How to Buy Bitcoin Safely on Exchanges with American Express

Major crypto exchanges, including Coinbase, Binance, and Kraken, don’t accept American Express cards directly for Bitcoin purchases. The main reason comes down to chargebacks. When you buy crypto, that transaction is permanent and can’t be undone, but credit card companies let you dispute charges and get a refund.

The differing policies create an exposure problem for exchanges, since someone could buy Bitcoin, transfer it elsewhere, then dispute the charge and get a refund while keeping the crypto.

So is it possible to buy crypto with Amex? Yes, you can still use your American Express card with some legitimate workarounds. You can link Amex to digital wallets, like PayPal or Apple Pay, that exchanges accept, or use third-party payment processors such as MoonPay and Mercuryo that integrate directly with major platforms.

Likewise, you could also buy Bitcoin using peer-to-peer marketplaces where individual sellers may accept Amex payments. Some platforms automatically detect Amex when you link it through PayPal or Apple Pay.

Top 3 Exchanges That Let You Buy Bitcoin Using Amex

You can’t enter your Amex card details directly on most of the best cryptocurrency exchanges, but several trusted platforms support indirect American Express purchases through integrated payment methods. These exchanges give you secure, regulated ways to buy Bitcoin with Amex.

Coinbase—Best for beginners

Coinbase lets you connect your American Express card through PayPal or Apple Pay, and your funds appear instantly, so you can buy Bitcoin right away.

The platform charges higher fees for card purchases compared to bank transfers, but you get a straightforward interface and step-by-step guidance throughout the buying process. Your USD balance is FDIC-insured, and the platform includes fraud protection, making it a solid choice if you’re new to crypto.

Binance—Best for global users

Binance accepts American Express through payment processors like MoonPay or by linking your card through Apple Pay, giving you flexibility in how you fund your account. Card purchases include processing fees, but Binance’s trading fees are much lower at 0.1%, which saves you money if you plan to buy and sell regularly.

The platform supports over 350 cryptocurrencies, so you have room to explore other coins without switching platforms.

Kraken—Best for advanced users

Kraken only accepts American Express indirectly through PayPal. You’ll need to link your Amex to PayPal first before funding your Kraken account.

Once set up, Kraken offers the lowest trading fees and advanced features like margin trading and futures for more sophisticated trading strategies. The platform has one of the strongest security records in the industry, with no major hacks, making it a reliable option for holding larger amounts of Bitcoin.

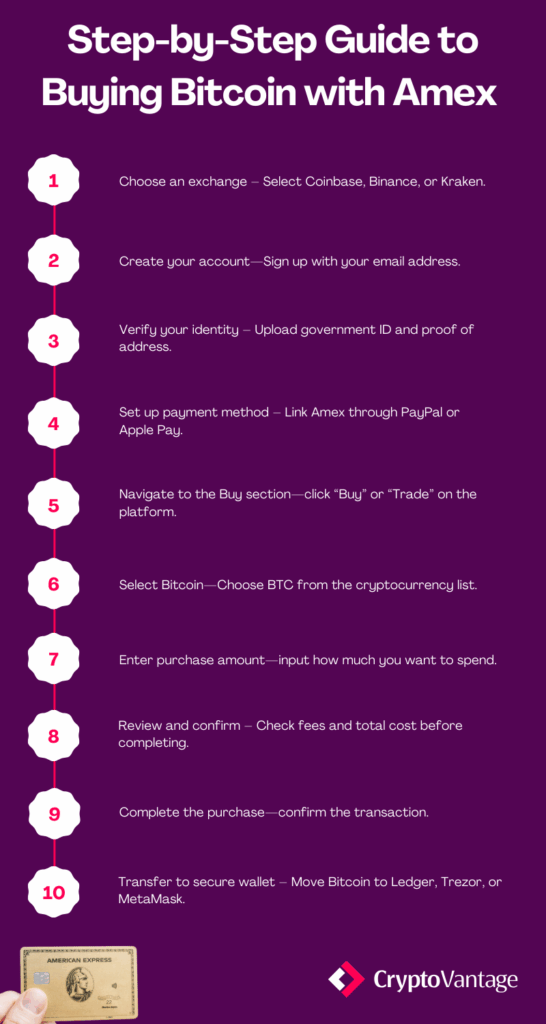

Easy Steps to Buying Bitcoin Safely on an Exchange

- Choose a supported exchange.

- Link your Amex card via your chosen payment method.

- Verify your account and payment details by completing identity verification with a government-issued ID and proof of address.

- Buy Bitcoin and transfer it to a secure wallet once the purchase completes.

Note: Some platforms automatically detect Amex when linked through PayPal or Apple Pay.

Buy Bitcoin with Amex: Easy Step-by-Step Guide

Top tips: How to avoid issues with Amex purchases

Always check transaction fees before you buy. Credit card payments can cost 3-4% compared to 0.5-1.5% for bank transfers. Use secure, private Wi-Fi rather than public networks when entering payment information. Double-check your wallet address before sending Bitcoin, since crypto transactions are permanent and can’t be reversed if you send to the wrong address.

Pros and Cons of Using American Express for Crypto Purchases

Using American Express for Bitcoin purchases has clear advantages and drawbacks compared to other payment methods. Understanding these tradeoffs helps you decide whether Amex works for your crypto-buying needs.

Pros

Fast and convenient processing lets you buy Bitcoin and start trading within minutes, unlike bank transfers that take 3-5 business days.

Strong Amex buyer protection through American Express fraud monitoring and dispute resolution, which keeps your purchases safe.

Works on mobile-friendly exchanges with easy integration through Apple Pay and Google Pay on iOS and Android devices.

Cons

Higher fees than bank transfers, ranging from 3-4% for credit card purchases compared to just 0.5-1.5% for bank transfers.

Fewer exchanges support Amex compared to Visa and Mastercard, giving you fewer platform options.

Some exchanges have purchase caps that limit credit card transactions to specific amounts per transaction or per day.

Bitcoin Storage: Best Wallets for Security and Ease

After buying Bitcoin, moving your holdings to a safe crypto wallet protects your investment from exchange hacks and platform failures.

Hardware wallets like Ledger and Trezor store your private keys offline on physical devices, giving you maximum security against online threats. Software wallets like MetaMask and Trust Wallet offer convenient mobile and desktop access with strong security standards suitable for everyday use.

Tip: Always move your Bitcoin to a secure wallet after buying. Never store large amounts on exchanges.

Our Final Thoughts on Amex and Buying Bitcoin

Buying Bitcoin using American Express is possible with the help of third-party services. You can use Amex indirectly through PayPal and Apple Pay on Coinbase, PayPal on Kraken, and third-party processors like MoonPay or Mercuryo on Binance.

Using credit cards is convenient but can come with high and hidden fees. Bank transfers offer a cheaper alternative for larger, recurring buys.

FAQs

No, you can’t enter American Express card details directly on Kraken, Coinbase, or Binance to buy Bitcoin. However, you can use Amex indirectly by linking it to PayPal, Apple Pay, or Google Pay, which these platforms do accept. Some platforms automatically detect Amex when you link it through PayPal or Apple Pay.

Crypto exchanges limit American Express acceptance mainly because of chargeback risks and higher processing fees. Credit cards let buyers dispute charges and potentially get their money back, while crypto transactions are permanent and can’t be undone, creating financial risk for exchanges. American Express also charges higher fees to merchants compared to Visa and Mastercard, making it less attractive for platforms working with tight margins.

Buying Bitcoin with a credit card is generally safe when you use regulated, reputable exchanges like Coinbase, Binance, or Kraken that have industry-standard security measures. American Express adds extra protection through fraud monitoring and buyer protection policies.

Want to know if you can buy bitcoin with Amex gift cards? Some platforms accept prepaid and virtual cards for Bitcoin purchases, but it varies a lot by platform and card type. Many exchanges and third-party processors restrict prepaid cards because of anti-money laundering rules and increased fraud risks. Check directly with your chosen exchange to confirm whether they accept Amex gift cards before you try.

Yes, American Express purchases cost 3-4% per transaction, much higher than the 0.5-1.5% charged for bank transfers. Most platforms also set daily or per-transaction limits on credit card purchases, depending on your account verification level. Some American Express cards may treat crypto purchases as cash advances, which have extra fees and higher interest rates. Check with your card company before making your first purchase.