- >Best Crypto Exchanges

- >eToro Exchange Review

eToro Exchange Review 2026: Is This the Best Trading Platform for You?

eToro at a Glance

Social trading platform where you can trade crypto alongside stocks and assets.

Pros

Diverse range of assets

User-friendly interface

Fee-free stock and ETF trading

Social trading allows tracking of other users’ trades

Trusted market option

Cons

Hidden fees

Limited options for US traders

Inactivity fees

Not available in all US states

Supported Cryptocurrencies

130+ cryptocurrencies supported

FIAT Currencies

USD, GBP, EUR, and AUD

Trading Volume and Liquidity

$20.8 billion as of Q3 2025

Number of users

40 million registered users

Customer support

24/7 chatbot, live chat support

Fees

Flat crypto trading fee

Highlights

eToro is a user-friendly, multi-asset trading platform with a strong social investing community that attracts over 40 million users worldwide.

Users can trade stocks, ETFs, cryptocurrencies, and commodities, all of which they manage within a single portfolio.

The platform’s unique features, CopyTrader and Smart Portfolios, allow users to follow or replicate successful investors and invest in pre-grouped asset classes. Additionally, eToro offers advanced analysis tools, educational resources, and a free demo account for practice.

The platform prioritizes user safety by ensuring strict regulatory compliance under the oversight of CySEC, the FCA, and ASIC. eToro holds clients’ funds in segregated accounts at top-tier banks and employs advanced security measures to protect data and funds.

Experienced traders can use eToroX. This separate, professional-grade platform provides access to advanced order types and a tiered maker/taker fee model.

Fees & Costs

eToro has a straightforward fee structure, but traders must know exactly what they will be chard as these fees ultimately impact their bottom lines.

Instant buy/sell fees

The standard platform uses a simple, flat fee of 1% each way, ideal for beginners who want pricing clarity.

Stock and ETF trades are commission-free in most regions, but spreads and overnight fees apply to leveraged and CFD positions.

eToroX users enjoy a volume-based maker/taker fee model, which offers lower fees to high-volume traders.

Deposit & withdrawal fees

No fees are charged when clients deposit funds onto the platform. However, users are required to pay a conversion fee when depositing non-USD currency.

Withdrawing funds costs a flat $5, and non-USD deposits or withdrawals incur a currency conversion fee of around 0.5%.

Margin/futures fees

Leveraged CFD positions on the platform incur a variable spread (the difference between the buy and sell price) as the primary transaction cost. A rollover fee (also known as an overnight fee) is then applied daily for any position held open overnight.

eToroX handles futures trading using a separate Maker/Taker fee model. This includes volume rebates designed for institutional clients and high-volume traders.

Hidden costs & spreads

The platform is transparent with its fees. However, there are costs users should consider when using (and not using) their exchange accounts.

Spreads on the platform vary and fees can be higher on less liquid assets. The variable interest charged on leveraged CFD positions can impact user profits, while the impact of the flat withdrawal fee can be avoided by withdrawing funds less frequently.

There is an $10 a month inactivity fee charged when users don’t log into their accounts for more than 12 months. This monthly fee will be deducted until the user logs into their account or their account balance reaches zero.

Security & Regulation

The platform prioritizes user safety through strict regulatory compliance, advanced security measures, and industry best practices. All these factors contribute to their goal of being one of the safest cryptocurrency exchanges.

Storage & custody

Clients’ cryptocurrency is stored offline in secure cold wallets, with a percentage of funds held in hot wallets to allow for immediate transactions.

User deposits are held in separate accounts at top-tier banks. This is a mandatory requirement for their FCA and CySEC licenses. This ensures that if the company ever becomes insolvent, clients’ funds are legally protected and cannot be used to pay the company’s debt.

Account security

All accounts are protected by mandatory two-factor authentication and multi-layered withdrawal security. SSL encryption and 24/7 fraud monitoring add extra layers of security.

Audits & compliance

eToro is a publicly listed company on the NASDAQ, which requires them to publish audited financials and adhere to strict corporate governance rules.

The company has also achieved SOC 2 Type II compliance certification. This verifies that the company maintains stringent controls to protect client data and privacy.

Regulatory licenses

The exchange operates under strict oversight from top regulators in multiple jurisdictions. This includes the FCA in the UK, CySEC in the European Union, ASIC in Australia, and SEC & FINRA in the United States of America.

Past incidents & mitigation

In 2020, cybersecurity researchers discovered an open, unauthenticated API endpoint that was leaking sensitive personal data for thousands of users. The platform patched the vulnerability after reasonable disclosure.

There have also been anecdotal reports from users that their accounts have been hacked and they subsequently incurred financial losses. However, the platform maintains that it found no breaches on its side.

Features & Tools

The platform offers a comprehensive set of features and tools that aim to bridge the gap between traditional investing and cryptocurrency trading.

Trading features

One of the most notable features is CopyTrader, which allows users to automatically copy the trades of experienced investors in real time.

Users can select an investor, hit the COPY button, and choose how much money they want to allocate. While using the feature is free, the minimum required amount to copy a trader is $200, and an amount of $1 is required for each copied position. Positions not meeting the $1 minimum will not be opened.

CFD (Contract of Difference) trading is available on the platform. This allows users to leverage trades with borrowed money and speculate on asset prices. It’s important to note that while this can be profitable due to magnified profits, losses can also be magnified.

The platform also offers Smart Portfolios, which allow users to invest in “ready-made” thematic investment bundles. Examples of this include cybersecurity, Big Tech, and Crypto-Equal.

They offer 0% commission on some stocks from 20 global exchanges and access to more than 100 cryptocurrencies.

Staking & earnings

Several crypto assets can be staked on the platform, including Ethereum, Cardano, and Solana. Users receive a share of the network rewards based on their eToro Club level. Staking rewards are distributed monthly in the same asset that was staked and are credited directly to the user’s portfolio.

NFT marketplace & crypto services

The platform offers a specialized mobile application (separate from the main trading app) that functions as a digital wallet. This allows users to transfer crypto from the exchange to this wallet or external crypto wallets.

Mobile application

The eToro mobile app has most of the functionalities of the desktop platform. This includes copy trading, smart portfolios, and real-time social fees. The app also includes a pre-loaded demo account with $100,000, which users can use to practice their trades without risking money.

Institutional & API tools

eToro provides APIs through a dedicated developer portal. These tools allow users to programmatically manage market data, portfolio performance, and trading executions while integrating social features.

The platform introduced AI tools allowing users to build custom trading strategies in plain English, which removes the need for traditional programming knowledge.

While this doesn’t require users to have traditional coding skills, they are required to understand financial terminology.

eToroX: For the more advanced crypto trader

While the main platform is an excellent choice for beginners and casual investors, eToroX is tailored for more experienced crypto traders. It advanced order types, access to deep liquidity via professional order books, and a tiered maker-taker fee model.

FEATURES

eToro

eToroX

USER INTERFACE

Simple, beginner-friendly dashboard with social features (CopyTrader)

Advanced trading UI with full order books and depth charts

FEES

Flat 1% per crypto trade

Tiered maker/taker model based on 30-day volume (as low as 0.03%)

ORDER TYPES

Market orders only

Market, limit, and other advanced order types

CHARTING TOOLS

Basic charts with sentiment data and social stats

Real-time price charts with technical indicators and order book depth

IDEAL USE CASE

Best for beginners or casual traders looking for a simple, social platform

Best for advanced or high-volume traders who need more control and lower fees

Supported Assets & Markets

Several popular and emerging cryptocurrencies can be traded on the platform. Here are some of the supported assets available on eToro.

Cryptocurrencies & tokens

eToro crypto exchange offers a wide selection of cryptocurrencies, a lot of the big names like Bitcoin, Ethereum, Solana, and more. You will also find some lesser-known coins on the exchange, including Stellar, DAI, and BAT, among many others. New crypto assets are regularly added on the platform, giving users access to established coins and emerging tokens.

Fiat pairs

Assets on the platform are primarily traded against the US dollar. While users can make deposits using multiple fiat currencies, internal account balances are displayed in USD.

Geographic availability

The platform is available in Europe, the UK, and Australia. While the platform is accessible in the United States of America, it is restricted to major assets and has limited functionalities. It is completely unavailable in Canada, India, and Japan.

Usability & User Experience

eToro aims to make trading accessible while balancing intuitiveness with advanced functionality. Here’s what it’s like to use the exchange.

Desktop & web interface

The desktop and web interface are straightforward and easy to use. This makes navigating between different asset classes and using the wide variety of crypto trading tools and features a simple exercise.

The platform provides advanced charting integrated with technical tools and indicators. Users can save chart templates to ensure their preferred indicators load automatically at login. A streamlined navigation bar allows for quick switching between watchlists and portfolios, while a social feed offers long-form market analysis from popular investors.

Mobile app experience

The mobile app is beginner-friendly and is described as a blend between social media and a traditional brokerage.

Navigation is streamlined on the app, and users can quickly switch between their portfolios and potential investments. Users can also execute trades instantly in one click, while push notifications can be set up to alert users of market movements.

Learning curve

New users are encouraged to use the demo account functionality, which allows them to practice risk-free trading and familiarize themselves with the platform’s features.

Once they are comfortable, they can switch from trading in virtual currency to real currency and begin trading on the platform.

Customer support

The company offers support through an online help center, support tickets, and a live chat feature for verified users.

While their knowledge base is extensive and covers most common questions, response times for direct support can vary.

There’s no phone support for trading issues, but the self-service resources are helpful for troubleshooting and learning.

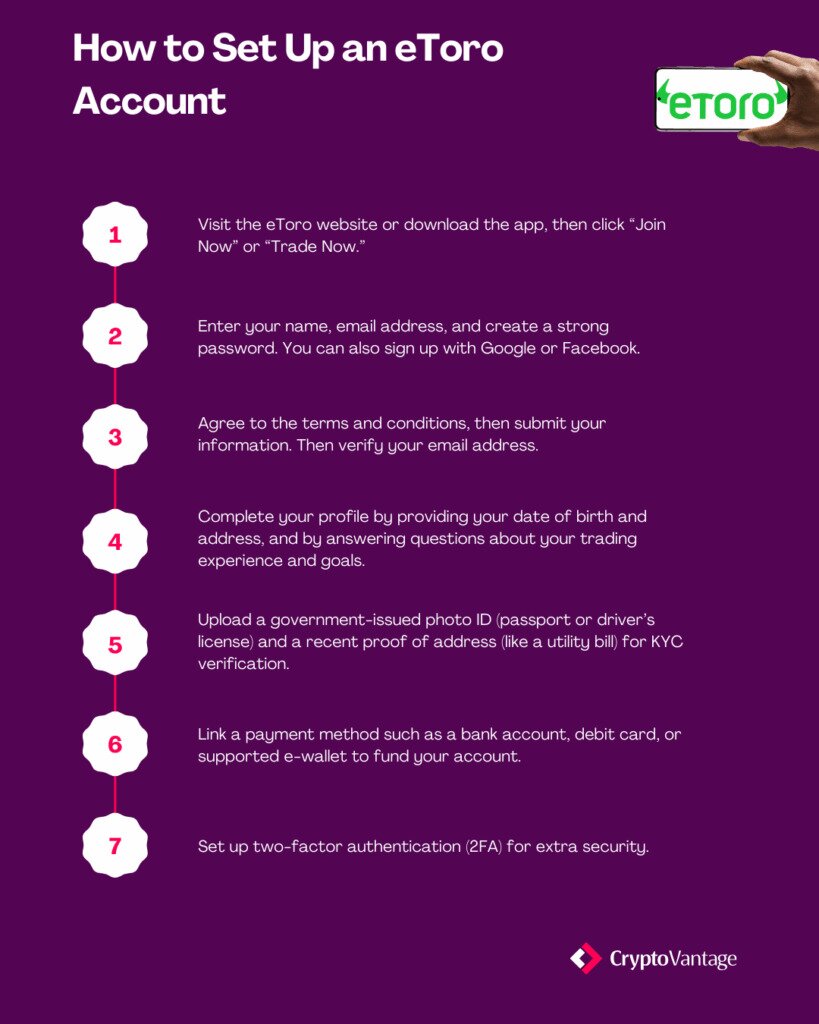

How to Set Up an eToro Exchange Account

If you want to try out eToro for yourself, here’s what you need to do:

Account verification is usually completed within three business days, but this can vary. Once verified, users can begin trading on the platform.

History & Background

Ronen Assia, Yoni Assia, and David Ring founded eToro in Tel Aviv in 2007. The company began as a fintech startup aiming to make global markets accessible to everyone and raised over $162 million in early funding.

Milestones & growth

In 2014, the company expanded into cryptocurrency trading, positioning itself among the first major platforms to support digital assets alongside traditional investments.

The platform made headlines in 2022 with a Super Bowl ad featuring Shiba Inu Coin and a Bored Ape Yacht Club NFT.

They now operate in over 140 countries while maintaining their headquarters in Israel and remaining especially prominent in Europe and Latin America.

Reputation & public events

The eToro exchange has built a solid reputation for being a pioneer of social trading and has become a top choice for new traders. This is thanks to its innovative user experience and significant regulatory compliance.

However, there have been challenges along the way, including an ASIC lawsuit over its CFD screeding process, a $1.5 million penalty paid to the US SEC after operating as an unlicensed broker, and customer support complaints.

Etoro Alternatives

While the exchange will satisfy the needs of most traders, some investors may want to consider other options. We’ve reviewed some of the best cryptocurrency exchanges to help users decide which one best suits their trading needs.

Exchange

Ideal For

Fees & Pricing

Security Features

Regulation & Security

eToro

Multi-asset traders

Flat fees

Two-factor authentication

FCA-regulated

Final Thoughts & Verdict

eToro remains the platform of choice for investors prioritizing a user-friendly, all-in-one trading platform with innovative social investing features.

Their strong regulatory compliance, coupled with an ever-expanding product suite, makes the platform a compelling and secure option for building a diversified portfolio.

FAQs

Yes, eToro is a legitimate and regulated platform, authorized by top-tier financial authorities like the FCA (UK), CySEC (EU), and ASIC (Australia). eToro uses strong security measures, including SOC 2 Type II certification, two-factor authentication, and segregated client funds. Some users have reported slow customer support and delayed withdrawals, along with isolated regulatory fines and a data breach in 2024, though no funds were lost. As with any platform, always use personal security best practices.

eToro’s main drawbacks are higher fees on certain trades, limited account types for U.S. users, and fewer traditional investment options like retirement accounts. Its platform is also less streamlined than competitors like Robinhood, and some features, such as CopyTrader and Smart Portfolios, may not appeal to investors who prefer simple, self-directed trading.

There is no guarantee of making money on eToro or any trading platform. Your results depend on your investment decisions, market conditions, and risk management. Features like CopyTrader enable you to follow experienced investors, but this does not ensure profits, and losses are possible. Always invest only what you can afford to lose.