- >News

- >A Step-by-Step Guide to Staking Crypto with Coinbase

A Step-by-Step Guide to Staking Crypto with Coinbase

Coinbase Exchange has long been known for the Coinbase Learn and Earn program. With the Lean and Earn program, you watch videos about a crypto asset before answering simple questions based upon the videos. In exchange for getting the answers right, you earn a small amount of the cryptocurrency. Coinbase Learn and Earn isn’t the only way to get free crypto on Coinbase though, as the platform also offers Coinbase Earn, which allows you to stake specific crypto assets and receive a return.

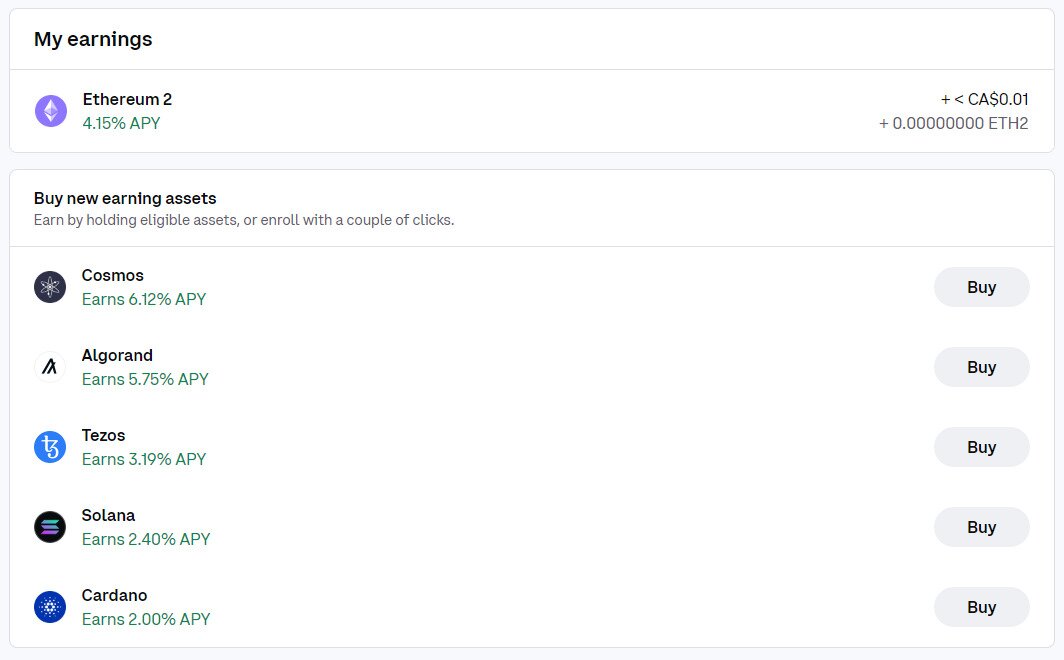

Coinbase lets you stake Ethereum, Cosmos, Algorand, Cardano, Solana, and Tezos. Yearly returns on staking these assets ranges from 2-6% APY depending on the asset. If you’re wondering how to stake crypto with Coinbase you’re in the right place. In this guide we’ll be giving you step by step instructions for staking crypto with Coinbase. First, let’s recap what staking is.

What is Staking?

Staking is a function for proof of stake (POS) cryptocurrencies such as Polkadot (DOT), Cardano (ADA), Tezos (XTZ), Ethereum (ETH), Cosmos (ATOM), and Polygon (MATIC). Staking crypto helps with securing and validating transactions on the blockchain. As a reward for helping secure the network, you are rewarded with a payout in the digital asset staked in proportion to your contribution.

Depending on the coin or token there may be periods when you receive no return. Some digital assets also have locking periods where you cannot access your stake for a certain amount of time, as it is being used on the blockchain network. An example is Cosmos (ATOM), which has a 21-day unlocking period. This means that once you unstake an amount, it takes 21 days before you can access the assets.

Typically, you delegate the crypto you want to stake to a validator. When you delegate your crypto to a validator you are not giving up your holdings to them, but simply giving them the power to use it to do things such as vote on proposals or validate transactions. The assets stay in your custody.

You can also stake digital assets through an exchange. Some exchanges offer staking rewards if you simply hold the asset on the exchange, while others require you to deposit it into their Earn program, as is the case here with Coinbase Earn.

How to Stake on Coinbase: Step by Step Guide

Below, we’ll outline the steps required for staking crypto on Coinbase exchange. For this example we are going to describe how to stake Ethereum on Coinbase. While you can stake ETH yourself through an application like Ledger Live, it is a more complex process. This is especially true when compared to staking Ethereum with a provider such as Coinbase.

Staking Ethereum through Coinbase like this is the best way for a beginner to get started with staking ETH as there is less technical knowledge required, less cost, and more support available.

Note that in order to stake any asset with Coinbase, you need to register for an account and have some of the asset you want to stake in your Coinbase account. Let’s jump in.

Staking on Coinbase in 6 Steps

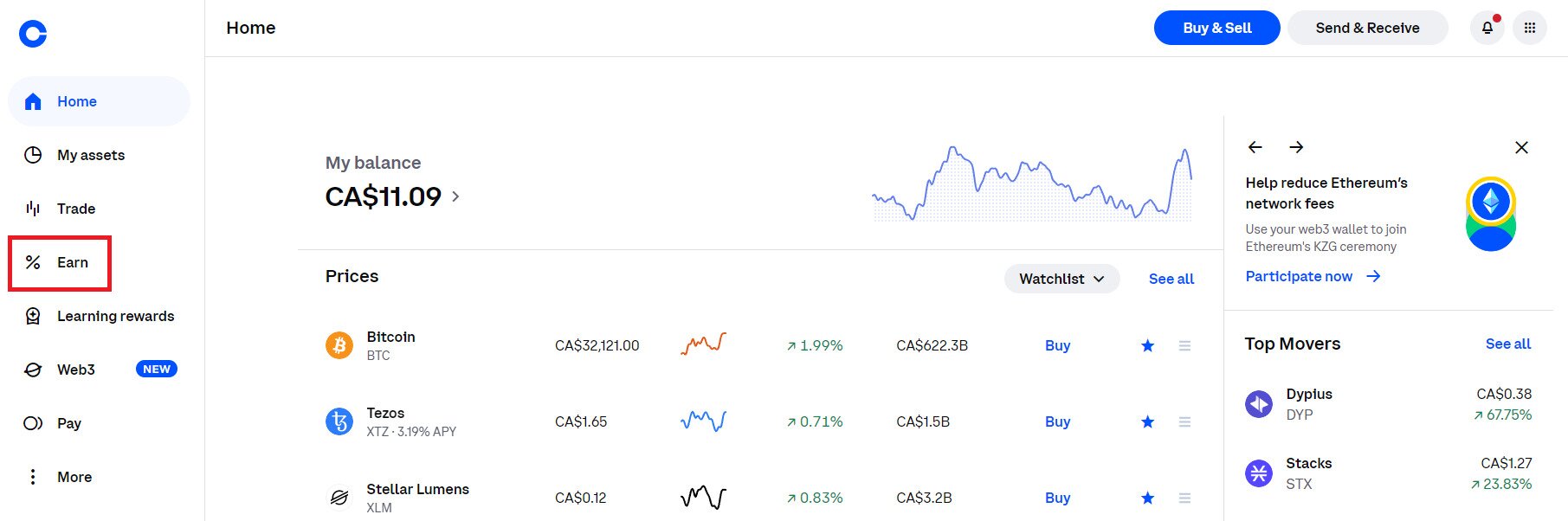

Step 1: Log in to your Coinbase account. Then locate the “Earn” tab on the right side of the homepage (and every page). Click “Earn”

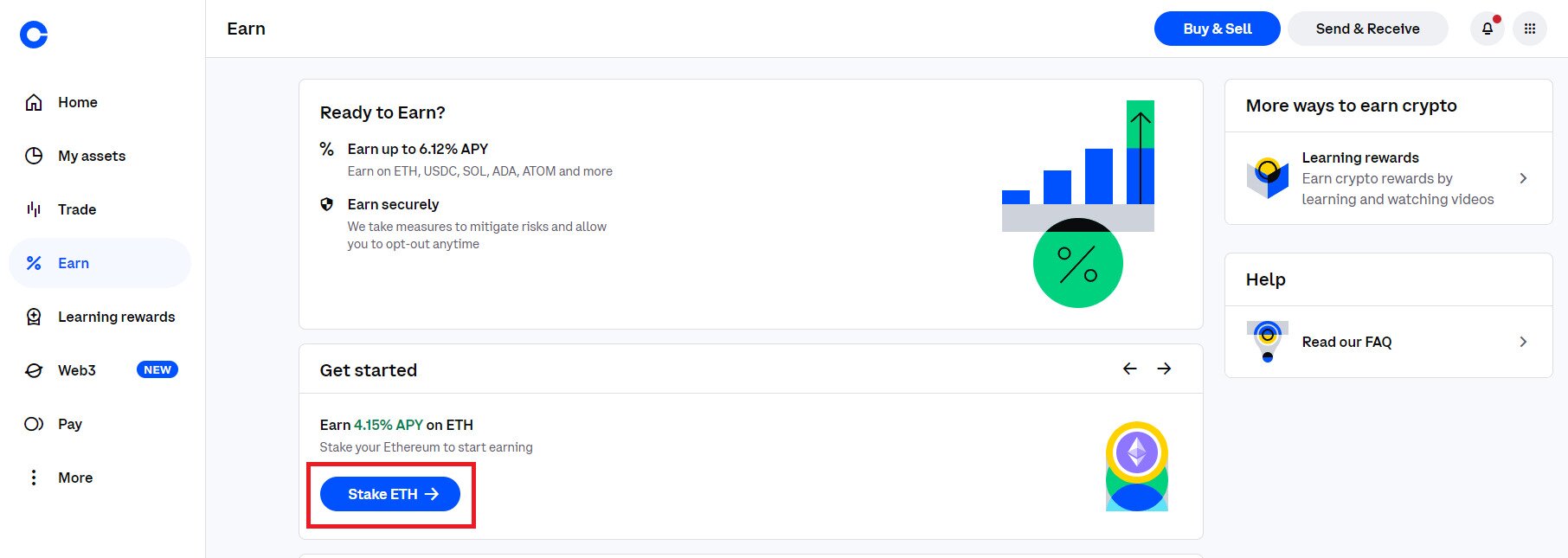

Step 2: Once you’re on the Coinbase Earn page, you can see the assets you have to stake in the Get Started box. Click “Stake ETH”. If you don’t already have an asset you can stake, it will instead show you which assets you can buy and their staking annual percentage return (APY).

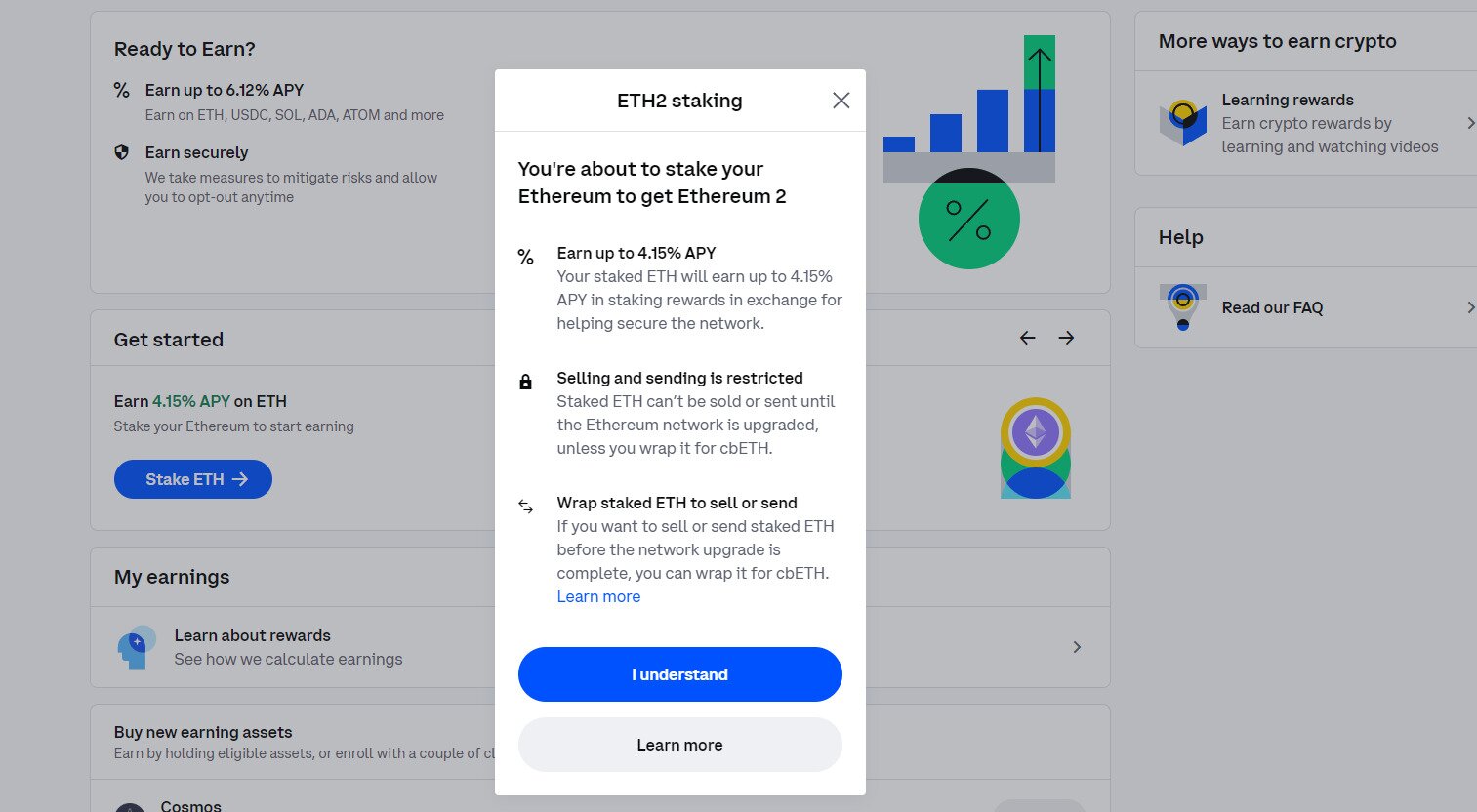

Step 3: After clicking “Stake ETH” (or whichever asset you choose to stake), you will see the below prompt. Click “I Understand”, or if you want to find out more about the staking process click “Learn More” instead.

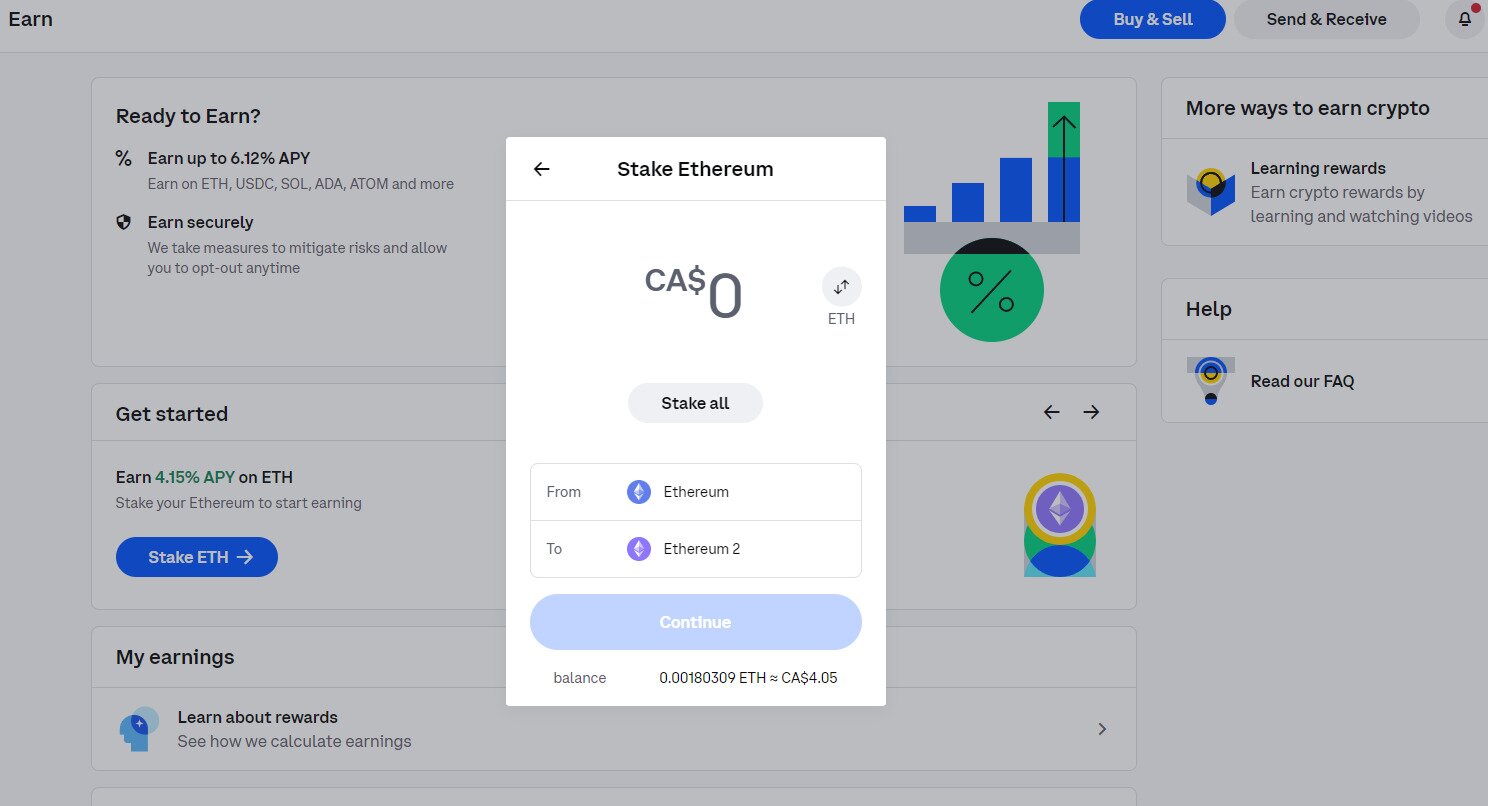

Step 4: Enter the amount of ETH you wish to stake, or click “Stake All” to stake your entire balance. For other assets the prompts will be the same. When you’re satisfied with the amount, click “Continue”.

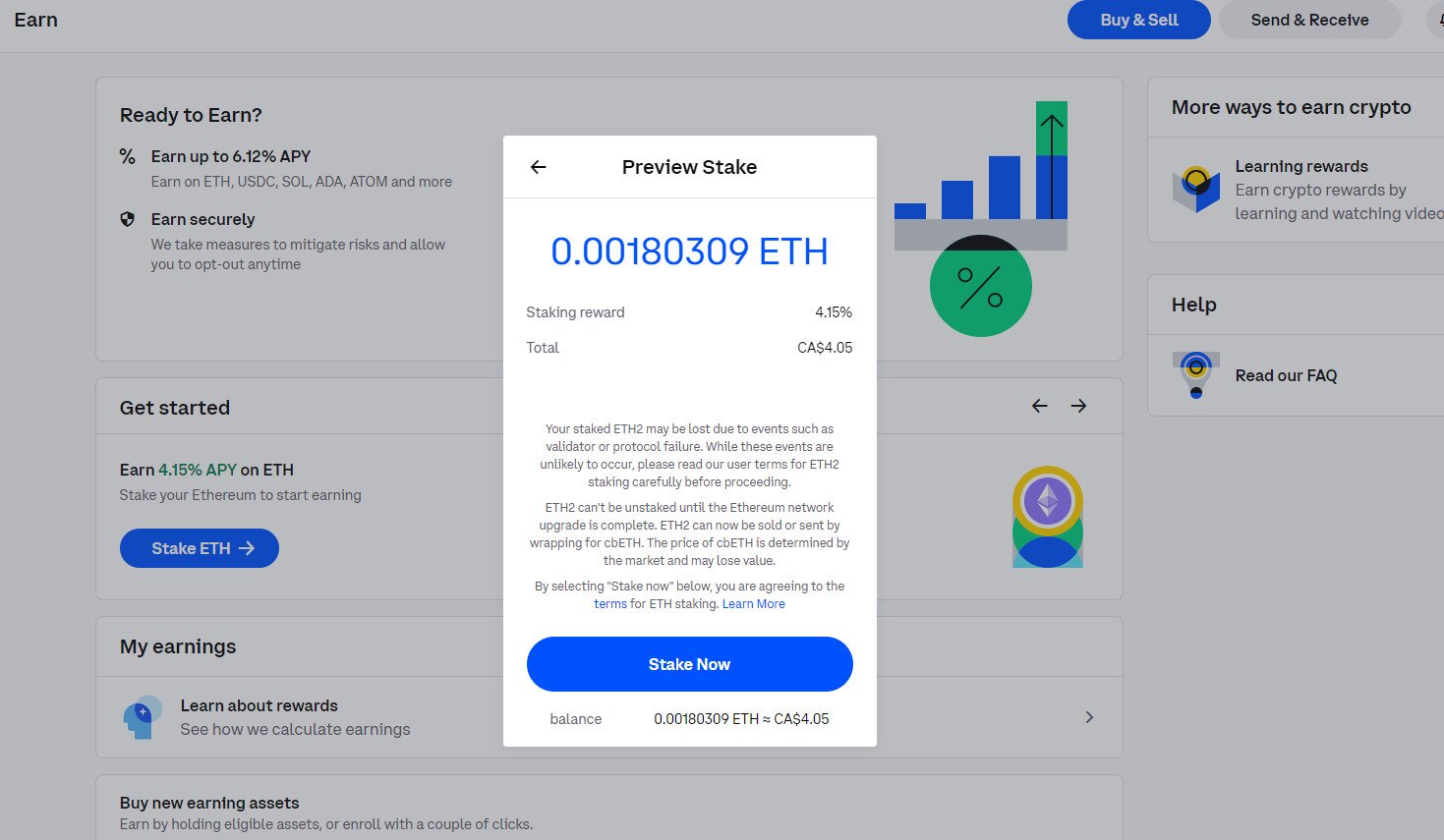

Step 5: You will then be shown the below prompt. Review the amount you’re staking, the staking reward, and read the terms. When you’re ready, click “Stake Now”.

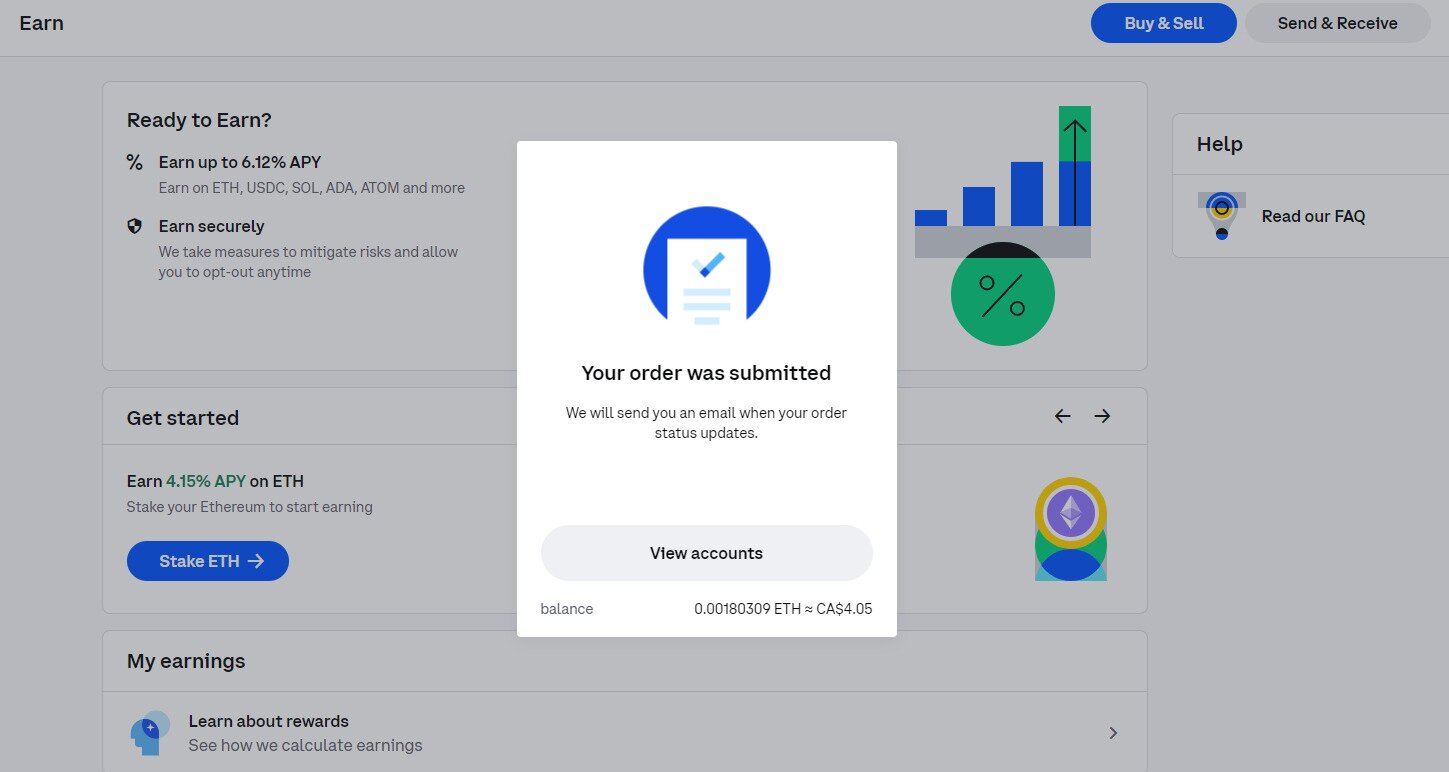

Step 6: You’ll then be shown the below confirmation that your staking order has been submitted to Coinbase Earn. You can see how much you’re earning at any time on the Earn page.

That’s it! You’re now staking on Coinbase Earn. Rewards will automatically accrue and be shown like below on the Earn page.

Is Staking with Coinbase Safe?

Yes, staking with Coinbase is safe. There is no risk to your principal balance. Staking ETH used to have a risk before it successfully completed the Merge because if the Merge wasn’t completed successfully then you’d never receive staking rewards. However, with the successful switch of ETH from proof of work to proof of stake, there is now no risk with staking any asset using Coinbase.

Recently the SEC in the USA has been cracking down on exchanges offering staking services (most notably Kraken) but they haven’t touched Coinbase (which is a publicly traded company) so it remains to be seen what will happen. Regardless staking would remain available around the rest of the world.

How do Coinbase’s Returns Compare to Other Staking Services/Methods?

Coinbase’s staking rewards are comparable to other exchanges, with some platforms such as Binance and KuCoin offering more risky forms of staking with higher returns. However, compared to staking assets directly to a protocol yourself, the returns can be low.

For example, if you stake Cardano to a validator on the Cardano blockchain rather than to Coinbase, the average return is about 4% per year. Compared to the 2% being offered by Coinbase, this is low. However, you’re trading a bit of return for the convenience of Coinbase’s Earn program.