- >News

- >Now That It’s Switching Protocol, Is EOS an ‘Ethereum Killer’ Again?

Now That It’s Switching Protocol, Is EOS an ‘Ethereum Killer’ Again?

The past one or two weeks haven’t been a great time for crypto. Still slumbering in a bear market that has lasted the best part of a year, temporary gains were canceled out by yet another fall, with many major coins dipping by around 7% (or more) in the last seven days. However, one top-100 coin bucked this trend: EOS.

Yes, many a layperson may have forgotten that EOS even existed, with the onetime ‘Ethereum killer’ arguably fading into obscurity since its $4 billion ICO and launch in 2018. Nonetheless, its price has jumped by 15% in the past week, with a planned switch to a new protocol, Antelope, the big driver of this gain.

The thing is, this switch necessitates a hard fork, with Antelope supporters now pursuing legal action against Block.one, the company originally behind EOS’ launch. So can the EOS Network Foundation finally steer the altcoin to success after years of frustrated promises, or is the price surge merely a flash in the pan?

A Very Brief History of EOS

Conceived in 2017 by Cayman Islands-based software company Block.one, EOS promised a governed blockchain that “may ultimately scale to millions of transactions per second, eliminates user fees, and allows for quick and easy deployment and maintenance of decentralized applications,” as its technical white paper put it.

With prominent developer Daniel Larimer at the helm of development, such promises resulted in a hugely successful year-long ICO, with the aforementioned $4 billion still reigning as the record in crypto. Unfortunately, despite launching its mainnet in June 2018, EOS’ fortunes seemed to go downhill from there.

First, there were reports of numerous bugs in its code, with one white hat hacker alone managing to pocket $120,000 in bounty fees in a week. Such bugs continued to plague EOS for much of its early life, dampening enthusiasm for the would-be Ethereum killer.

Of course, most bugs can always be resolved sooner or later, yet a more fundamental problem for EOS was that Block.one failed to support it in any substantial way. The latter had obviously raised a whopping $4 billion in funds to bootstrap its development and invest in startups building on EOS, yet it seemed that the bigwigs at the company were more focused on using the ICO’s proceeds to invest in other cryptocurrencies.

In fact, Block.one launched its own crypto-exchange — Bullish — in 2021, using a big chunk of the ICO’s proceeds. This was the very same year it stopped supporting EOS’ development, with Dan Larimer having left as CTO of the company in December 2020/January 2021.

Source: CoinGecko

What this neglect meant is that EOS never really got off the ground, despite its early ambition. Having risen to an all-time high of $22.71 in April 2018, it had dwindled as low as $0.8418 by June of this year, representing a decline of 96.3% across the intervening four years. That said, EOS is still up by 239% compared to its all-time low of $0.5024, set in October 2017, so early investors are still in the black.

Antelope and Resurgence

Needless to say, EOS’ price isn’t $0.8418 right now, having risen to $1.70 as of writing. As stated in the intro, the switch from the original EOSIO protocol to Antelope is the reason for this resurgence, with EOS’ community having effectively regained control over the cryptocurrency and its blockchain now that Block.one has abandoned it.

Source: Twitter

This reclamation of control began in August 2021, when EOS block producers (i.e. EOS’ equivalent of ‘miners’) banded together to found the EOS Network Foundation. This foundation resolved to support the development of EOS, and from November it began producing a number of “blue papers” that outlined improvement proposals.

Importantly, the EOS Network Foundation managed to recruit original developer Dan Larimer, who together with the foundation formulated a long-term development plan. This laid the seeds for Antelope, the core protocol that would drive EOS.

Basically, the EOS Network Foundation promises that Antelope will help EOS realize its aims of high scalability, while also offering even faster finality and inter-blockchain communication. It will implement the fork to Antelope on September 21, implying that the market may continue to see price surges from EOS as this date draws nearer.

Such a move will confirm that the EOS community has decisively reclaimed the blockchain for itself. This doesn’t necessarily mean that EOS will become the Ethereum killer it once promised to be, however.

Firstly, Block.one continues to be the legal owner of the proceeds of the $4 billion ICO from 2018, implying that the EOS Network Foundation lacks the really substantial resources you’d probably need to build a viable rival to Ethereum (and other big layer-one chains such as Cardano and Avalanche).

That such proceeds are important to EOS’ future development is underscored by the fact that the EOS Network Foundation initiated legal action against Block.one in February of this year, highlighting the fact that the reason for this action is to gain the ICO money.

In other words, if the EOS Network Foundation doesn’t succeed in claiming significant damages, it may be difficult for it to grow EOS in a way that transforms it into an important network.

Then there’s the standing of its rivals, chiefly Ethereum. The latter is by far the biggest blockchain within the cryptocurrency market, accounting for $35.99 billion in total volume locked in, or 57.5% of the overall DeFi market (not counting Ethereum-based layer-two solutions). What may be sobering for EOS champions is that Ethereum is in this dominant position even before shifting to a proof-of-stake consensus mechanism (due next month), something which is likely to shore up its dominance even further.

Just looking at EOS’ total value locked, it pales in comparison to Ethereum’s, standing at only $148 million. This figure is also dwarfed by the TVL figures for Binance Smart Chain, Tron, Avalanche, Solana and Polygon, all of which are counted in the billions.

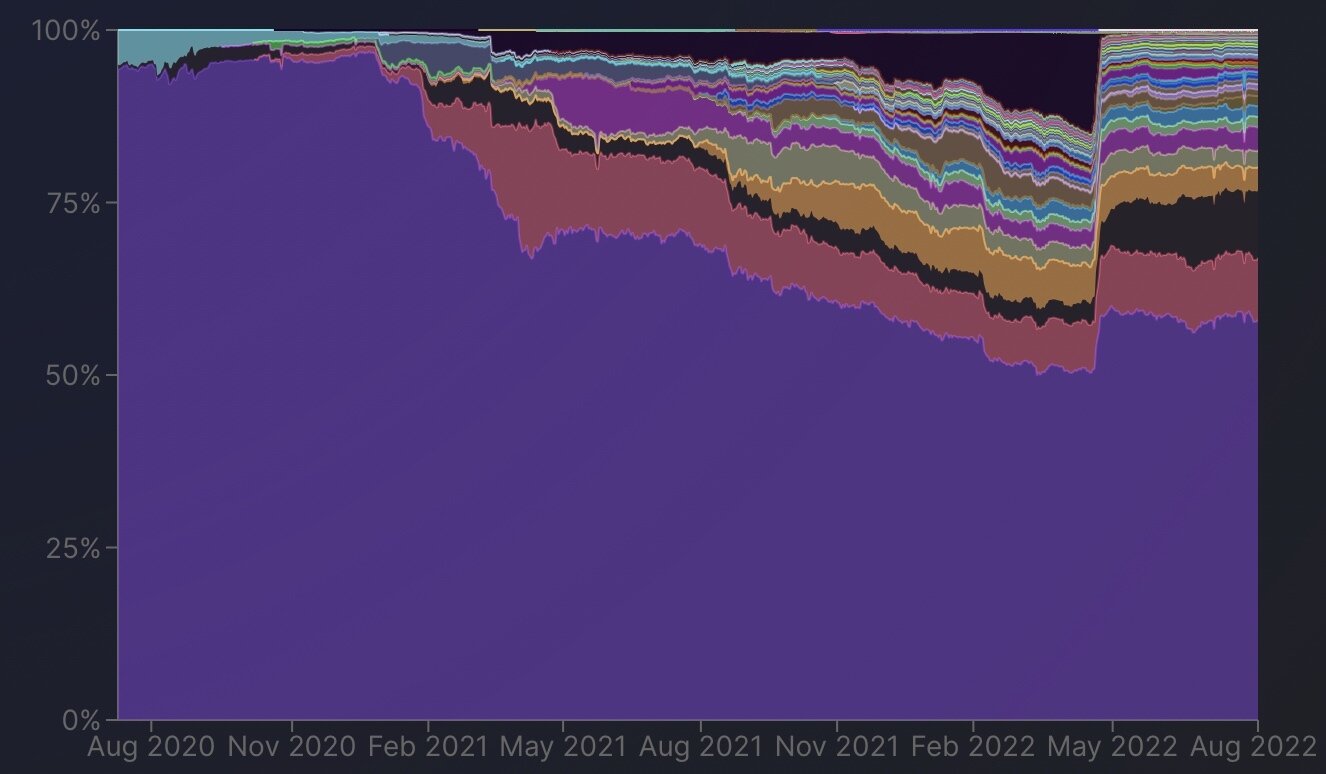

Chart shows TVL of each blockchain as a percentage of the market’s overall TVL. Ethereum is in purple, while EOS accounts for only 0.24% of the DeFi market. Source: DefiLlama

This shows that EOS and its foundation have a long way to go before it can credibly claim to have birthed an Ethereum killer. Still, the move to Antelope is undoubtedly a step in the right direction, and may help EOS regain some of the value it has lost since its record-breaking token sale four years ago.