- >Best Crypto Trading Bots

- >Shrimpy Review: Tiny Name, Big Trading Bot

- Excellent free version that offers a large number of features

- Social trading portion that lets you follow other traders

- Different tiers for pricing with support for enterprise-level organizations

- Automatic portfolio re-balancer

Shrimpy Pros & Cons

Pros

Easy to use

Affordable plans with free version available

Social trading

Backtesting

Portfolio rebalancing

Cons

No crypto signals

How Shrimpy Pricing Works

Shrimpy has three types of accounts available for their services, the free version is more powerful than many other crypto bot platforms, but their paid versions are quite affordable and provide a great amount of benefit. Here are the three types of accounts:

Hodler (Free)

Portfolio Tracking

- Link unlimited exchanges

- Multiple portfolios

- Performance monitoring

Professional ($19/month, $16/month for 6 months, $13 month for 12 months)

Portfolio Management

- Strategy automation

- Trade history

Index Builder

- Variable allocation weights

- Dynamic asset selection

Portfolio Rebalancing

- On demand

- Periodic

- Threshold

Backtest

- Backtest custom portfolios

- Backtest exchange specific data

- Backtest up to 5 years of historic data

Social

- Earn money as a social leader

- Social leaderboard

- Follow leaders

Settings

- IP whitelisting

- Custom spread and slippage safeties

Enterprise (Price determined based on needs)

Enterprise features also include:

- Cross-exchange re-balancing

- Account reconciliation

- Specialized re-balancing algorithms

- Tax optimization

- Priority support

- Custom feature development

Available Exchanges

Once considered a weakness of Shimpy’s platform, they have continuously added new exchanges and now offer the availability to connect to 16 of the world’s top cryptocurrency exchanges. The best part is even with their free account you can link to unlimited exchanges! Here are the exchanges currently supported by Shrimpy:

- KuCoin

- Coinbase Pro

- Gemini

- HitBTC

- Binance

- Binance US

- Bibox

- OKEX

- Bittrex

- Bittrex Global

- Kraken

- BitMart

- Bittamp

- Poloniex

- Huobi

- Bitfinex

Shrimpy allows the connection of an unlimited number of exchange API keys. This means for every exchange they support; you can have any number of exchange accounts linked. Whether you have 10 Binance accounts or 1 for every exchange we support, Shrimpy works for your needs.

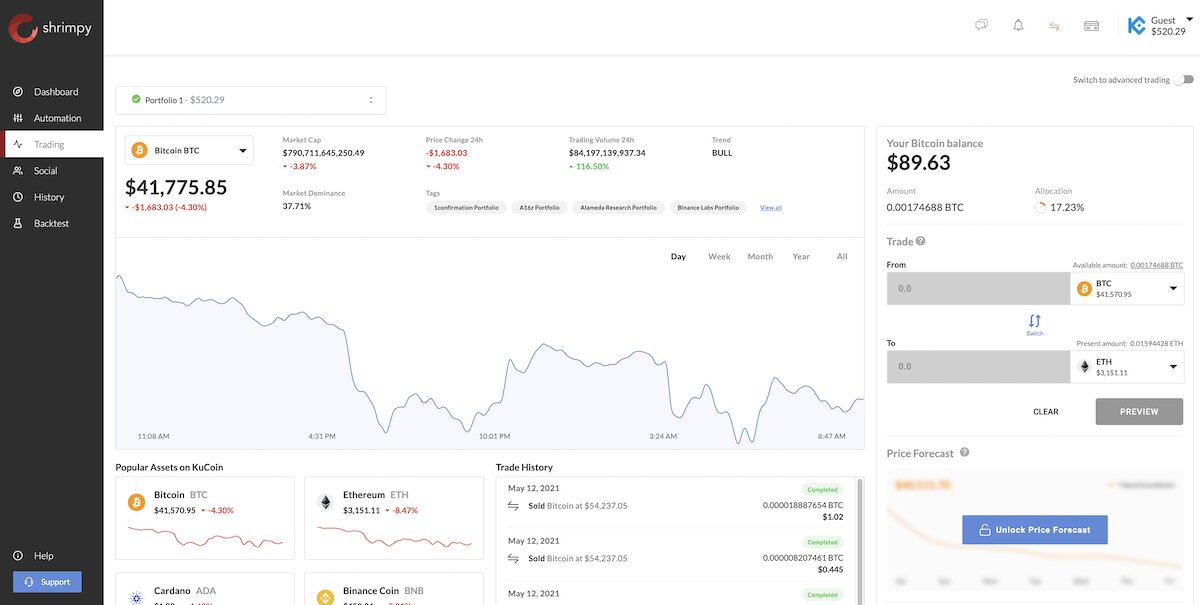

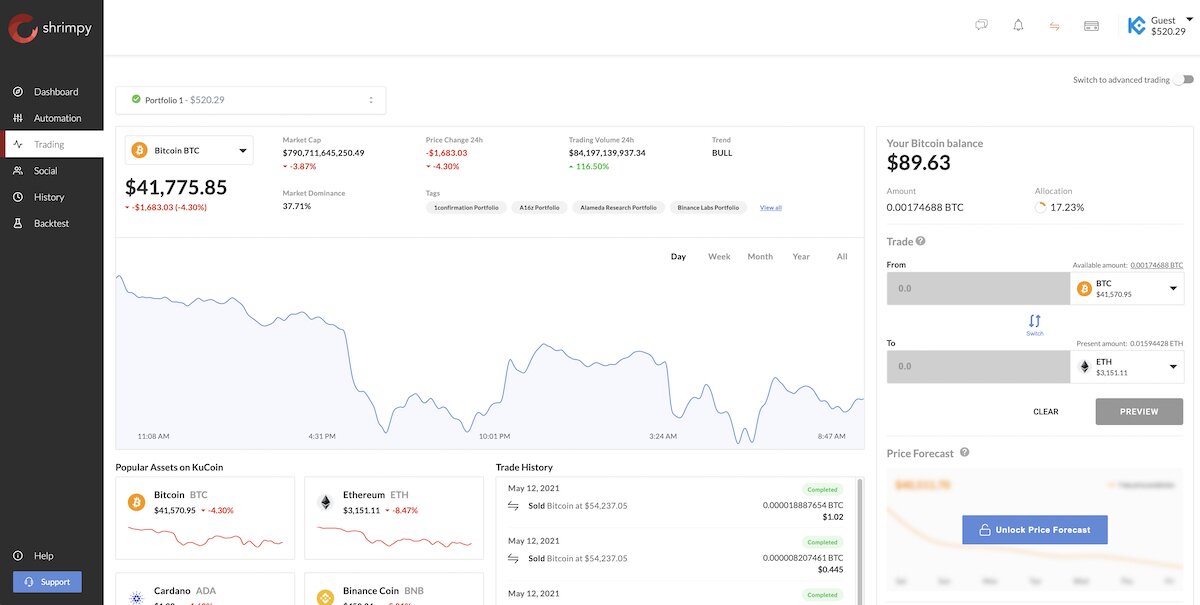

Letting Shrimpy Manage Your Crypto Portfolio

Once you have picked your account type and linked it through your API keys giving the bot access to your account, you can then begin letting Shrimpy automate your portfolio management.

You can allocate the percentage of each asset you would like to own and Shrimpy will automatically re-balance your portfolio to fit those percentages. You can do this across multiple linked exchange accounts with different assets in each custom portfolio you make. Or you can copy other traders’ portfolio through the social leaders feature. With a single click, you will instantly start implementing the same strategy as the leader you follow. Each time the leader changes his portfolio, executes a trade, or adjusts his strategy, those changes will instantly be copied to your portfolio. The assets you hold will be the same as the industry leaders assets.

Shrimpy’s Features

Shrimpy offers a number of features that help it stand out from some of its competitors. Here’s a look at some of the best features of Shrimpy:

Security

Shrimpy is one of the safest crypto bot platforms on the market. Every API key is securely encrypted and stored using validated hardware security modules to protect the confidentiality and integrity of your exchange API keys. Shrimpy only requires the ability to read data and make trades, so your funds cannot be removed from the exchange. They also encourage all users to utilize their Two-Factor Authentication (2FA) service which secures access to your account.

Portfolio Management

Social portfolio management is a concept that is being defined by Shrimpy. They allow crypto investors to leverage social portfolios by copy leading traders, discuss different strategies, and automate their portfolio. Shrimpy is not designed for trading signals or indicators like many other crypto bots. Instead they focus on portfolio management through simple automation of things such as rebalancing, dollar-cost averaging and stop loss. With one click you can copy an industry leader’s trading strategy and portfolio holdings.

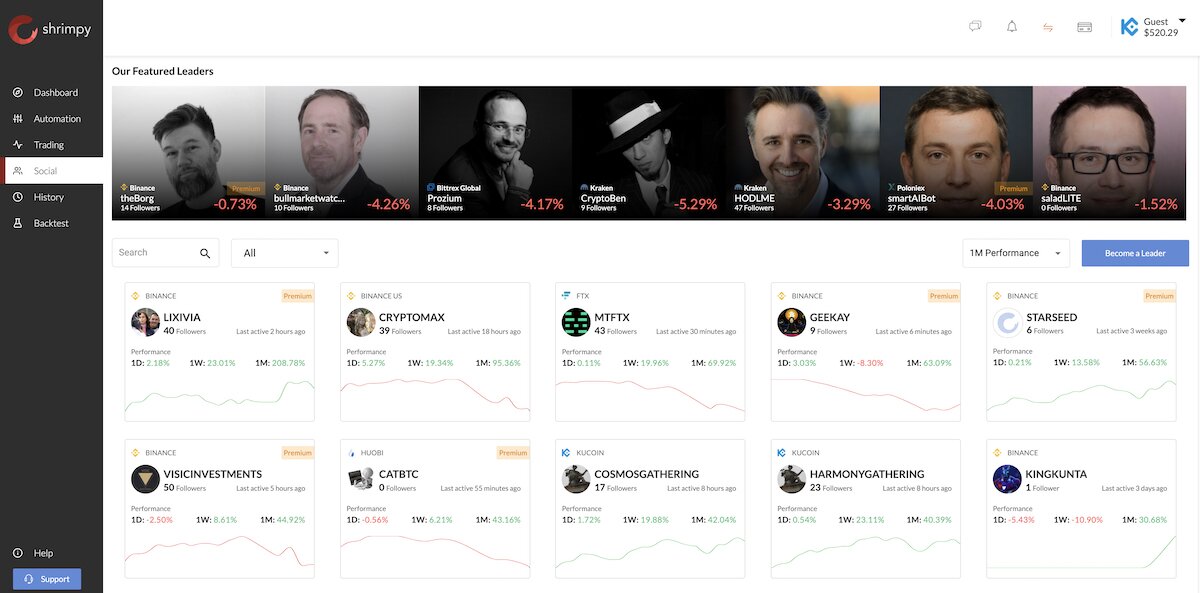

Social Trading

Related to portfolio management, social trading is the most unique feature of Shrimpy and what separates it from other crypto trading bots. As mentioned earlier, with one click you can implement a leader’s strategy, but it goes further than that. Followers have direct access to a powerful portal where they can browse the top crypto traders and leaders in the market. Selecting a leader shows their allocations and current strategy which helps in providing deep insights into the most profitable portfolios. There is a great amount of incentive to be a leader as well, as for each follower you have you get $4 a month from Shrimpy.

Backtest

When setting up your custom strategies/portfolios on Shrimpy, you can get an idea about how it performs by backtesting it, so that you can tweak it to improve it and find your ultimate portfolio allocation. Shrimpy’s backtesting tool lets you test any strategy or index with historical data to see how your exact strategy would have performed in the past across any exchange. One potential issue with backtesting is that it does focus on historical data, and crypto is a constantly changing space, meaning what worked a year ago may not longer work in the current market conditions.

Shrimpy Alternatives

There are a large number of trading bots available these days with some of the most popular including TradeSanta, Coinrule and Haasbot.

Trade Santa is exceptional for new trading bot users while Coinrule is widely recognized as having one of the best UIs for a trading bot. Meanwhile Haasbot is an excellent tool for experienced traders.

- Great entry-level trading bot platform

- Virtual bot available to see how it all works without risking your own money

- Completely automates the trading experience

- Several pre-set strategies for trading

- Slick U.I. for new trading bot users

- Free daily emails with trading strategy

- Free account option

- Attempts to provide professional-level trading to new users

- Advanced Trading Bot Platform

- Cloud management available for users

- Backtested and simulated trading

- Refer friends to earn free Bitcoin