- >News

- >FTX Collapse Creates Crypto Contagion Risk for Market All Over Again

FTX Collapse Creates Crypto Contagion Risk for Market All Over Again

FTX has filed for bankruptcy, confirming fears that the (onetime) second-biggest cryptocurrency exchange in the world was on the brink of collapse. CEO Sam Bankman-Fried has also resigned from his position, with his place now occupied by John J Ray III, the US lawyer who was appointed in 2004 to oversee the liquidation of Texas-based energy firm Enron, which collapsed in 2001 following the exposure of large-scale fraud.

This appointment of John J Ray III underlines the seriousness of the position in which the cryptocurrency market now finds itself. Emerging details increasingly suggest that FTX and its former head Bankman-Fried may have engaged in outright fraud during the exchange’s brief existence, with reports suggesting that the company didn’t really have a board of directors, and that its parent company Alameda Research ‘borrowed’ $10 billion in customer deposits from the exchange in order to fund speculative investments. As a result of such revelations, the public’s perception of cryptocurrency and the industry surrounding it may only worsen, not that it was great to begin with.

Even worse, the FTX collapse raises the very real risk of contagion, not least because the fall of the smaller Terra in May caused its own contagion effects in the following months. And with various firms exposed to the now-defunct firm in various ways, the cryptocurrency market may be in for a very unhappy Christmas.

FTX Collapse and Bankruptcy: Everything We Know So Far

Without repeating too much of what we published last week, FTX’s troubles began when a leaked balance sheet revealed that its parent company Alameda was effectively insolvent. That is, while its assets were nominally larger than its liabilities, around two thirds of said assets were in illiquid altcoins, meaning it couldn’t realistically repay all of its debts.

This caused a run on FTX, which caused the exchange to halt withdrawals, which caused it to go to Binance (and also OKX) for help. Binance pulled out of an informal agreement to acquire the exchange, citing the misuse of customer funds and two pending federal investigations among its reasons.

And while Sam Bankman-Fried had mentioned something vague about raising new funds from investors, absolutely none were forthcoming, so he went ahead and filed for chapter 11 bankruptcy protection on November 11. What this form of bankruptcy protection does is provide a firm with the opportunity to reorganize itself and its debts, with the possibility kept open that it may continue operating (this appears to be Bankman-Fried’s hope).

Source: Twitter

This is basically the current state of play, yet various details have emerged in the days following the FTX bankruptcy. In a New York Times article, for instance, venture capital investors in the exchange reported that Sam Bankman-Fried refused to entertain their recommendations as to how to run the company in a more considered way, shooting down suggestions that he appoint an experienced CEO.

The article also explains that Bankman-Fried reportedly provided investors with little detail as to how FTX was run, with the former CEO failing to mention the intertwining of the exchange’s (customer) funds with Alameda’s balance sheet. He also failed to appoint any outside investors to FTX’s board of directors, which comprised only an FTX employee and a lawyer, as well as himself.

Needless to say, the two federal investigations currently focusing on FTX — one led by the Department of Justice and the other by the Securities and Exchange Commission — may turn up a few more interesting details. These inquiries are seeking to find evidence of criminal activities and securities offenses (respectively), and given what we now know about FTX, it seems like both have very good chances of resulting in charges. It’s also facing an investigation in the Bahamas, where it‘s officially headquartered, increasing the chances that Sam Bankman-Fried and others linked with Alameda/FTX will face eventual prosecution.

In terms of FTX’s users and customers, they may struggle to recover the funds they’ve deposited with the bankrupt exchange. Under chapter 11 bankruptcy, the exchange’s users will be classed as unsecured creditors, putting them at the back of the line in any distribution of money owed by the failed businesses. At the same time, Reuters has reported that at least $1 billion (and potentially as much as $2 billion) in customer funds have gone missing from FTX, according to inside sources.

This would appear to reduce the chances of all FTX customers receiving their money, and when combined with the uncertainty of how cryptocurrencies may be classified under bankruptcy law, it’s obviously a very bad time to be an FTX customer. Indeed, some customers of the exchange have gone so far as using NFTs to pay users living in the Bahamas (where FTX withdrawals are still possible, given that the exchange is HQ’d there) to send them crypto equivalent to the value of their accounts.

Crypto Contagion

This brings us to the bigger question of what FTX’s downfall means for the industry. Well, aside from raising serious questions of trust, the bankruptcy has also ignited fears of similar insolvencies among other exchanges and platforms.

These fears manifested themselves over the weekend, when it appeared that Crypto.com (another exchange famous for running a high-profile ad during this year’s Super Bowl) faced a run on withdrawals, with analytics firm Argus putting the figure at more than $70m on Sunday November 13.

Source: Twitter

Such a rush to withdraw funds has led a number of exchange bosses to take to the airwaves in order to assure customers and investors that they’re safe from falling victim to FTX’s fate. As we wrote last week, Binance has vowed to publish some kind of ‘proof-of-reserves’ in the near future, and now the exchange has been joined by OKX, Derebit, and Crypto.com, while Coinbase has long maintained a policy of holding customer assets 1:1.

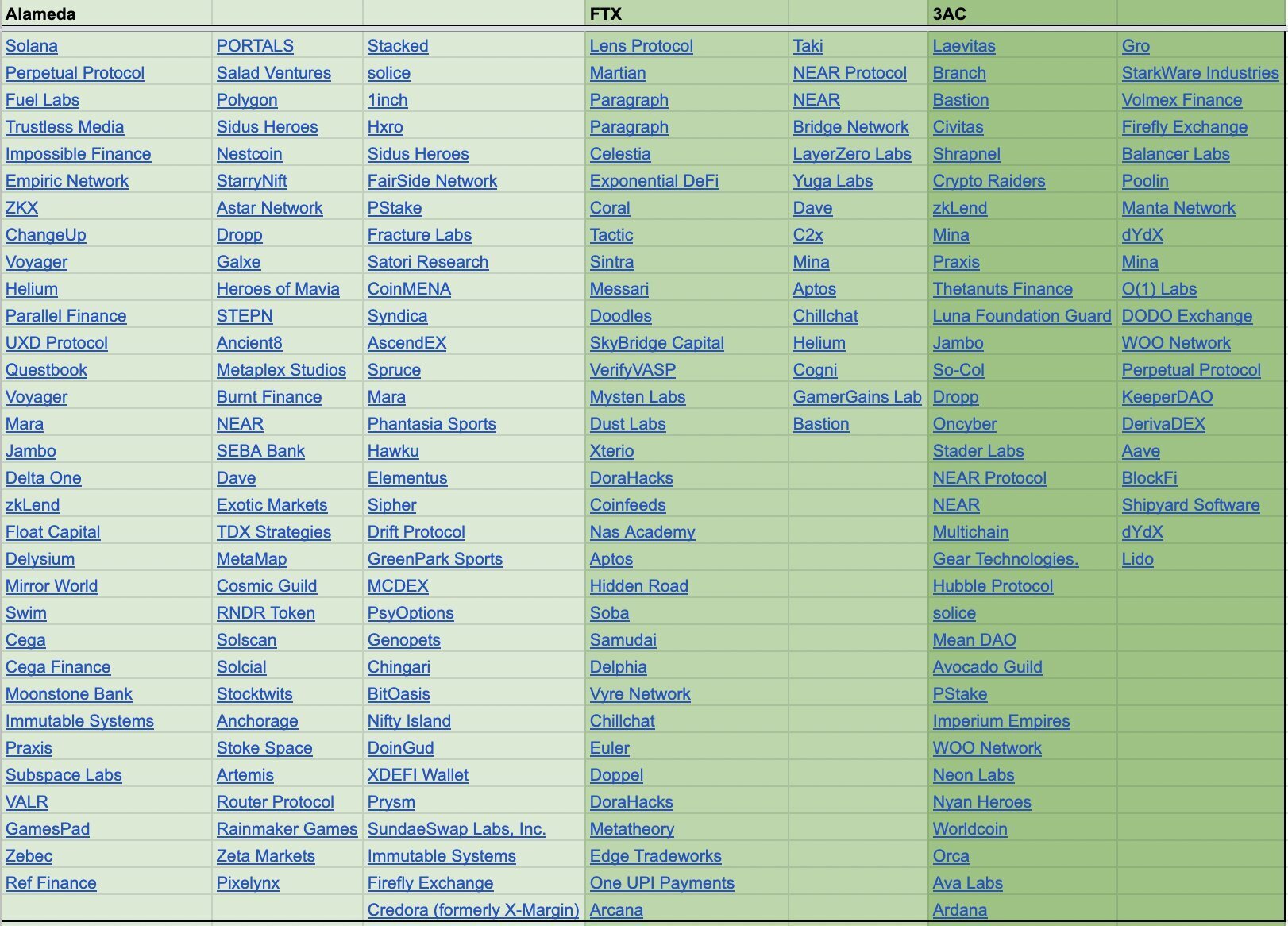

VC investments made by Alameda Research, FTX and (the previously collapsed) Three Arrows Capital. Source: Jack Niewold/Twitter

While ‘proof-of-reserves’ may be an overly informal assertion in some cases, this sudden increase in exchanges striving to prove stability to its customers is arguably the main silver lining of the whole FTX collapse fiasco. Yes, the industry is likely to see a few more collapses in the coming weeks (not necessarily of exchanges), especially when Alameda and FTX’s investments in the space were so extensive. Yet once the dust has settled and the industry begins rebuilding, it’s likely that it will do so on a more secure footing.

Indeed, regulators will be coming for exchanges and cryptocurrency firms after this episode, which again will necessitate some short-term pain but will ultimately make the sector more sustainable. And while FTX’s customers are no doubt having a very difficult time right now, its collapse has inaugurated the kind of testing period that crypto will need to become a more mature industry.