- >Best Crypto Exchanges

- >Waves Review

Waves Review 2026: Features, Fees, Security & Verdict

Waves Exchange at a Glance

A decentralized exchange built on the Waves blockchain.

Pros

Low trading fees

Decentralized, non-custodial platform

Staking and liquidity pool options

Multi-platform support, including web, desktop, and mobile apps

Cons

Limited asset selection

Poor user ratings

Very low liquidity

Higher learning curve

Highlights

WX Network is a decentralized exchange without publicly disclosed regulatory licenses or oversight from financial authorities. The platform offers several ways to earn passive income, including WAVES staking, liquidity pool staking for major assets like BTC, ETH, USDT, and USDC, and governance participation through WX tokens that give users voting power on platform decisions.

While they currently support 11 major cryptocurrencies with active trading pairs, the underlying Waves blockchain hosts over 30,000 custom tokens created by users. Serious issues emerged in 2022-2023, with people reporting blocked withdrawals, forced conversion of assets to worthless gateway tokens, and inadequate customer support when problems arose. These red flags warrant careful consideration before depositing funds on the platform.

Fees & Costs

WX Network employs a mixed fee model: a predictable low flat fee for spot trades contrasts sharply with the unpredictable costs arising from low liquidity, variable withdrawal charges, and smart contract fees.

Spot trading fees

The platform charges a flat fee of 0.01 WAVES per transaction for all trades. Costs are predictable regardless of trade size or volume. This fee can be paid in either WAVES or WX tokens.

Deposit & withdrawal fees

Currently WX Network does not charge fees for depositing tokens to accounts from external blockchains. Withdrawal fees are made up of the network transaction fee plus the gateway fee. Gateway fees can fluctuate without notice because they depend on the external network transaction fees, conditions and the current external network load.

Hidden costs & spreads

The average bid-ask spread across trading pairs is 1.24%. For transactions involving smart contracts, additional fees apply: the transaction fee increases by 0.004 WAVES for each script execution when tokens are sent from a smart account or when smart tokens are involved.

However, this increase does not apply to exchange transactions if the order originates from a smart account or if the matcher fee is paid in a smart token. The platform’s extremely low liquidity creates a serious concern for traders. With only $86,500 in 24-hour trading volume on WX Network, you’ll likely face unfavorable spreads and price slippage on larger transactions.

Security & Regulation

The platform is designed around non-custodial security. This ensures that users retain complete control over their private keys and funds, eliminating the risk of centralized exchange hacks.

Storage & custody

The platform is non-custodial. You maintain control of your private keys rather than depositing funds with the exchange. They do not hold user assets in centralized hot or cold wallets; instead, assets remain in users’ self-custodied wallets throughout the trading process.

They don’t offer any insurance policy protecting user funds against theft, hacking, loss, or exchange failure.

Account security

Users can access WX Network through multiple secure authentication methods, including seed phrases, Ledger hardware wallet integration, and email-based login. Critical account recovery issues have been reported.

People who lost 2FA devices reported that the platform refused to disable 2FA authentication, resulting in permanent loss of access to staked funds. Users have also reported disappearing funds from staked accounts without any 2FA confirmation emails or phone requests, suggesting potential internal security vulnerabilities. For this reason, we don’t include this provider on our list of secure cryptocurrency exchanges.

Digital wallet icons show mobile payment, digital wallet transfer, and online banking. Digital wallet supports secure payment, cashless transactions, and financial integration. Entice SSUCv3H4sIAAAAAAAACpySwW7DIAyG75P2DhHnRkpLErK9SrWDA6RBpRAB6TRVffcZSCp23S3+bP/2j/N4f6sqMoJXnHxWjxhhrLRefXAQlDWIm8PGnTRCupLcHe2bEoAqIylUsE6BLuEIgc8GbhKhWbWO+JmSxAcIq5c+7rIhDkFeUCPDl0Re+Jzjak+kJHZgipBDwfw6JrajLP6vzvzx9TJ8kYb/pIULI05qCdnIOZeS63eQ7lZag1UoW7i6Ww46FtBCCdQCDv70LU5xZS4FsWFOd9mVuF1NcHGrlxmirV1g1PHVJxwjdz6D91gudl7M5vgX2Fsxx9iQPG2qROBxYnikbXNi3Yl2Q98P7dCxrSAfdFaok9bZhTDmVyVKVypuQI4jZ4y1U03pB9QtbaZ6ELKvoZum09hxYMDwFs9fAAAA//8DAAloulW5AgAA

Audits & compliance

The exchange doesn’t provide publicly disclosed proof of reserves, ISO certifications, or SOC audit reports. All platform features, including investment products, swaps, and voting mechanisms, are managed by smart contracts that users can audit independently.

Regulatory licenses

The platform doesn’t hold publicly disclosed regulatory licenses from financial authorities in any major jurisdiction.

Past incidents & mitigation

Gateway Shutdown (2023): The provider disconnected gateways in 2023, converting users’ BTC, ETH, USDC, and USDT into worthless gateway tokens that could not be withdrawn. Users reported value losses exceeding 90%, with USDC dropping to 15 cents after forced conversion.

Withdrawal Suspensions (2022-2023): Multiple users documented withdrawal delays ranging from weeks to over 2 months, with some withdrawals never arriving. The platform was accused of manually controlling withdrawals and blocking users from accessing funds.

Liquidity Crisis (2022): During market volatility following the FTX collapse, the exchange experienced severe liquidity issues, forcing users to pay significant premiums (up to $400) to convert assets for withdrawal.

Account Access Issues: Users have reported funds disappearing from accounts and an inability to log in, with customer support providing no assistance or claiming no transaction logs existed despite 2FA security being enabled.

The platform has not publicly disclosed comprehensive mitigation strategies or compensation programs for affected people.

Features & Tools

WX Network allows users to actively engage with DeFi through simple decentralized spot trading and competitive staking features for WAVES and liquidity pools.

Trading features

The platform provides decentralized spot trading for cryptocurrency pairs, primarily using WAVES as the base currency. The most active trading pairs include PWR/WAVES, WAVES/ROME, WAVES/XTN, and WX/WAVES.

They do not currently support margin trading, futures, or advanced derivative products. Low liquidity levels may result in significant slippage and unfavorable execution prices, particularly during periods of market stress.

Staking & earnings

WX Network offers staking for WAVES tokens (earning around 5% APY), liquidity pool staking for XTN, EAST, USDT, BTC, and ETH, and WX token staking for governance participation.

You can track earnings daily, weekly, and monthly with a complete payout history. However, during the 2023 gateway shutdown, liquidity pool participants had their stablecoins and major cryptocurrencies forcibly converted to gateway tokens, causing 90%+ losses.

Waves Pro & mobile app

There is no Pro or premium tier version. The standard exchange works across multiple platforms, including web browsers, desktop applications for Windows, macOS, and Linux, plus mobile apps for Android and iOS devices. The interface resembles traditional online banking for accessibility.

Institutional & API tools

API access is available for developers and advanced users, with comprehensive documentation for deposit, withdrawal, and trading operations. The API supports currency management, platform integration, and withdrawal address generation. No specific OTC (over-the-counter) services or dedicated institutional accounts are documented.

Supported Assets & Markets

The platform supports a boutique range of cryptocurrencies, fiat pairs, and emerging tokens

Cryptocurrencies & tokens

WX Network currently supports 11 coins with 24-26 active trading pairs. They provide access to major cryptocurrencies, including Ethereum (ETH), Bitcoin (wrapped as WBTC), BNB, and various tokens built on the Waves protocol, like Power Token (PWR), WX Network Token (WX), Unit0, Swop, and Puzzle Swap.

They also enable access to over 30,000 tokens available on the Waves protocol. Gateway support includes Bitcoin, Ethereum, XTN, NSBT, and Litecoin

Fiat pairs

This crypto-to-crypto exchange has limited direct fiat currency support. They do not feature traditional fiat trading pairs like USD/BTC or EUR/ETH. If you want to convert fiat to cryptocurrency, you need to use external on-ramps.

Geographic availability

As a decentralized exchange built on blockchain technology, the exchange is accessible globally without jurisdictional restrictions typical of centralized platforms.

Usability & User Experience

The platform brings cryptocurrency trading and management directly to your fingertips, whether you prefer a desktop, web browser, or mobile device.

Desktop & web interface

The web application has an interface designed to resemble online banking, making it easier for people familiar with conventional financial services. The lightweight application connects directly to Waves network nodes, enabling quick access and reduced system resource usage. Desktop versions for Windows, macOS, and Linux are available.

Mobile app experience

Mobile apps for iOS and Android let you create accounts in minutes using seed phrases, Ledger hardware wallets, or email login. The app includes all core functions of the exchange: sending and receiving tokens, trading, staking, and investing in liquidity pools.

You can access 24/7 support through in-app chat, though customer support quality has been heavily criticized in user reviews.

Learning curve

Because the interface looks like online banking, it is helpful for users familiar with traditional finance apps. The platform is, however, a decentralized exchange where you manage your own private keys and seed phrases. This can be challenging if you’re new to crypto.

Features like liquidity pool staking and governance voting require understanding DeFi basics. The gateway system and token conversions can be confusing, especially during withdrawal issues or liquidity problems.

Two diverse crypto traders brokers stock exchange market investors discussing trading charts research reports growth using pc computer looking at screen analyzing invest strategy, financial risks.

Customer support & resources

Support channels include 24/7 human support via in-app chat. Users who experience difficulties can create support tickets or engage with the community forum. The platform maintains comprehensive documentation covering staking, trading, deposits, withdrawals, and smart contract interactions.

Critical concerns: Trustpilot reviews and Reddit posts reveal dissatisfaction with customer support quality. Users report that support is unresponsive or unhelpful when addressing withdrawal blocks, account access issues, and fund recovery requests. Multiple users stated that support ignored inquiries or provided no resolution for serious problems.

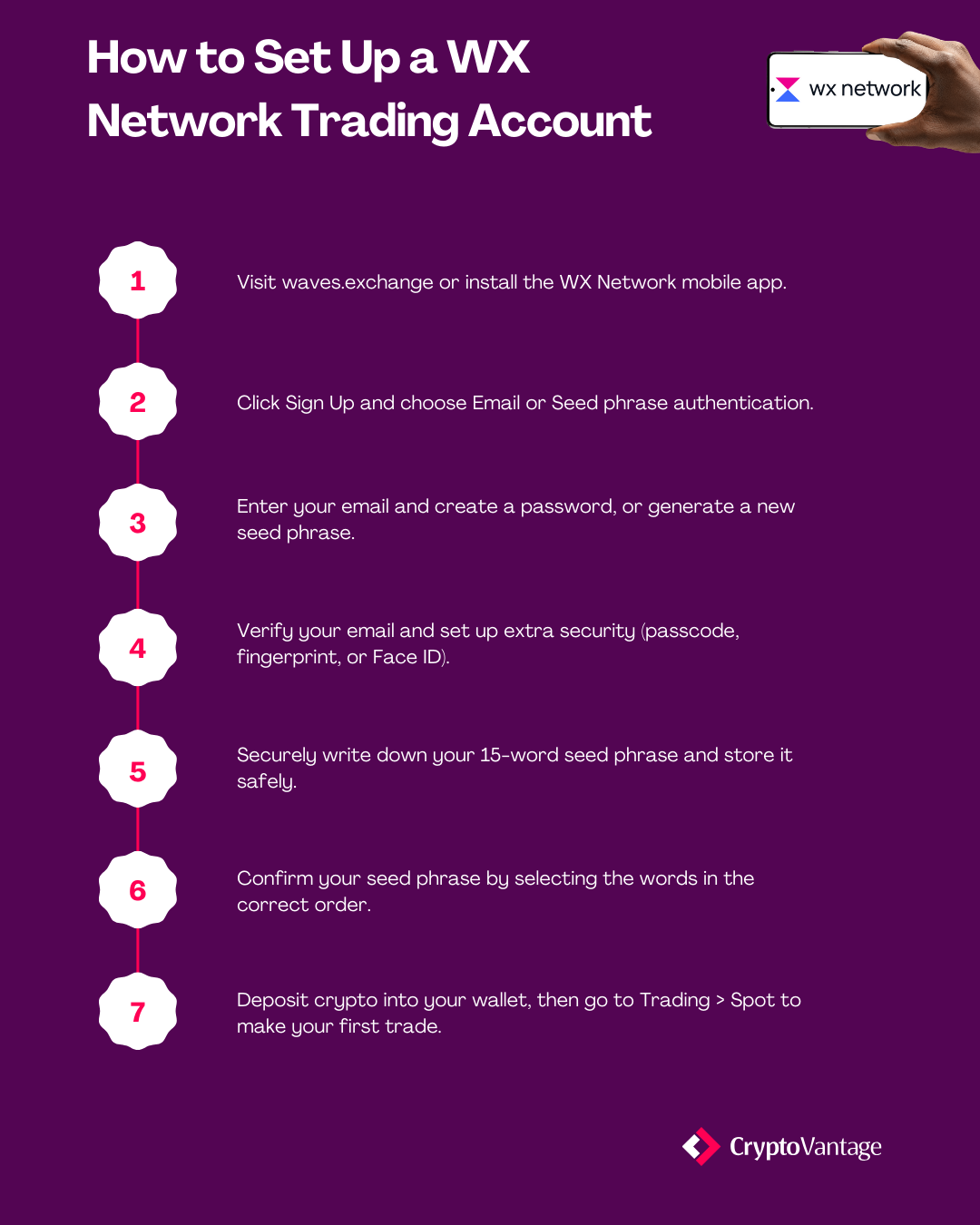

How to Set Up a WX Network Account

History & Background

WX Network originated as Waves DEX in 2017, built on the Waves blockchain platform which was founded by Russian physicist and entrepreneur Sasha Ivanov in 2016. The decentralized exchange launched as a simple token-swapping service within the broader Waves ecosystem.

Milestones & growth

The platform evolved over five years, expanding from basic token swaps to include liquidity pools, token creation tools, staking services, and investment features. In November 2022, the platform rebranded from Waves.Exchange to WX Network because the name “Exchange” no longer fits what it has become, a platform offering much more than trading.

Reputation & public events

The company faced severe credibility challenges during 2022-2023, coinciding with the FTX collapse and broader crypto market turmoil. Liquidity crises prevented withdrawals for certain assets, forcing conversions at significant premiums.

The 2023 gateway shutdown converted users’ BTC, ETH, USDC, and USDT holdings into worthless gateway tokens, causing losses exceeding 90% for some affected users. These events generated poor ratings on Trustpilot and widespread complaints across Reddit and social media.

Waves Alternatives

WX Network/Waves crypto exchange may not be the right fit for everyone, especially given its limited liquidity and documented user issues. For centralized alternatives, Kraken offers strong security and regulatory compliance, Binance provides the lowest fees and widest selection of cryptocurrencies, and Coinbase delivers the best beginner experience with FDIC-insured balances.

If you prefer decentralized trading, Uniswap and PancakeSwap offer similar non-custodial features with significantly better liquidity. Here’s a quick rundown of some of the best crypto exchanges to consider.

Exchange

Ideal For

Fees & Pricing

Security Features

Regulation

WX Network

DeFi-savvy self-custody

Flat WAVES order fee

Non-custodial smart contracts

No formal regulation

Security-focused compliant traders

Standard maker-taker rates

Cold-storage proof-reserves

Licensed globally

Low-fee high-variety traders

Discounted maker-taker pricing

SAFU fund, cold storage

Mixed jurisdiction licensing

Beginners seeking U.S. safety

Clear higher-tier fees

Insured cold-storage reserves

US-Regulated

Final Thoughts & Verdict

WX Network is definitely not for beginners or anyone who wants reliable customer support and regulatory protection. That said, it could appeal to experienced DeFi users who are comfortable with self-custody and willing to accept higher risks.

For users who value security, liquidity, and regulation, platforms like Kraken, Binance, or Coinbase are safer bets.

FAQs

Proceed with caution. The Waves crypto exchange platform experienced severe issues during 2022-2023, including blocked withdrawals, forced conversion of user assets to worthless gateway tokens, and 90%+ losses for some users. No insurance coverage or regulatory oversight exists.

Trading costs 0.01 WAVES per order (approximately $0.01-0.02), regardless of trade size. Internal transfers between WX Network accounts cost 0.001 WAVES. Deposit fees are zero, while withdrawal fees vary by cryptocurrency.

As a decentralized exchange, they do not require KYC (Know Your Customer) verification for basic trading and account creation. Users can create accounts using email or seed phrases without identity verification.

Yes. WX Network offers staking, liquidity pool staking for XTN, EAST, USDT, BTC, and ETH, and WX token staking for governance participation.

WX Network has significantly lower trading volume, fewer supported assets (11 coins vs 350+ on Binance), no insurance coverage, and documented withdrawal issues. They also don’t have the best crypto tools compared to some providers. Kraken, Binance, and Coinbase offer better liquidity, security, and regulatory protection.