- >News

- >What Are the Top 3 Things People Get Wrong About Solana?

What Are the Top 3 Things People Get Wrong About Solana?

Solana is an open-source blockchain for decentralized applications that rivals other DeFi platforms like Ethereum and Cardano.

Like all major blockchain projects, there is nuance, evolution, and growth of the network. What do we get wrong about Solana? Solana is much more than a platform for DeFi apps and, if Alexis Ohanian has his way, will be the new face of decentralized social media. We also need to understand how the community operates.

Is Solana truly decentralized and what is the breakdown of the core-token pie? Ultimately, Anatoly and the Solana community will decide what it becomes going forward.

What is Solana?

In November 2017, Anatoly Yakovenko published the Solana whitepaper that outlined the creation of a ‘Proof of History (POH)’ blockchain whose value prop was the ‘fastest blockchain in the world.’ At its core, they would use a new method of keeping time between network validators. Combined with Proof of Stake (POS), and as long as validators can all agree on time, processing transactions would become — according to them — very fast.

Solana’s creators have ambitions of becoming the highest throughput blockchain in the world while maintaining low cost. Easier said than done, as most blockchains tend to have higher fees as more and more transactions are processed across the network. As usage on other major blockchains, like Ethereum, continues to rise, transaction time and fees rise in tandem. Solana creators claim that this limits their potential and impacts scalability and they believe they’ve created a solution which makes them the “fastest growing ecosystem in crypto.”

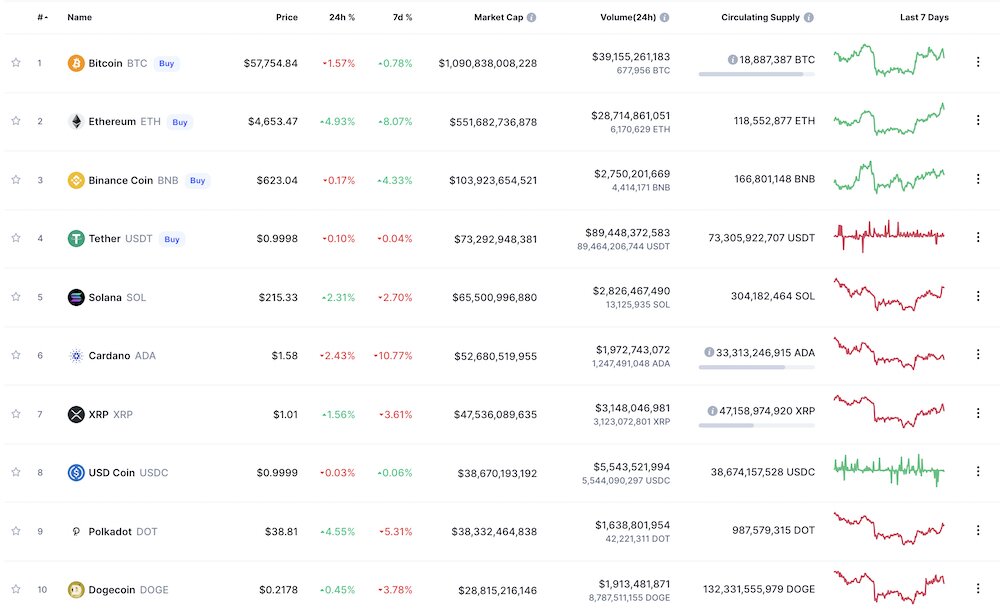

In April of 2020 Solana’s core token, SOL, was introduced to the market and rose to prominence quickly. It’s the token that Solana validators are rewarded in (regular users can be rewarded too and holders have the right to vote on future upgrades) and its price has exploded. At the time of writing Solana is currently #5 by total market cap.

Solana has big ambitions. It would be easy, and probably practical, to be skeptical of all that it claims to be and do. High throughput is good, decentralization is good, and low fees are good. This, to the consumer, makes Solana an attractive alternative to Ethereum, now famous for high gas fees when trying to process transactions across the Ethereum blockchain.

For all that we seemingly know about Anatoly and Solana, what do we get wrong?

Three Things We Need to Understand

1. Solana Has NFTs, Apps, Metaverse and More

When we think about blockchains designed to power decentralized applications, most of us first think of finance: trading, buying, and selling cryptocurrencies. It’s a common first take, but there appears to be a lot more here with Solana and that is likely misunderstood. You can buy and sell NFTs on Solana, use encrypted messaging apps, and enter the Metaverse in apps like Allfarium. At Solana’s annual conference in Lisbon, Alexis Onhanian (co-founder of Reddit), and Solana Ventures committed $100M USD to building the next generation of decentralized social media on the Solana blockchain.

Solana and its community are definitely paying close attention to the NFT market. As NFTs become big business and the hype-cycle continues, Solana stands to benefit and you can bet it is on their roadmap going forward. The Degenerate Ape Academy coming to Solana, for example, was undeniable and we’re seeing other NFT projects make the jump or use Solana as their core infrastructure..

2. Solana’s Decentralization is Often Criticized

Solana talks a big game. It claims to be ‘unstoppable’ and the decentralized nature of the network means that ‘transactions will never be stopped.’ On September 14th, the network was stalled by a Denial of Service (DOS) attack that drowned the network in illegitimate traffic. Once the network was jammed, legitimate transactions became impossible and Solana’s 1000+ validators chose to “restart” the network. The entire blockchain was down for almost 18 hours.

Decentralization matters here. Specifically, the true nature of Solana’s decentralization. When validators crashed to the extent that they could not mutually agree on the accurate and current state of the network, processing, and confirmation of new blocks were not possible. Eventually the community of 1000+ validators were able to come to a fairly fast resolution and reboot the network.

There are two elements of discussion within the Solana community that directly apply here: is the validator community big enough and, if not, why is the barrier to entry to become a validator so high? It appears that the two major concerns are cost of hardware, and the cost implications of being able to vote (as it stands, staking SOL). Others in the community are convinced these costs will come down over time as the community grows.

For Solana to be truly seen as decentralized, we’re looking for the validator community to grow and for cybersecurity events like the September DoS attack to be incredibly rare.

3. Solana’s Top-Heavy Token Distribution

Another element of Solana that seems to be poorly understood is it’s distribution of SOL, the core token associated with the blockchain. Web3 communities are just different. They expect transparency, clear communication and they want to participate in, and own, the community. We saw this in the ENS drop: value and responsibility was given to holds of .eth domains for actively participating in the community. Solana is no different and it’s participants want to know what piece of the pie is being put on which plate.

According to Messari, 48% of Solana’s core token is given to the insiders. That’s the team, company, and VC purchased tokens. 13% of what remains is allocated to the foundation or to community controlled grant-pools. About two-thirds of what remains is reserved for ‘community allocations’ and only a fraction of the pie is for public sale. Compare and contrast that with competitors like Ethereum, which offered nearly 80% of ETH to public sale.

The Road-Map

Although there isn’t an explicit road-map for Solana going forward, it is fair to say we can expect innovation in the coming months and years as they expand community governance and grow.

Anatoly is very public and announcements like those from Alexis Ohanian and co., only drive the amount of money and time committed to the Solana blockchain higher. Investors, users, validators, and the core community will want to be an active part of the community going forward.