- >News

- >New Study Shows 56% of Canadians Fear Bank Collapse. Is Crypto a Safe Haven?

New Study Shows 56% of Canadians Fear Bank Collapse. Is Crypto a Safe Haven?

March was a tough month for the banking sector, which saw a string of high-profile and dramatic collapses. These began on March 8 with the bankruptcy of Silvergate Bank, which failed due to a combination of high interest rates, unprofitable bonds, mismanagement, and mass customer withdrawals (caused in turn by fears surrounding the lender’s exposure to the also-bankrupt FTX). Soon after, the sector witnessed the failures of Silicon Valley Bank and Signature Bank, while Credit Suisse had to be acquired by UBS, as banking stocks around the world suffered massive declines.

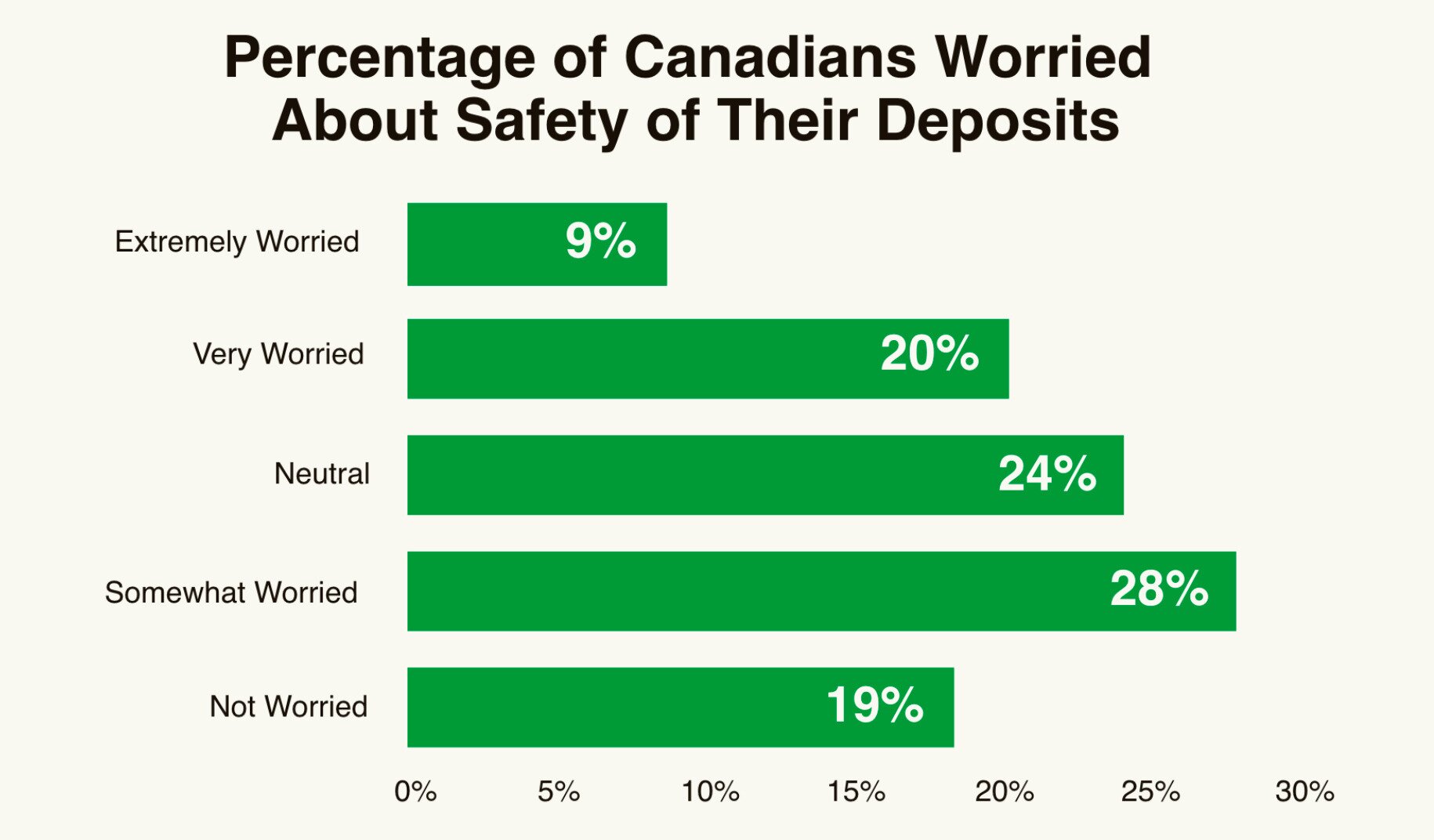

And now, just as news breaks that regulators have stepped in to broker JPMorgan’s takeover of First Republic, a survey has emerged which finds that 56% of Canadians fear that Canada’s banking system is vulnerable to collapse. Published by WealthRocket, the poll also found that more than a quarter (28%) of Canadians are worried about the safety of their deposits, while 22% have even gone so far as to withdraw their money from a bank in order to protect it from a potential failure.

This survey chimes with similar polls taken by a variety of financial institutions, which have found that investor confidence has dropped dramatically since March, with fund and wealth managers around the world fearing a systemic banking crisis. It’s against this backdrop of uncertainty and doubt that the cryptocurrency market has witnessed a mini-recovery of sorts, with bitcoin (BTC) — often referred to as ‘digital gold’ — enjoying a rise from $19,600 on March 10 (when Silicon Valley Bank collapsed) to almost $31,000 by April 14.

But is crypto really a safe haven against the possibility of bank collapses? Well, the answer to this question depends on the timescale in which it’s asked, as well as on which cryptocurrencies are being discussed. Because while bitcoin has undoubtedly risen in the context of the current banking fears, other coins have done less well, while there’s no evidence to indicate just how crypto would fare in response to a full-blown and global financial crisis.

Banking Fears = Cryptocurrency Price Rises

What’s interesting about the current banking crisis, even more so than with the 2007-8 crash, is that it reveals the increasingly global outlook of so many consumers and savers.

Speaking to WealthRocket for the purposes of its survey, economist David-Alexandre Brassard said he wasn’t surprised that most Canadians are scared by the possibility of a banking crisis, given that the news the public ‘consumes’ has become increasingly globalized.

“Information is less differentiated geographically than it used to be. We get a lot of our information from the web and see a lot of news from the U.S. and Europe. So, I would expect that to colour people’s impressions,” he said.

And while there have been no specific threats of any Canadian bank failing since March (and Canada didn’t have a banking crisis in 2008 either), the WealthRocket survey also found that most Canadians — at 57% — are worried to varying extents about the security of the money they’ve deposited with their banks. In fact, 29% are either ‘very worried’ or ‘extremely worried.’

Source: WealthRocket

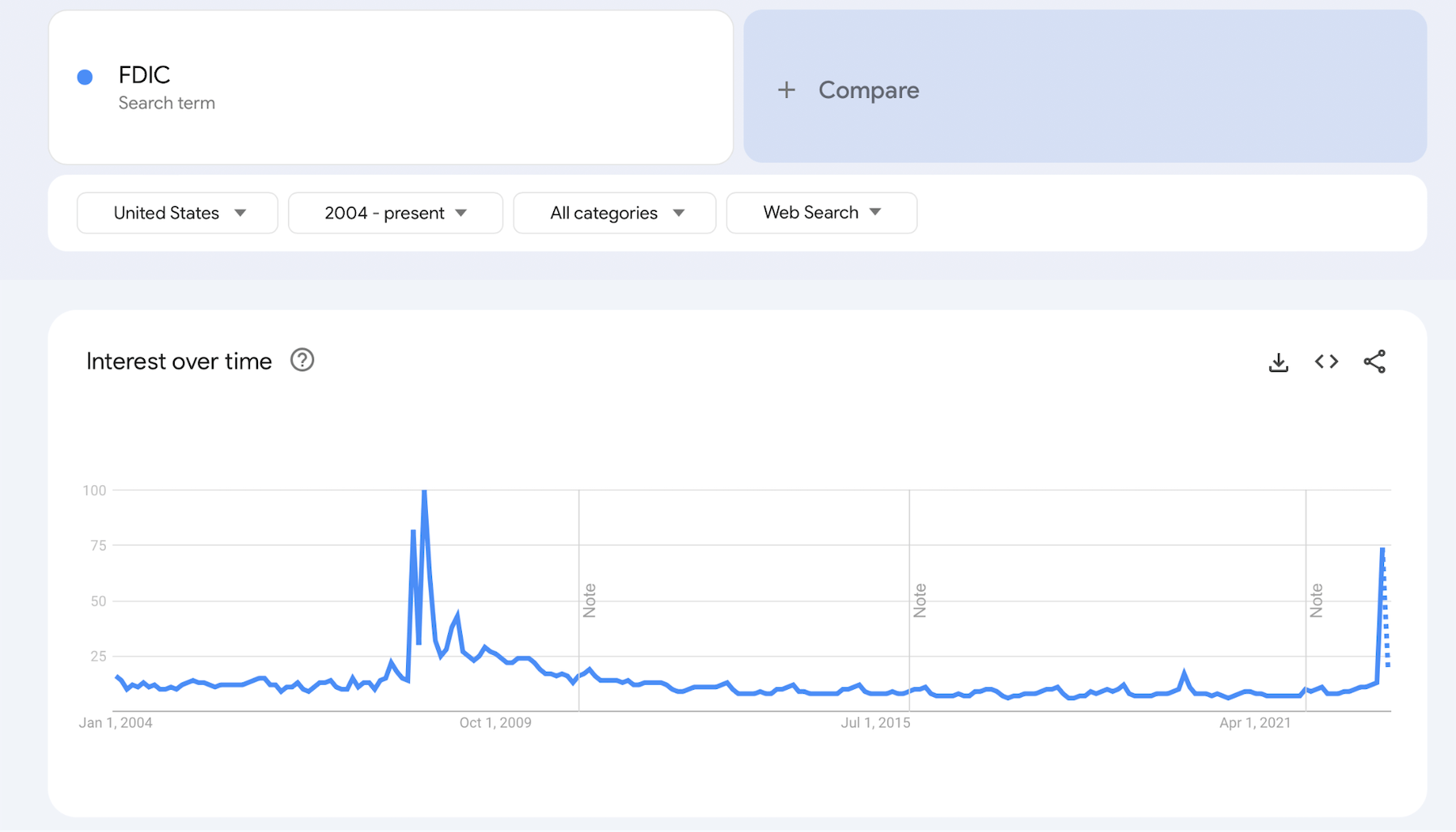

Again, this coincides with the concerns that have gripped normal people throughout much of the world, with Google searches for “FDIC” (i.e. the Federal Deposit Insurance Corporation) reaching their highest levels in the United States since 2007-8.

Source: Google

In other words, millions of people are concerned about their money at the moment, and it seems that the cryptocurrency market has benefitted from their anxieties. Since March, the cap of the crypto market as a whole has risen by as much as 37%, and is up by 47% since the beginning of 2023.

Given that both a banking crisis and cryptocurrency price rises have happened at the same time, many commentators within (and outside of) the cryptocurrency industry have concluded that crypto — and bitcoin in particular — has benefited from this crisis.

There might be something to such suspicions. Since March, over $100 billion has been withdrawn from US financial institutions alone, while bank outflows hit a record level in the Eurozone in February. While most of such outlaws have likely gone to other banks, it’s also likely that a small portion has gone to crypto, with glassnode analysis suggesting that spot trading (which is more synonymous with retail investors) has been more important in driving bitcoin’s recent increases, as opposed to leveraged futures.

Source: Twitter

Claims that crypto is benefiting from the banking crisis is also supported by the fact that bitcoin — which is generally seen as the ‘safest’ cryptocurrency — has increased its dominance over the rest of the cryptocurrency market. From around 41% in February, its market cap as a percentage of crypto’s entire cap has risen to 47%, indicating that people are increasingly turning to the longest-running cryptocurrency with the most secure network.

Is Crypto a Safe Haven Alternative to Banks?

But while there probably has been some flow from banks to bitcoin and/or crypto, it would be difficult — and also irresponsible — to argue that cryptocurrencies are a good, safe alternative to storing your money with a regulated financial institution.

Perhaps this might be the case for long-term holders, such as those who bought bitcoin numerous years ago and who are now simply waiting for the token to reach new peaks. However, it could be risky to put a big chunk of your money into bitcoin or any other crypto now and expect it to be safe. Yes, you may end up making a profit, but you could also end up making a loss.

Even if BTC has risen substantially since March, it has also seen a number of falls, meaning that latecomers won’t be assured of having their wealth preserved. For instance, bitcoin has fallen by 4% in the past 24 hours, doing so in response to the news of First Republic’s collapse and in response to the possibility of further Fed rate hikes this week.

Bitcoin’s price since February. Source: CoinGecko

As such, anyone investing in cryptocurrency right now should do so only in the knowledge that they’re exposing themselves to potential risk as well as reward. That said, even if they buy some bitcoin now and see a few dips in the shorter term, history has taught us that BTC will steadily rise over the longer term. And with the next Bitcoin halving due in 2024, next year could be a strong one for the world’s original cryptocurrency and the wider crypto market, even if the world’s banks continue to struggle.