- >Best Crypto Tax Software

- >TaxBit Review

TaxBit Review in 2025: A Comprehensive Overview

TaxBit Overview

- Free crypto tax software for individuals

- Useful for consumers and institutions alike

- A one-stop shop for cryptocurrency accounting

- Very reputable company with backing from the biggest names in crypto

Pros

Free for individuals (includes unlimited transactions)

Works for both consumers and enterprises

Supports exporting to TurboTax or preferred tax software

Used by regulatory agencies

Designed by CPAs and tax attorneys

Cons

Still a few exchanges that aren’t supported

No mobile app availability

Currently only works with the IRS in the United States

How Does TaxBit Work?

TaxBit launched in early 2021 with a fair bit of media attention because the company raised $100 million from some of the biggest names in crypto investment space.

The company made a bit of a splash in the media in early 2021 due to the announcement that they had raised $100 million from some of the biggest names in the crypto investment space.

The connections made with the likes of Coinbase Ventures and Winklevoss Capital helped TaxBit quickly become the defacto solution for enterprises that need to help their customers with their 1099 forms every year.

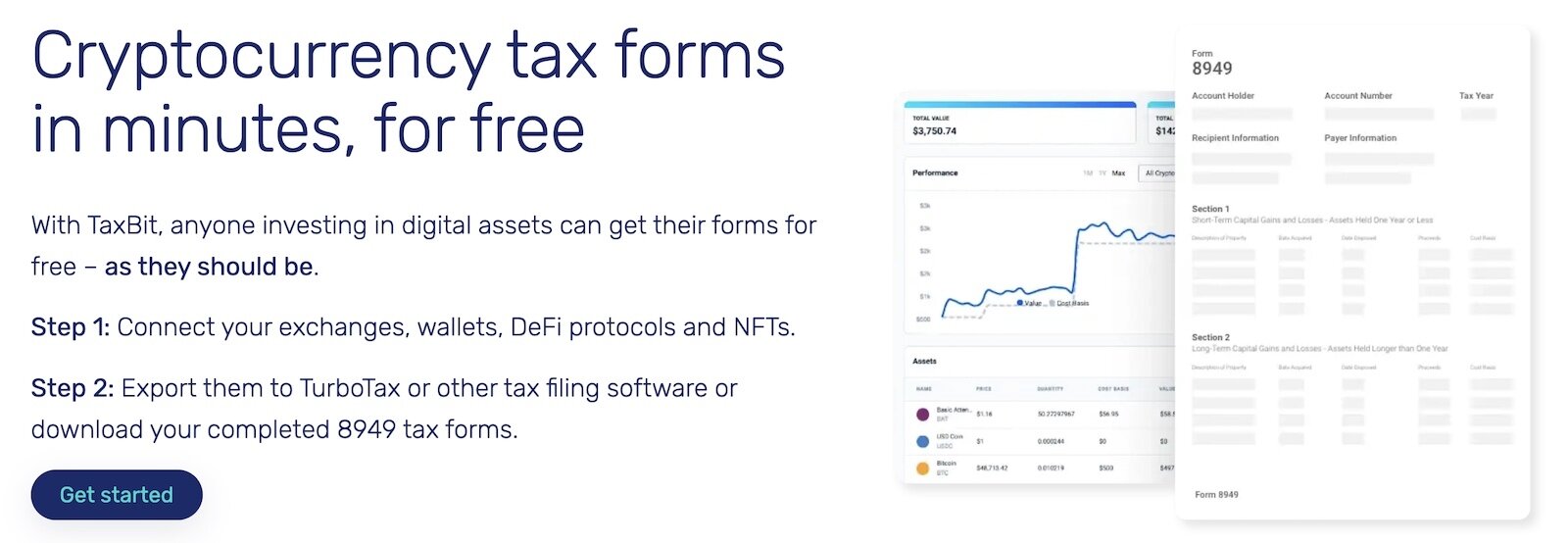

TaxBit is heavily focused on providing high-end solutions to enterprise clients but the company also offers a surprisingly robust option for individuals that’s 100% free.

TaxBit’s plan is to get anyone who needs to do their crypto taxes every year onto the platform, and they’ve even been able to help out regulatory agencies who are still learning how to navigate this new world of blockchain technologies.

Best Features of TaxBit

The best feature of TaxBit does not really have anything to do with the actual software at all. It’s more about the level of trust that users can put into the TaxBit system as a whole. TaxBit is built to be the most trusted crypto tax software on the market, and that goal is underpinned by the entities that have backed this project with their own money. Paradigm, PayPal, Coinbase Ventures, and Winklevoss Capital are some of the most prestigious names in the cryptocurrency investment space, and they’re all backers of the TaxBit crypto tax app. This sort of backing from well-respected investors in the crypto ecosystem makes TaxBit perhaps the most credible solution to the growing problem of how crypto will be taxed around the world.

Another key feature of TaxBit is the 360-degree view taken by the company in terms of who should use the platform. It doesn’t matter if you’re the average person on the street who just needs to figure out how much money they owe in taxes for a single bitcoin purchase or you’re a regulator trying to grasp the basics of crypto taxation, TaxBit has you covered in both cases. Additionally, the plan is for TaxBit to be the default option for enterprises who need to help their customers correctly file their crypto taxes every year. At the end of the day, TaxBit wants to become the trusted institution for all aspects of crypto taxation, sort of like the TurboTax for crypto.

Finally, a great feature of TaxBit is that they offer their service for free to individuals so that people can easily sign-up for an account and see what they might owe.

Is TaxBit Good for Beginners?

TaxBit’s overall goal is to be a crypto tax solution for any company or individual involved in the cryptocurrency ecosystem, and that definitely includes beginners who may be learning about crypto taxation for the first time.

The user interface for TaxBit is extremely intuitive, and the layout is designed in a way where an individual can see their entire portfolio and zoom in on specific transactions to get more details whenever necessary. This platform is also integrated into a number of different cryptocurrency exchanges, so some people may be beneficiaries of this product whenever they receive a 1099 form from a third party service in the crypto industry.

Did we mention that it’s free?

What’s the Sign-Up Process?

The best way to get started with TaxBit is to go to the official homepage and look for the “Join” button in the top-right corner of the page.

There are also various buttons you can click for starting a free trial offer on various TaxBit web pages. Once you’re on the sign-up page, you will be presented with a form to fill out that requests some basic information about you such as your postal code and estimated income.

This first part of the sign-up process is used to figure out the specific tax rates that can be applied to your capital gains accrued during the previous tax year. Once your tax rates are calculated based on your location and income, you will then be asked to connect all of your exchange accounts to the TaxBit platform.

This will automatically import all of your trades from these exchanges and calculate your gains and losses. Once this information has been complied and synced, you can then load all of your data in the TaxBit interface and get a high-level view of your crypto tax situation.

How Much is TaxBit?

Pricing works a little differently on TaxBit than any other crypto tax software.

While most crypto tax software offer a number of tiers for their clients (such as $50 for basic, which only includes 250 transactions), TaxBit made the decision to offer their software for free to individuals in 2023.

That’s right, TaxBit is 100% free for individuals and it offers unlimited transactions too.

There’s a good chance that TaxBit made that decision in order to focus on their enterprise business but it’s an amazing boon for individual crypto investors and makes it one of the easiest recommendations in the business.

If you’re a prospective enterprise client you’ll have to contact TaxBit for their pricing plans.

What Countries are Supported?

According to an FAQ on the TaxBit website, the crypto tax reporting platform currently only works for individuals who are reporting to the United States’s Internal Revenue Service (IRS).

That said, the company is also working on increasing the number of countries of supported as quickly as possible to more than 100 different jurisdictions around the world.

Additionally, you can contact TaxBit at support@taxbit.com if you would like to be notified when their crypto tax service becomes available in your country of residence.

What Exchanges are Supported?

TaxBit supports a wide range of popular crypto exchanges to help users automatically import and track their transactions for tax reporting. Some of the most popular exchanges supported by TaxBit include:

The company also supports a wide range of wallets and DeFi products (in total TaxBit supports over 500 different entities). Some of the popular non-exchange products it supports include:

- Exodus

- BitGo

- BitPay

- MyEtherWallet

- Phantom

- Trust Wallet

- Trezor Wallet

Potential Dealbreakers

The biggest issue with TaxBit is that it’s currently focused exclusively on the US market. It’s a shame because it’s a powerful product for individuals at a price that can’t be beat.

We’re hoping the company adds more regions in the near future.

In addition its missing some of the integrations and features that you’ll find on some of its competitors, but you’ll have to pay heavily for those features so there’s something to be said for TaxBit’s streamlined approach.

Finally potential issue with TaxBit for some users is the fact that there is no mobile app available for this platform. While those with a lot of trading data to go through will probably have no issue with sitting down at their laptop for a few minutes to look over everything before sending their reports to the tax authorities, the reality is some people still enjoy the convenience of using an app on their phone rather than visiting a website in a browser on their desktop computer,

CoinLedger (formerly CryptoTrader.Tax): A Worthy Alternative

If you’re exploring alternatives to TaxBit, CoinLedger (previously known as CryptoTrader.Tax) is a strong contender. Designed for ease of use, CoinLedger guides users through a simple, step-by-step process to generate accurate crypto tax reports. It supports a wide range of exchanges and wallets, making it easy to import transactions automatically. CoinLedger also integrates with platforms like TurboTax and offers tools for tax-loss harvesting. With its user-friendly interface and robust features, it’s an excellent option for individuals looking for a reliable and straightforward crypto tax solution.

- Free version available

- 100% Money-back guarantee

- Integrated with TurboTax for added simplicity

- Tools to automate connections to exchanges

FAQs

Yes, TaxBit is fully IRS-compliant. It generates tax forms like Form 8949 and supports 1099 reporting. The platform is even used by government agencies, ensuring it meets the highest regulatory standards.

Yes, TaxBit offers a free plan for individual users that includes unlimited transactions, which is especially appealing compared to competitors with caps on free usage.

Yes, TaxBit supports DeFi and NFT tracking by connecting to wallets like MetaMask and platforms such as Uniswap, Aave, and OpenSea.

TaxBit generates key crypto tax documents, including Form 8949, Schedule D, and 1099s. These forms can be used directly for filing or integrated with platforms like TurboTax.