- >News

- >Surviving the Markets: How xStocks Turn Investing into the Last of Us

Surviving the Markets: How xStocks Turn Investing into the Last of Us

A lot is happening in the world right now… HBO is airing a new season of The Last of Us (don’t worry – no spoilers ahead), and Kraken is breaking down barriers with the launch of xStocks.

Admittedly, these two things do not have much to do with each other at first glance. However, some late-night X-scrolling (0/10 would not recommend, by the way) has got me thinking deeply about how we prepare to survive in the metaphorical post-apocalyptic landscape that is the current global economy.

The Crypto Stocks I Would Pack in My Backpack In Case of An Alien-fungus Invasion

Now that you have your head wrapped around (Cordyceps-style) the tokenization of stock, I am hoping that you can see how it all clicked for me when tuning in to watch The Last of Us season 2.

Whilst I am admittedly not fighting for my life against the clickers, securing my financial future is a fierce battle of sorts. And, choosing the right xStock to invest in, is a lot like sorting out your gear inventory in a survival game.

The options are endless, and the best choice for you always depends on your personal financial situation, the current market, and your goals. That being said, here’s what I would pack in my backpack (and by backpack, I obviously mean stock portfolio) if I were Joel, and why:

Apple (AAPL): 🪓The Fire Axe

Why: It’s sleek, dependable and multi-use.

DeFi significance: AAPL stock is a great option for anyone looking for a foundational asset, which has seen relatively low volatility over time. Just as a battleaxe will work equally well for chopping down trees for firewood, or as a weapon if needs be – this stock’s predictability and stability makes it a go-to choice for many investors who want strong base layer collateral.

Quick stats:

- Volatility Score: Low

- Market Cap: $3.01 Trillion USD

- Average Daily Trading Volume: About 53.7 million shares

- On-Chain Liquidity: Moderate (widely adopted in tokenized markets)

- Sector: Technology

Tesla (TSLA): 🗡️The Combat Knife

Why: Quick, sharp, and comes in handy in a pinch.

DeFi significance: A weapon of momentum, TSLA stock is well-known for their volatility and rapid movement within the market. It’s an ideal choice for investors that prefer high-risk strategies and those who have the patience to watch and wait for the best moment to strike.

Quick stats:

- Volatility Score: High

- Market Cap: $1.096 Trillion USD

- Average Daily Trading Volume: Around 107.6 million shares

- On-Chain Liquidity: High (popular among crypto traders)

- Sector: Automotive

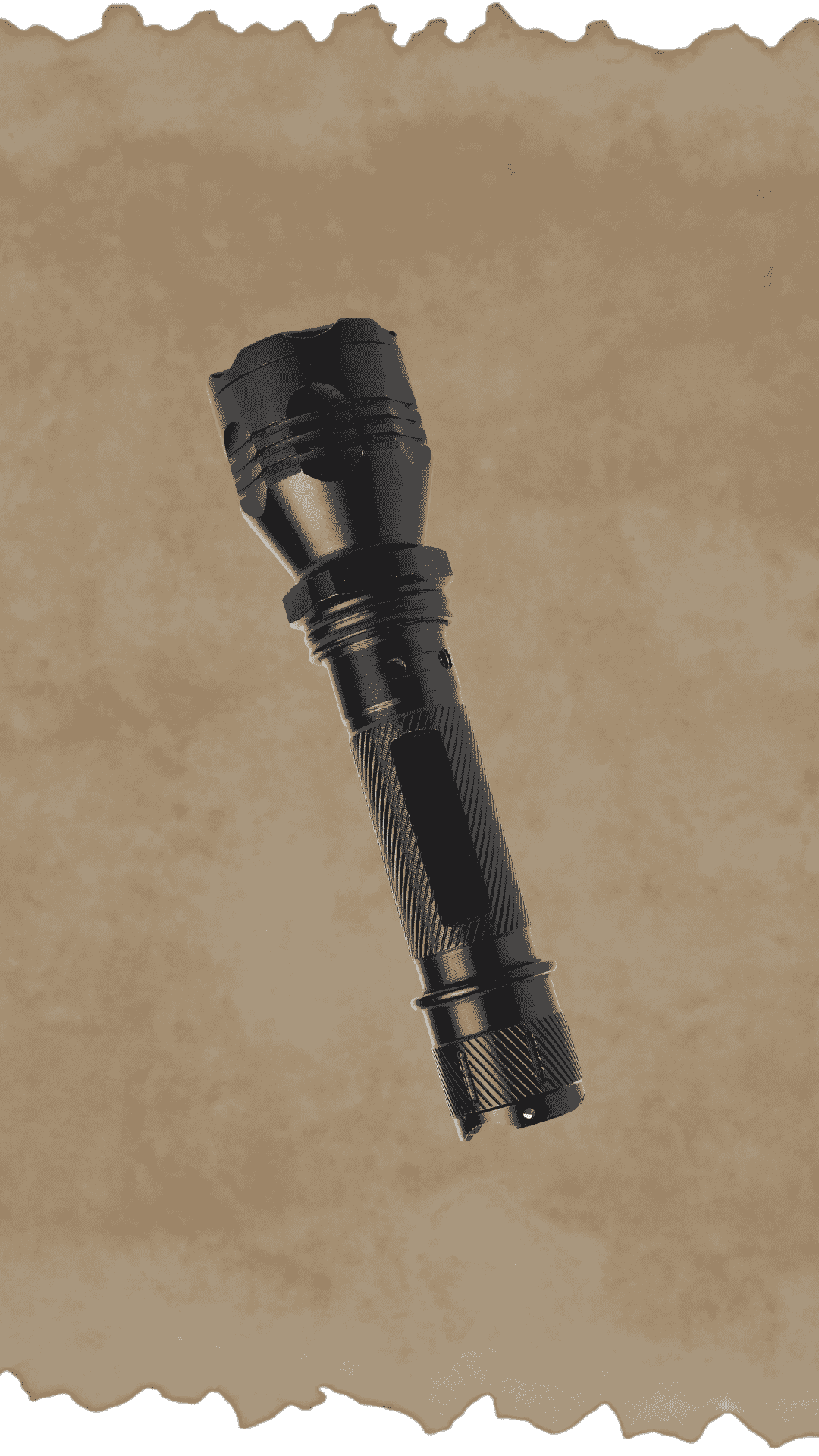

NVIDIA (NVDA): 🔦The Tactical Flashlight

Why: Put simply, it lights the way.

DeFi significance: For those betting on tech growth, NVDA stock is in high demand. Similarly to how a flashlight may be useful whilst exploring unchartered terrains (for as long as your batteries hold out, that is), NVDA stock’s higher volatility may just play to your favor within liquidity pools or yield farms.

Quick stats:

- Volatility Score: Moderate to High

- Market Cap: $3.763 Trillion USD

- Average Daily Trading Volume: Around 240 million shares

- On-Chain Liquidity: High (significant presence ion DeFi platforms)

- Sector: Technology

Meta (META): 🔥The Molotov Cocktail

Why: It’s an (explosive) game-changer.

DeFi significance: Playing fast it and loose with investments isn’t always the best bet, but a little explosive action at the right time can really turn things around. The rise and fall of META stock is subject to public opinion, the invention of new technologies, global trends, regulatory changes, and more. However, this volatility can be great for momentum trading, farming and hedging.

Quick stats:

- Volatility Score: Moderate

- Market Cap: About 1.6 Trillion USD

- Average Daily Trading Volume: n/a

- On-Chain Liquidity: Moderate (growing interest for new formats)

- Sector: Technology

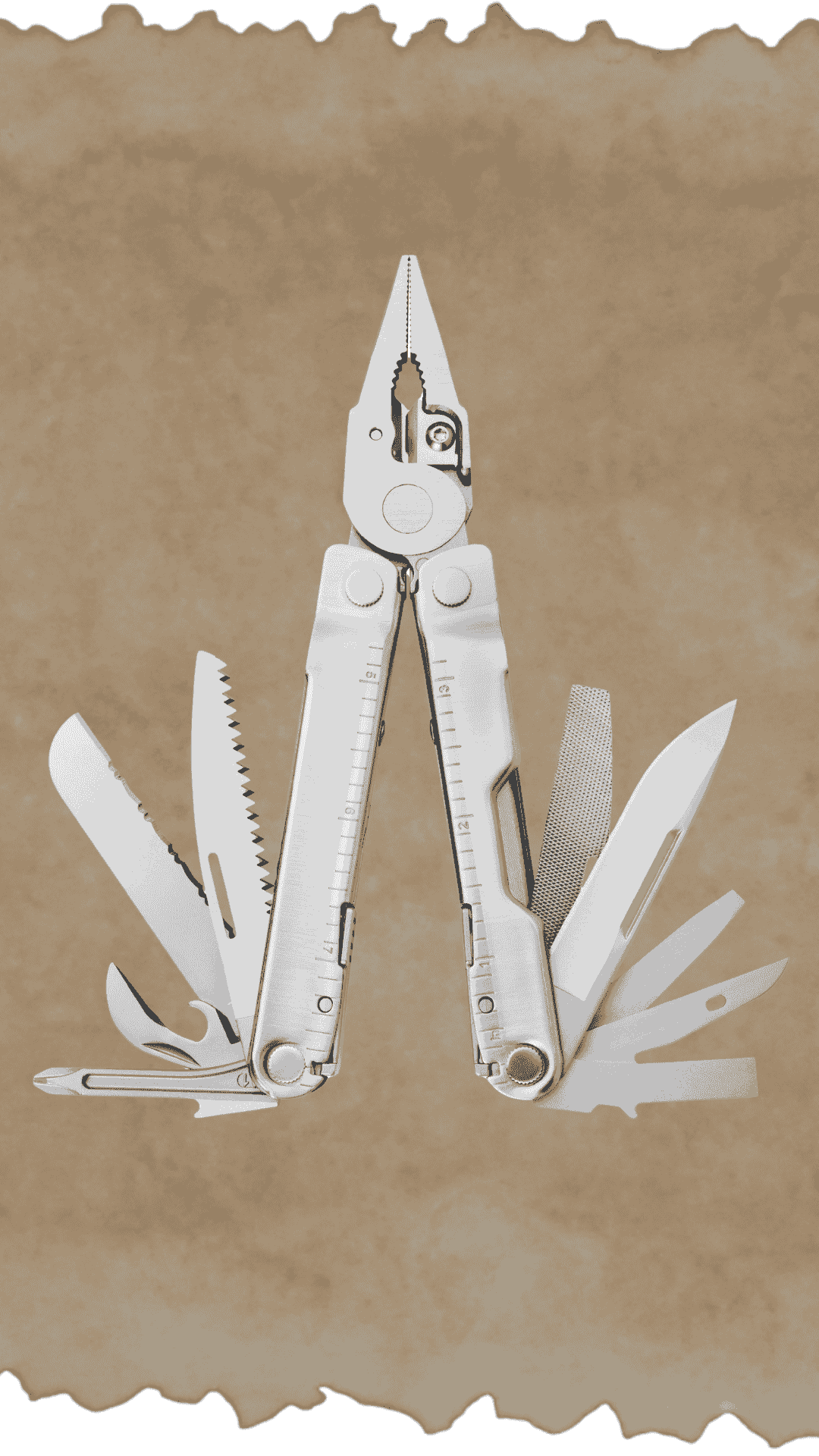

Microsoft (MSFT): 🛠️The Multi-Tool

Why: It covers (almost) anything.

DeFi significance: Every good survival pack needs an all-rounder tool that can be used in various different situations. MSFT stock is like a one-stop shop in a single token. Since the company has a hand in everything, from the cloud to cybersecurity dealings, this type of xStock acts as anchor within a very diversified portfolio.

Quick stats:

- Volatility Score: Low to Moderate

- Market Cap: $3.648 Trillion USD

- Average Daily Trading Volume: n/a

- On-Chain Liquidity: High (widely used in tokenized equity markets)

- Sector: Technology

At the Loading Screen - What's In Your Loadout?

xStocks can be an invaluable tool in fighting for your ideal financial future. And in the wilderness of 24/7 markets and crypto-native finance, the right tools make all the difference.

Like Joel’s backpack — rugged, modular, and always within reach — carefully selected xStocks can give you exactly what you need, when you need it, to keep moving forward. What will you be stuffing your portfolio with? And which Clickers are you fighting off along the way?