- >News

- >Does the Djed Stablecoin Make Cardano a Real Ethereum Killer This Time?

Does the Djed Stablecoin Make Cardano a Real Ethereum Killer This Time?

The phrase ‘Ethereum killer’ has become something of a running joke in crypto. Over the years, it’s been used to describe a wide variety of rivals to Ethereum, yet most of these have fallen by the wayside. This includes EOS, a former ‘killer’ that famously raised over $4 billion during its ICO, but which has seen its native token decline from $22.71 in April 2018 to $1.07 today, amid a relative lack of use.

This list also arguably includes Cardano, which was founded in 2015 by Ethereum co-founder Charles Hoskinson and launched in 2017. For numerous years, work on Cardano continued in the context of ambitious claims regarding what it would do, without these claims ever really being substantiated. That’s because, while the network had plenty of credentials behind it and some interesting technical underpinnings, it never really attracted any real use, even after its enabling of smart contracts in September 2021.

However, this is potentially all about to change, since the past month saw an important milestone for Cardano and its development. Namely, the Cardano-based algorithmic stablecoin Djed (DJED) was launched, providing the cryptocurrency ecosystem with something — i.e. a stable stablecoin — it’s been crying out for ever since the collapse of Terra in May 2022. And given that DJED uses substantial amounts of ADA in its reserves, its launch could also mean that ADA enjoys some big price increases over the coming months.

Djed Stablecoin Launches, ADA Price Rallies

On January 31, Cardano code maintainer COTI launched Djed on the Cardano blockchain. As an algorithmic stablecoin, Djed’s price is kept close to $1 by means of burning and minting it and its reserve token Shen (SHEN), while ADA is also used to back its value. Interestingly, Djed is substantially overcollateralized, with SHEN and ADA being held at a ratio of between 400% and 800% of the nominal value of DJED itself.

According to the Djed whitepaper, this makes it “the first stablecoin protocol where stability claims are precisely and mathematically stated and proven.” Such claims were enough to generate considerable interest in Djed when it launched, with the stablecoin now at a circulating supply of 1.9 million.

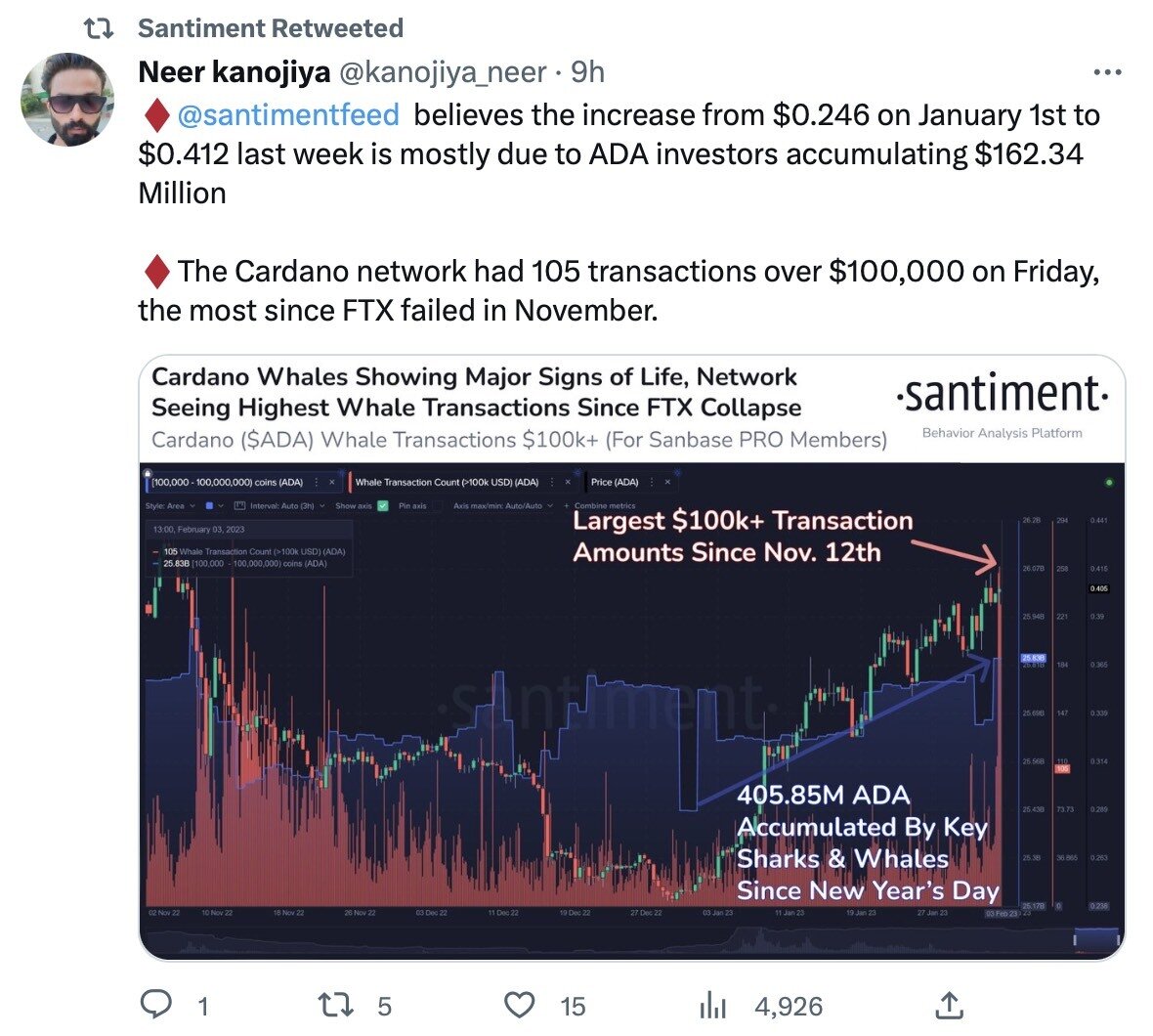

More significantly, Djed’s arrival caused a big surge in demand for ADA, not least because the latter is one of its main reserve tokens. So on the one hand, Djed’s reserves have now swallowed up around 30.17 million ADA, up from 20.1 million on January 31. At the same time, investors now expect that the launch of Djed signals a rising price for Cardano over time, so they went ahead and bought ADA in the days following the stablecoin’s launch. This also includes big investors (aka ‘whales’), with Cardano witnessing a growing number of transactions worth at least $100,000 in recent days.

Source: Twitter

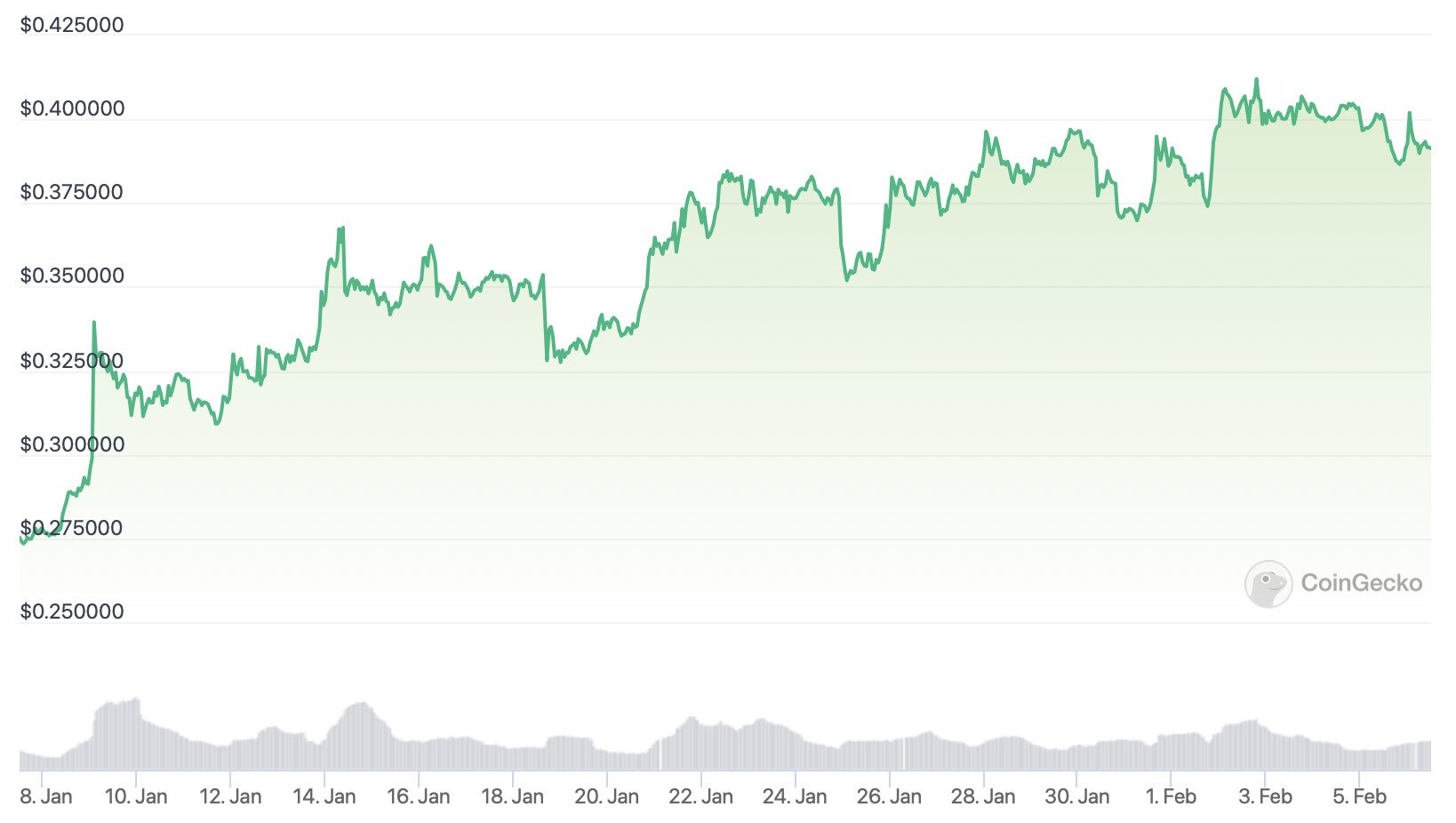

Indeed, the ADA price went from as low as $0.35 in the week before Djed’s launch to a seven-day high of $0.413 on February 2, representing an increase of 18%. This made ADA one of the best-performing coins during this period, and potentially provides a sign of things to come.

ADA price over the past 30 days. Source: CoinGecko

What’s important to note at this juncture is that Djed’s reserves will inevitably grow in parallel with rising demand for the stablecoin. Cardano-based DEXes MuesliSwap and Minswap have already listed the stablecoin, while so has centralized exchange Bitrue. The number of exchanges supporting the stablecoin will likely grow steadily over time, which will necessitate the minting of more DJED.

In turn, more ADA will be taken out of circulation and placed in Djed’s reserves. In theory, this will boost ADA’s price over time.

Of course, it needs to be pointed out that only 0.09% of the circulating supply of ADA has been removed from circulation at this point in time. This is largely because Djed has only just been launched and has a very small supply, at 1.9 million (worth around $1.9 million). But as we’ve come to learn from the cryptocurrency market, demand for stablecoins can be very large, with TerraClassicUSD (USTC) having a market cap of around $18.7 billion prior to its collapse in May.

Now, USTC is worth only $318.5 million, indicating the vacuum it has left since its collapse. In other words, there is a big opening and opportunity for a new stablecoin to serve the cryptocurrency market. And given its claims to having “mathematically stated and proven” stability, Djed could end up being that stablecoin.

Djed will also invite further demand insofar as it will provide opportunities to earn yields. This will come from depositing DJED itself and sister token SHEN with the various DEXes that already list them. For example, MuesliSwap has said it will offer returns of between 10% and 15% for yield farming via the DJED/ADA and SHEN/ADA liquidity pools on its platform.

Source: Twitter

As such, there will be an extra source of demand for DJED and ADA, something which will help push up the values of each in the coming months.

Cardano On the Up

Perhaps the most important point of all in this is that Djed’s launch sees Cardano offering more utility to the crypto ecosystem than it ever has before. The stablecoin’s arrival could see its adoption rate accelerate considerably in the coming months, with the network’s total value locked in has grown from $48.95 million on January 1 to $102 million today, representing an increase of more than 100% in about a month.

Yes, Cardano’s value as a network has effectively doubled since the launch of Djed, and will likely continue growing. This is partly because of Djed itself, but also because of the constant development Cardano witnesses on a regular basis.

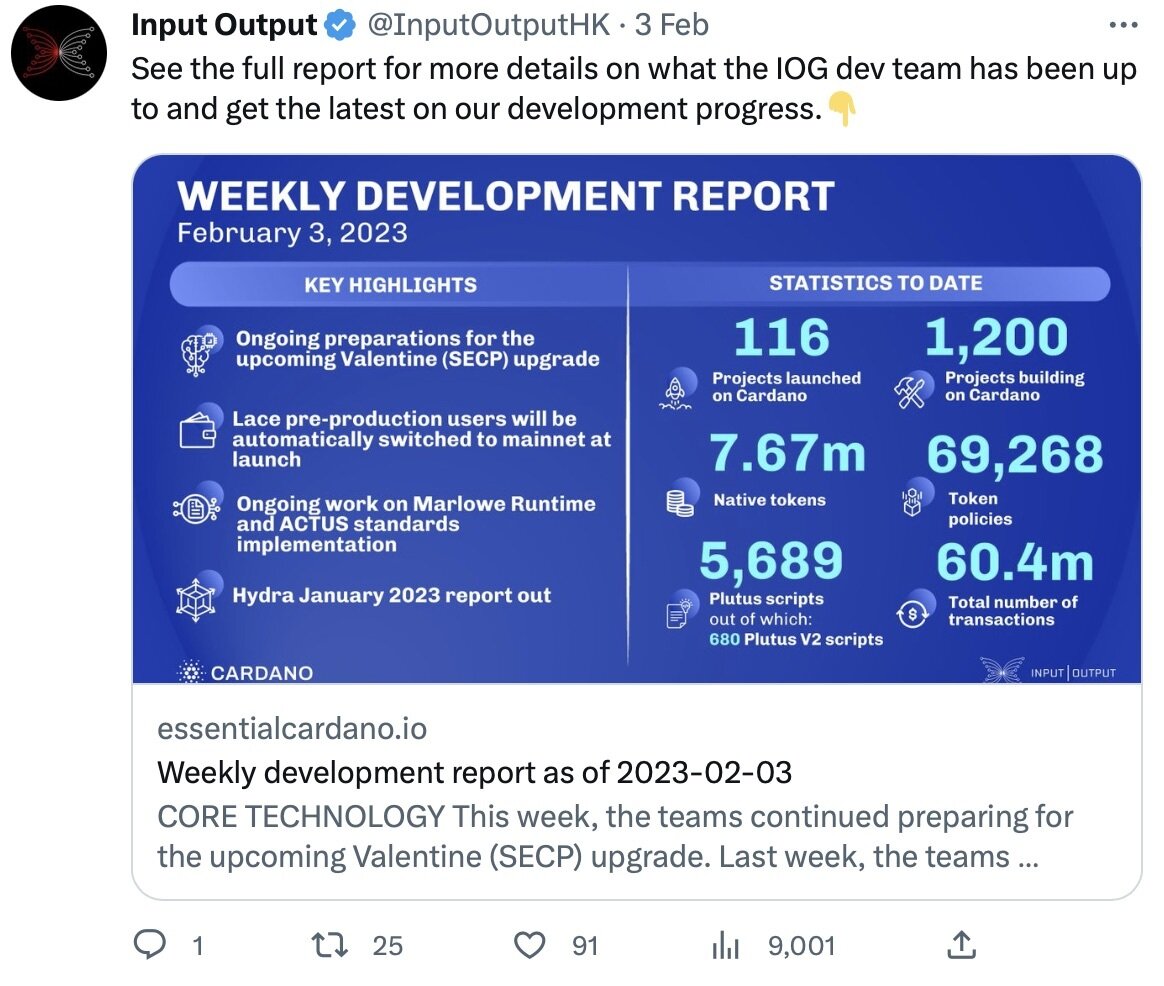

Most notably, the layer-one network has an important update scheduled for this month. This will upgrade its Plutus smart contract language, so that it will “support ECDSA and Schnorr cryptographic signatures to make it easier for developers to build cross-chain apps.”

Source: Twitter

Put differently, Cardano is going to benefit from more interoperability between itself and other chains, such as Bitcoin and Ethereum. This will potentially expand the pool of users for the Djed stablecoin, which by extension ultimately means more demand (and a higher price) for ADA. At the same time, cross-chain compatibility means that more developers can include support for Cardano when building dApps. Again, this will result in more usage of Cardano over time.

Even now, Cardano’s ecosystem numbers around 1,200 apps and projects building on its network, as well as more than 115 projects already running. At the same time, 5,689 Plutus scripts (i.e. Cardano’s version of smart contracts) are running on the network, up from just over 3,200 back in mid-September.

Source: Twitter

Combined with the launch of Djed, this all points to an ecosystem that’s not only growing, but one that will also be thriving in the months and years to come. And while it would still be hyperbolic to call Cardano an ‘Ethereum killer,’ it may now be fair to say it’s in the process of becoming a genuine rival.