- >News

- >Ask CryptoVantage: Is There a Way to Buy Bitcoin with Zero Fees?

Ask CryptoVantage: Is There a Way to Buy Bitcoin with Zero Fees?

One of the first questions most crypto beginners have is whether they can avoid fees completely when purchasing Bitcoin for the first time.

Unfortunately, there’s currently no way around paying some amount in fees or premiums when buying bitcoin.

The important thing is to understand what fees you should expect when transacting in Bitcoin and which ones are extraneous to the network.

Companies that advertise zero fees usually make their profit by buying bitcoin below market rates and then selling it for more.

Even if you find a company selling bitcoin with zero fees and zero premiums, you must still pay a network transaction fee (also known as a mining fee) when you send the bitcoin to your own wallet. Check out our article “Why Do I Need a Crypto Wallet?” for more information on using your own wallet.

It’s important to know what types of fees you might run into when buying bitcoin. This article explains the four types of fees you may come across and gives tips on how to minimize fees when buying bitcoin. While the ability to buy bitcoin without fees isn’t feasible at this point, you can still pay very low fees.

Types of Fees to Consider When Buying Bitcoin

Funding and Withdrawal Fees on Exchanges

Some exchanges require that you pay a fee in order to send money to – or receive money from – their platforms. This can include both traditional currencies and cryptocurrencies. The fee that an exchange charges to add funds to your account is called a “funding fee” or a “deposit fee”. The fee they charge to send funds from your account to an external wallet is called a “withdrawal fee”.

These two types of fees can be handled in different ways. Some exchanges charge a flat fee (usually anywhere from $1.99 to $5) or a percentage (.02% up to 1% in some cases).

These deposit and withdrawal fees can be very important to understand if you’re new to crypto. For instance if you wanted to buy a minuscule amount of Bitcoin — let’s say $10 — than a crypto exchange’s flat fee of $2.99 would be a serious problem. In that case it would be far better to use an exchange that charges a percentage.

In addition there are also different fees depending on what financial instrument you use to deposit or withdrawal. In general credit and debit cards are the most expensive ways to deposit on crypto exchanges (although they are also the fastest) while bank transfers are cheap or even free in some cases (but they can take up to a few days to get processed).

Trading Fees

Most exchanges charge a small amount, usually 0.1% to 0.2%, for every trade you make on their platform. This might not sound like much, but it can add up if you frequently trade cryptocurrencies.

You may see these trading fees referred to as “maker” and “taker” fees. These terms refer to the fact that you are either “making” an order (i.e. adding a new order to their orderbook), or you are “taking” an order (i.e. filling an order that someone else has already added to the order book). Maker fees are typically discounted compared to taker fees because exchanges want to incentivize people to create new orders. New orders increase liquidity (the amount of trading activity that is taking place), which makes the exchange more valuable.

In general any kind of “instant” purchase will be more expensive than taking the time to properly fund your account.

Premiums

Some companies that buy and sell cryptocurrencies claim not to charge any fees, but they make profits by charging a premium on the bitcoin they sell. For example, if the market price of one bitcoin is $7000, the company will buy bitcoin at that price and then sell it for $7200.

This is often referred to as “spread” and it’s important to do some research and get an idea about what the spread is like on the exchange you want to use. It can be difficult to find the “true” price of a crypto but if you check enough exchanges you’ll get a better idea of what’s reasonable.

Transaction Fees (Mining Fees)

On top of any other fees or premiums you may pay, when you transfer bitcoin, or almost any other cryptocurrency, you will need to pay transaction fees. A transaction fee is also known as a mining or network fee, and is paid to whichever miner adds your transaction to the blockchain. This means that if you want to truly own bitcoin, you need to pay transaction fees to have the bitcoin sent to your wallet.

The cost of the transaction fees are based on how many people are using the network so they vary drastically. Over the last few years they’ve been as low as a 50 cents but they can also reach up to $62 (!) per transaction. This is an ongoing problem with the Bitcoin network and various technologies are being developed to deal with the high transaction cost (including the Lightning Network) but for the time being it’s important to check the current transaction fees before you send. Remember that sending BTC will be cheaper during off hours.

Regardless, the vast majority of the time you should expect to pay somewhere between $1 and $3 per each time you send Bitcoin.

It is also important to know, however, that exchanges and wallets often pay higher than the minimum fee in order to get the transaction added to the blockchain faster. Finally, and this is an important one, transaction fees do not increase with the amount of bitcoin being sent – you can send $10 or $1,000,000 worth of BTC for the same fee! That would be unheard of in traditional finance.

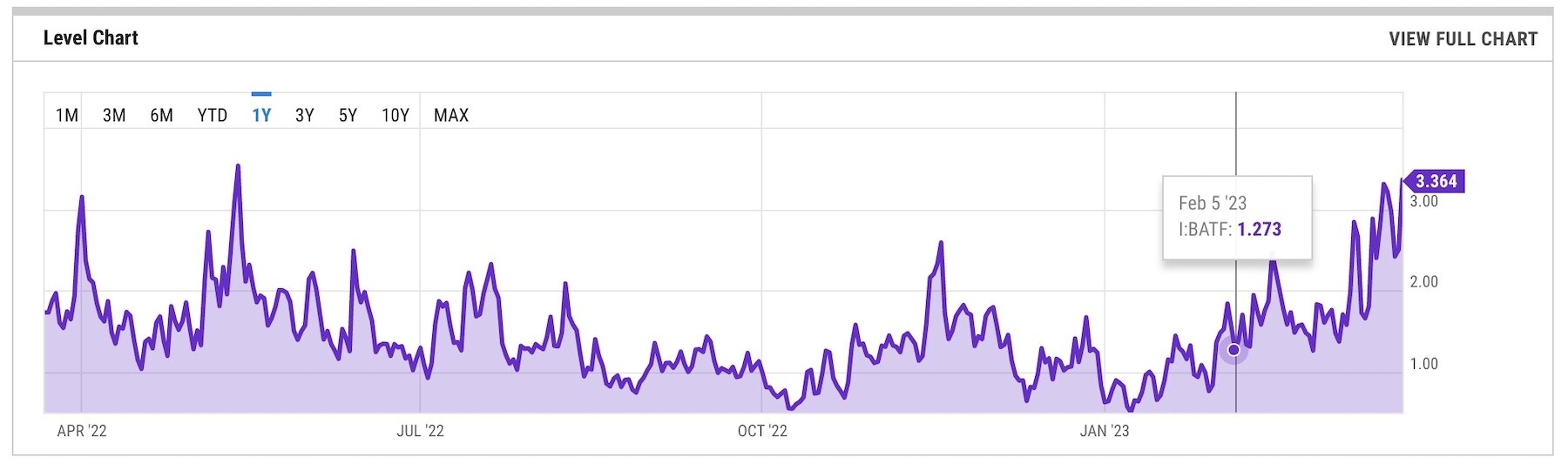

An example of Bitcoin fees over the last year. Bitcoin fees were $3.36 on the day this screenshot was taken. Chart courtesy of ycharts.com.

Reducing Fees When Buying Bitcoin

When choosing which exchange to buy from, don’t just look at the price that they offer. It is also very important to look at the fee structure. Does the exchange charge its users to send money to or from their own exchange accounts? Will there be an additional trading fee charged when you buy bitcoin on this exchange? Is there a premium included in their price? Answering these questions will give you a more realistic idea of what you’ll end up spending on bitcoin from any given exchange.

You can also save on fees by buying bitcoin directly from someone you know who may be looking to sell. Be very careful if you go this route since there are so many scammers out there. It’s possible for a scammer to impersonate one of your friends or family members and pretend like they want to sell you bitcoin.

Summary

It’s helpful to consider the different types of fees and premiums you might need to pay when you buy bitcoin. But remember, be very careful of scammers: It’s even more important to buy bitcoin from a trustworthy and reputable source (we reviewed some here).

For more information on avoiding crypto scams, read our guide “How to Spot Crypto Scams”.