owns 90% of the exchange, although Forbes has also produced its own estimates which suggest that he owns 70% of the company. Accordingly, the latter calculated his fortune in April of this year at $65 billion, based on March 11 cryptocurrency prices and its valuation of Binance at $92.5 billion.

This estimate didn’t cover all of Zhao’s cryptocurrency holdings, so there’s a chance he’s worth more, although it would be pure speculation to suggest how much more. Unfortunately, the ongoing bear market has taken its toll on the Binance CEO’s wealth, with Bloomberg suggesting in October, 2022, that he’s now worth around $15.6 billion.

As for what Zhao might do with his wealth, he has previously suggested he will give away anything from 90% to 99% of it when the time comes. For now, he’s second only to Satoshi Nakamoto.

3. Barry Silbert

Current Wealth: $2 billion+

ATH Wealth: $4 billion

Silbert is the founder and CEO of Digital Currency Group, a holding group that owns five separate cryptocurrency companies, including CoinDesk, Genesis Trading, and Grayscale Investments. This means Silbert has his hands in several different pies, allowing him to spread risk and opportunity a little more evenly than other crypto billionaires.

The crown jewel of DCG’s empire is Grayscale Investments, which is an institutional investor in cryptocurrency, managing around $28 billion in assets across numerous funds. Its biggest is the Grayscale Bitcoin Trust, which currently has $13.1 billion in bitcoin under management, and has enjoyed a return of over 13,000% since its inception in September 2013.

Silbert reportedly has a 40% stake in DCG, which was valued at $10 billion in November 2021, when it raised $700 million. This would have meant he was worth $4 billion at the time, but has since suffered a fall, with Forbes now putting his fortune at $3.2 billion.

It’s all-but certain that Silbert also personally owns cryptocurrency, although he has deliberately been evasive about just how much. There’s a good chance it’s a considerable amount, particularly when DCG notes in its about page that he “began buying bitcoin in 2012 and quickly established himself as one of the earliest and most active investors in the industry.”

Not only does his personal cryptocurrency holdings likely boost his wealth even further beyond $3.2 billion, but Silbert also profited from the sale of liquidity provider SecondMarket — which he founded in 2004 — to NASDAQ in 2015. This earlier venture likely provided him with the finances to have a good head start in buying bitcoin, back when it was cheap.

Silbert may actually have considerably less these days as Genesis Trading and Grayscale Investments have been hit hard by the recent bear market.

5. Cameron and Tyler Winklevoss

Current Wealth: $2.1 billion (each)

ATH Wealth: $5.679 billion (each)

While identical twins Cameron and Tyler Winklevoss do fall into the category of rich owners of crypto-exchanges, they distinguish themselves from Changpeng Zhao and Sam Bankman-Fried by virtue of the fact that a large part of their respective fortunes comes from the personal ownership of bitcoin.

Yes, the Winklevoss are also famous for having purchased around 200,000 bitcoins in 2013, using the proceeds from a 2008 lawsuit against Facebook founder Mark Zuckerberg that resulted in a $65 million settlement for them. They’ve sold significant portions of this stash of BTC at various points since they began accumulating it from around 2012, using some of the proceeds to found the US-based Gemini exchange in 2015.

According to Forbes, they still own 70,000 BTC in total. At the time of bitcoin’s ATH of $69,044 in November 2021, this pile would have been worth $4.833 billion. Then researchers could add the value of the twins’ 75% stake in Gemini, which was valued at $7.1 billion in the same month. The twins also own 100% of NFT marketplace Nifty Gateway, which had an estimated value of up to $1.2 billion as of March 2021.

Adding these figures together, the Winklevoss twins had a combined wealth of at least $11.358 billion in November 2021. That said, Nifty Gateway was likely to be worth more at this point (in comparison to its March 2021 valuation), so the real figure was probably a little higher.

Now, however, Forbes estimates the wealth of each twin (Cameron and Tyler) at $2.1 billion. What’s interesting about this is that the twins have suffered a smaller fall than other members of the crypto rich list. This is possibly because they aren’t solely dependent on the valuation of their trading platforms, in that they have a big trove of bitcoin to fall back on.

While the twins haven’t made the kind of grandiose commitments seen with Changpeng Zhao, they have donated to charity on a few occasions already. Most notably, they are the leading donors to the Bitcoin Water Trust, which aims to hold bitcoin until at least January 2025 so that it can use price appreciation to bring drinking water to developing nations.

5. Chris Larsen

Current Wealth: $2.9 billion

ATH Wealth: $17.646 billion

Rounding off this list of the six richest people in crypto, Chris Larsen is the co-founder of Ripple, which launched in 2012 under the name of OpenCoin. One of the primary advantages of being co-founder for Larsen is that it means he owns 5.19 billion XRP, amounting to 17% of its overall supply.

Incredibly, this 5.19 billion XRP was worth $17.646 billion on January 7, 2018, when the price of the altcoin reached an all-time high of $3.40. There has been no indication that he has sold any of this, even with the Securities and Exchange Commission putting Ripple in some difficulty via the launching of legal action in December 2020.

Assuming he still has all 5.19 billion XRP, this would put his current wealth at roughly $2.138 billion. However, Forbes estimates his personal fortune at $3 billion, with the remainder likely coming from Larsen’s previous business ventures and earlier wealth, as well as his 17% stake in Ripple Labs (which was valued at $15 billion in January 2022).

For instance, Larsen was the co-founder, CEO and chairman of early fintech firm E-Loan, in which he had a 5.05% stake around the time it was sold for $300m to Banco Popular in 2005. He also founded lending-borrowing marketplace Prosper.com in 2006, before stepping down as its CEO in 2012.

Larsen therefore stands out from other crypto billionaires due to his earlier background in fintech startups. This gave him plenty of experience prior to co-founding Ripple in 2012, and is perhaps one of the essential ingredients of his later success in Ripple. And while his personal wealth has declined during the current bear market, it may shoot up dramatically if Ripple gains a favorable outcome in its legal battle against the SEC, something which looks likely.

Bears vs Bulls

There are plenty of other crypto billionaires who could be included in this overview, but who for the sake of concision were excluded. This includes the following individuals, most of whom owe their wealth to significant stakes in crypto-exchanges, with some notable exceptions:

-

The anonymous owner of a wallet holding 132,882.54 BTC, worth $2.776 billion as of writing.

-

Brian Armstrong: Founder and CEO of Coinbase, currently worth $2.1 billion according to Forbes, with an ATH personal fortune of $6.6 billion.

-

Gary Wang: Co-Founder and CTO of FTX, currently worth $5.7 billion.

-

Song Chi-hyung: Founder of South Korean exchange Upbit, currently worth $3.5 billion.

-

Jed McCaleb: Co-founder of Mt. Gox, Ripple and Stellar, currently worth $2.1 billion.

These are also a couple of other crypto billionaires worth mentioning in a little more detail. Michael Saylor, to take one more example, is the CEO of consultancy MicroStrategy, which in August 2020 began accumulating bitcoin as a reserve asset. It now holds somewhere in the region of 130,000 BTC, with Saylor himself worth an estimated $1.6 billion.

Another name of note is Matthew Roszak, who is co-founder and chairman of blockchain tech startup Bloq, and who began accumulating bitcoin in 2012. Owing to his early start in buying up BTC, his personal wealth is now estimated at $1.4bn. As with Saylor and the Winklevoss twins, he’s on the list of the richest people in crypto because he entered the market early, before bull markets and price increases. The same goes for the anonymous owner of the wallet holding 132,884 BTC, who began stacking his sats in February 2019.

This is one of the common themes that emerges from researching the richest people in crypto. That is, those individuals who are now among the wealthiest people in the space generally saw opportunities before anyone else did. It can be argued that most had the advantage of entering crypto many years before it blew up, yet some — such as Michael Saylor and the anonymous whale — entered during dips, at a time when many investors and entrepreneurs weren’t especially interested. And while Saylor’s investment has lost value in recent months, MicroStrategy has continued to accumulate BTC during the ongoing bear market.

Such investment is based on the belief that investing in bitcoin and crypto is a long game and that, over time, patience will be rewarded. And given that the cryptocurrency market has already been through several bear and bull cycles in its short history, previous movements suggest that those who buy the dip and hold out long enough will end up making a sizable profit, even if they probably won’t become billionaires.

Dishonorable Mention: Sam Bankman-Fried

Current Wealth: $0 billion

ATH Wealth: $24 billion

We would be remiss to not mention a startling cautionary tale.

Sam Bankman-Fried’s meteoric rise in crypto, starting with the launch of international mega exchange FTX in 2019, and sudden fall in 2022 will likely be taught in economics text books for years to come as an example of what not to do.

It turns out that it’s relatively easy to build a fortune in crypto if you’re skirting the rules. While it’s not exactly clear what all went wrong with FTX (it will likely be the source of investigations for years to come) it seems the exchange essentially stole its customer’s funds, let sister trading firm Alameda Research invest the funds and then the market downturn created insurmountable losses. Game over.

Forbes’ highest estimate of Bankman-Fried wealth hit $24 billion, based on a calculation of FTX’s valuation in March 2022. That might all be gone now. It’s unknown if customers will ever get their funds back.

At just 30 years old, Bankman-Fried has likely earned and lost one of the greatest fortunes in history.

How it All Stacks Up

Here’s an updated look at some of the current (and former) crypto billionaires: