Get Started Quickly with the Top Exchanges for Staking Polygon

Staking Polygon on an exchange is the easiest way to start earning rewards, quickly. Here’s our curated list of options:

- One of the oldest cryptocurrency exchanges with plenty of liquidity

- Better for advanced users

- Very competitive trading fees

- Large variety of cryptocurrencies to buy

- International exchange with hundreds of different cryptos

- Extremely simple sign-up process

- Very high level of security

- Users can invest in the success of KuCoin through KuCoin Shares

- Solid platform for experienced traders looking to put in large amounts of volume

- Competitive fees compared to other exchanges

- Headquartered in Cayman islands

- Huge selection of cryptocurrencies

What is Polygon (MATIC)?

Polygon (MATIC), formerly known as the Matic Network, is a layer-2 blockchain network built on top of the Ethereum network. This means MATIC tokens are ERC-20 tokens, protected by the same security infrastructure as the Ethereum blockchain. MATIC is the native token of the Polygon network that also works on the Ethereum layer.

Polygon is a proof-of-stake digital asset. What is proof-of-stake? It means that you can stake MATIC on the Polygon network, in order to earn exclusive rewards. Polygon validators run their own node, stake MATIC, and verify transactions, while delegators can have tokens staked with a validator to earn passive income. The latter is referred to as a staking pool.

Where Can You Stake a Polygon (MATIC) token?

Polygon’s Proof-of-Stake consensus mechanism allows holders to delegate tokens. This helps to secure the network, but (perhaps more importantly) can help you earn some passive income. Our Crypto Staking Guide covers the whole process in detail, but here are three main ways of staking Polygon:

- On an exchange – This is the quickest and the easiest way. You surrender your tokens to the exchange, and the platform handles the technical details on your behalf.

- On the blockchain – This method involves directly staking MATIC on the Polygon network through the official dashboard.

- Through liquidity staking – You hand over your digital assets and receive a “receipt token” in return.

Each of these methods have their unique advantages and disadvantages, but we will discuss all the details, as well as how to stake MATIC in more detail, below.

On An Exchange

This is the most straightforward method and the best place to stake Polygon. In this method, the platform handles most of the heavy lifting, and you get access to very competitive rewards. All you need to do is:

- Sign up to a crypto exchange that supports MATIC staking (we have listed our favorite options right at the top of this page for a quick start).

- Navigate to the staking section of the platform.

- Select MATIC from the list of available tokens.

- Select the Stake Now option and fill in the type, duration, amount, and any other necessary information to complete the transaction.

- Confirm the transaction.

Once you have confirmed the transaction, your coins will be locked away and you will start earning rewards. Let’s see where this option shines and falls short compared to the others.

Weighing the upsides and Downsides of staking MATIC on an exchange

On The Blockhain (Native Staking)

Staking Polygon directly on the blockchain is slightly more complicated, but it can be done using a noncustodial wallet, such as MetaMask. Before you can begin staking MATIC, you’ll need to have one of these wallets. Plus, you will have to ensure that you have at least some MATIC tokens in the wallet. If you haven’t done that yet, we suggest you transfer or swap out some tokens quickly, before you get started. Then, simply follow these steps:

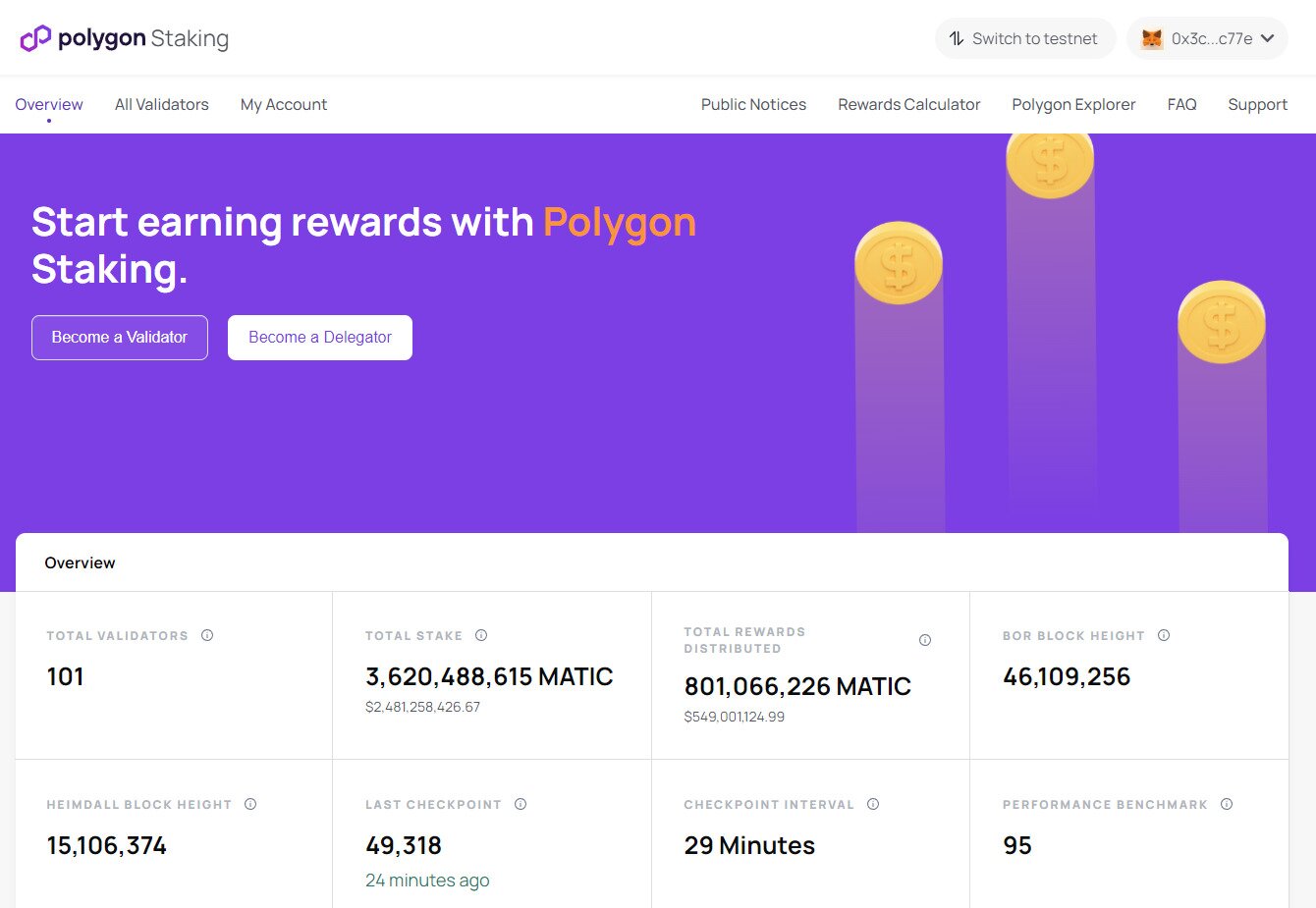

Step 1: Go to Polygon’s Website

The first step is to go to their official staking platform and connect your wallet (the most popular option is MetaMask).

CryptoVantage tip: Check the Polygon staking website, even if you decide to use one of the other methods, to cross-reference and find the ideal APR.

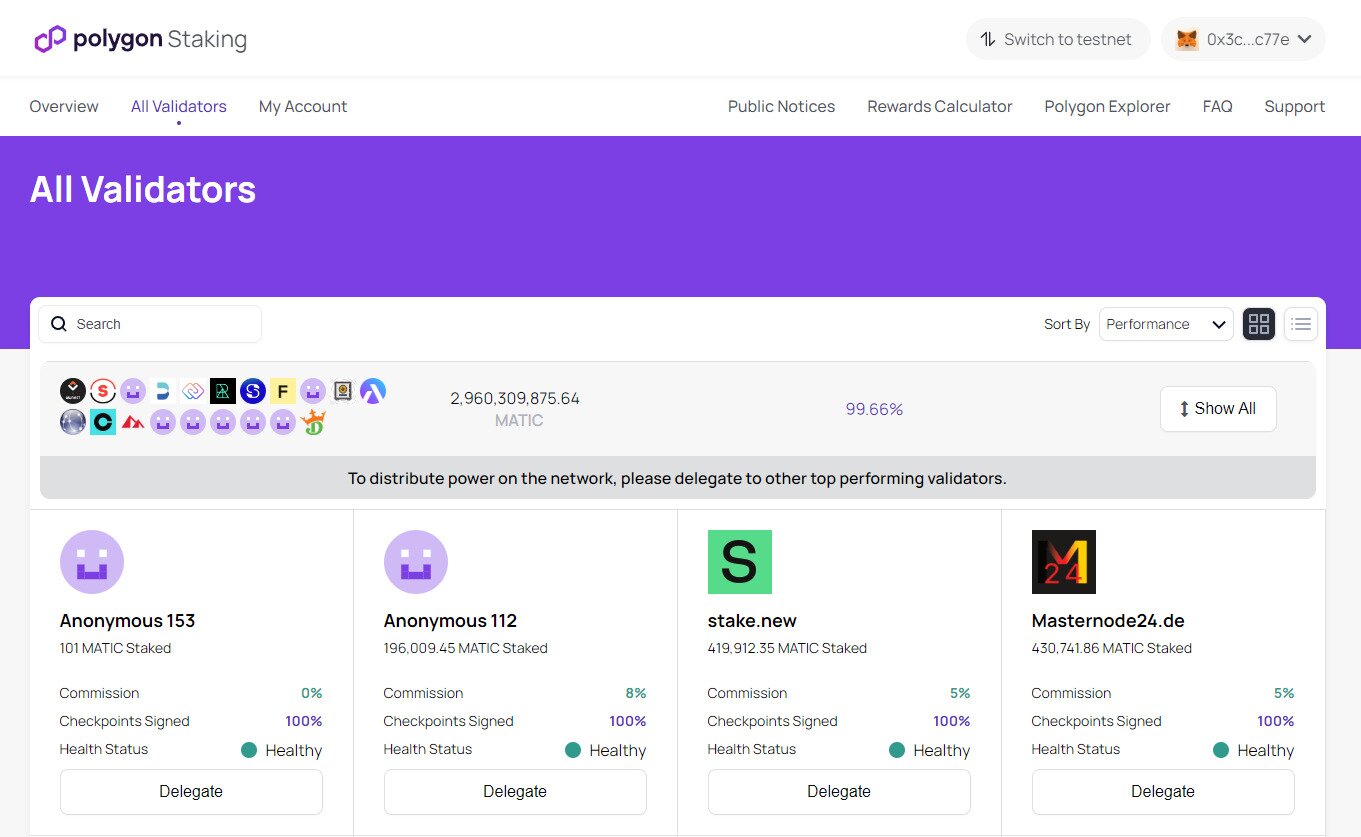

Step 2: Choose a Validator

Polygon’s validator set is capped at 100 active validators. This means that if you want to buy into the network, you will have to delegate your MATIC to one of the existing validators. To do this, you will need to:

- Click Become a Delegator.

- Select a validator for staking Polygon (CryptoVantage tip: when comparing validators, try to find one with 100% of checkpoints signed, and a commission percentage that is on the lower end).

- Click Delegate.

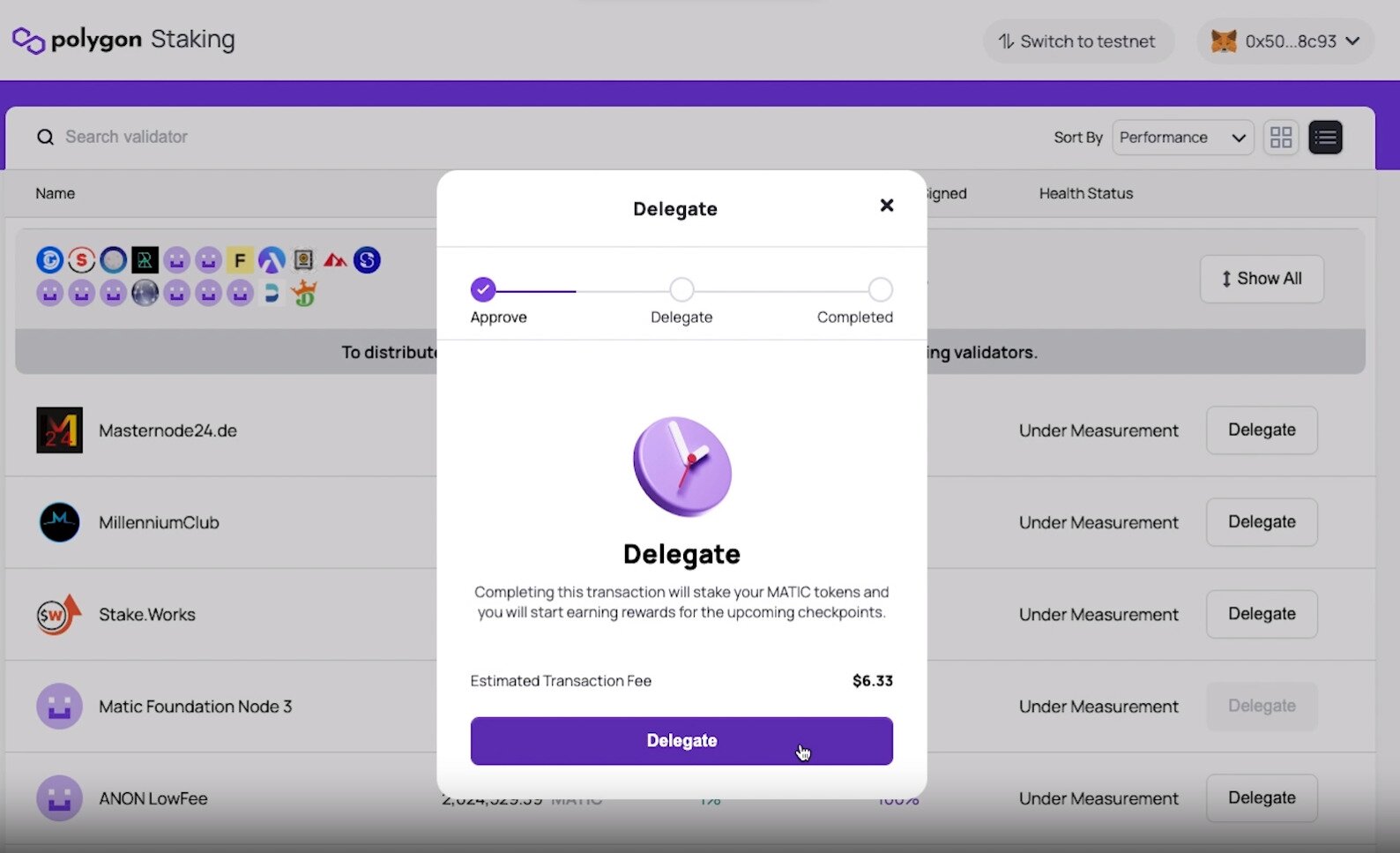

Step 3: Choose Your Delegation Amount and Confirm

Once you click Delegate you’ll see the below popup. You can enter the amount you want to delegate, or click MAX to stake it all. Click Continue when you’re happy with the staking amount. Be sure to check the following before you confirm your transaction:

- The amount of MATIC you are willing to stake.

- The estimated transaction fees.

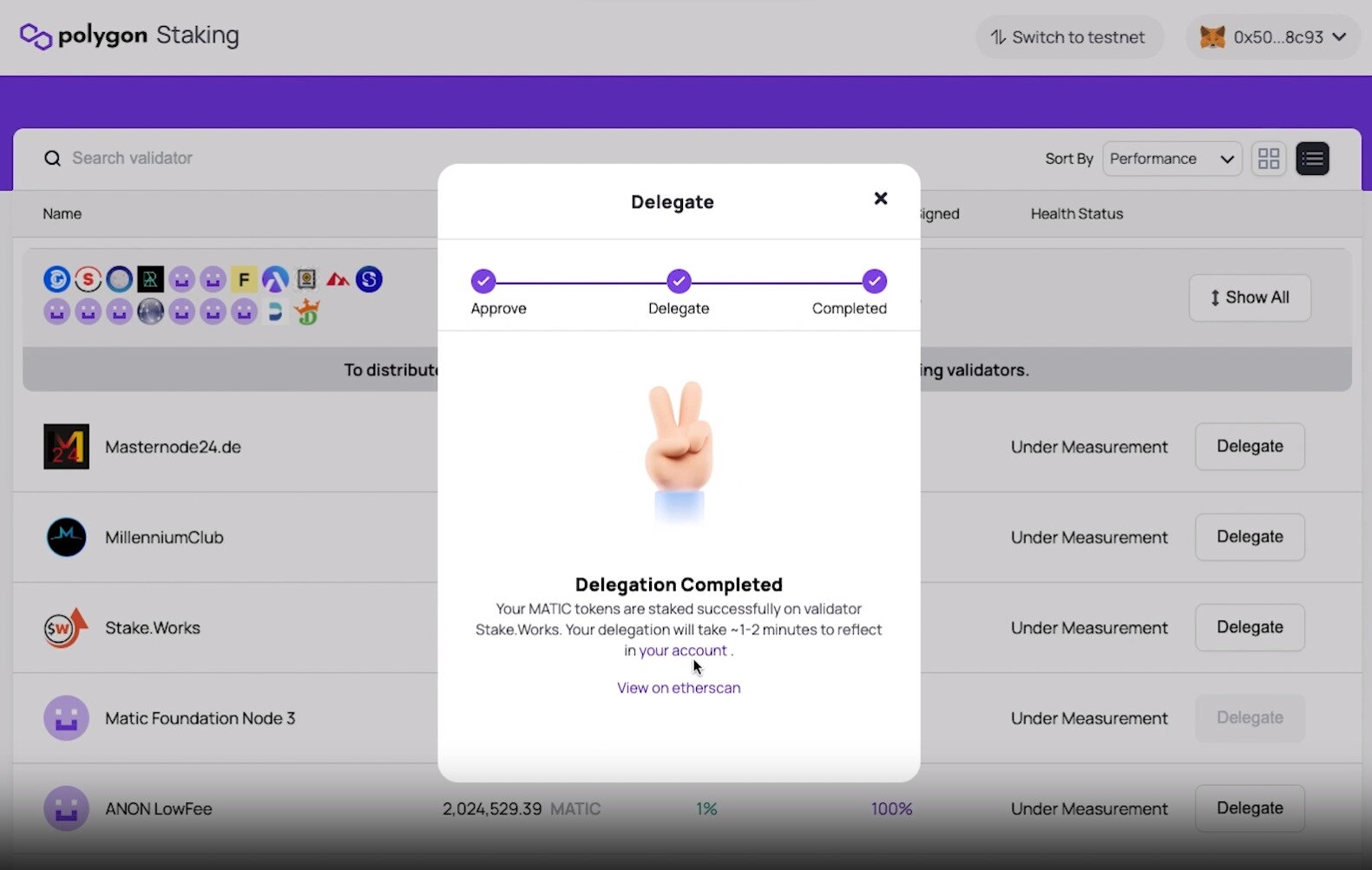

Step 5: All Done!

Once you’ve confirmed the transaction, you should receive a message confirming that the delegation has been completed.

The advantages and disadvantages of direct Polygon staking

Liquidity Staking

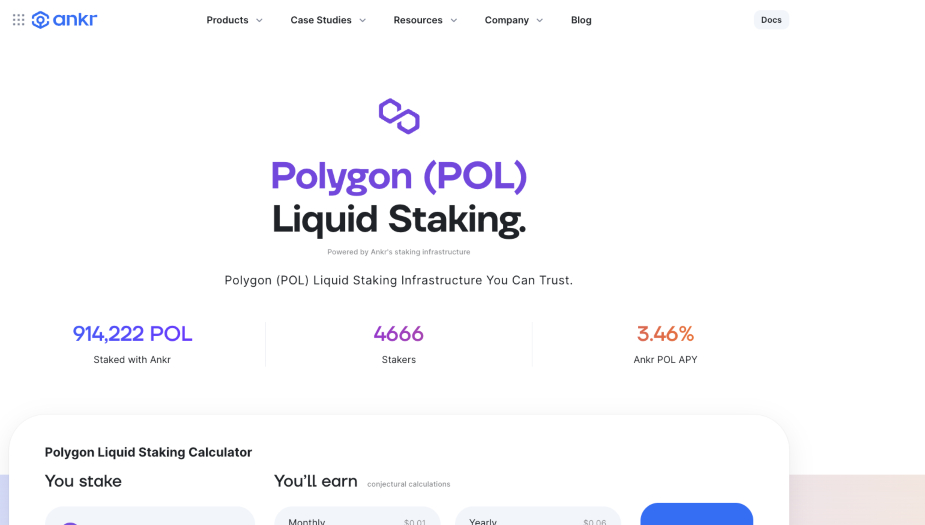

Both of the methods we discussed above require you to lock your MATIC for a set amount of time. Liquid staking MATIC, on the other hand, allows you to earn rewards whilst still retaining control over a liquid token. This token (usually ankrMATIC) can be used in DeFi activities like lending and farming.

This method typically involves staking MATIC through a third party, like Ankr, as follows:

- Ensure that you have added the Polygon Mannet (or Ethereum) to your wallet and that you have added some MATIC tokens for the transaction.

- Find a MATIC portal that suits your needs.

- Connect your wallet to the portal.

- Confirm the amount of MATIC you want to stake.

- Complete the transaction.

You should receive a tokenized version of your MATIC tokens to use in the meantime, with no lockup required.

Is Polygon Staking Worth It?

The short answer is yes. Especially if you want to earn a passive income and grow your holding over time, and even more so if you believe in the Polygon ecosystem. It is definitely a great way for users who prefer low-effort investing to grow their portfolios. However, if you need high liquidity, or you plan to use your MATIC for DeFi activities, like lending and farming, long-term lockup may not be the best option.

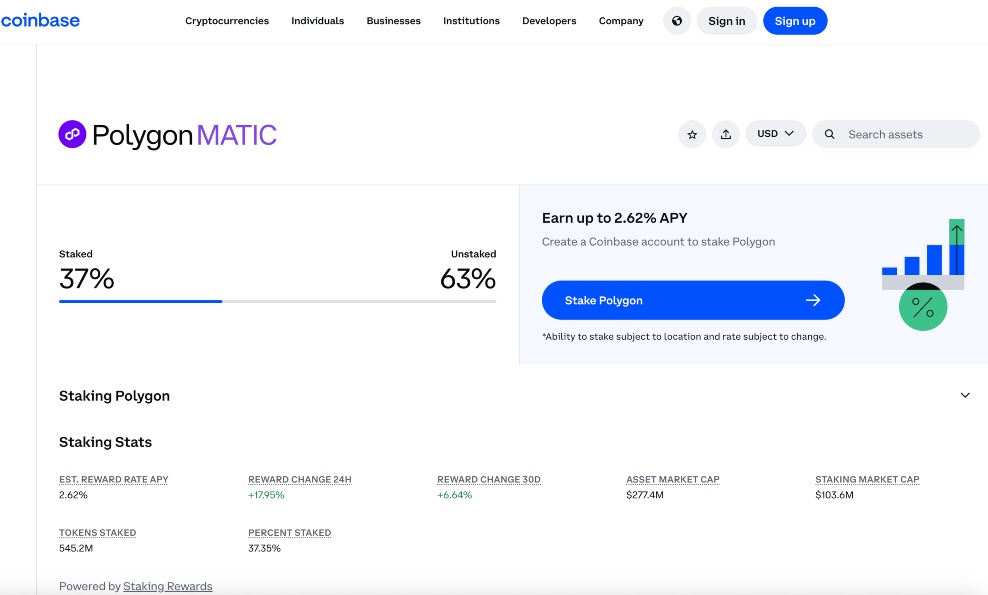

What Rewards Should I Expect for Staking Polygon?

The rewards you receive for Polygon staking will vary depending on a number of factors. This includes the method you chose, the validator, the platform and even the network.

Native staking APR typically ranges between 4% to 10%. Exchanges usually offer APYs that are slightly higher, whilst returns on liquidity staking change alongside the value of the token. Rewards are usually paid out in MATIC (or a liquidity token).

Is Putting Your MATIC to Work Risky?

Committing to holding any token long-term involves some risk. However, the good news is that Polygon staking is generally considered low- to medium-risk. Price volatility is the main factor that you should be aware of, as the fiat-value of your MATIC tokens and your earned rewards are never set in stone.

Expert tips for responsible yield earning

The best way to keep the risk involved in this process to a minimum is to follow these pro tips:

- Stick to the trusted platforms and validators

- Understand the implications of locking up your tokens and weigh up the withdrawal times carefully

- Accept that there will be ups and downs in the price of every coin

Final Thoughts: Making the Most of Your Polygon Locking Strategy

Staking is, and will always be, a great way to earn a little extra with your MATIC tokens. Whether you decide to increase your Polygon stake through an exchange (easiest), directly through the blockchain, or through a liquidity pool, it is a relatively low-effort way to put those digital assets to work. And, now that you know how to stake MATIC, there is nothing standing in your way.

Frequently Asked Questions About Staking Polygon

Yes, there are staking fees for Polygon (MATIC). Polygon validators charge a commission for their services. You have multiple validator options to choose from, so you can pick which one will earn rewards and stake your MATIC tokens with them.

Yes. Typcially, the minimum amount for Polygon staking is 1 MATIC. However, this amount may differ slightly f you are working through an exchange, or through an established liquidity pool.

The short answer, is no. You essentially agree to lock up your tokens when you stake them, which means that these coins are not available to be sold or transferred during the specified period of time. Some liquidity pools will offer you a liquidity or derivative token, which can be traded and sold on most DEX platforms (or used in DeFi transactions).

There are many different ways to put your tokens to work. Polygon (MATIC) tokens can be staked through some crypto exchanges, along with other crypto assets. Coinbase, Binance, and Kraken are all examples of platforms where staking MATIC is possible. You can also work directly through the Polygon staking platform, and through liquidity pools (though, these methods are a little more complicated).

It typically only takes about 1 to 2 days for investors to start earning rewards. If this is your first time staking Polygon, the process may take a little bit longer, since your stake will have to be validated before you can start earning returns. In the end, your usual reward frequency will depend on the validator, the method or network you chose, and general market conditions.