- >News

- >Ask CryptoVantage: What Are Considered “Blue-Chip” Cryptos?

Ask CryptoVantage: What Are Considered “Blue-Chip” Cryptos?

In moments of true innovation, we naturally reach for an analogy to the world we know. In the web3 era, and especially in DeFi, we reach for analogies to traditional finance. We use terms like ‘digital gold’ to describe bitcoin and we start with the traditional art market when thinking about Non-Fungible Tokens (NFTs).

As investors, we’ve lived in the FAANG (Facebook, Apple, Amazon, Netflix, Google) era for so long that we’re trying to find the next big winners amongst the plethora of cryptocurrencies. Although we need to look deeper into elements like the size of the user base, the quality of the software, consensus mechanisms, the developer community, it’s utility in the world, and it’s transaction volume, speed, and cost, we can still be relatively sure that projects on top of the charts for an extended period of time will continue to perform.

That begs the question, what are the blue-chip cryptocurrencies? Today, the blue-chip cryptocurrencies are bitcoin, ethereum, binance coin, and solana.

What Does ‘Blue-Chip’ Mean?

In traditional finance, ‘blue-chip’ refers to a company that is widely recognized as a high-performer over an extended period of time. It’s a direct analogy to when poker chips were blue, red, and white, with the blue chips being the most valuable. Blue-chip stocks have stood the test of time, have weathered bear markets and down-turns and are seen as being financially stable and productive over time.

Although volatility is an inevitable part of any long-term investment strategy, blue-chip stocks are seen as less volatile because of their institutional nature. The brand is trusted and widely used, the market cap is often north of $5B USD, and they are often included in major indices like the S&P500. As it stands today, the major S&P500 allocations are names you will no doubt know: Facebook, Apple, Amazon, Microsoft, Alphabet, and Tesla. All of the above are widely used and have obvious utility in the world.

How Do We Define ‘Blue-Chip’ in Crypto?

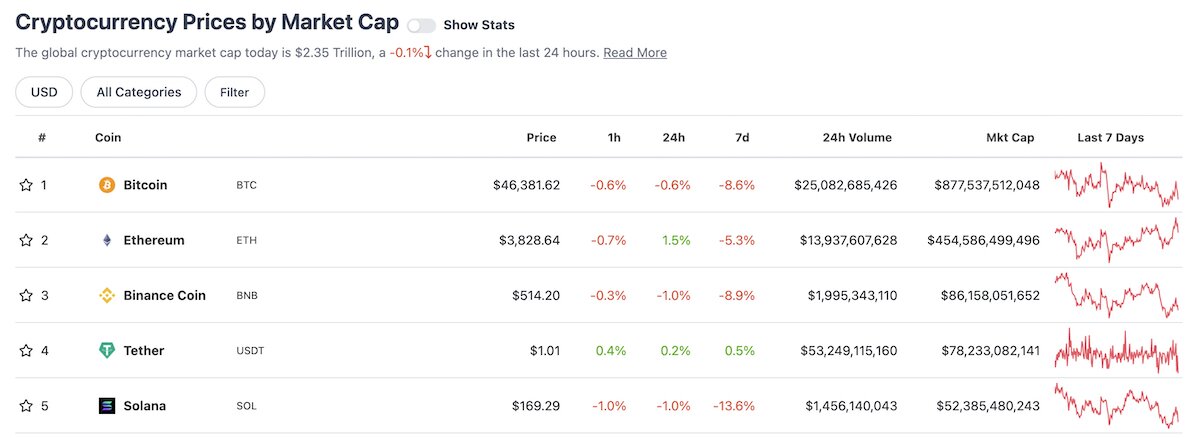

Defining what is ‘blue-chip’ in crypto can be a much greater challenge because of the innovative and unique nature of the industry itself. Let’s start by taking a look at the current market caps in USD.

What you’re looking at above are the top 5 cryptocurrencies by market cap. We can also look at the spot price but that is less interesting to those who simply want to HODL and likely does not dictate longevity. Let’s unpack each of these coins.

What Are the ‘Blue-Chip’ Cryptocurrencies?

Bitcoin

The obvious blue-chip cryptocurrency is bitcoin. Bitcoin is a robust digital store of value created by the anonymous Satoshi Nakomoto in 2009 and was first described by the creator(s) as a ‘Peer-to-Peer Electronic Cash System.’ Bitcoin was the world’s introduction to a truly decentralized financial system that uses an innovative Proof-of-Work (PoW) mining and consensus system.

It has a finite, and predetermined maximum of 21 million bitcoin, with the final coin being minted around the year 2140. Bitcoin’s market cap is hugely significant in any financial context, currently boasting a size about 1/10 of the entire gold market. It has hundreds of millions of users and is on the same growth trajectory as the internet itself in the later 1990s.

Although some who doubt the legitimacy of bitcoin will point to it’s volatility in the short term, on a long enough time scale it’s direction is singular: up and to the right. When we use the word ‘blue-chip’ we are looking for that track record and performance over time. With recent developments like the lighting network (a bitcoin layer 2 protocol) and taproot (it’s most recent software upgrade) we will be looking to see if bitcoin sustains it’s incredible growth path.

Ethereum

Performance over time is, in many ways, what makes cryptocurrency and DeFi so hard to measure here and now. We’ve seen pump-and-dumps of epic proportions and coins that don’t have a value proposition or even a real-world use case.

That, of course, is not true of the entire DeFi space. DeFi continues to prove it’s legitimacy as more and more users opt out of the closed, traditional financial system in favour of peer-to-peer, open protocols.

The most robust and active DeFi blockchain to date is ethereum. Ethereum has only been live for six years, and it’s impressive run since 2015 has us asking some obvious questions about what is next. Ethereum is responsible for the explosive rise of the NFT market and it’s core token, ETH, is the second largest cryptocurrency by market cap.

Ethereum has millions of dedicated users and is currently leading the DeFi space by a mile, but there are elements of the project we will be watching closely going forward. It’s ‘upgrade’ to Proof-of-Stake (PoS), lowering it’s transaction fees, enhancing transaction speed, and watching the rise of it’s core token will all factor into ethereum remaining a cryptocurrency blue-chip.

Binance Coin

Binance coin is the core token of the largest cryptocurrency exchange by daily total trading volume, Binance. Newer still than bitcoin or ethereum, there has only been a market for binance coin since 2017. As all ambitious exchange projects propose to do, Binance wants to bring cryptocurrency investing and trading to the forefront of our new financial reality.

Binance harnesses the amazing power of Web3 composability for it’s users. There is a robust blockchain, trusted wallets, and even Binance Academy for those who want to learn more about cryptocurrency. It can be hard to validate the robustness of the core token of a cryptocurrency’s blockchain, but the success of binance coin has been the core of Binance’s many initiatives in the space, creating a positive feedback loop for users.

We will be looking to see if binance coin (and Binance itself) can stand the test of time.

Solana

In November 2017, Anatoly Yakovenko published the Solana whitepaper that outlined the creation of a ‘Proof of History (POH)’ blockchain whose goal is becoming the ‘fastest blockchain in the world.’ At its core, they would use a new method of keeping time between network validators. Combined with Proof of Stake (POS), and as long as validators can all agree on time, processing transactions becomes, in theory, very fast.

Solana’s creators have ambitions of becoming the highest throughput blockchain in the world while maintaining low cost. Easier said than done, as most blockchains tend to have higher fees as more and more transactions are processed across the network. As usage on other major blockchains, like Ethereum, continues to rise, transaction time and fees rise in tandem. Solana’s creators claim that this limits their potential and impacts scalability and they believe they’ve created a solution which makes them the “fastest growing ecosystem in crypto.”

In April of 2020 Solana’s core token, SOL, was introduced to the market and rose to prominence quickly.

Although Solana has enjoyed an incredible rise, becoming ethereum’s obvious competitor, it does have lofty ambitions and time will tell if they play out. Solana not only wants to power DeFi transactions, it wants to be the most powerful blockchain in the space for dApps, NFTs, DAOs, and decentralized social media.