- >News

- >Best Time to Buy Crypto? A Look at the Most Profitable Days, Months

Best Time to Buy Crypto? A Look at the Most Profitable Days, Months

In a market defined by volatility and uncertainty, investors have a tendency to look for regularities, averages and patterns wherever they can find them. This is entirely understandable, especially when the gains and losses in crypto tend to exceed those witnessed in more conventional markets. And it’s especially understandable in 2022, when cryptocurrency losses have outnumbered gains, exposing traders to greater risks than in other years.

One area in which (some) investors look for regularities is in the timing of cryptocurrency movements. Yes, there’s a wealth of data available on this subject, from month-by-month return percentages for the bitcoin price, to heat maps on Ethereum gas fees by the hour. This article collates such data into a global picture, providing some insight into the best time, days and months of the year to buy crypto.

The Best Months for Crypto Investment

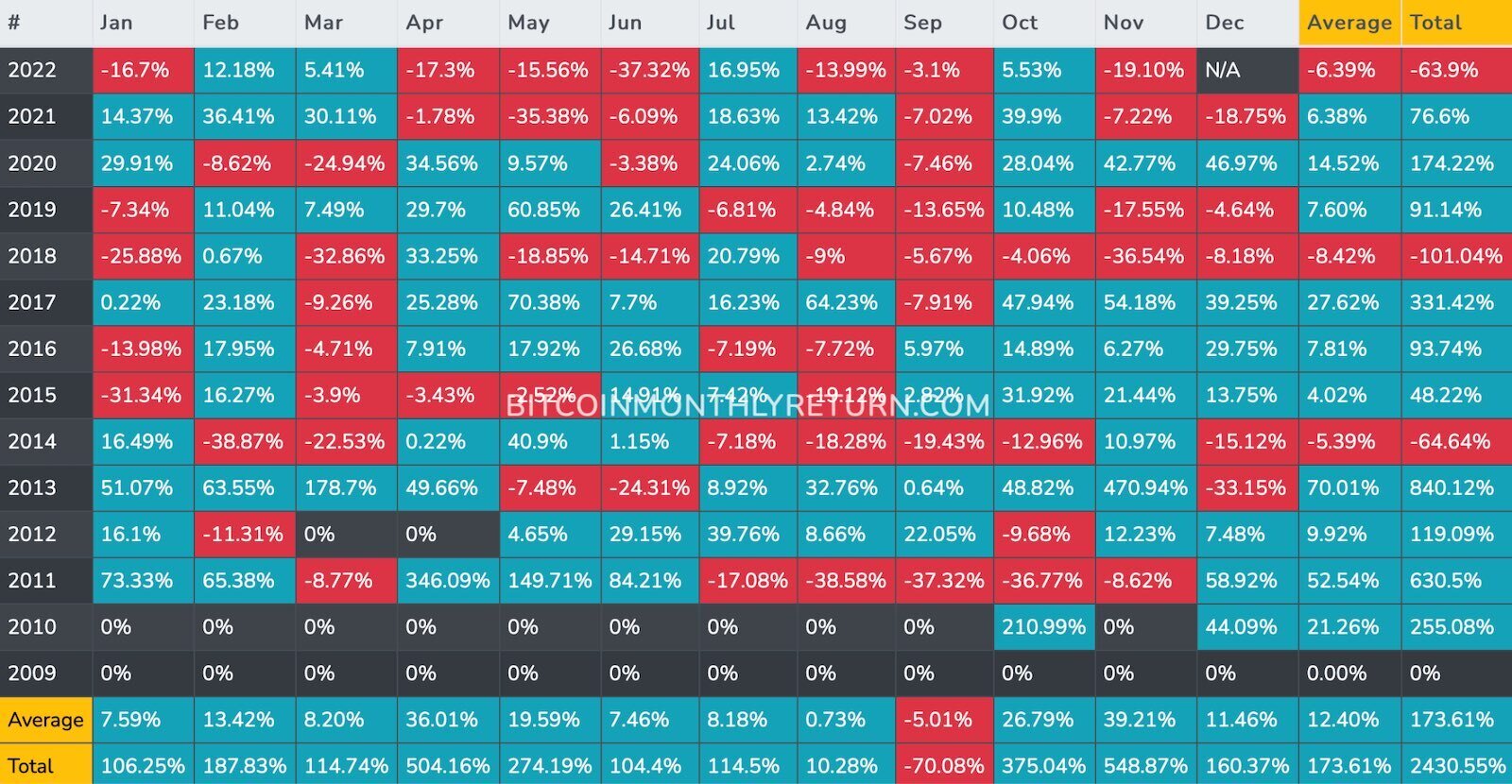

Bitcoin gains/losses per month since 2009. Source: bitcoinmonthlyreturn.com

As the chart above shows, 2022 has been the worst year for monthly BTC gains since 2018, with seven months in the red so far (compared to nine for 2018).

With regards to how the months themselves fare, the chart can be parsed in one of two ways. Firstly, it shows average returns and total returns (since 2009) for each month, which can be presented in the following way:

-

November – average gains: 39.21%; total gains: 548.87%

-

April – average gains: 36.01%; total gains: 504.16%

-

October – average gains: 26.79%; total gains: 375.04%

-

May – average gains: 19.59%; total gains: 274.19%

-

February – average gains: 13.42%; total gains: 187.83%

-

December – average gains: 11.46%; total gains: 160.37%

-

March – average gains: 8.2%; total gains: 114.74%

-

July – average gains: 8.18%; total gains: 114.5%

-

January – average gains: 7.59%; total gains: 106.25%

-

June – average gains: 7.46%; total gains: 104.4%

-

August – average gains: 0.73%; total gains: 10.28%

-

September – average gains: -5.01%; total gains: -70.08%

A few things can be gleaned from such figures. To begin with, if a trader wants to increase the probability of making a profit, they may want to focus their buying on the October/November and April/May periods, which have historically posted the biggest average monthly returns for bitcoin.

Of course, investors need to be mindful that they would want to buy crypto just before these periods, so that they maximize their potential gains. For example, the data shows that September has historically been the worst month on record for bitcoin gains, so a savvy investor might want to wait until the end of September and then make a purchase, just in time for the potential increases October and November could bring.

In terms of the optimum time of the month for purchases, bitcoin’s price chart reveals that it’s often the start of the month (i.e. the first ten days or so) that tend to bring the bulk of the gains. This is particularly the case with its action in 2021, which was a very bullish year for the cryptocurrency, bringing multiple rallies.

Bitcoin’s price chart for 2021. Source: CoinGecko

Of course, some may say that this data is really only valid for bitcoin, and not for other cryptocurrencies. However, most cryptocurrencies are heavily correlated with BTC, so it can still be taken as an indication of what coins such as ethereum and ripple may also do on any given month of the year.

Best Days of the Month to Buy Crypto, and Times of the Day

Turning to specific days, there isn’t the kind of price data that ranks each day according to average returns since the birth of bitcoin/cryptocurrency. Nonetheless, there are various pieces of evidence and data that do offer some valuable insights.

Average realized bitcoin volatility per hour of the day (left), and per day of the week (right). Source: Genesis Volatility/Amberdata

For example, bitcoin volatility data for each day shows that the weekends generally aren’t great for traders looking to make a quick profit. Instead, they may prefer to look at either Monday or Thursday/Friday, where bigger movements tend to be clustered. This works both ways though, so it may also increase the risk of a fall, particularly in more bearish years.

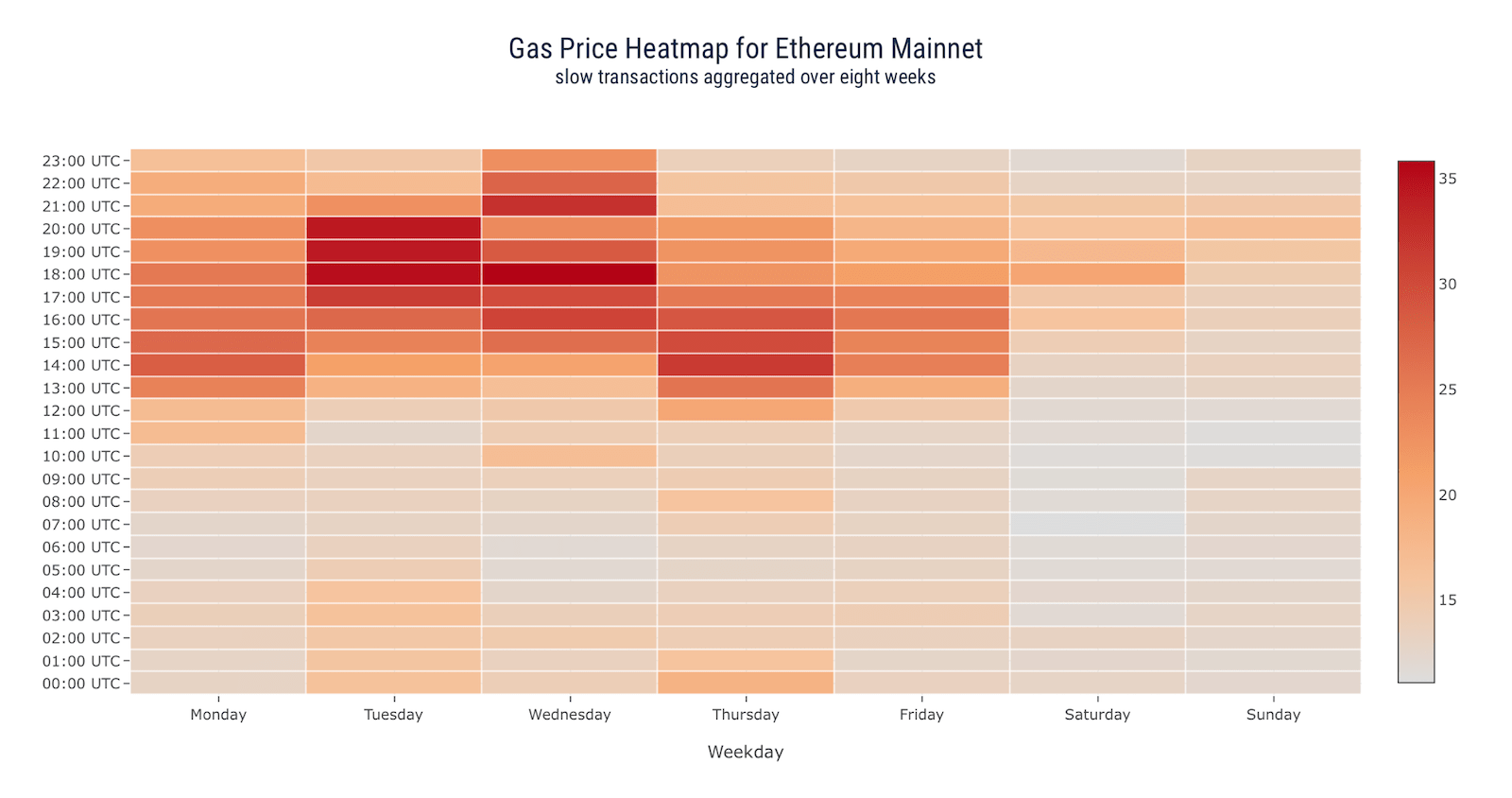

The volatility data above is also supported by average Ethereum gas prices, which again shows less activity on weekends, although in this case things heat up most on Tuesdays and Wednesdays. What this implies is that, if you’re looking to day trade or for short-term action, doing it on Saturday or Sunday is not really a good idea.

Source: Anyblock Analytics

What the above two charts also show is times of day with the highest volatility/gas prices, and what’s interesting is that they both show greater activity later in the day. For example, in both cases the busy periods tend to be between 3:00 pm UTC (or 10:00 am Eastern Time, 7:00 am Pacific) and 9pm UTC (4pm Eastern, 1pm Pacific). So anyone assuming that the market is more likely to move up rather than down — and who wants to make a quick buck — is advised to time moves just before this window of opportunity.

Warnings

Almost needless to say, ‘timing’ is mostly irrelevant for investors playing a long-term game, at least with regards to days and hours. Instead, many long-term holders may be better off simply adopting a dollar cost averaging approach, buying a little of their desired cryptocurrency each month. Such an approach tends to ‘average out’ volatility over the longer term, although short-term traders who live for volatility may not appreciate this.

Also, it has to be said that, while the data above covers bitcoin/cryptocurrency history up until the present day, there’s no guarantee that the future will resemble the past. So even though the weekends aren’t great for volatility, and even though November has historically been the best month for bitcoin returns, this needn’t be the case in the coming years.

As such, going long in the fullest sense of the term and using dollar cost averaging remains the way to go for most retail investors.