- >News

- >Are Experts Right to Say Bitcoin Will Eventually Replace Fiat Currency?

Are Experts Right to Say Bitcoin Will Eventually Replace Fiat Currency?

Hyperbitcoinization is coming. Yes, according to a panel of 42 cryptocurrency executives and researchers, Bitcoin will one day replace fiat currency, with 54% of this panel predicting that this will happen by 2050 at the latest (if not earlier).

This is an extremely bullish prediction, with the implication being that, if bitcoin does replace a significant number of fiat currencies, its price will have skyrocketed.

Skeptics may dismiss such an exuberant forecast immediately out of hand, yet the survey in question includes input from 12 researchers at recognized universities, suggesting that it isn’t based only on wishful thinking. However, as encouraging as the survey’s conclusions may be for some, it’s this author’s opinion that it’s highly unlikely bitcoin will ever replace fiat currencies.

While some governments may end up adopting bitcoin as a reserve asset (i.e. as a complement to gold), it seems hard to believe that any major nation-state will willingly adopt it as its main or only currency. Because to do so would entail a number of very undesirable consequences from the perspective of governments, from making debt increasingly expensive to dampening consumption and making business cycles more extreme.

When Moon? And Hyperbitcoinization?

A study published by Finder.com in 2021 produced some interesting conclusions regarding the prospect of hyperbitcoinization.

61% said that bitcoin (which was worth $39,000 at the time of the study) was undervalued, with the average price prediction for the end of 2021 hitting $66,284. It turns out they were more-or-less correct with Bitcoin hitting $69,000 by November in 2021.

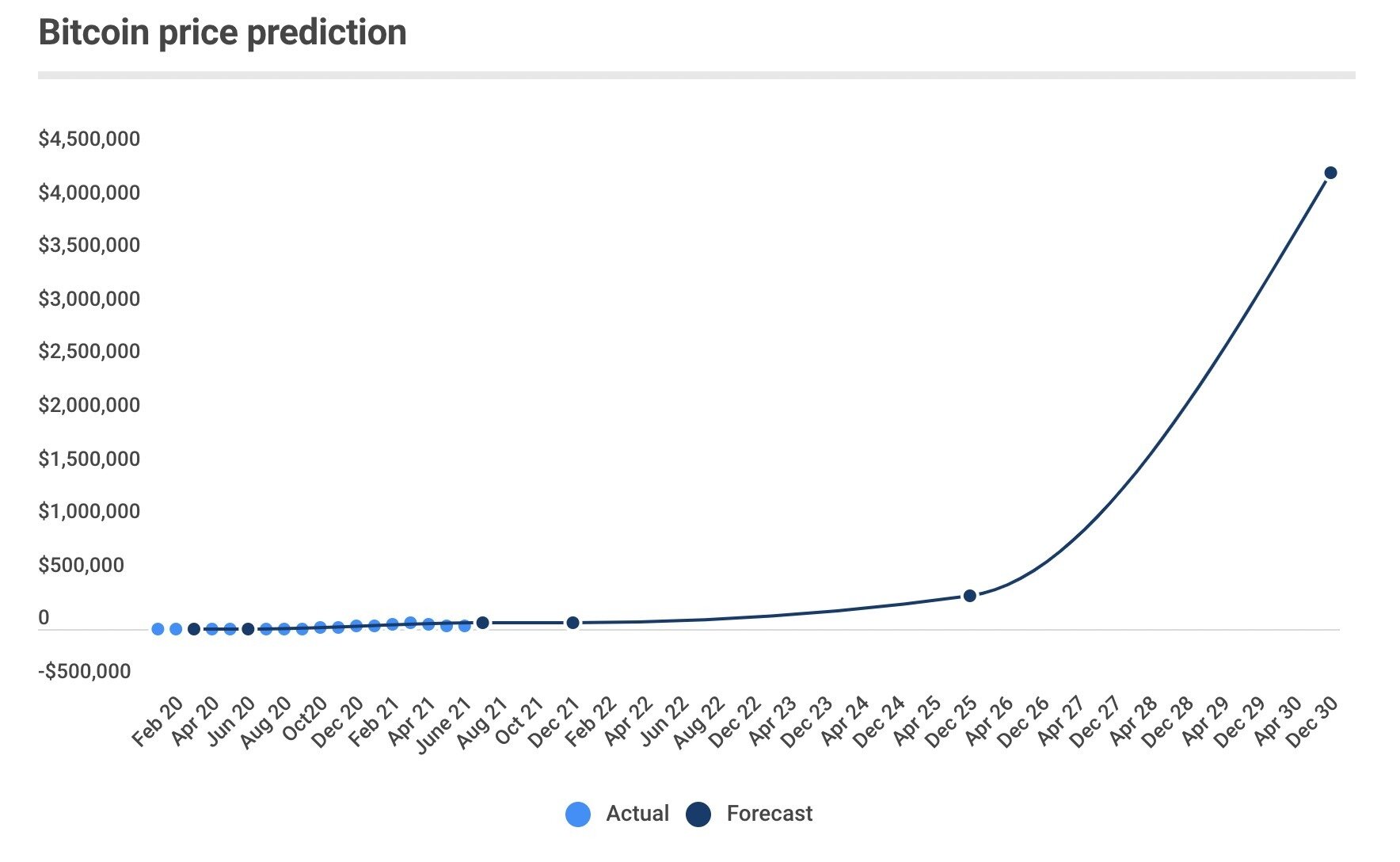

More interestingly, the panel’s average prediction for the end of 2025 is $318,417, while the average for the end of 2030 is a whopping $4,287,591 (although the median prediction for this date is only $470,000).

Source: Finder.com

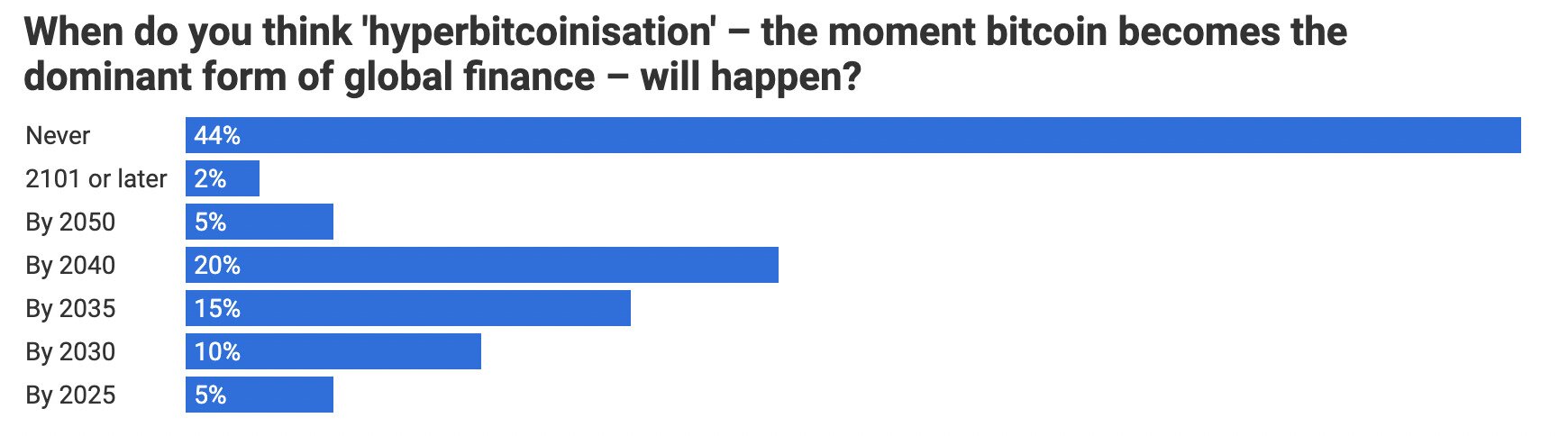

As for views on hyperbitcoinization — the process of bitcoin replacing one or more fiat currencies — 54% of the 42 panelists believed it would at some point happen by 2050, with this percentage fairly evenly split as to when exactly.

Source: Finder.com

As the above graph illustrates, 5% of the panel (or rather, two people) think hyperbitcoinization will occur within four years. 10% (or four people) think it will happen in under nine years, while 15% (or six people) think it will happen in about 14 years. The largest percentage (20%) of true believers think it will happen in about 20 years, while a few suspect it will be much more distant.

Referring to El Salvador’s adoption of bitcoin as legal tender, Amber CEO Aleks Svetsk believes it could set a trend that may ultimately lead to some form of hyperbitcoinization.

“The momentum will only pick up. But the beauty is also that these broken nations will transform faster than major nations as Bitcoin undermines the nation state model,” he said.

Likewise, Coinmama CEO Sagi Bakshi also suspects that El Salvador could end up being a trailblazer.

“All eyes on El Salvador now – some mocking, some crossing fingers. I am sure that their use case will be a great example of innovation and fast penetration. Financial services will be built on top of a public ledger, and the naysayers will be surprised,” he said.

Why Governments Will Resist Bitcoin

However, while a good portion of the survey’s panel were optimistic, it needs to be pointed out that 44% of the panel said that hyperbitcoinization will never happen.

As opposed to the gung-ho industry CEOs, it was largely the researchers — who have much less of a financial interest in bitcoin succeeding — who took this view.

“I can envision a world where Bitcoin is used by populist governments to challenge and undermine the dominant economic forces in our world, but more as a bargaining tool than because they are true believers,” said Dr Paul J. Ennis, who’s an assistant professor at the School of Business at University College Dublin and whose research currently focuses on cryptocurrency.

As far as this author is concerned, this is more or less the correct view to take. Hyperbitcoinization in its strictest sense — bitcoin replacing national fiat currencies — will almost certainly never happen.

On the one hand, governments will never willingly replace their own fiat currencies with bitcoin. And for various reasons.

Firstly, most governments fund their spending on public services (and war) through debt financing, meaning they sell bonds (they also raise tax, but let’s put that aside for now). For example, the UK government sold over £500 billion (c. $681 billion) in bonds in 2020, while the US government owes $1.1 trillion to China alone via the sale of bonds.

Imagine if such debt were denominated in bitcoin. Knowing that BTC has a fixed supply and is a deflationary currency, it could potentially make a $1 trillion debt become even more insanely expensive in a few years time. Much the same applies to corporate bonds, which reached $1.3 trillion in the US in 2020.

The subject of corporate bonds touches on another problem: by making credit more expensive, bitcoin would potentially limit economic growth, by making it harder for companies to repay loans. Copious amounts of research have long shown that raising interest rates (and lending in bitcoin would be tantamount to imposing a high interest rate) results in more corporate failures and bankruptcies. One possible way out of this would be to actually offset bitcoin deflation by adding a negative interest rate, so that borrowers actually have to pay back a little less BTC than they receive. But would lenders really be willing to accept less bitcoin than they lent, particularly when they could simply sit on their bitcoin instead and let it appreciate?

And one of the other unfortunate consequences of deflationary currency such as bitcoin is that it would likely weaken consumption, something which has been shown (in the case of Japan) to result in economic stagnation.

Indeed, they may get a bad rap, but inflationary currencies have their uses and benefits, and spurring spending — and hence job creation — is one of their prime virtues. Likewise, the ability of governments to print money and spend extra during economic crises (as with Covid-19) is also pretty important as far as smoothing out business cycles goes, with research showing that monetary shocks (i.e. a lack of money) during the gold standard era often exacerbated the severity and duration of contractions.

Reserves, Not Currencies

Basically, there are plenty of reasons why most nation-states would not want to replace their existing fiat currencies with bitcoin.

On the other hand, proponents of hyperbitcoinization may argue that the process of bitcoin becoming the dominant form of currency will have nothing to do with governments, who may even become irrelevant or obsolete by the time of BTC’s ascendance. However, the disappearance of governments and nation-states (as Aleks Svetski’s comments implied) is such a speculative, remote and alien outcome, that it would be very hard to predict, among other things, whether bitcoin would become the dominant currency in such a scenario.

But even if the prospect of hyperbitcoinization is unlikely, it’s also this author’s opinion that we could eventually witness numerous central banks and/or governments adopting bitcoin as a reserve asset of some kind. Assuming that bitcoin continues to be bought and invested in by major institutions and corporations, its value will sooner or later increase to a level where many governments may find it hard to resist owning some bitcoin in addition to gold.

This is basically what Morpher CEO Martin Fröhler predicts, although he went as far as suggesting bitcoin will supersede gold.

“The next halving cycle will see increased adoption of Bitcoin as a legal tender by developing countries, and [by] 2030, Bitcoin will have replaced gold as a global reserve asset,” he said.

And from the point of view of current bitcoin holders, this should be almost just as good as hyperbitcoinization, since it will imply a greatly elevated price.