Best Exchanges for Staking Cardano

How to Stake Cardano (ADA) in a Self-Custodial Wallet

Follow the steps below to stake Cardano (ADA) in a Cardano staking pool. The steps shown will be for using the Eternl Cardano wallet, but you can use any Cardano wallet app such as Yoroi wallet or Daedalus wallet, a hardware wallet like Ledger, and it can be done through crypto exchanges as well. Before being able to stake ADA, you’ll need to own some, so if you haven’t bought ADA tokens yet, you’ll need to do so before proceeding. After you have some ADA tokens, you can then come back here and begin the staking process.

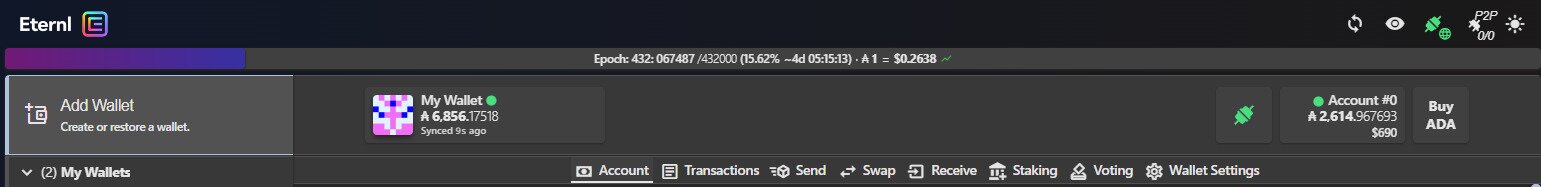

Step 1: Open your custodial wallet app

The first step to staking your ADA on the Cardano network to earn rewards is to open your wallet app. For this example, we’ll be using the Eternl Cardano wallet, which is a browser extension that can also be used in conjunction with a hardware wallet. Once you’ve opened your wallet, click “Staking” from the dashboard bar seen in the image below.

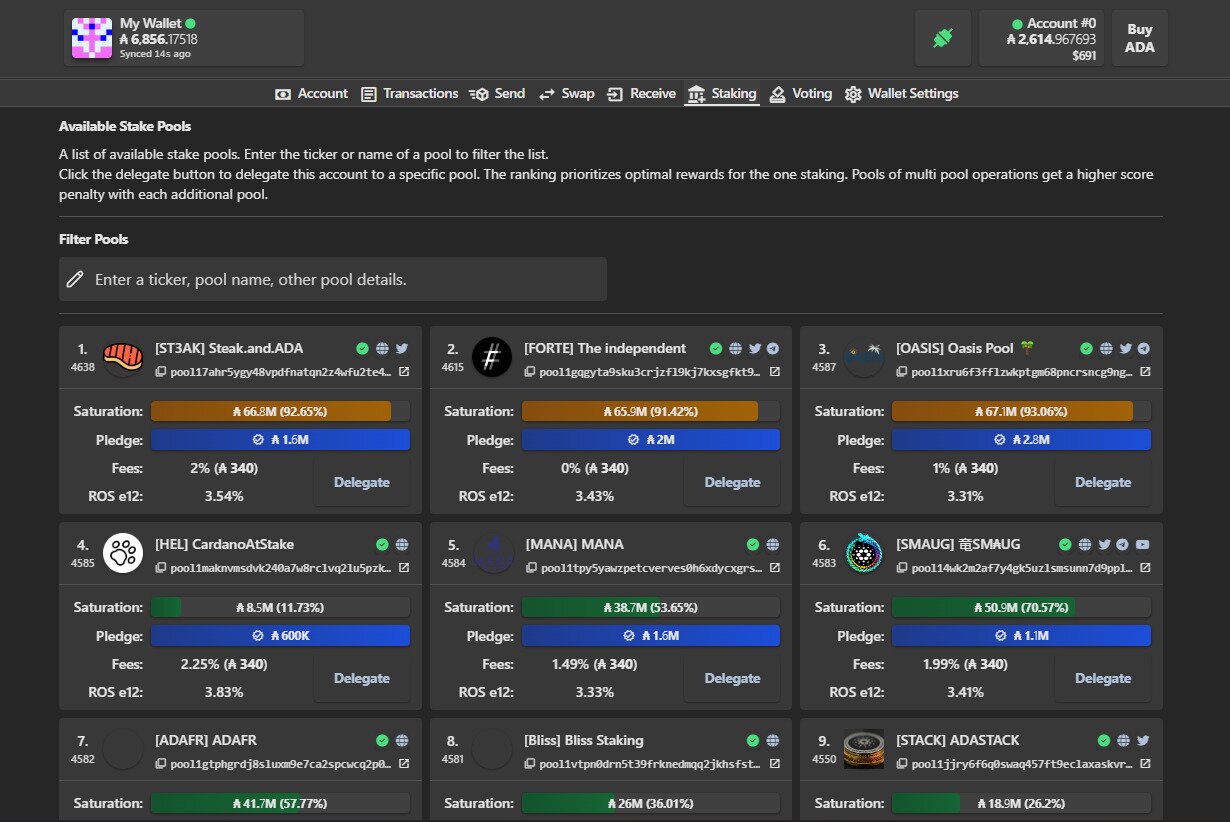

Step 2: Choose a stake pool

Once you’ve clicked staking, you’ll see the below page, where you can choose from all the stake pools available to ADA holders. These are all validators, who collect transaction fees when validating transactions, and add new blocks to the Cardano network. You can search for a validator you’re interested in, or simply browse. There are varying commissions charged by validators, along with different levels of saturation. You should do your own research before picking a pool to start staking with. Some staking pools offer additional crypto assets for staking with them.

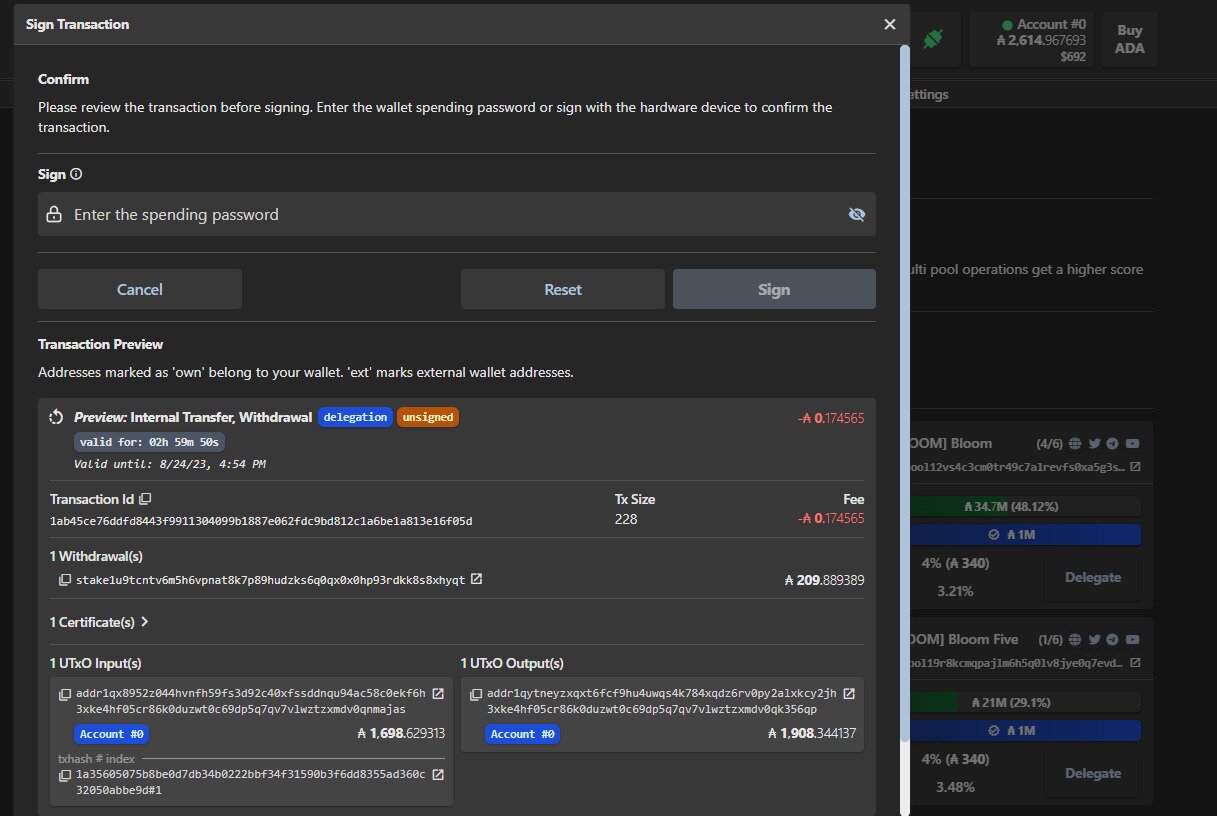

Step 3: Delegate your ADA

When you’ve found a staking pool to your liking, click the “Delegate” in their box. You’ll then have to enter your password in order to approve/sign the staking transaction. You can see the transaction fees for the process in advance. If you want to stake Cardano with more pool operators, you can create more than one account within your wallet and do ADA staking with multiple validators. This is beneficial if there are different staking rewards for staking ADA with different validators, such as earning other crypto assets in addition to Cardano.

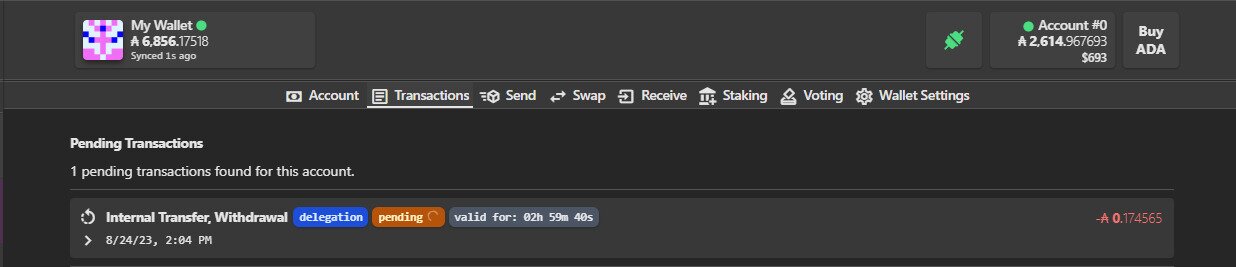

Step 4: Wait for transaction data to process

Once you’ve signed the transaction for staking Cardano with a stake pool operator, you’ll need to wait for the transaction to process, as seen below.

Step 5: You’re staking ADA!

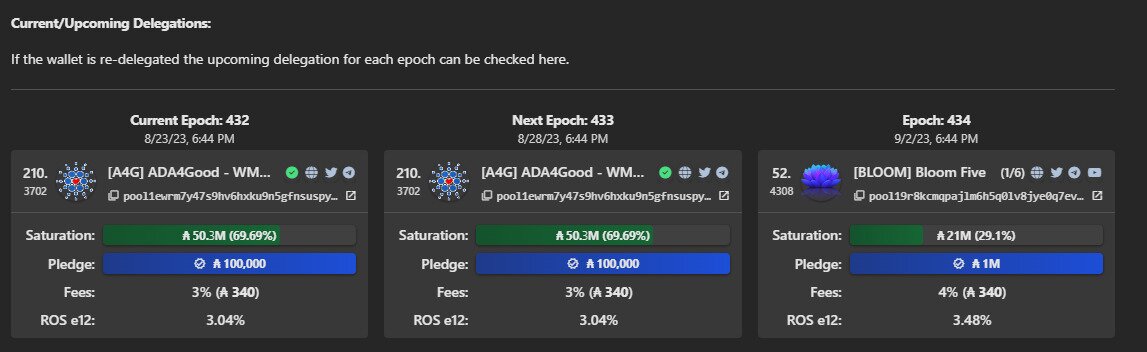

That’s it, if you look at your account tab, you’ll see the pool you’re currently delegating to (if any), and the new pool which you’re going to be staking Cardano with. Cardano makes staking easy by showing you approximately when you’ll earn rewards. Cardano rewards are paid out every epoch, which is about 5 days. It takes 10 days to earn your first rewards if this is a brand new delegation.

What's the Difference Between a Delegator and Validator?

Within Cardano proof of stake there are two types of staking parties: delegators and validators. A delegator gives their stake to a validator. You’re not giving them the assets themselves, or your private keys, but rather the power of “holding” the assets. With your stake delegated you earn rewards. Usually, multiple delegators give a validator access to their crypto asset holdings and the validator uses them to participate in governance actions such as voting on proposals. This can be referred to as a staking pool.

Validators are also required to validate transactions taking place on the blockchain network. There is a higher technical and financial barrier to being a validator than a delegator, and you have to be processing transactions. This is why validators receive a commission from their delegators’ rewards.

What happens if stake pools get oversaturated?

Unlike crypto mining, with Cardano staking, if a pool begins to have too much delegated ADA tokens, the rewards for the stake pool will be reduced. Network participants are expected to help keep staking pools under the saturation level to earn rewards.

Can stake pool operators run more than one pool?

Yes, so if stake pool owners are finding that their pool is starting to become oversaturated, they can create another staking pool for users begin delegating their ADA to.

What Are the Staking Rewards?

The average ADA rewards for staking Cardano is around 3-5% APR. Staked ADA has to be manually compounded.

It’s worth noting that although crypto staking rates are usually relatively low you’ll receive far more significant returns if the value of the underlying asset (Cardano in this case) increases in price. Crypto staking is somewhat unique in these aspect as traditional investments like stocks don’t usually offer a yield.

What’s the minimum ADA staking required to receive rewards?

To make Cardano staking work you need a minimum of 10 ADA tokens in your Eternl, Daedalus wallet, or Yoroi wallet. However, there is no minimum delegation amount required to earn rewards, so you can delegate just one ADA.

Are There Any Risks to Staking Cardano (ADA)?

There’s no real risks when staking your Cardano, unless you do it through centralized exchanges, as they’re technically the ones that hold the private keys in this scenario so if they lose the ADA, so do you. Otherwise the only risk is oversaturated staking pools.

As long as you do your due diligence and pick a pool with fewer participants, you’ll roughly net the same rewards every epoch.