How Cryptocurrency Exchanges Actually Work – A Simple Guide

Maybe this is your first time setting up an account, or perhaps you have set up an account before, but you need some advice. Either way, our first tip: You have to use one of the best cryptocurrency exchanges in the industry to keep your assets secure.

So, what is a crypto exchange? Briefly, it’s a platform that exists to make it easy for users to buy and trade crypto, similar to how a stock exchange works for shares, but with digital assets.

Through a crypto exchange platform, you’ll be able to convert fiat currency (like USD or EUR) into digital assets, and vice versa. Each platform offers different functionalities, fees, and features, so it all depends on the particular exchange you choose. For example, Kraken and Gemini focus mostly on crypto, while others, like eToro, also offer non-fungible tokens (NFTs).

Kraken, conveniently allows you to transfer assets directly to another exchange, like Binance, for example. It’s really up to what you would like to achieve and what would best suit your needs. Just make sure you select a safe cryptocurrency exchange, to avoid any negative experiences.

Choosing the Perfect Platform Before Setting Up Your Crypto Exchange Account

Picking the right platform is arguably just as important as who you bank with. In both cases, you need to know your assets are protected and secure at all times. You want the platform to have decent features, be reliable, and have a great user experience. Oh, and a solid reputation matters too, so do your checks beforehand.

Here are our top five cryptocurrency exchanges that offer you all of the above, and more:

Coinbase: Our top pick for beginners.

If you’re starting out, then this one is for you. Coinbase has an incredibly easy-to-use interface and it offers top notch security. You’ll also find a wide range of assets supported on the platform, have a look at our Coinbase exchange review for a more in-depth analysis.

Uphold: Incredibly user-friendly

In terms of making things substantially simple for users, our top pick would definitely be Uphold. It has an all-in-one user interface, the fee structure is easy to understand, and it’s a great choice if you’re not a highly experienced trader. If this sounds appealing to you, checkout our full Uphold exchange review, and see how this platform can elevate your portfolio.

KuCoin: Impressive features and quick sign-up process

This exchange offers a large variety of tokens, simplicity and relatively low fees. In our KuCoin exchange review, we unpack how it boats a wide array of innovative features, and a high tech platform. It’s secure and has a built-in wallet that lets you store and manage your crypto directly on the platform—no extra setup needed.

eToro: Best choice for social trading.

We’ll be honest here- this exchange has come a long way since it launching in 2015. We’re talking tech-forward, multiple assets, and an advanced trading platform that offers stellar new features. But, that’s for the veterans, so let’s not get ahead of ourselves. As a moderate trader, look into all the benefits of the standard platform in our eToro exchange review.

💡Tip: Take advantage of their copy-trading feature, so you can copy winning moves from big traders and maximize your potential.

Gemini: Best for innovation and security

With Gemini, you can stake popular coins directly on the platform and you can earn crypto with every purchase using the Gemini Mastercard crypto credit card. If you’re a beginner, this platform won’t be a hassle for you. If you’re quite experienced, you should probably go for the ActiveTrader platform.

Your Step-by-Step Guide for Setting Up a Crypto Exchange Account

Now that you have all the information, it’s time to setup your account. Don’t worry, it’s not a daunting task; it’s fairly easy. Here’s a step-by-step guide that applies to most exchanges:

1. Choose Your Exchange:

Start with one of the best ones—when it comes to the crypto market, rather be safe than sorry. Research extensively before you sign up. Look at the security features, fees, and which assets are supported to trade.

Furthermore, look at other users’ experiences. What did they like best? What did they complain about? Also, if you prefer to trade on the go, some exchanges, like Coinbase, also offer a secure mobile phone app.

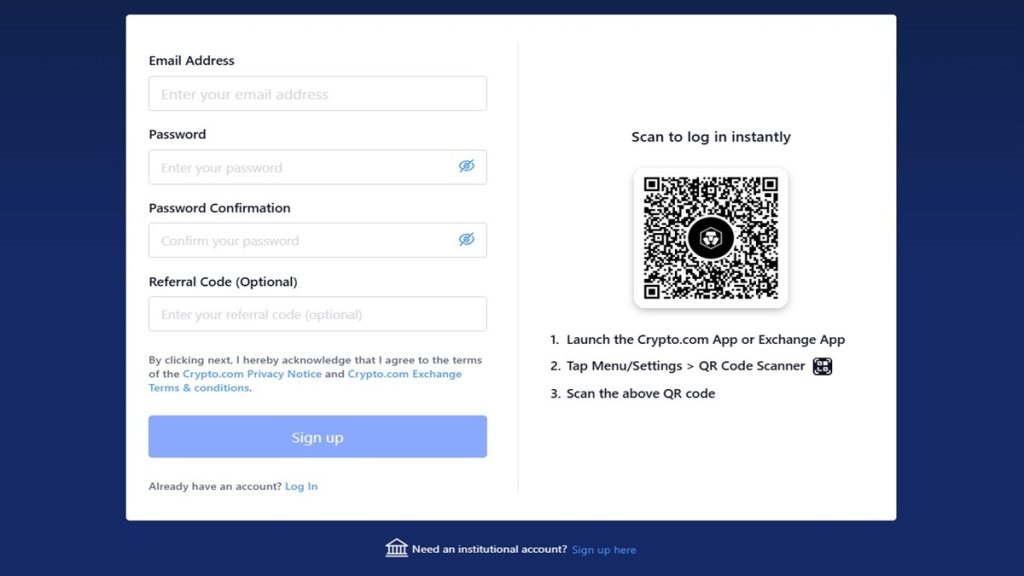

2. Sign Up with Your Email

Right! Now that you have chosen an exchange, it’s time to create your account. This usually involves providing your email address and creating a password. Make sure it’s strong and unique. While it’s easier to use the same password on multiple platforms, it’s definitely not wise, hackers anticipate that. So, don’t reuse logins as an added security measure.

Setting up a unique email address for your cryptocurrency exchange accounts can be beneficial and can prevent prying eyes from accessing your account.

3. Verify Your Identity:

The best (and safest) exchanges require you to verify your identity to unlock all the features of the exchange. This may be compulsory if you want to trade larger volumes of cryptocurrency.

Identity verification also ensures that the exchange complies with international laws and regulations. We’ll touch on that briefly later. The verification process can take anywhere from a few minutes to a few days.

4. Secure Your Account:

The top exchanges all offer tight security measures. One of the most common security measures is two-factor authentication (2FA). 2FA requires you to provide a second form of verification when you log in.

That might include verifying your login on your mobile or via email. Alternately, the exchange may have the option to use an authenticator app. Google Authenticator is a popular tool for verification.

Security features like 2FA are great for preventing anyone else from logging into your account without your knowledge.

5. Fund Your Account:

Once your account is set up and verified, you can begin funding it. You’ll need to deposit fiat currency before you can start buying crypto.

Most exchanges offer multiple ways of depositing money, including bank transfers, using a debit card, or PayPal. You can also deposit your digital assets.

6. Start Trading or Buying Crypto:

Now for the part you’ve been waiting for. With your account funded, you’re ready to start trading or buying crypto. But before you start your journey, it’s best to familiarize yourself with the exchange, the interface, features, and functionalities. If this is your first time, look for an exchange that is relatively easy to navigate.

A quick checklist:

✔️ A valid email address

✔️ A strong, unique password

✔️ Your government-issued ID for Know Your Customer (KYC) verification

✔️ A two-factor authentication (2FA) app (e.g., Google Authenticator)

✔️ A bank account or credit/debit card for funding your account.

Why Know Your Customer (KYC) Laws Matter More Than Ever

To confirm the identity of their clients, financial institutions and other regulated organizations are required to implement Know Your Customer (KYC) procedures. This is part of the rules that are meant to enforce Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws.

Clients must submit documentation for these KYC processes, such as bank statements, government-issued identification, proof of address, and continuous due diligence.

KYC requirements are implemented by the majority of exchanges, such as Uphold, eToro, and Gemini. While there are no KYC requirements with KuCoin, users have limited trading options and low withdrawal limits without verification.

Top 5 Tips for Beginners: Set Up Your Crypto Account Today

Here are the things we wish someone had told us before we got started. These tips will make setting up your exchange easier and smoother.

1. Choose a crypto exchange with a good reputation

A cryptocurrency exchange’s safety reputation is crucial for traders who want to know if their money will be secure.

Online forums are a great place to see what other users have to say about the crypto exchange platforms. Many traders use online forums to discuss difficulties they’ve encountered. This could tell you about potential challenges users encounter on platforms and how exchanges helped their customers.

Remember, it pays to do a little research before committing to a platform.

2. Reliable customer support is a must

Customer support is another critical factor you must consider. Before joining an exchange, find out what customer service options they offer and decide if they will be good enough for you if you ever have a problem.

While some exchanges have specialized phone lines designed to help customers promptly, others may offer email ticketing and live chat support. Several exchanges have specialized support mechanisms in place for their premium users.

Knowing the type of customer support a crypto exchange offer can help you make an informed decision and choose the exchange that is best for you.

3. Why Safety Should Never Be Your Last Priority

Security is a top priority when it comes to trading digital assets. Even though numerous security measures have been implemented by exchanges to provide their users with peace of mind, traders can still take precautions.

For the safest online experience, we recommend using a secure internet connection and a solid VPN, as public Wi-Fi connections can have hidden viruses and hacking tools.

Consider using one of the safest crypto wallets in the industry. It’s important not to think of a crypto wallet as a regular wallet, as you won’t be storing your Bitcoin or Ethereum in it. Rather, you’ll be storing your public key and your password that provide you with access to the platform where you are trading your digital assets.

Hot wallets are always online, allowing you to easily access your security key from a website or your phone. This is a very convenient way to manage your crypto.

Cold wallets keep your security keys completely offline on a physical device, like a special USB. Since you only plug it in to make a trade, it’s a very safe option because your device—and your keys—are always in your control.

Reading reviews is a smart idea, as they will inform you whether an exchange experienced any security breaches and how they handled them.

4. Start small and build your winning portfolio

If you are new to trading, it is best to start with small trade amounts. This will help to minimize errors and enable you to progressively raise the value of your traders as you gain confidence.

Some platforms offer demo trading accounts, which allow users to practice their trades without risking any money. Many users use these demo accounts to get to know the exchange, practice using the tools, and get better at trading on the platform.

5. Set a Budget for Crypto Trading and stick to it

There is a risk associated with trading; it is imperative to avoid taking significant risks and placing all of one’s eggs in a single basket.

It’s advisable to set a budget for your investments and stick to it. Seeing a token rally on an exchange may tempt you to break your budget, but don’t. Great traders know to take precautions and stick to their budget.

Next Steps After Creating Your Crypto Exchange Account

Once your account’s set up, you can really get the most out of your exchange. Here’s what you can do next.

- Buy Bitcoin or Other Tokens: You’ll be able to buy tokens using your account, like Bitcoin or Ethereum. Make sure you’re familiar with the buying process, though, before you make any purchases.

- Invest in a Wallet: Consider investing in a good-quality wallet. It allows you to store your crypto securely rather than keeping it on the exchange. Hardware wallets are the most secure because they keep your private keys offline. If you’re a beginner, have a look at our guide on how to set up a crypto wallet easily – the Ledger Nano X Wallet is a good choice for people who don’t have a lot of experience.

- Set Up Alerts: Most exchanges allow you to set up alerts. They’ll notify you of changes in market trends and token prices.

- Join Rewards Programs: Your exchange may offer reward programs for active traders. Take advantage. You can earn some great additional benefits.

- Track Your Performance: Use the tools provided by the exchange to track your trading performance. Analyze your trades and make informed decisions.

Our Final Thoughts

Setting up an account on a crypto exchange can be easy and straightforward. However, you must take your time and consider all the options before deciding on a trading platform.

Novice traders should look at the user-friendliness of a platform, while more experienced traders should consider a platform’s advanced tools and features to get the most out of their trades.

It’s essential to trade responsibly. This includes sticking to your budget, managing risk, prioritizing security, and avoiding emotional trading. Slow and steady are two of the most critical things you can do to make the most out of your trading, now and in the future.

FAQs

Set-up times vary depending on the exchange and the verification process. Typically, it can take anywhere from just minutes to a few days. Initial registration is usually quick, but the KYC verification process can take a bit longer.

Yes, you can. Having accounts on more than one exchange can allow you to take advantage of the different features offered on each. It’s also great if you want to diversify your investments.

After setting up your account, you can fund it by depositing fiat currency (e.g., USD, EUR) or transferring cryptocurrency from another wallet. Most exchanges offer multiple funding options, including bank transfers, credit/debit cards, and PayPal.

The short answer? No. Do we recommend using an exchange that doesn’t need verification? It’s risky. Perhaps too much so. Verification can mean a little less anonymity. That said, it’s also the safest way to go.