HODL Meaning and Origins

HODL is a humorous backronym meaning “Hold On for Dear Life” that dates back to 2013. The term HODL first came on to the scene in a Bitcoin talk forum when a frustrated trader under the username GameKyuubi was letting his bottle of whiskey do the talking and posted the now infamous thread “I AM HODLING”.

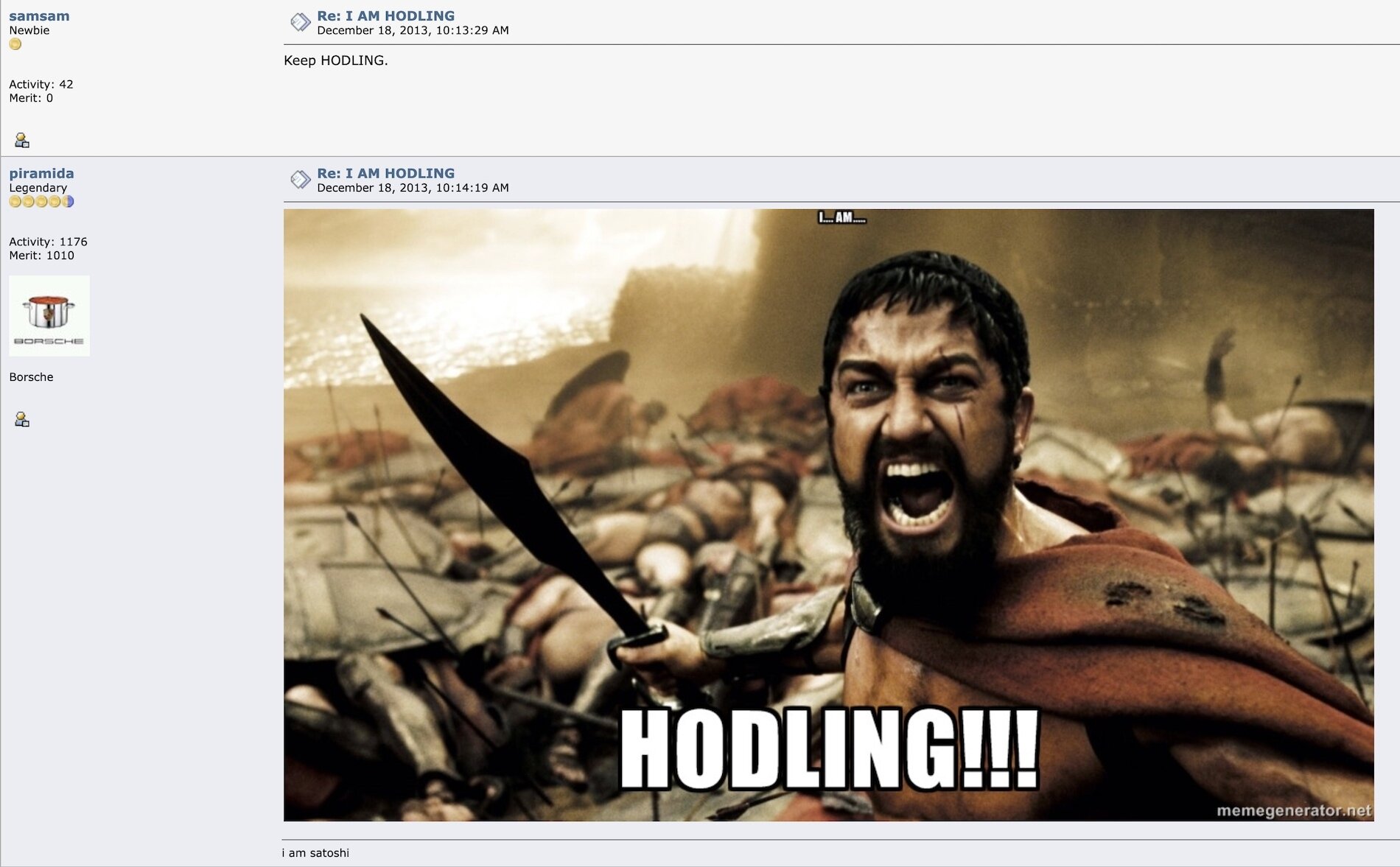

The point of GameKyuubi’s post was to let the cryptocurrency world know that, despite the serious fall Bitcoin had just taken, they planned to still hold on to their BTC. What GameKyuubi didn’t know was this simple typo would soon become an iconic term used by crypto communities around the world. HODL started gaining traction in mainstream media and late-night television, in addition to being held responsible for the creation of countless memes.

The first HODL meme? Source: Bitcointalk.org forum

Why Would You HODL Your Cryptocurrency?

The highly volatile nature of cryptocurrencies can be a good thing, if used to an advantage. That being said, more often than not, short-term swings work against new traders. Some traders, known as “hodlers”, live by the philosophy of hodling and shun trading based on short-term price movements. This strategy aligns with the original discourse by GameKyuubi in the belief that novice traders are likely to make mistakes in their timing and lose money or at best make less than they would have by simply hodling onto their crypto investment.

Short-term trades are often conducted by investors with a pessimistic outlook in what they consider a “bear market”. These investors address themselves or a particular cryptocurrency as “bearish”, indicating their preference to sell rather than HODL. Two tendencies short-term traders can exhibit are FUD (Fear, Uncertainty, and Doubt), which leads to selling low, and FOMO (Fear Of Missing Out), which leads to buying high. By simply hodling rather than selling, hodlers can relieve themselves of these pressures and other profit-eroding emotions.

Historically the price of Bitcoin always ascends higher over the long term. As an example here’s a chart of Bitcoin price since the Bitcoin HODL meme originated in late 2013:

The red circle represents when the HODL meme was created. Source: CoinMarketCap

Is HODLing a Good Investment Strategy?

When analyzing the short-term swings we’ve seen, cryptocurrencies may seem like a risky investment. However, by taking a step back like hodlers have, you can see the long-term growth of Bitcoin and other coins occur in spurts rather than a steady stream.

At the head of hodling is patience, backed by a theory from noted analyst Thomas Lee, head of research at Fundstrat Global Advisors, who advises hodling Bitcoin. Hodlers, and Thomas Lee, keep an optimistic or “bullish” opinion that bitcoin’s price follows a predictable pattern. Based on previous trends, Bitcoin is a “bull market” that it will rise again, even after losing over 50% of its value in the last year. Basically over the long-term HODLing really does seem to work.

Beyond your typical hodlers, there lies a group of die-hard believers in the theory and cryptocurrency itself, known as maximalists. These hardcore crypto investors believe that cryptocurrencies will eventually replace fiat currencies (government issued currencies) and become the new basis of all future economic structures. Therefore, to maximalists, the current fiat exchange rate of cryptocurrencies is irrelevant, and the only option is to HODL.

Many crypto investors left the market after Bitcoin topped at $19,000 in late 2017, only to have Bitcoin roar back to life in 2020 before peaking at nearly $70,000 in 2021.

Need an example of the power of holding Bitcoin long term? The price of BTC at the time GameKyuubi made his infamous “HODL” post was roughly $691. It’s gone up over 3,000% since then. Let’s say GameKyuubi had 10 BTC in 2013 stayed true to his HODLing convictions and held all the way to the present day. He’d have over $214,000. From an investment of less than $7,000.

Suffice to say that HODLing would certainly have worked for GameKyuubi!

That said, HODLing Bitcoin over many years can be trickier than you might think. First off, you’ve got to make sure your Bitcoin is stored securely (most likely on a hardware wallet, not an exchange). Second, you can’t fall prey to the emotions of a drastic bear market where the value of BTC drops precipitously. Instead you must have the conviction of the spartan soldier that featured prominently in the first HODL meme. Hold the line, above all else.

Which Cryptocurrencies Can You HODL?

Of course, you can HODL any cryptocurrency you like. However, it is difficult to know which coins will prevail and survive long-term. While there is a colorful spectrum of coins and tokens on the rise that are worth looking at, there are two that we believe stand out among the crypto crowd.

Bitcoin remains the king of the cryptocurrency world in terms of users, market cap, and value despite numerous contenders in the market. It’s the first cryptocurrency to dent the mainstream and easily the most famous cryptocurrency in the world. Over the years, other cryptocurrencies have surpassed Bitcoin in terms of speed of transaction. Still, no coin comes close to its market cap, number of users, and overall popularity. Moreover, Bitcoin usage with merchants is up 600% from 2018 to 2019, further ingraining Bitcoin in the financial world, according to new reports. It’s difficult to compare other tokens to Bitcoin because no other coin has survived as long (over a decade now). That proven resilience is what makes BTC as a long-term store of value.

Ethereum has the second largest market capitalization after Bitcoin. It is, without a doubt, one of the biggest success stories out of the cryptocurrency world. With the new upcoming launch of Ethereum 2.0, it could push the platform to new heights. Ethereum isn’t just another cryptocurrency, it gives users the ability to program application, called dApps, on its blockchain infrastructure. ETH remains one of the most popular altcoins in the world and a darling amongst developers and investors alike. The bull case for Ethereum over Bitcoin is that it’s more versatile and potentially more future-proof thanks to upcoming scalability improvements. That said, nothing is as proven as Bitcoin and institutions seem to prefer it to any other coin.

Of course there are many other cryptocurrencies. Popular ETH competitors include Solana (SOL), Cardano (ADA), Polkadot (DOT) and Avalanche (AVAX). HODLing these coins long term is a slightly riskier proposition because they have less of a proven record. However, they could provide an even bigger reward if one of them becomes a dominant token that actually competes with BTC or ETH. Therefore it’s usually recommended to have a smaller percentage of your HODL portfolio to these coins but in the end that decision is entirely up to you.

What Are the Best HODL Strategies?

HODLing crypto is really more of a mindset than an investing strategy.

When making your initial investment it’s obviously great when you can catch the bottom of a current price decline trend but that is extremely difficult to do and has thwarted many traders over the years.

Since you’re HODLing long-term you really don’t have to worry too much about price fluctuations. Instead you should be wary when crypto hits all-time highs. But there’s really no right or wrong if you’re holding long-term.

If you’re worried about buying at the top of the market you might consider a dollar-cost averaging strategy. Using a DCA strategy lessons the impact of volatility by making many small investments into crypto over the years. For instance buying $50 of Bitcoin every month. This method is a nice compromise when you’re worried about buying the top.

Many crypto exchanges have built in features for dollar-cost averaging. It’s usually referred to as “recurring buys” or something along those lines. Basically you input how much crypto you want buy and the frequency you want to buy. It’s a great “set it, and forget it” style of investing that works extremely well with the HODL mindset.

What’s Next to Come for Hodlers and Cryptocurrency?

Bitcoin and other cryptocurrencies have experienced both exponential increases and decreases in price over the years. Hodlers are of the opinion that Bitcoin will rise again even after its slide in price, and some even believe now could be the best time to buy BTC.

There are arguments on both sides for continued longevity or the ultimate demise of the crypto market. What side are you on?