- >News

- >Bitcoin Price Surges Past $30,000: Is a New Bull Market Incoming?

Bitcoin Price Surges Past $30,000: Is a New Bull Market Incoming?

Bitcoin’s strong 2023 has continued this week with the cryptocurrency surging beyond $30,000, reaching its highest level since June and marking an 82% gain since the beginning of the year. Combined with a 47.6% increase for the cryptocurrency market as a whole, this precipitous rise has goaded some people into declaring the beginning of a new bull market.

However, such a declaration may be a little premature, even if bitcoin’s gains this year are undeniable. Yes, BTC’s rise in the face of a banking crisis has led some people to conclude that investors are turning to the cryptocurrency as a safe haven, and yes, recent indications of an improving economic situation have improved investor sentiment to some degree. But the fact remains that the cryptocurrency market continues to face a number of significant challenges, from regulatory crackdowns and exchange shutdowns to fears of a full-blown recession.

As such, it’s hard to accept claims that recent price rises are the first telltale signs of a new bull market. Still, there is evidence of increasing accumulation of BTC by retail investors, signaling that the market may not be far from turning bullish. And while some skeptics have suggested that much of the current pump is down to renewed Tether printing, it’s more likely that traders moving out of other stablecoins (and into bitcoin) has been a bigger factor in recent price rises.

The Case for a New Bull Market

Aside from the fact that bitcoin in particular and other coins in general have witnessed substantial gains this year, there are other indications that we may be at the very beginning of a new bull market.

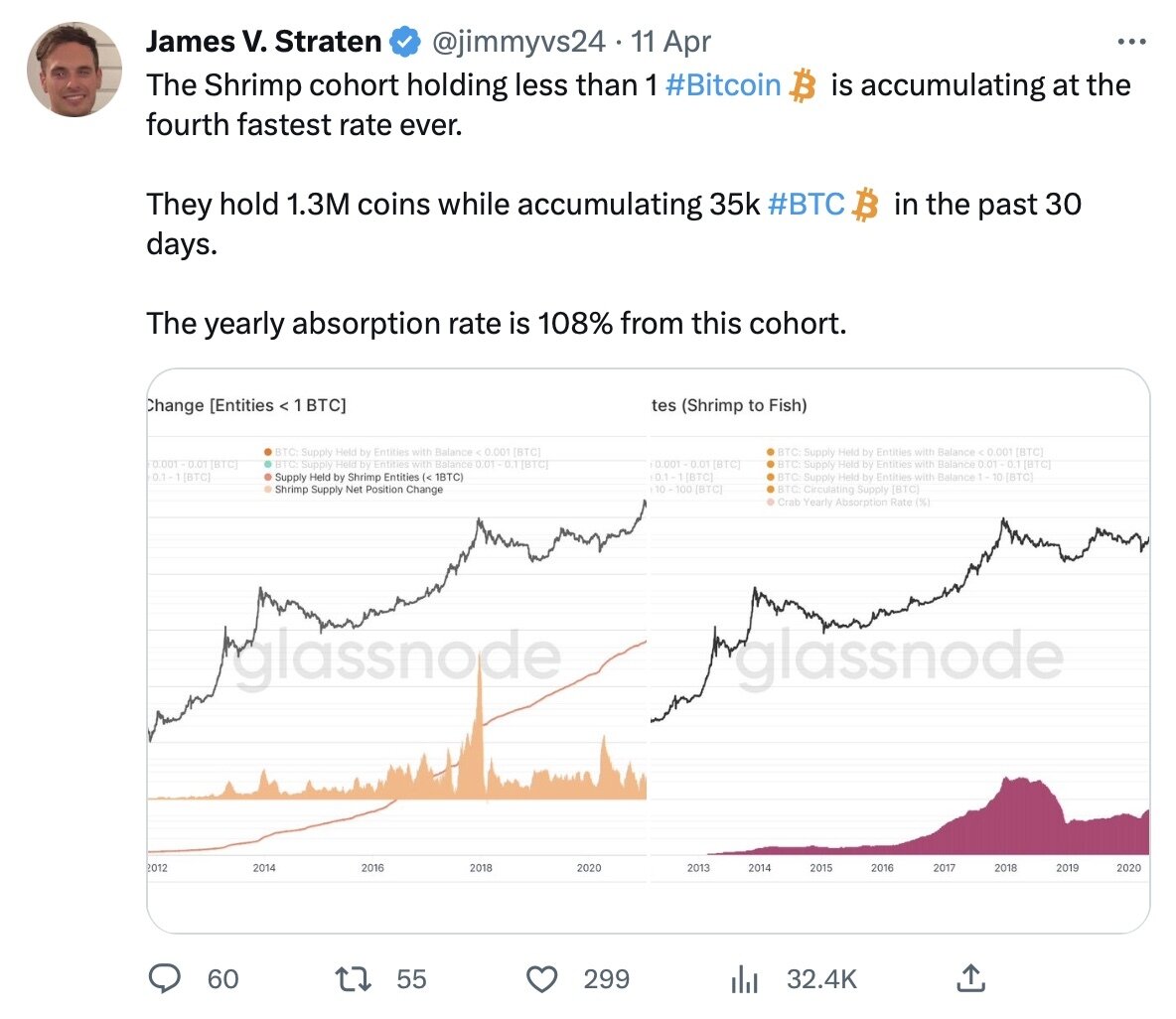

As noted above, retail investors have been accumulating bitcoin (and other token)s in recent weeks. In fact, data from glassnodes reveals that so-called ‘shrimps’ — holders of less than 1 BTC — have accumulated around 30,000 bitcoin in the past 30 days, equal to a little over $1 billion (as of writing). This brings their total bitcoin holdings to 1.3 million BTC, while other glassnode data shows that ‘fish’ (10-100 BTC) and ‘sharks’ (100-1,000 BTC) are accumulatings bitcoin “at near ATH rates,” along with shrimps.

Source: Twitter

Such peak activity for (relatively) smaller investors suggests that retail is returning to the market in a significant way, something which is necessary for a bull market to unfold. This has taken place in the context of fears regarding the stability of the US and global banking system, given the failures of Silicon Valley Bank, Signature Bank, Silvergate and Credit Suisse in March.

It does seem that such concerns have spooked people with money. On the one hand, banking stocks have fallen significantly, wiping out around $300 billion from the value of US financial institutions. On the other hand, much of this value appears to have been redirected towards gold, which has seen its price rise from $1,800 (for an ounce) at the beginning of March to just over $2,000 today.

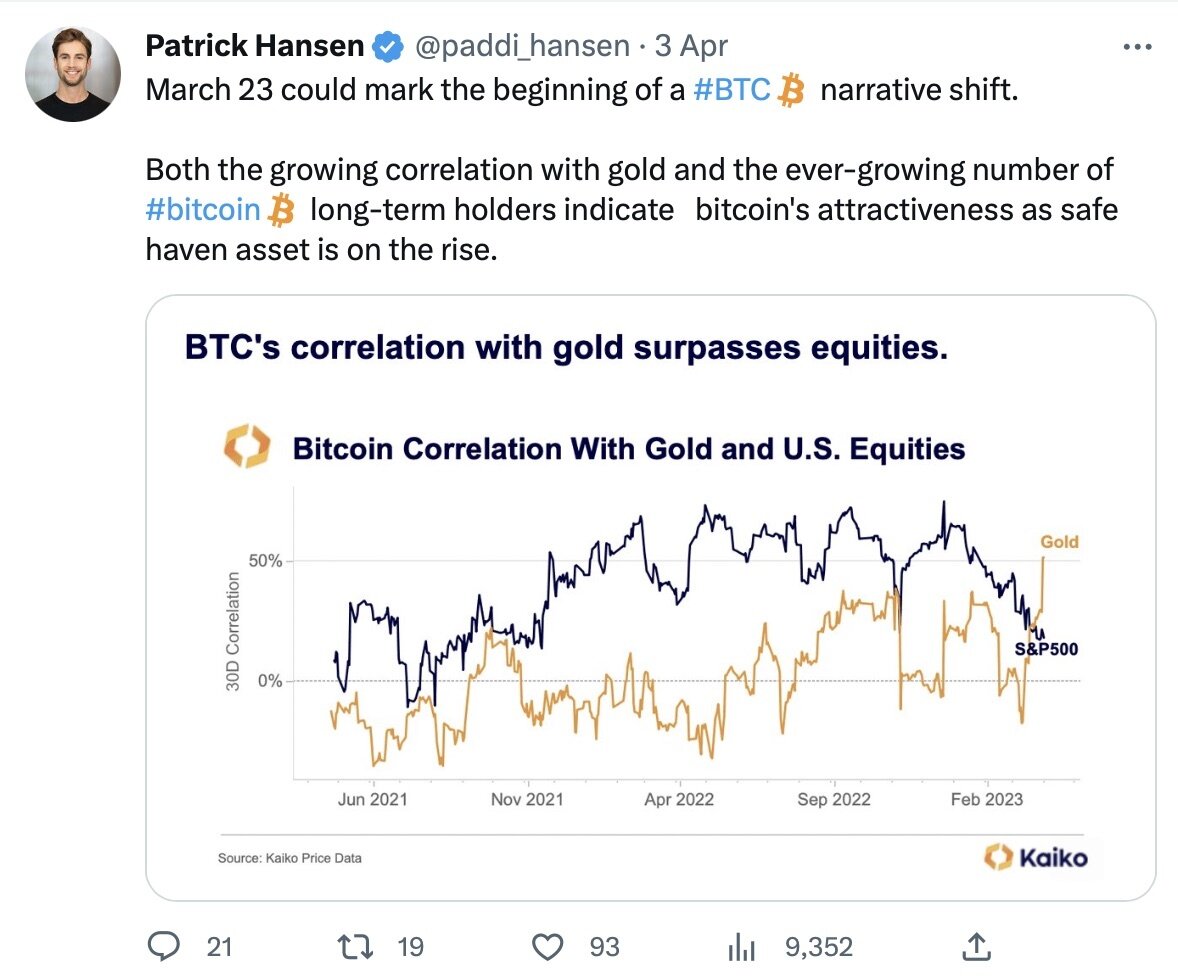

Gold has also been joined in such gains by bitcoin, with some observers choosing to interpret the cryptocurrency’s increases as an indication of its growing status as a safe haven (even if many analysts still consider it a ‘risk asset’).

Source: Twitter

And what this has led to is an increase in bitcoin’s dominance of the cryptocurrency market, as measured as a ratio of BTC’s market cap to the cap of the market as a whole. This currently stands at 47%, according to CoinMarketCap, up from 38% as recently as this past September. What’s significant about this is that bitcoin dominance tends to rise at the very beginning of a bull market cycle, as witnessed in 2017 and 2021, before altcoins catch up as part of ‘altcoin season.’

The Case Against a New Bull Market

The thing is, bitcoin’s above-average rise in the past few weeks isn’t enough on its own to declare a bull market. For one, if we can take the account above at face value, it has risen in price because of fears over the state of the global economy, something which hasn’t usually been conducive to a sustained rally for the cryptocurrency market as a whole.

Indeed, economists throughout the world have been predicting a recession since the beginning of the year, a warning that has been repeated in recent weeks in the United States. While any recession this year may not be severe, it will nonetheless dampen the appetite of retail investors for cryptocurrencies, while also simply making them less able to invest. As such, the global economy will need to return to fairly consistent growth before the cryptocurrency market can expect to enjoy sustained increases across the board (even if BTC may benefit from banking fears).

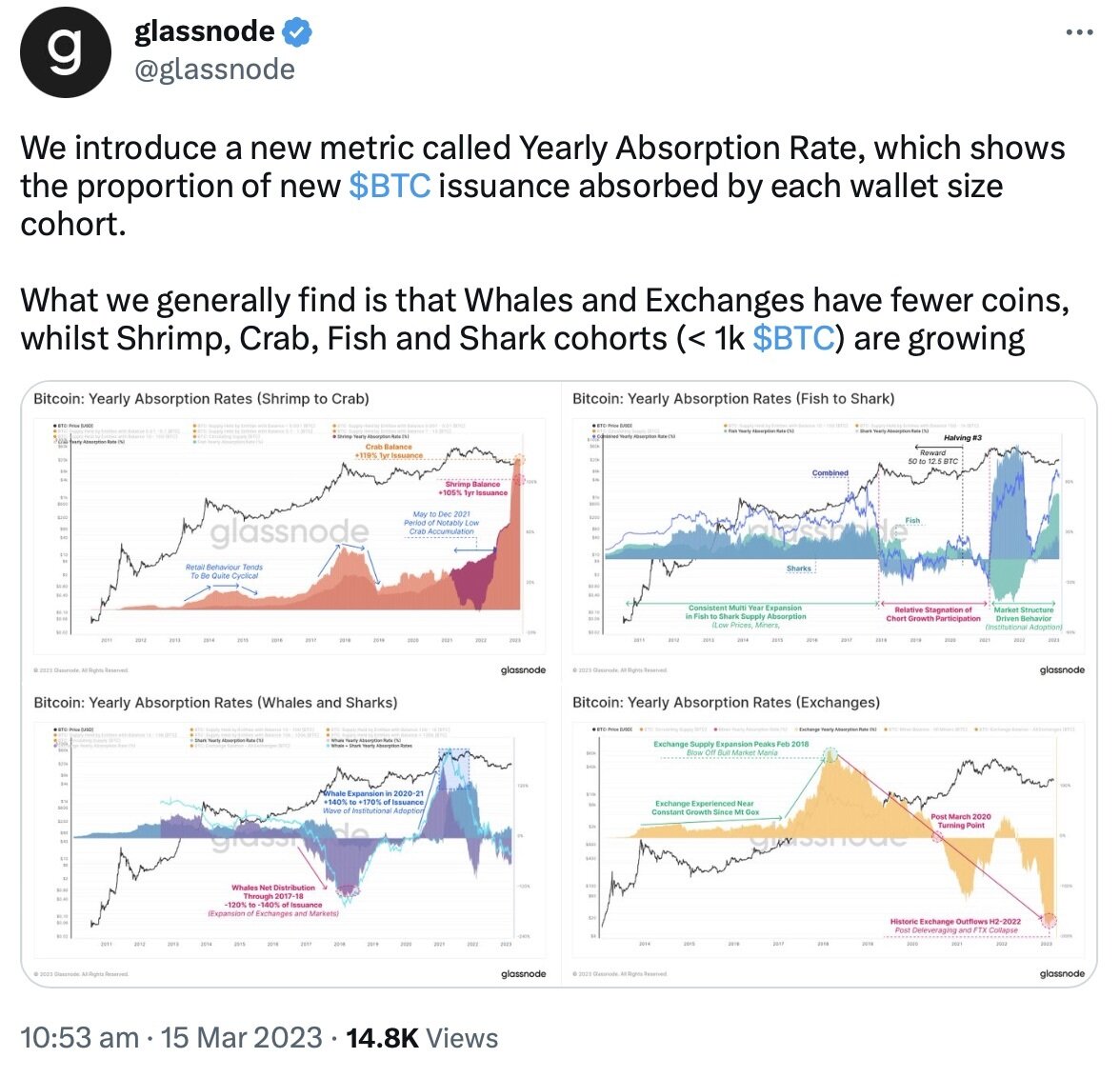

And while the glassnode data mentioned above has shown an increase in retail investors purchasing bitcoin in the past month, it’s worth pointing out that whales have generally been offloading much of their holdings during this period.

Source: Twitter

By contrast, the 2021 was characterized by a substantial increase in institutional holdings (see the bottom-left chart in the image above). For this reason, it’s arguable that we cannot proclaim the start of a new bull market until institutions and whales get in on the act again.

Stablecoin Instability and Shenanigans

There are also a small number of observers and skeptics who have argued that much of the gains we’ve seen this past month are largely due to Tether. That is, Tether — which has never undergone a full audit — has issuing much more of its USDT stablecoin, with its supply rising from $66 billion on January 1 to $80 billion as of writing.

Source: Twitter

There’s no question that an expansion in the supply of Tether has coincided neatly with an expansion in bitcoin’s price. This raises suspicions insofar as previous academic research has suggested that increases in the USDT supply have been “inflating cryptocurrency prices” in the past.

The market caps of USDT (blue) and bitcoin (red/orange) since January. Source: CoinMarketCap

However, a few things need to be said against such claims. First of all, if the recent rallies were solely about new Tether printing, you’d expect the prices of all cryptocurrencies to rise more or less uniformly. Yet bitcoin has noticeably outperformed most other major coins, suggesting that real money is indeed going towards the original cryptocurrency (which is supported by the data).

Secondly, Tether has likely expanded its supply in response to a genuine growth in demand, seeing as how other stablecoins have had problems in recent months. USDC issuer Circle admitted $3.3 billion exposure to Silicon Valley Bank last month, for example, causing the supply of the stablecoin to fall from $44 billion at the start of March to $32 billion today. Something similar applies to Paxos and its BinanceUSD token, the supply of which has also reduced dramatically.

This leads to one last explanation of the recent rallies, which is that the instability of the aforementioned stablecoins has benefited bitcoin. Indeed, with investors pulling out billions from BUSD and USDC, it remains credible to suggest that they then went and put some of this into bitcoin. This has been argued by such commentators as Molly White and David Gerard, who claimed that BUSD holders who couldn’t pass KYC controls at Paxos opted to buy BTC with the stablecoin instead.

This possibility aside, it’s clear that bitcoin is enjoying a notable rally at the moment, one which cannot be accounted for solely by appeals to ‘Tether pumping’ or ‘stablecoin outflows’. Retail investors have bought significant amounts of the cryptocurrency in recent weeks, and even if a fully blown bull market isn’t beginning just now, history suggests it’s only a matter of time.