- >News

- >The Best-Performing Cryptocurrencies of the 2022 Crypto Crash (So Far)

The Best-Performing Cryptocurrencies of the 2022 Crypto Crash (So Far)

The wait goes on. Yes, traders and investors hoping for the long-awaited end to 2022’s crypto crash and bear market will have to wait further, with cryptocurrency prices falling by more than 5% across the board in the 24 hours before these words were written. This drop comes despite the fact that technical indicators all largely point towards a market bottom, meaning a bull market ‘should’ be due any day now…

While such a market still hasn’t arrived, traders looking for good news may be encouraged to hear that a handful of major coins have in fact outperformed market averages over the past few months and posted some decent gains. Sure, looking at price data for the past year (or the year to date) reveals noticeable falls for pretty much every coin in the top 100 (save for some stablecoins), yet data over the past 90 days shows that some cryptocurrencies have performed relatively well during the ongoing bear market.

As such, this article collects the seven best-performing cryptocurrencies of the 2022 crypto crash, demonstrating that growth is possible during even unfavorable conditions.

Lido DAO (LDO)

Lido DAO is a decentralized autonomous organization (DAO) that oversees the governance and operation of the Lido staking platform. The latter enables people to stake various cryptocurrencies (e.g. Ethereum, Solana, Polygon, Polkadot), and is now the second-biggest DeFi app in the crypto ecosystem in terms of total value locked.

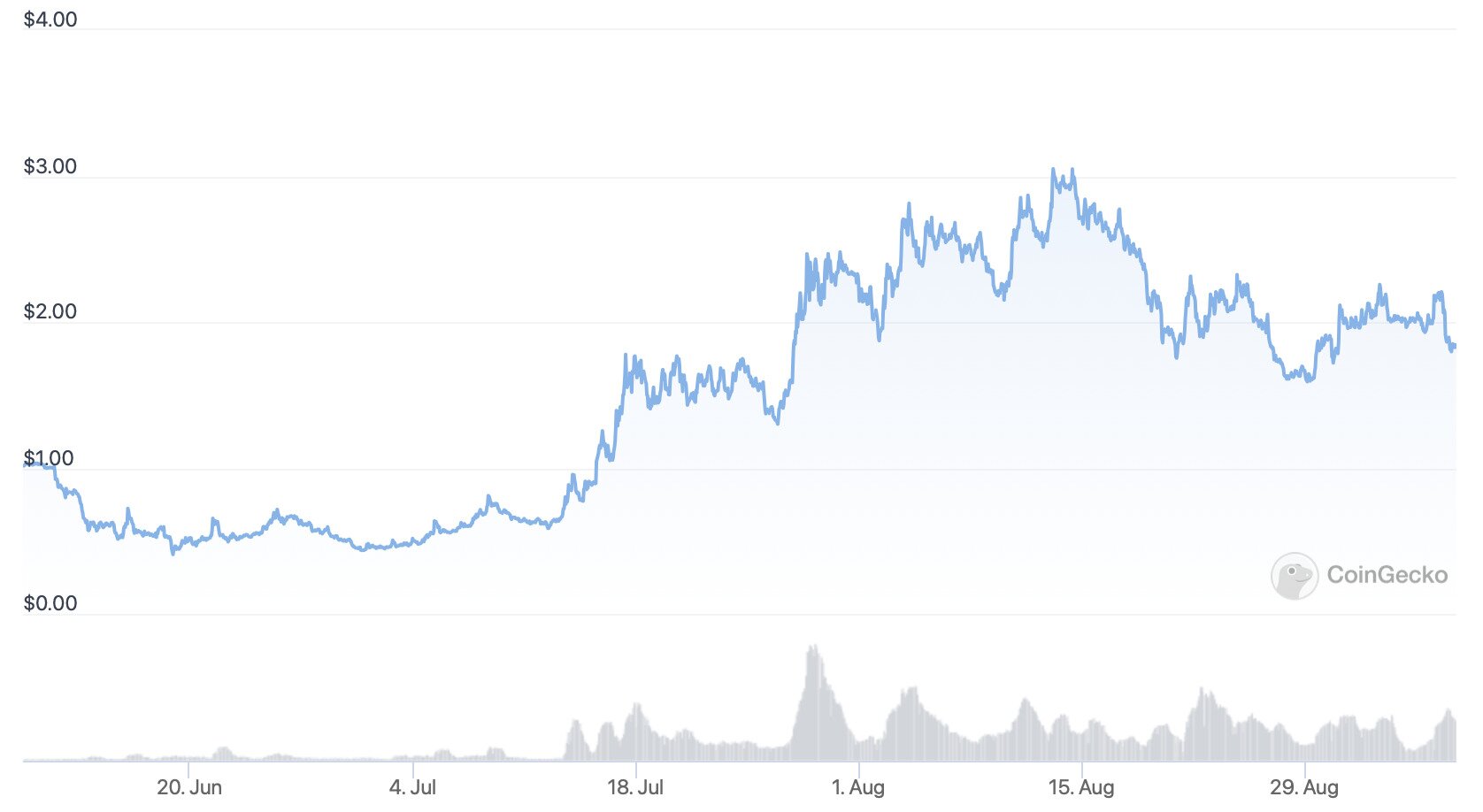

Lido’s native token, LDO, has risen by 79.4% in the past 90 days (a ‘season’ in crypto-speak). Its price has gone from $1.02 at the start of this period, to $1,83 as of writing.

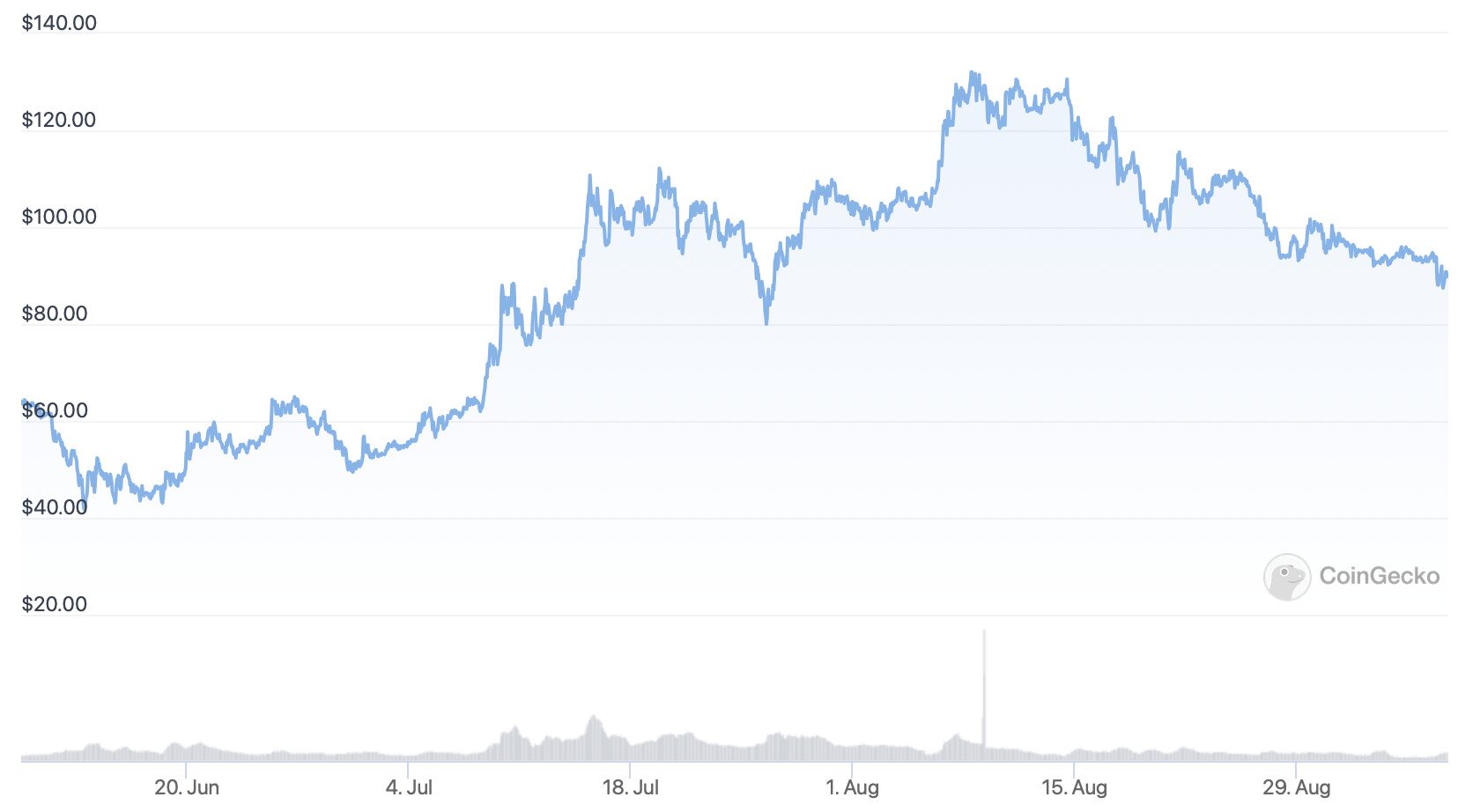

LDO’s price action in the past 90 days. Source: CoinGecko

This above-average performance is due largely to Ethereum and the growth of Ethereum staking. With the Merge due in the next few days, more investors have wanted to stake ETH, and many have gone to Lido. Indeed, it now accounts for over $4 million in staked ETH, making it the largest staking provider for Ethereum.

Ethereum Classic (ETC)

Continuing with the Ethereum theme, the next best-performing cryptocurrency of the 2022 crypto crash is ethereum classic (ETC).

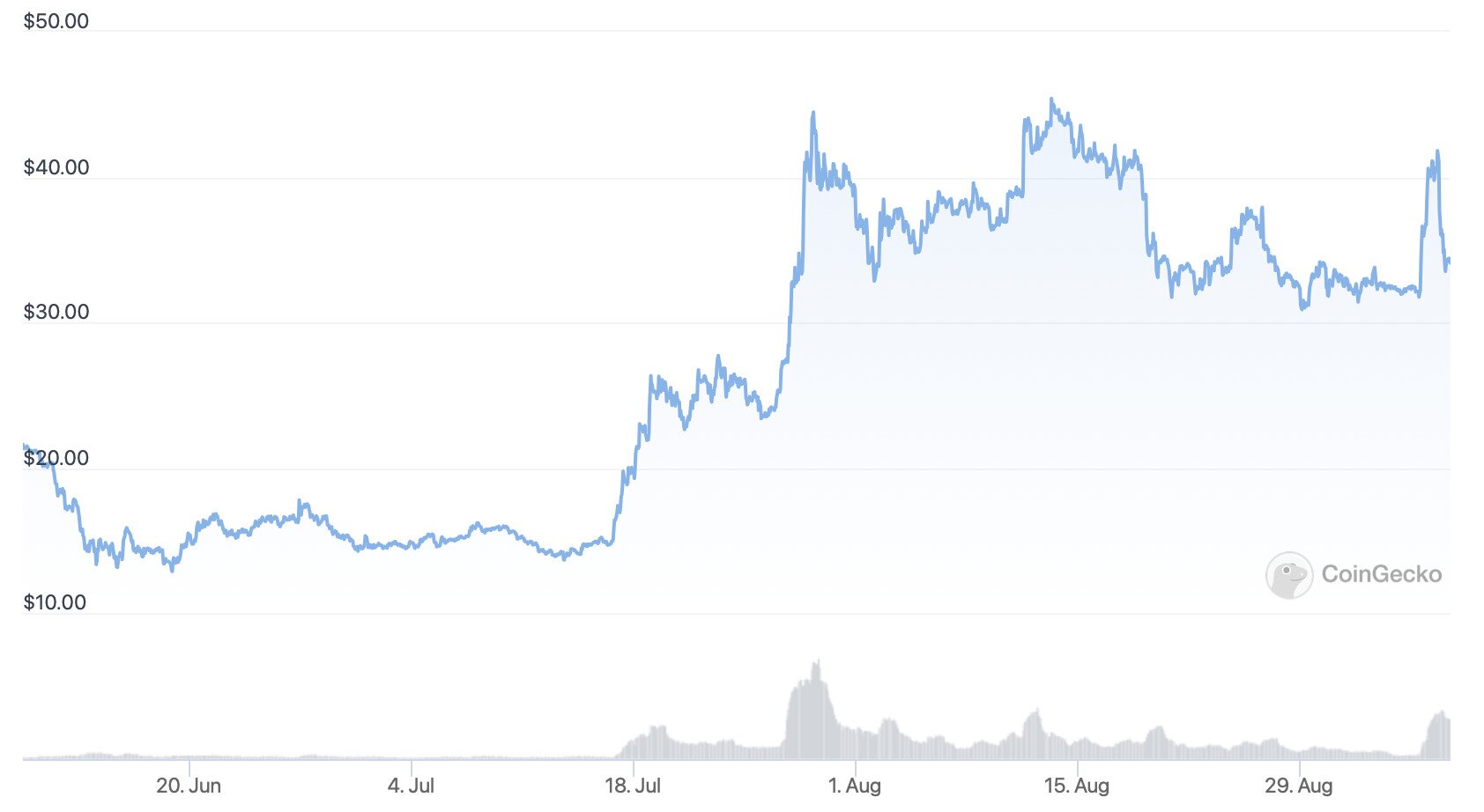

It has risen from $21.59 some 90 days ago to $34.12 today, making for a 58% rise during this period. By contrast, bitcoin has fallen by 38.5% over the same 90 days, underlining the fact that conditions have been very bearish.

Source: CoinGecko

ETC has risen largely because of Ethereum’s shift to a proof-of-stake consensus mechanism. This means that the latter’s miners are at risk of becoming redundant, so many have flocked to Ethereum Classic, improving its strength and security.

Trust Wallet (TWT)

TWT is the governance token of Trust, which is one the most popular app-based cryptocurrency wallets in the industry. As a governance token, it affords holders the ability to vote on new governance and update proposals, while it also grants discounts within Trust itself.

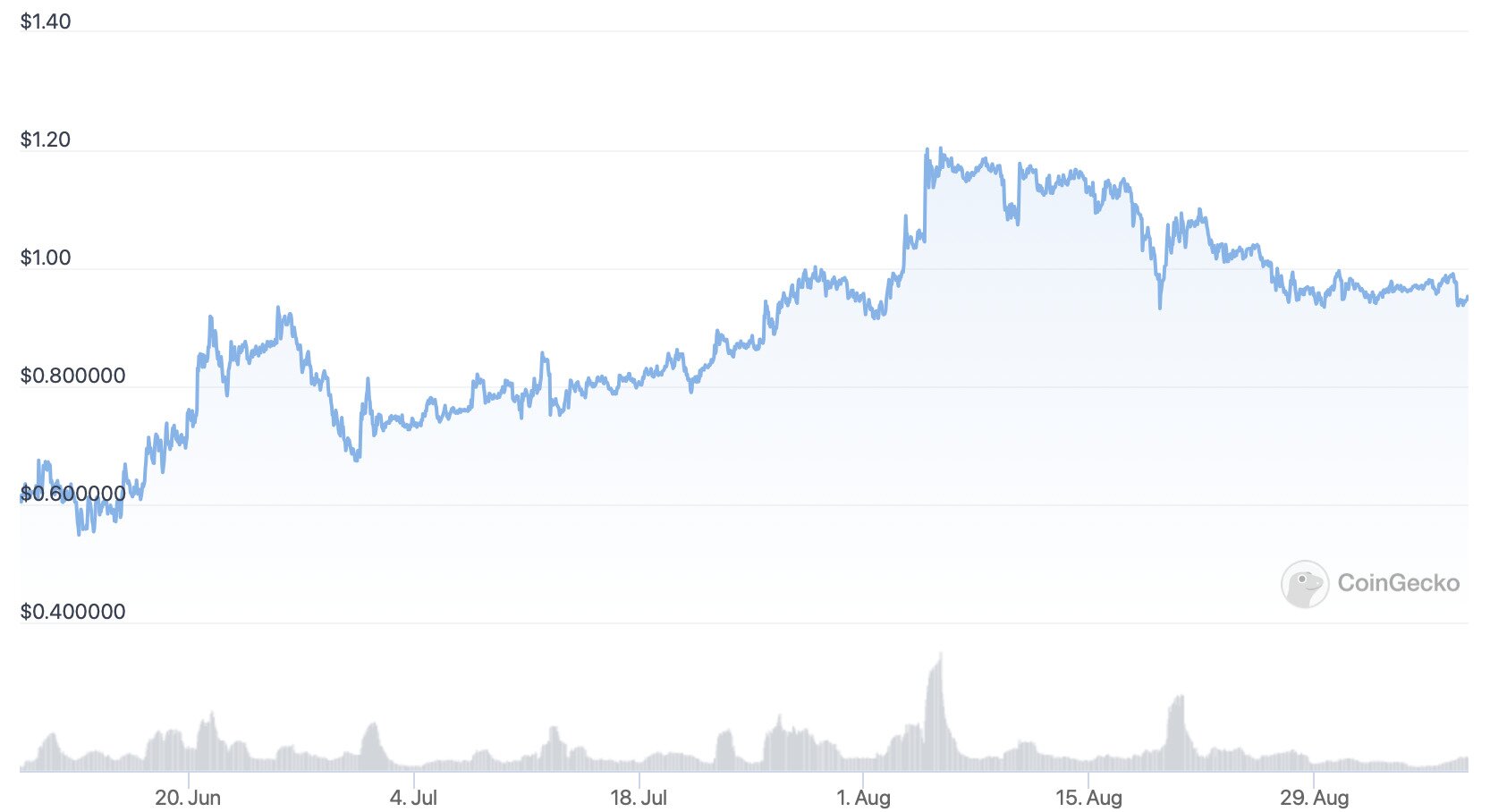

Having stood at $0.613435 90 days, TWT has since risen by 54.4%, to $0.947261. This growth has come largely from growing use of Trust Wallet, which is owned by Binance (having been acquired in 2018).

Source: CoinGecko

Trust’s own figures suggest that it currently serves around 25 million people, and with cryptocurrency ownership generally increasing every year, expect it to keep growing.

Chiliz (CHZ)

Chiliz is an Ethereum-based platform for the creation of sports team-related cryptocurrencies. It issues specific cryptocurrencies and fan tokens for the various teams (mostly soccer teams) it partners with, and these tokens provide fans with a number of various perks and rewards related to their teams.

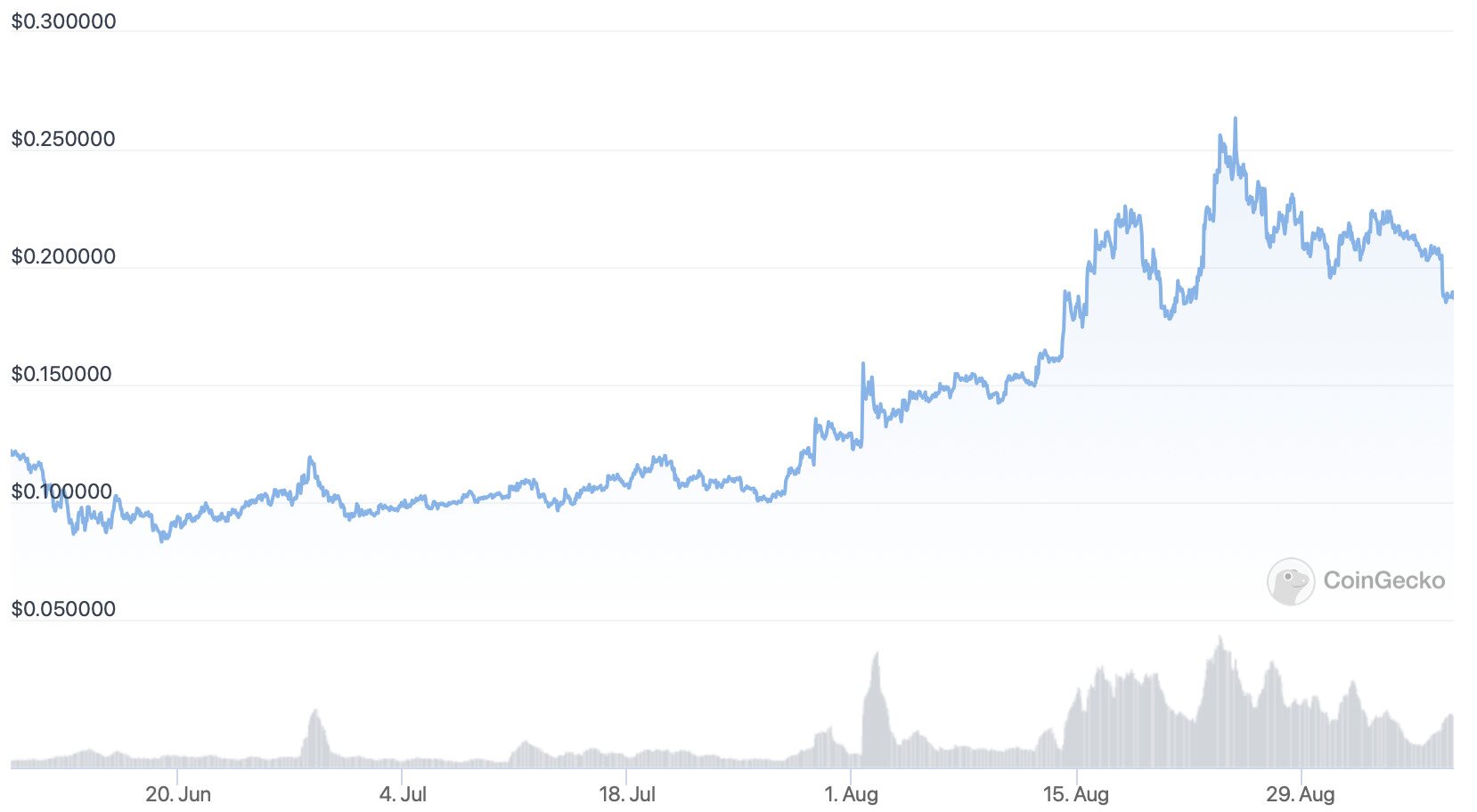

CHZ has risen by 53.2% in the past 90-day period, moving from $0.121921 to $0.186783 today. It does, however, remain 78% down from its all-time high of $0.878633, set back in March 2021.

Source: CoinGecko

The main reason for CHZ’s good performance during the current downturn is that it announced a partnership with Barcelona FC. Specifically, parent company Socios.com invested $100 million in August, thereby acquiring a 25% stake in Barcelona’s digital content.

Quant (QNT)

Quant is an Ethereum-based platform used to connect public blockchains with private networks. Its native token QNT is used within its platform to pay network and transaction fees, giving users access to particular applications, services or networks.

QNT has increased by 42.4% in the past 90 days, rising from $64.10 to $89.90. As with many other coins, it does remain down heavily compared to its ATH of $427.42, from September 2021.

Source: CoinGecko

Nonetheless, QNT’s above-average performance during the recent lean spell is due largely to its growing partnerships. Not only has it partnered with Oracle and Lacchain in recent months, but it also emerged in July that it has been in discussion with various governmental agencies about using its network.

Cosmos (ATOM)

Self-described as the ‘internet of blockchains,’ Cosmos is a network that seeks to connect other chains, creating an interoperable ecosystem in the process. It launched in 2019, and since then its native token, ATOM, has become the 24th biggest cryptocurrency in the market (or 22nd, if you ask CoinMarketCap rather than CoinGecko).

ATOM is a staking cryptocurrency that can also be used for governance of Cosmos itself. Flying in the face of much of the market, it has appreciated by 32.7% in the past 90 days, from $8.91 to $11.82.

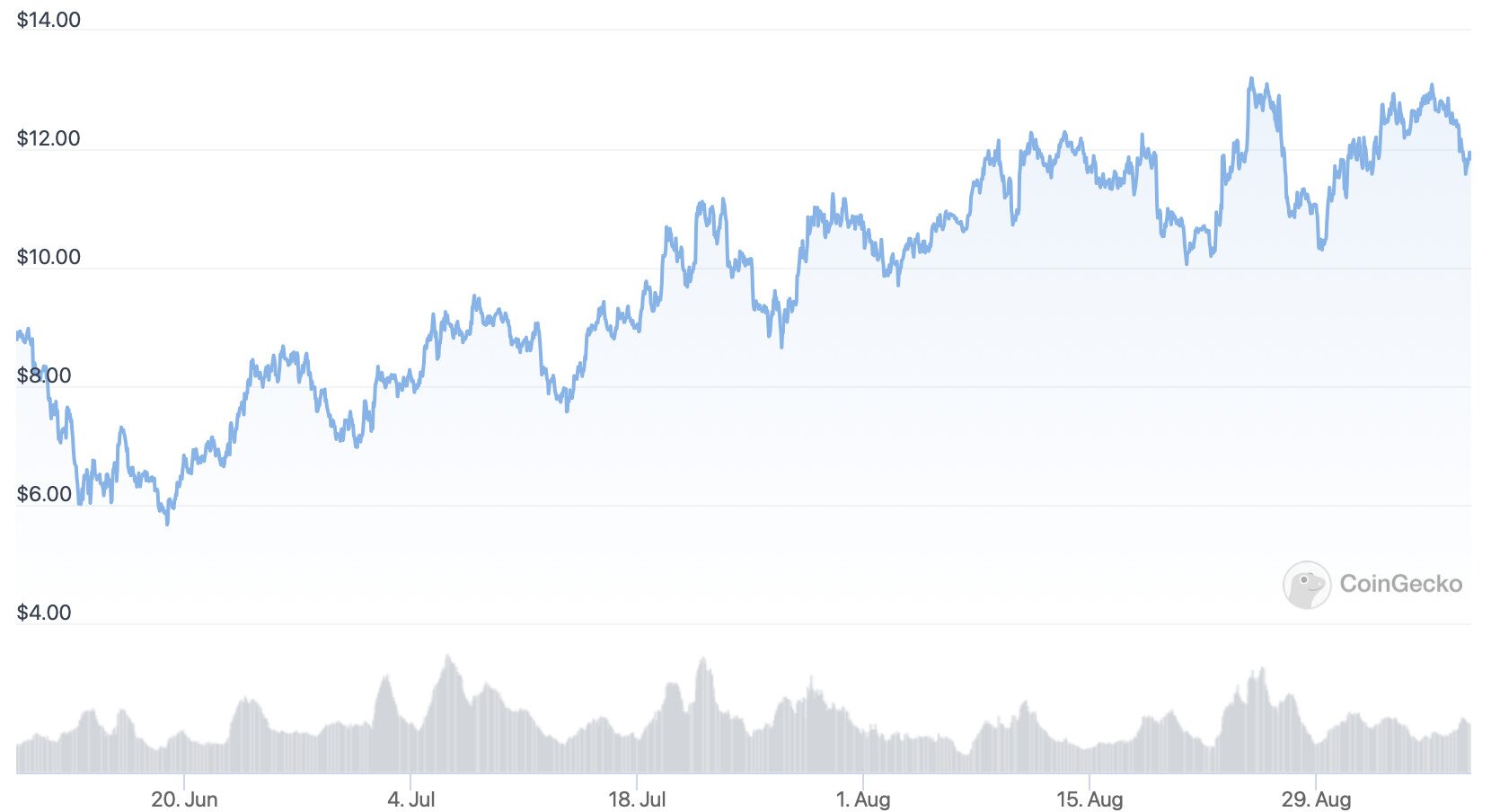

Source: CoinGecko

One big reason for this jump is that Cosmos has witnessed significant development in the past couple of months. It launched its first DEX, Emeris, in mid-August, while later in the month it also saw the opening of another DEX, Sifchain, which will facilitate cross-chain trades between Cosmos and Ethereum.

Polygon (MATIC)

Polygon is the biggest layer-two scaling solution for Etherum, commanding some $1.65 billion in total value locked in, which puts it ahead of many layer-one chains. It launched in 2017, giving it first-mover advantage among many of the current crop of layer twos (e.g. Arbitrum, Optimism, Loopring).

Its native token MATIC, has risen from $0.630782 90 days ago to $0.804218. This is a jump of 27.5%, something which Polygon has Ethereum (again) to thank.

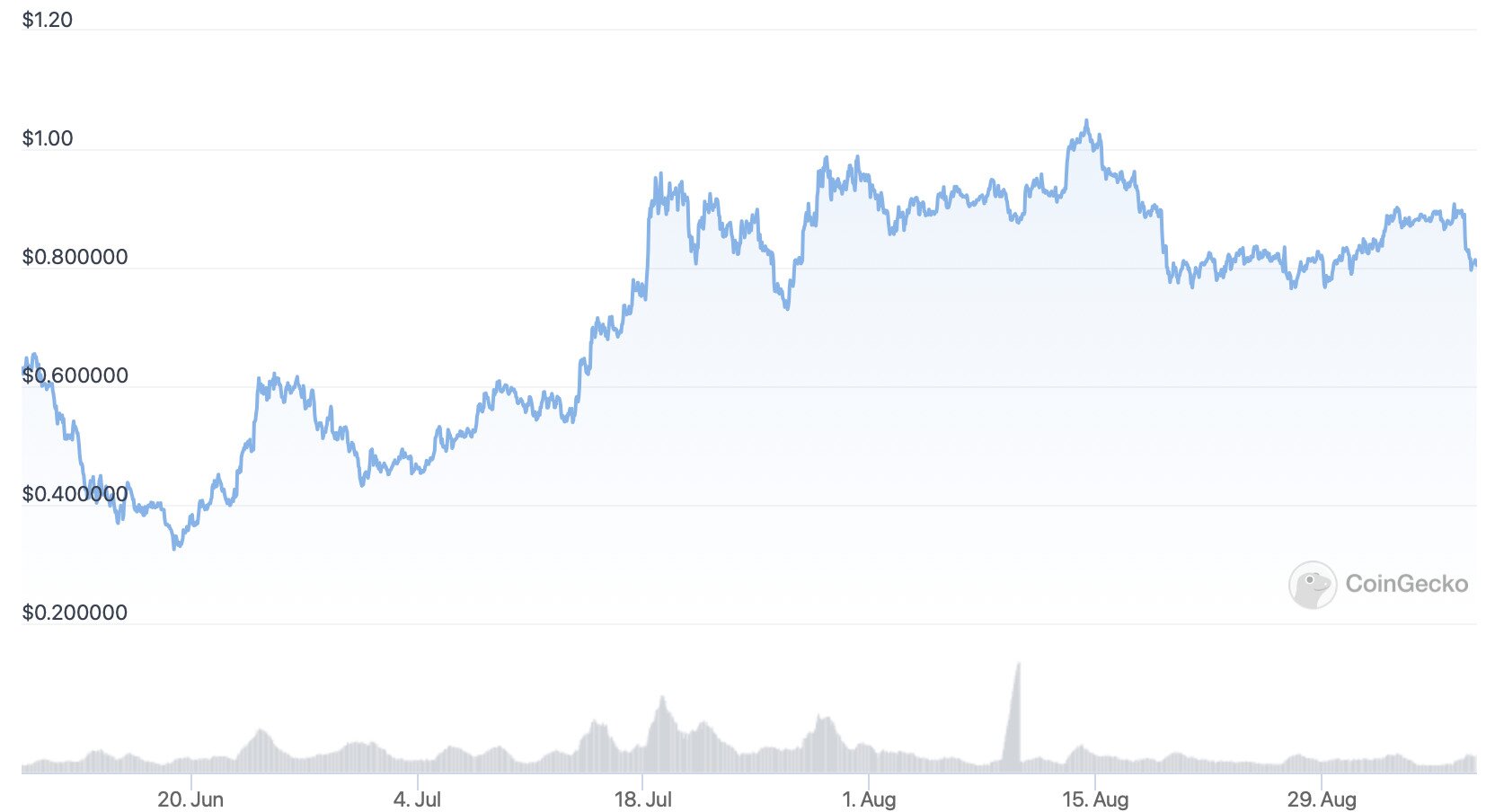

Source: CoinGecko

Yes, Ethereum’s shift to a proof-of-stake consensus mechanism means two things for Polygon. Firstly, it will increase usage of Ethereum and its ecosystem, yet secondly, because it won’t do anything for scalability and fees in the short-to-mid term, it will also increase usage of Polygon.