- >News

- >Will Ethereum’s Shanghai Update Crash or Boost the ETH Price?

Will Ethereum’s Shanghai Update Crash or Boost the ETH Price?

Ethereum’s long-awaited Shanghai update is now live on the Goerli public testnet, allowing developers to see how withdrawals of staked ethereum (ETH) will play out in the wild. The deployment is the final step before Shanghai is rolled out on Ethereum’s mainnet, which is expected to happen sometime around mid-April. And for some observers, what’s also expected to happen is that the ability to withdraw around 17.7 million staked ETH will have a noticeably negative effect on the cryptocurrency’s price, as well as on the market as a whole.

On the surface, the prospect of unlocking 17.7 million ETH does seem scary, given that such a quantity of ethereum is worth around $30 billion (as of writing). The cryptocurrency market is volatile enough at the best of times, so such a large influx of ETH could have an outsized impact on prices, as stakers look to finally offload their tokens.

However, the good news is that it’s highly unlikely that all 17.7 million ETH will be sold at once. This is for a variety of reasons, from the fact that most stakers would actually realize a loss if they sold now to the fact there are protocol-level limits on how much ETH can be unstaked at the same time. And when you add the fact that the successful introduction of withdrawals will likely encourage more investors to get involved in staking, it’s more likely that Shanghai will boost the ETH, at least in the medium-to-long term.

Why Ethereum’s Shanghai Update Won’t Result in an ETH Crash

To understand whether Shanghai poses a risk to the price of ethereum, it’s necessary to understand how exactly it will be implemented. As detailed in its GitHub specification page, Shanghai will include several different improvement proposals, including technical changes to contract creation and contract code size.

Shanghai also introduces EIP 4895, which specifically enables validators to execute requests to withdraw staked ETH. At a superficial level, this would appear to suggest that all validators and stakers will be able to withdraw all staked ETH at once, yet Ethereum’s developers have set a number of limits and constraints on how withdrawals will be processed.

In particular, there will be an exit queue to unlock staked ETH, with developers setting a limit of 16 withdrawal requests per block (one per 12 seconds). As such, it would likely take months for all of the staked ETH to be unstaked, should all validators want to withdraw all of their holdings.

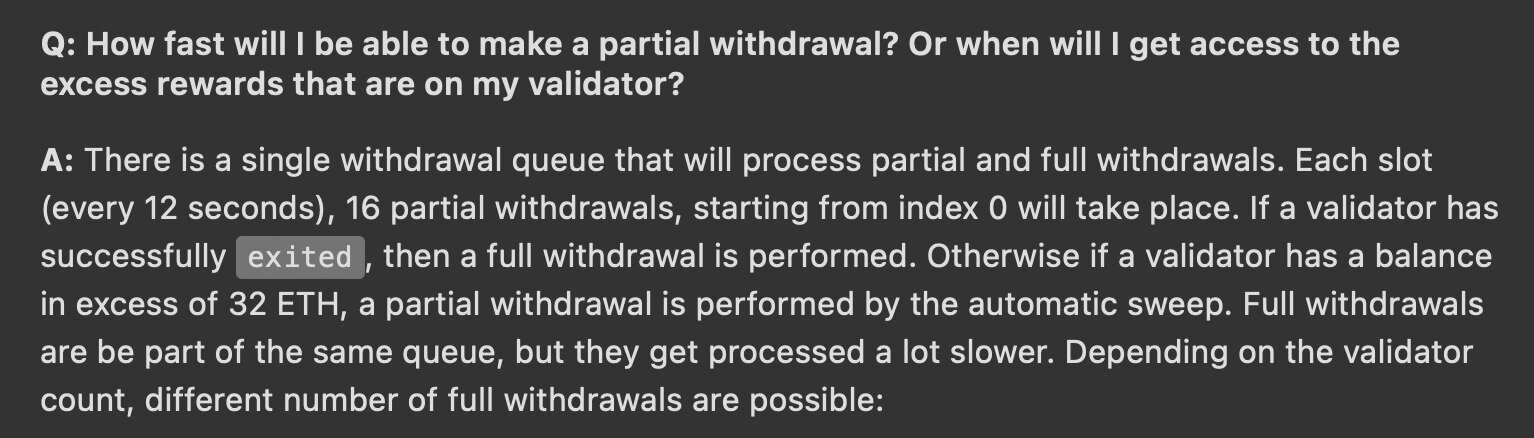

Q&A from an official Shanghai FAQ. Source: ethereum.org

As the screenshot below makes clear, “partial withdrawals” — which involve withdrawing rewards (but not the original 32 ETH stake) — will be given processing priority over full withdrawal requests.

This condition will impose a brake on the speed of ETH withdrawals, yet Ethereum’s developers have actually imposed a further constraint, which is that there’s a limit to how many full withdrawals (of 32 ETH) can be processed per day.

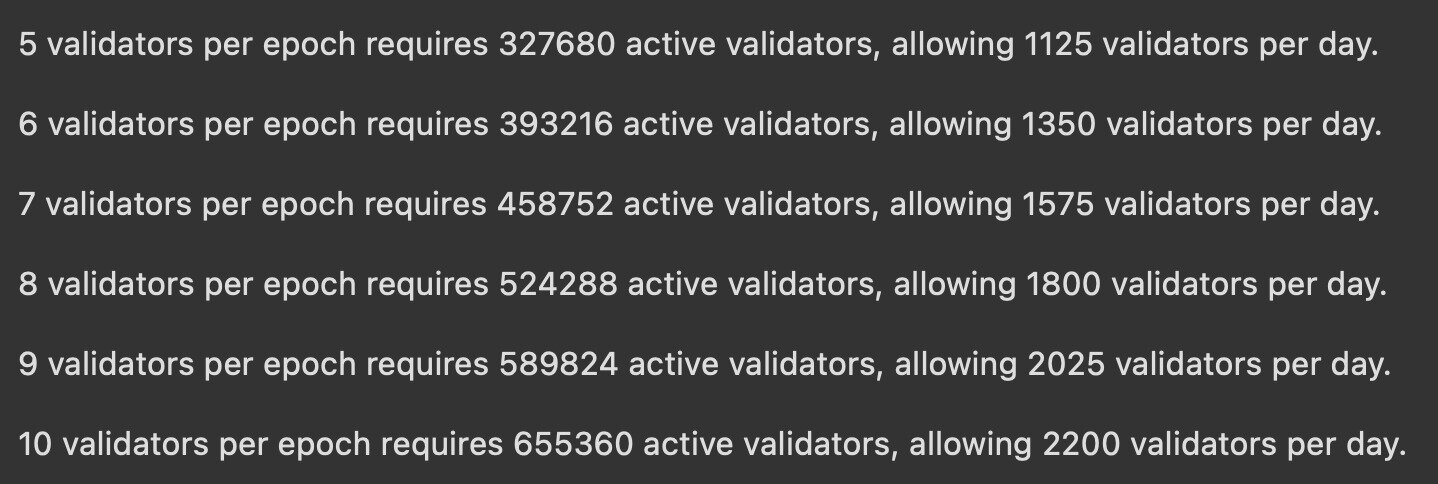

At the moment, this limit is set at 1,800 per day, based on the fact that there are currently 554,000 active validators on the network. Once this figure rises to 589,824, then the full withdrawal limit will increase to 2,025 per day.

A specification of how many validators can make full withdrawals of 32 ETH per day, based on how many active validators there are on the Ethereum network. Source: ethereum.org

In other words, a maximum of 1,800 x 32 ETH could be withdrawn per day (excluding partial withdrawals of staking rewards), based on current technical specifications. This works out at 57,600 ETH, or $97.9 million (based on current prices). Or to put it differently yet again, with 554,000 active validators (each with 32 ETH staked) and a rate of 1,800 full withdrawals per day, it would take approximately 307 days to unstake all validators. This is roughly 10 months.

Of course, not every validator is even going to want to unstake all their locked-up ETH. In fact, data suggests that most would want to keep their ETH staked, since most are holding it at a loss. According to figures compiled by CryptoQuant, 60% of ETH stakers are actually in the red, with the implication being that they would at least want to wait until they can realize a profit before withdrawing their tokens. On top of this, CryptoQuant points out that most of the ETH that is in profit was staked less than a year ago, meaning that holders don’t have the kind of large returns that usually result in profit-taking.

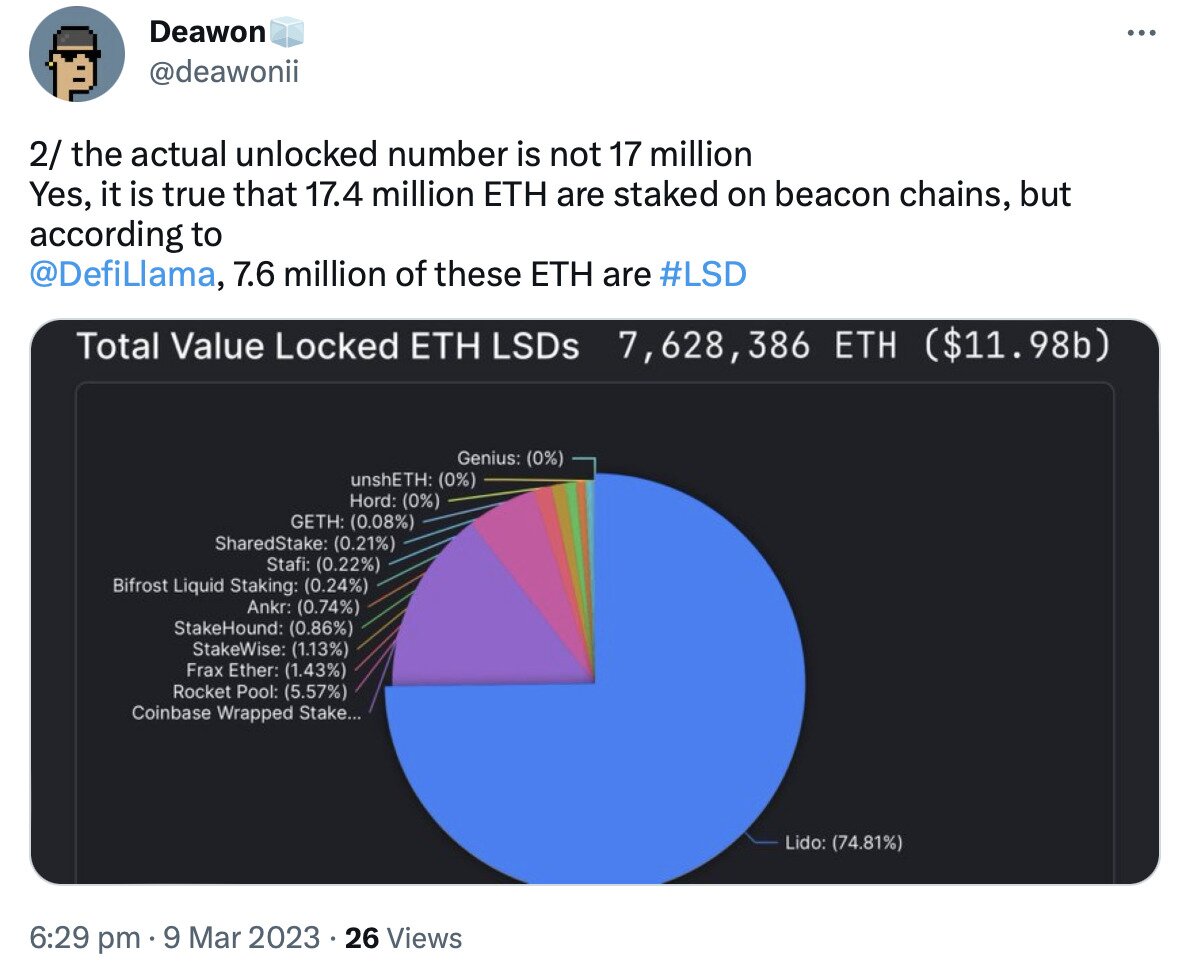

Source: Twitter

If this weren’t reassuring enough, there’s also the fact that 7.6 million ETH has been staked with platforms that provide stakers with a staking derivative in return. For example, this includes Lido Staked Ether (STETH), which is equal in price to ETH itself. The thing with such derivatives is that they can already be sold, so if any stakers already wanted to cash out, they could have done so by selling STETH and other derivatives.

Source: Twitter

How Withdrawals Will Boost Ethereum

Taken together, this means that Ethereum’s Shanghai update isn’t going to introduce as much selling pressure as some might suppose in passing. Yes, around 18 million ETH will technically be open to withdrawal, but there’s no way this quantity of ETH can be released onto the market at once, and there’s little inclination among most stakers to do so anyway.

On the other hand, it’s highly arguable that Shanghai will end up boosting the ethereum price, particularly in the long run. This is because it’s another important step in the process of development and evolution that began with September’s Merge, which saw Ethereum become a proof-of-stake blockchain and which will eventually see it introduce sharding at some point next year.

Introducing withdrawals effectively completes the process of transitioning to a proof-of-stake mechanism. Importantly, there’s an argument that it will “de-risk” staking for investors (big and small) in that it will offer reassuring proof that stakers can get their tokens back, should they need to. This is likely to incentivize further staking over time, with data suggesting that most other layer-one proof-of-stake chains have a staking ratio at least three times higher than Ethereum’s.

Most other PoS blockchain have a much higher staking ratio than Ethereum. Source: Staking Rewards

This means there’s plenty of scope for increasing the quantity of staked ETH, with institutions increasingly coming around to the idea of investing in Ethereum in recent months. And with more ETH locked up, this can only increase the cryptocurrency’s price in the coming months and years, helped by the fact that previous updates make the token deflationary during periods of peak traffic.

Because of all this, the fundamental picture looks very strong for Ethereum. Yes, the global economy still needs to fully recover for crypto to return to strong growth, but once it does, Ethereum has positioned itself very nicely to lead the charge.