- >News

- >Ask CryptoVantage: What’s the Best Basic Strategy for Bitcoin Investing?

Ask CryptoVantage: What’s the Best Basic Strategy for Bitcoin Investing?

Different bitcoin investment strategies work for different people, depending on the amount of money they want to invest as well as their risk tolerance. The simplest and most widely recommended strategy is called dollar cost averaging, which involves buying the same amount of bitcoin at recurring intervals.

Another common bitcoin investment strategy is lump sum investing, which can be a preferable method of investing if you have a large amount of cash and are willing to hold onto the bitcoin for a long time. The riskiest bitcoin investment strategy is bitcoin trading, which is based on the concept of buying low and selling high. This article explains these common bitcoin investment strategies so that you can be better informed when you decide which strategy is right for you.

Dollar Cost Averaging

The dollar cost averaging strategy (buying a pre-determined amount of bitcoin at set intervals) allows you to purchase bitcoin at the average cost over a certain period of time. This reduces the risk of the value of your bitcoin significantly dropping, but also reduces the chance that the value will drastically increase.

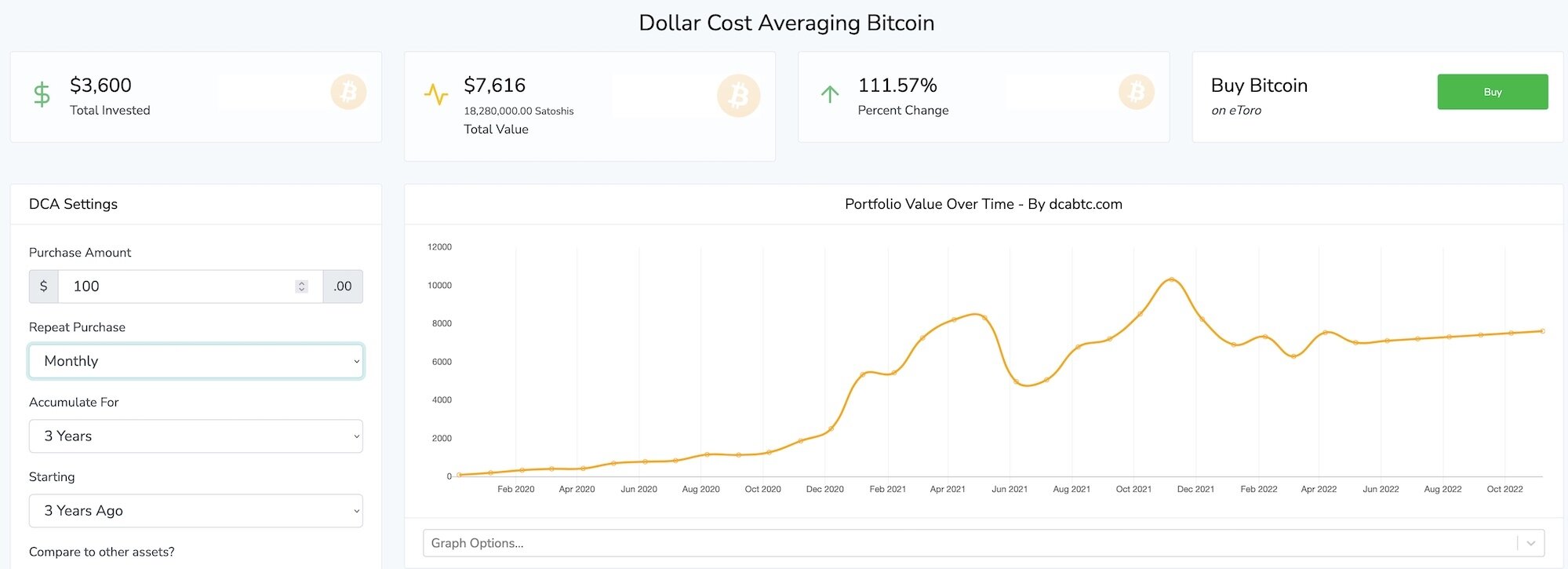

If you want to dollar cost average into bitcoin, you need to decide on a pre-determined amount of bitcoin to buy at set intervals, depending on your budget. For example, you might choose to buy $50 worth of bitcoin every week, or maybe you want to spend $100 out of every paycheck on bitcoin. If you had spent $100 of every paycheck on bitcoin for the past three years, you would have spent roughly $3,600 on bitcoin that is now worth $7,616, despite a recent market downturn. To get a feel for the dollar cost averaging technique and its historical performance try out the calculator at www.dcabtc.com. To learn even more check out our How Do I Dollar Cost Average into Bitcoin guide.

Here’s a look at a monthly investment of $100 into Bitcoin for three years till the time this article was published:

Lump Sum Investing

If you have a large amount of cash that you want to invest in bitcoin, and you are willing to accept a higher risk, then lump sum investing can be a good option. This technique involves purchasing a larger amount of bitcoin up-front and holding onto it until you decide to cash out.

Historically, lump sum investing has almost always been a profitable bitcoin investment strategy if the investor was willing to hold the bitcoin for a long enough time. The danger is that you could buy at the top of the market and have to wait years to become profitable or even break even. For instance in late 2017, Bitcoin peaked at roughly $19,000 per coin but then fell back down to as low as $3,000 over the next few years. It wasn’t till 2021 that it broke the barrier (and went far higher).

Lump sum investing can be a riskier strategy, but it also has the potential for higher rewards because you are making your entire investment at a single bitcoin price. There’s a common saying in the investment world: “time in the market beats timing the market”.

Bitcoin Trading

Bitcoin can be traded on exchanges in the same way as stocks, commodities, and other currencies. Unlike traditional markets, bitcoin and cryptocurrencies are available for trading 24/7.

Some investors try to increase their bitcoin holdings by trading profitably (buying low and selling high), but we do not recommend this approach, even for experienced investors. Most people lose money when trying to buy low and sell high because they are trading against either professional traders or trading bots that use algorithms to analyze the markets and make trades nearly instantly.

Considerations

If you have a large amount of cash and want to invest it in bitcoin, your two safest options are dollar cost averaging and lump sum investing. If you plan to hold onto your bitcoin for the long term and are willing to accept the added risk, lump-sum investing can be very profitable. On the other hand, if you want to play it more safely, you can choose to invest smaller, recurring amounts in bitcoin using the dollar cost averaging strategy. Remember, by dollar cost averaging, the cost of your bitcoin will be closer to the average over the period in which you invested, and you will not have to worry about a sudden drop in your bitcoin’s value.

No matter what method you choose, there are a few things to be aware of when getting started with bitcoin investing. First, there are many scams in the bitcoin and cryptocurrency space disguised as investment schemes. Read our guide on How To Spot Cryptocurrency Scams to protect your bitcoin investment. It is also important to ensure that you are holding your bitcoin in a wallet that only you have access to. Remember – not your keys, not your coins!