- >Best Crypto Credit Cards

- >Wirex Card Review 2025

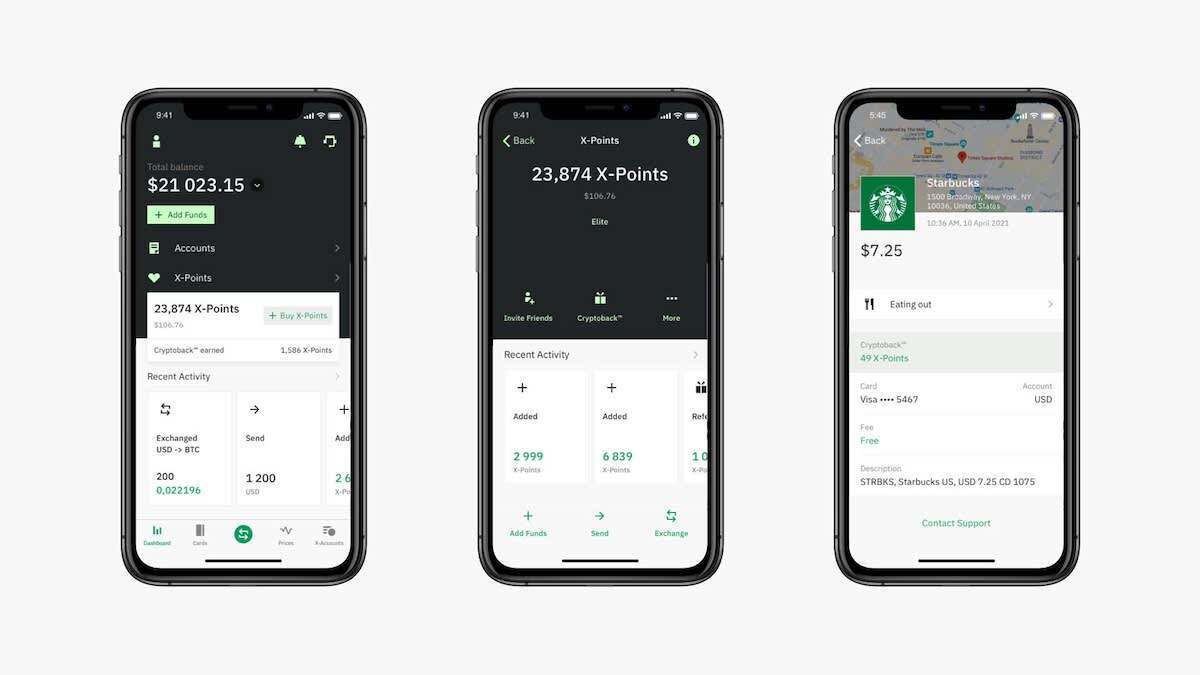

- You can earn up to 8% back in X-Points

- One of the oldest crypto Visa cards available

- 37 different cryptocurrencies in one app

- Usable wherever Visa is accepted

Pros & Cons

Pros

Earn up to 8% cashback rewards for all in-store purchases

Instant top-ups if you link your debit/credit card

Crypto funds held in cold storage using multisignature addresses

Commission-free trading and zero ATM fees (up to $200)

No annual fee

Cons

Less perks than some of the competing crypto credit cards

The card varies in different countries

You must convert X-Points to receive cryptocurrencies

High fees for exchanging between crypto and fiat

What is the Wirex Card?

The Wirex Card is part of the greater Wirex application, which is targeted to people who often find themselves in different parts of the world and needing to access a variety of different currencies.

Users are able to exchange currencies within the Wirex app, and they can move funds to their card account when they want to be able to access those funds through the Wirex Visa card. This crypto debit card comes with a cashback rewards program that can reach as high as 8%; however, the rewards are paid out in Wirex’s proprietary X-Points token, which must be converted to crypto.

What Are the Benefits of the Wirex Visa Card?

The biggest benefit available to Wirex Card users is the potential for 8% cryptoback rewards. However, these rewards are handed out in the form of X-Points.

If you’re looking to earn actual cryptocurrency than you’ll have to convert your X-Points into cryptos like Bitcoin or Ethereum. You can also take advantage of Wirex’s recently updated “X-Tras” rewards program by amassing X-Points.

Wirex also has plans to launch sDeFi-powered interest-earning accounts in the near future, which will be branded as X-Accounts. The company offers a wide selection of different cryptocurrencies, which is a nice change from certain cards like BlockFi Visa, which only offers Bitcoin rewards.

Potential Wirex Visa Card Dealbreakers

One of the downsides of the Wirex Card is that users receive X-Points instead of cryptocurrency, which adds an extra step for actually getting crypto.

Another downside of the Wirex Card is that the rewards program doesn’t currently offer near as many perks as the Crypto.com Visa Card or the Swipe Visa Card. The CRO card, in particular, offers perks like free Netflix and Spotify if you hold enough of the proprietary Cronos token.

Finally Wirex is a massive globe-spanning company with different products in different jurisdictions. You might want to check what’s available in your region.

Is Wirex Card Safe?

Yes. The Wirex Card is issued by Sutton Bank with two-factor authentication (2FA) and instant lock functionality.

The company also offers a secure wallet in the form of the Wirex Wallet and X-Account.

What Are Wirex Card Fees?

Wirex offers a few different levels of memberships but fees are minor on all of them.

Here’s a look at the fees (or lack thereof) on Wirex:

- $0 annual fees

- Commission-free trading

- Unlimited cryptocurrency external withdrawals

- Free ATM withdrawals up to $200 (2% after)

- No account fee

- 1% fee on crypto top-ups

Is the Wirex Visa Card Right for Me?

It’s hard to say for sure as no card is perfect for everyone.

The Wirex Visa card has a relatively simple rewards structure where you can earn up to 8% back in crypto rewards. Converting from X-Points is annoying but you do get to choose between 37 different cryptocurrencies, which is a very nice selection. There are no annual fees and even ATM fees are covered up to $200 a month. It also offers instant top-ups for a relatively seamless experience.

Wirex Frequently Asked Questions

The issuer of the Wirex Visa card is Sutton Bank, Ohio. Wirex Limited itself is regulated in the United Kingdom.

The fees for using the Wirex Visa card differ from region to region. There are three fee structure for Europe, Asia, and the rest of the world.

In Europe, there is a monthly card maintenance fee of 1 GBP or 1.20 EUR per month. In terms of making a deposit to the card, there is a 1% fee for digital currency deposits and fiat currency deposits are free. If the user wants to make a withdrawal via SWIFT, then there is a $15 charge. The fees for trades between fiat and crypto currencies is based on the OTC rate plus a commission taken by Wirex. This usually averages out to around 1.5%, which is a common rate for this kind of transfer. There is a 2.25 EUR fee for using an ATM to make a cash withdrawal in Europe, and this fee rises to $2.75 internationally. There is also a 3% fee on card payments that require a currency conversion.

In Asia, there tend to be lower fees. There is no monthly card maintenance fee and ATM fees are waived up to the first 400 SGD. After that, the ATM withdrawal fee rises to 2% of the transaction.

Similar fee structures for Wirex are found in the rest of the world; however, the Wirex Visa card is not available in these locations.

The Wirex Visa Card is available in all 50 US states.

There are no limits on the amount of currency that can be held in the Wirex app or exchanged on the platform. In fact, there aren’t any limits on how large a digital currency-based deposit can be, but users should be aware that there is a daily $50,000 limit on digital currency withdrawals.

Most fiat currency-based deposit methods come with a $50,000 per transaction and $500,000 daily limit. Up to $5,000 can be added to a Wirex Visa card user’s card balance per day, and there are no limits on ATM usage or card spending.

X-Points are Wirex’s own proprietary token that can be used to purchase cryptocurrency like Bitcoin or Ethereum.