- >News

- >What is Proof-of-Reserves? Which Crypto Exchanges Offer It?

What is Proof-of-Reserves? Which Crypto Exchanges Offer It?

For an ecosystem that revolves around trust, the latter is currently in short supply in crypto. Following the spectacular FTX bankruptcy, suspicions have understandably arisen that other exchanges and platforms may be at risk of collapse, or that they may have also been speculating recklessly with their reserves and/or customer funds. This has created a demand for so-called proof-of-reserves, with the world’s biggest exchange, Binance, being the first trading platform to confirm that it “will start to do proof-of-reserves soon.”

However, while the phrase ‘proof-of-reserves’ has now become fashionable within the cryptocurrency community, there’s considerable confusion as to what it actually means. Some interpretations are vaguer than others, with critics suggesting that it’s likely to become another smokescreen by which the industry hoodwinks customers into assuming safety where there is none. That said, other industry figures are putting their weight behind an entirely on-chain version of proof-of-reserves, whereby an exchange’s reserves are always visible to the public.

Proof-of-Reserves Becomes A Trend in the Wake of the FTX Collapse

Fears surrounding FTX, its native token FTT and the possibility of a Terra-style collapse first emerged on November 2, when the exchange’s balance sheet was leaked (by a still-unidentified whistleblower). It was only six days later, on November 8, that Binance CEO Changpeng Zhao tweeted that “all crypto-exchanges should do Merkle-tree proof-of-reserves.”

Source: Twitter

This set the industry in motion, with Binance itself publishing its reserves on November 10. Other exchanges followed suit, including Kraken, Coinbase, KuCoin, Deribit, OKX, Gate.io, Huobi and ByBit among the platforms that shared (or committed to sharing) some form of data testifying to their holdings.

In the case of Binance, it has provided a list of wallet addresses, along with a reading of the balance held by these wallets. As of writing, this shows it holds around 475,000 BTC, 4.8 million ETH, 17.6 billion USDT, 21.7 billion BUSD, and 58 million BNB, among a few other coins. This works out to around $67.24 billion in reserves.

This way of providing proof-of-reserves has largely set the standard for other firms to follow, combining a tally of cryptocurrencies held by an exchange at a given moment in time with addresses that can be checked later to see how a platform’s reserves may have changed.

The thing is, questions have been raised as to how some exchanges are providing their own proof-of-reserves. With Huobi’s PoR, for example, there were suspicions that it had received funds from other exchanges, and that it then returned said funds after its reserve snapshot was taken. That said, further analysis (e.g. from Paradigm) revealed that Huobi had moved funds between its own wallets, rather than to and from another platform.

Despite this explanation, noted cryptocurrency skeptics such as David Gerard continue to suspect that at least some exchanges may be mutually exchanging funds prior to reserve snapshots. While Gerard hasn’t presented convincing evidence of this, investors may be advised to remain vigilant of the information exchanges provide, preferring platforms which actually share wallet addresses that can be monitored following a snapshot.

Why More Needs to Be Done By Exchanges AND Investors

Even assuming that an exchange’s proof-of-reserves is reliable and transparent, such proof is only one part of demonstrating that the exchange in question is safe from collapse and bankruptcy. That’s because showing how much cryptocurrency an exchange holds doesn’t mean that much if this exchange doesn’t also provide a statement of its liabilities.

Yes, it may be reassuring to hear that Binance holds over $67 billion in cryptocurrencies, but how much debt does it owe? What are its operating costs? Such questions remain completely opaque, so it’s not a given that Binance is actually solvent. And because Binance is a private company (like most other exchanges), it can continue to not disclose its liabilities.

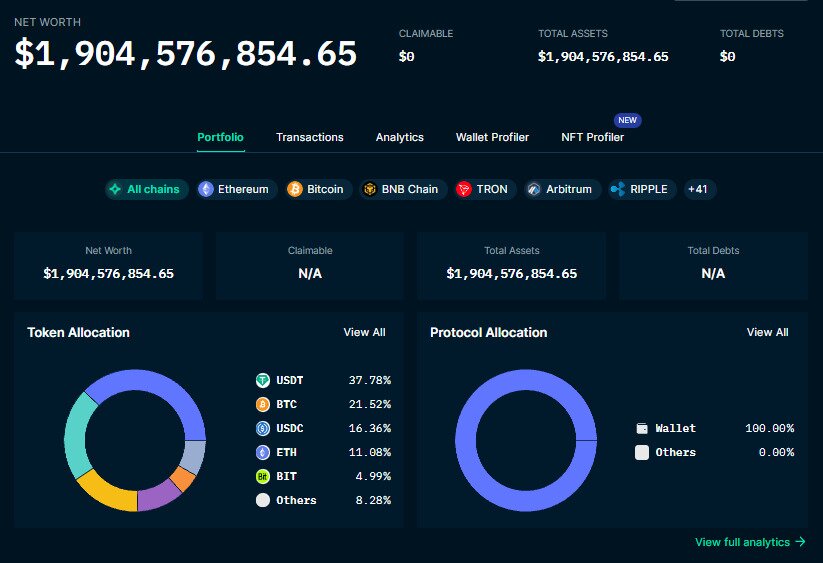

Source: Tagado Bitcoin & Crypto/Twitter

The above graphic representing Bybit’s reserves illustrates the problem neatly, in that there’s a big “N/A” in the Total Debts box. As such, what these reserves show is that the exchange has some cryptocurrency, and pretty much nothing else.

Even FTX held around $900 million in assets immediately prior to its bankruptcy, so reverses aren’t enough on their own to prove solvency. Because of this, some commentators have gone further than others in advocating for full on-chain accounting, something which would have liabilities as well as assets visible on one or multiple blockchains. This, of course, would be technically difficult to execute, insofar as exchanges and other platforms likely have liabilities that aren’t in cryptocurrencies, and so can’t be transparently monitored via a blockchain.

Another big problem for exchanges is that, with all of them holding their reserves largely in cryptocurrencies, they’re subject to wild fluctuations in value. This can prove fatal during downturns, particularly if their liabilities are denominated largely in terms of dollars or some other fiat currency.

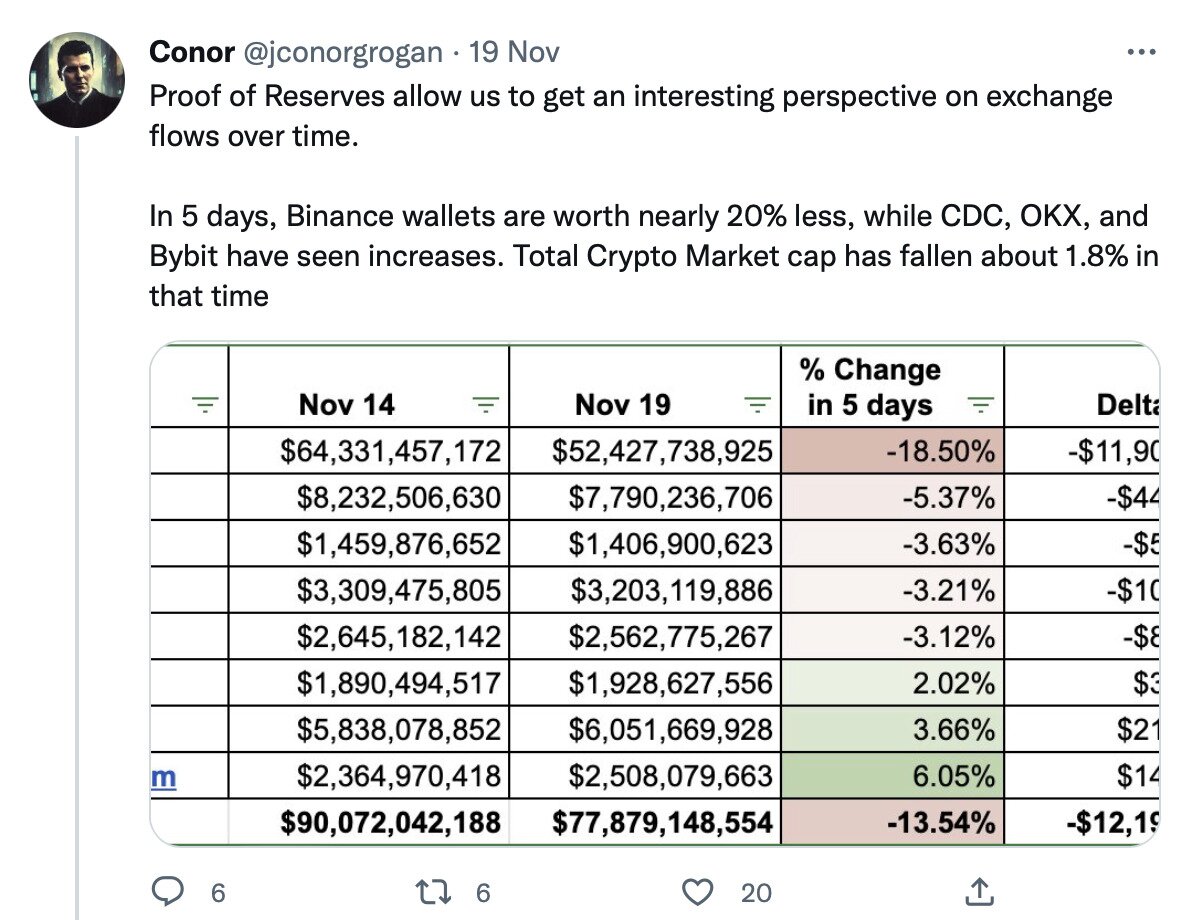

Source: Twitter

Indeed, as the tweet above shows, the value of Binance’s cryptocurrency reserves declined by 18.5% in the five days to November 19. This highlights the volatility exchanges are likely to experience in their reserves, as well as the potential difficulties they may face in managing their liabilities.

In light of these criticisms, there’s a growing sense among experts and holders alike that more emphasis should be placed on self-custody. What this means is investors keeping their holdings on their own hardware and software wallets, and transferring to exchanges such as Binance and Coinbase only when they wish to trade. That this is a sensible option is highlighted not only by FTX’s recent collapse, but also by the many exchange exploits the ecosystem has witnessed in recent years, with Binance suffering a hack on one of the bridges it uses as recently as last month.

In sum, it’s obviously a positive development that most major exchanges are committing to publishing their proof-of-reserves, if only because it will force them to be more financially prudent. But investors need to remember that, in an industry that still remains under-regulated, they’re the ones ultimately responsible for the security of their funds.