- >News

- >The Top 5 Benefits of Using Tax Software Like Koinly.io

The Top 5 Benefits of Using Tax Software Like Koinly.io

Tax season is always a stressful time. Assembling your totals, documents, receipts, and anything else you need to do to make your report.

The season can be especially stressful if you are a crypto user, as there are tax implications for almost everything you do with digital assets. Figuring out all your costs, transactions, and values across multiple exchanges or platforms can be a daunting task.

Tax season may have just ended in the USA but it’s never too early to prepare for next year. Furthermore, countries like Australia have tax deadlines coming up shortly.

Thankfully there are services like Koinly, which allow you to simply link exchange accounts and wallet addresses in order to generate the tax information you need. Here are some benefits to using tax software like Koinly to do your taxes.

Five Useful Reasons to Use Koinly for Taxes

When it comes to taxes, especially crypto taxes, there are multiple benefits to using tax software such as Koinly.

From saving you time, to compliance with local tax offices, there are a host of reasons you should use Koinly.

1. Exchange and Wallet Integration

If you’re like most crypto users, you likely have more than one exchange account or external wallet address that you use. Rather than needing to keep track of what you have done on each individual platform, Koinly allows you to do it in one place.

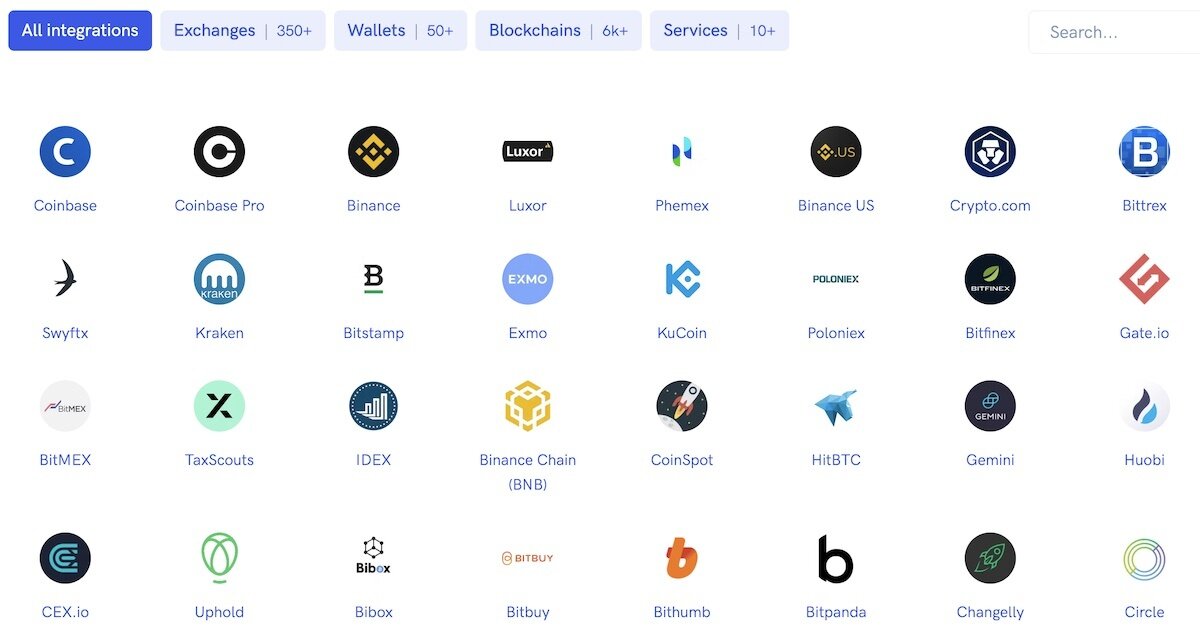

Koinly has integrated 380 crypto exchanges onto its platform, meaning once you add your read-only exchange API to the software, it will automatically note all your transactions on that exchange. Whether CoinSpot, CoinJar, or Digital Surge, Koinly has integration. Once you have added all the exchanges you do business with, Koinly will always be able to monitor and update tax reports each year.

Koinly also has wallet integration with over 90 crypto wallets. This allows you to simply provide your public wallet address in order for Koinly to be able to track your external wallet transactions in the same way in which it tracks exchange transactions. Whether you use MetaMask, Exodus, or Phantom, Koinly can track all your transactions.

2. Fair Market Value

It can be hard to keep track of what you paid for each crypto asset, and because selling, swapping, and buying crypto are all taxable events, it is incredibly important to know your cost basis. If your cost basis is off, you may end up paying more in taxes than you should or owe money that you shouldn’t.

Koinly not only keeps track of historic price values of each crypto asset, but they can also convert the price into your local currency. If you need to know what the price of Bitcoin was a year ago, in Australian Dollars, Koinly has that data. This is incredibly convenient for Australian and other users who have to file taxes in currencies other than USD, as most platforms use USD as their basis.

3. Advanced Use Case Support (DeFi And More)

Doing most of your crypto transactions off centralized exchanges can create an even larger headache for taxes. It is far less simple to figure out all you’ve done in decentralized exchanges (DEXs) and decentralized finance (DeFi) than with centralized entities.

Between staking, providing liquidity, and making swaps, there are many taxable events. Koinly is able to help figure out your numbers whether you are staking to a protocol or providing liquidity to a pool. All you have to do it provide your wallet addresses, and Koinly will figure out the rest.

4. Australian Taxation Office (ATO)

Koinly has integration with over 20 local tax office regulators, including the ATO. Koinly knows which numbers the ATO, or any other tax office they support, will need in order to be satisfied with your tax report.

Whether it is separating long-term gains from short or factoring in the 50% capital gains tax discount, Koinly does your report right. This helps ensure the ATO or similar entity doesn’t come knocking on your door for an audit.

5. Free Option

Perhaps one of the best benefits of Koinly, is that you don’t have to pay for it. You can use it as a tool to help you generate your own tax reports. This is because you can integrate all your wallets and exchanges and adjust your transaction types and cost-bases without ever having to pay for the software.

It is only once you go to generate the actual tax report that you will have to pay for the service. This allows you to potentially generate your own tax report with just taking information generated from Koinly’s software. That said, if your taxes are complicated enough to warrant one of the paid tiers than it’s likely worth it in the long run.

Conclusion: Tax Software Can Be Crucial for Crypto Investors

If you are a crypto user who is entering tax season, you should check out Koinly or a similar service. It will likely save you a lot of time and effort as you can keep track of so many things in one place.

When you are satisfied with your report, you can get Koinly to generate it, or simply pull the information yourself to file your own report. Either way, using Koinly certainly has benefits for crypto users. Check out our Koinly review to learn even more about the software or sign-up for an account below: