- >News

- >Bitcoin Payments on the Rise but Speculation Still Dominates

Bitcoin Payments on the Rise but Speculation Still Dominates

The popularity of bitcoin as a means of payment is steadily on the rise, despite the widespread perception that it’s used almost exclusively for speculation. A new report from BitPay has found that merchants who adopt bitcoin and cryptocurrency payments attract new customers, while also increasing average order values, reducing fees, and avoiding chargeback costs.

BitPay’s research also found a gradual increase in adoption, adding to other research and data released this year which found the same thing. Taken together, the available evidence indicates that the use of cryptocurrency as a medium of exchange is on the rise, and is arguably enjoying trickle down effects from the growing use of crypto for speculation and as a store of value.

The Benefits of Bitcoin And Crypto As A Means of Payment

Conducted on behalf of BitPay by research analysts Forrester, the latest study found clear and tangible benefits of bitcoin adoption among merchants that accept it.

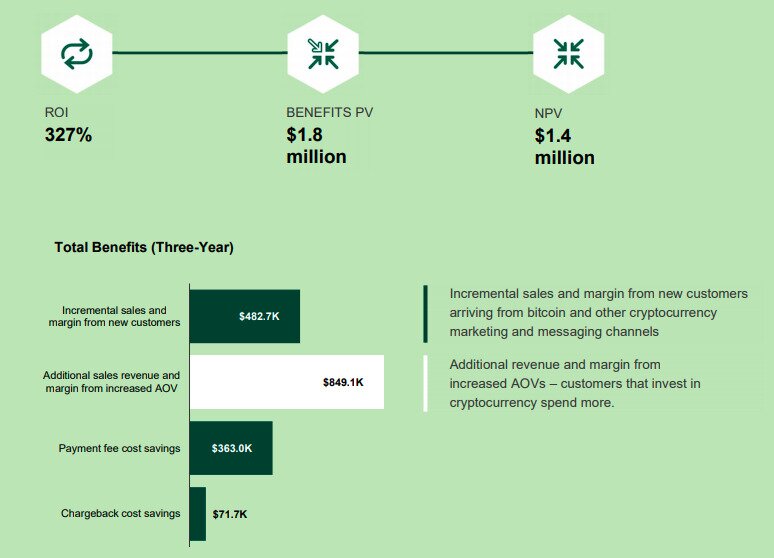

Looking in particular at four (unnamed) merchants, sales rose from new customers over a three-year period as a result of accepting bitcoin payments via BitPay, as did a number of other key performance indicators.

The average merchant witnessed the above benefits over a three-year period. Source: Forrester/BitPay

Forrester discovered that customers who purchase items using crypto spend around $450 more per transaction on average than customers using fiat currencies. Coupled with the lower charges from BitPay (1% as against card fees of around 2.25%), the research indicates retailers would have much to gain from accepting crypto in larger numbers.

The research also found a variety of “unquantified benefits,” including increased customer satisfaction and lifetime value, as well as peace of mind (by avoiding chargebacks and higher fees). Another 2020 Forrester survey cited in the report also found that adoption has been boosted by the coronavirus pandemic, with 11% of consumer respondents saying they’ve used a digital payment method for the first time.

This same survey has found a longer term increase in bitcoin use for ecommerce, compared to a similar survey conducted in 2018.

Source: Forrester

The above increases may be very slight, but they contradict a litany of naysayers who’ve claimed a continuing decline in the use of bitcoin (and crypto) for payments.

They’re also more impressive in the light of the rising use of bitcoin for speculation and as a store of value, with institutions increasingly investing in it. It seems that despite — or perhaps partly because of — the fact that more people want to hold onto bitcoin while it rises in price, more people are using it to actually buy things.

Other Research Points To Growing Use

An increase in the adoption of crypto for payments is supported by other research published this year. Back in January, London-based insurance provider HSB published the results of a survey of 505 small to medium-sized businesses in the United States. It found that 36% of American SMEs accepted cryptocurrency, while 59% of this sub-group purchased digital currency for their own use as well.

The survey also found that newer companies are more likely to accept crypto. 47% of the SMEs which accept cryptocurrency had been in business five years or less, compared to only 21% which had been operating for over 20 years. In other words, we’ll likely see adoption of crypto among merchants increase in the future, with newly founded companies being more likely to accept bitcoin and other cryptos.

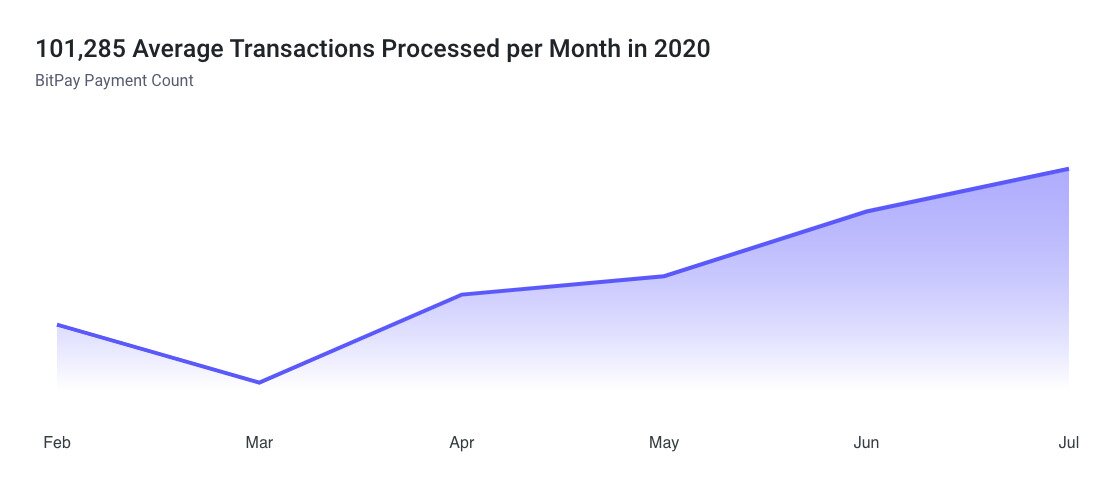

BitPay’s own data also indicates a steady increase in adoption. In 2018 and 2019, the payments processor recorded volumes of just over $1 billion. This year seems to be witnessing a gradual increase beyond this benchmark, as indicated by the continuously rising monthly volumes illustrated in the chart below.

Source: BitPay

BitPay’s data shows a volume of 98,548 transactions for the month of February, before full national lockdowns were introduced throughout much of the world. This figure has risen to 109,847 as of July, which is the latest month for which BitPay has published data.

This is an 11.5% increase in only five months. It would therefore seem that the coronavirus pandemic is pushing more people towards crypto as a medium of exchange, largely because this same pandemic has been pushing many of us towards online shopping.

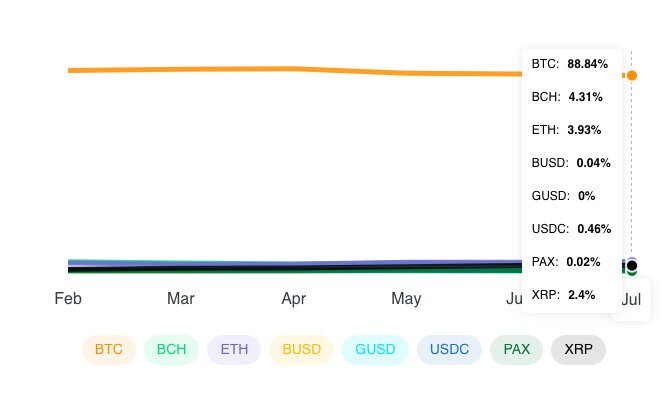

And what’s interesting about BitPay’s data is that it reveals Bitcoin’s dominance in online payments, even though it’s often written off for lacking scalability.

Source: BitPay

Future Adoption

This is all very encouraging for anyone bullish about Bitcoin. People may now be using the cryptocurrency mostly as a store of value, with Chainlaysis’ latest Geography of Cryptocurrency Report finding that only 1% of cryptocurrency value sent to North America and Europe is coming from merchants. That said, it would seem that the growing use of bitcoin for speculation is likely having the knock-on effect of making it more widely used for payments.

This makes basic sense: the more people own bitcoin (even if it’s primarily to save and invest money), the more people there are to spend it. Some high-profile bitcoin investors even think that the cryptocurrency will have to become fully established as a store of value before it will be used widely for payments.

Source: Twitter

This all means that we should welcome and encourage Bitcoin’s growing reputation as a store of value. As the latest data indicates, it isn’t stopping Bitcoin from enjoying a gradual rise in payment adoption, while it will most likely be necessary if the cryptocurrency wants to see large-scale use.