- >News

- >Can Whale Transfers Predict Whether the Crypto Market Will Go Up or Down?

Can Whale Transfers Predict Whether the Crypto Market Will Go Up or Down?

The cryptocurrency market is having an interesting time at the moment, with some significant rallies taking place amid the backdrop of an ongoing banking crisis. So while bitcoin (BTC) and a few other major tokens have performed consistently well over the few months or so, many others have kind of seesawed as renewed investor bullishness for crypto is repeatedly undermined by fresh concerns over the financial health of such institutions as Credit Suisse (as well as the banking sector as a whole).

Of course, predicting which way the wind is blowing in crypto is already difficult enough at the best of times, but the fragility of the current economic situation potentially makes the market even more volatile. However, certain traders have one method they like to use in order to help them gauge what prices may do next: watch out for big whale transfers.

Yes, looking to see whether whales (i.e large investors) have moved cryptocurrencies to or from exchanges can often provide hints as to whether a major market movement is imminent. But just how reliable are such transfers as an indicator of rallies or selloffs?

Well, while whale transactions can often lead just before a big market event, the data reveal that whales are just as inconsistent as normal retail investors when it comes to timing their moves. As such, doing your own research and sticking to your own strategy remains the best M.O. overall for the vast majority of investors.

How to Use Whale Transfers to (Hopefully) Predict Crypto Market Rallies and Selloffs

The basic principle involved in whale watching is simple enough. On the one hand, it involves following the various alert accounts on Twitter that do nothing but report large transfers of cryptocurrencies, checking to see when a cryptocurrency you hold (or are interested in buying) is involved in a big movement.

The most popular account in this vein is Whale Alert (@whale_alert), which now has around 2.2 million Twitter followers, while also being on Telegram. This account tracks over ten major cryptocurrencies (as well as stablecoins), including bitcoin (BTC), ethereum (ETH) and XRP.

Source: Whale Alert

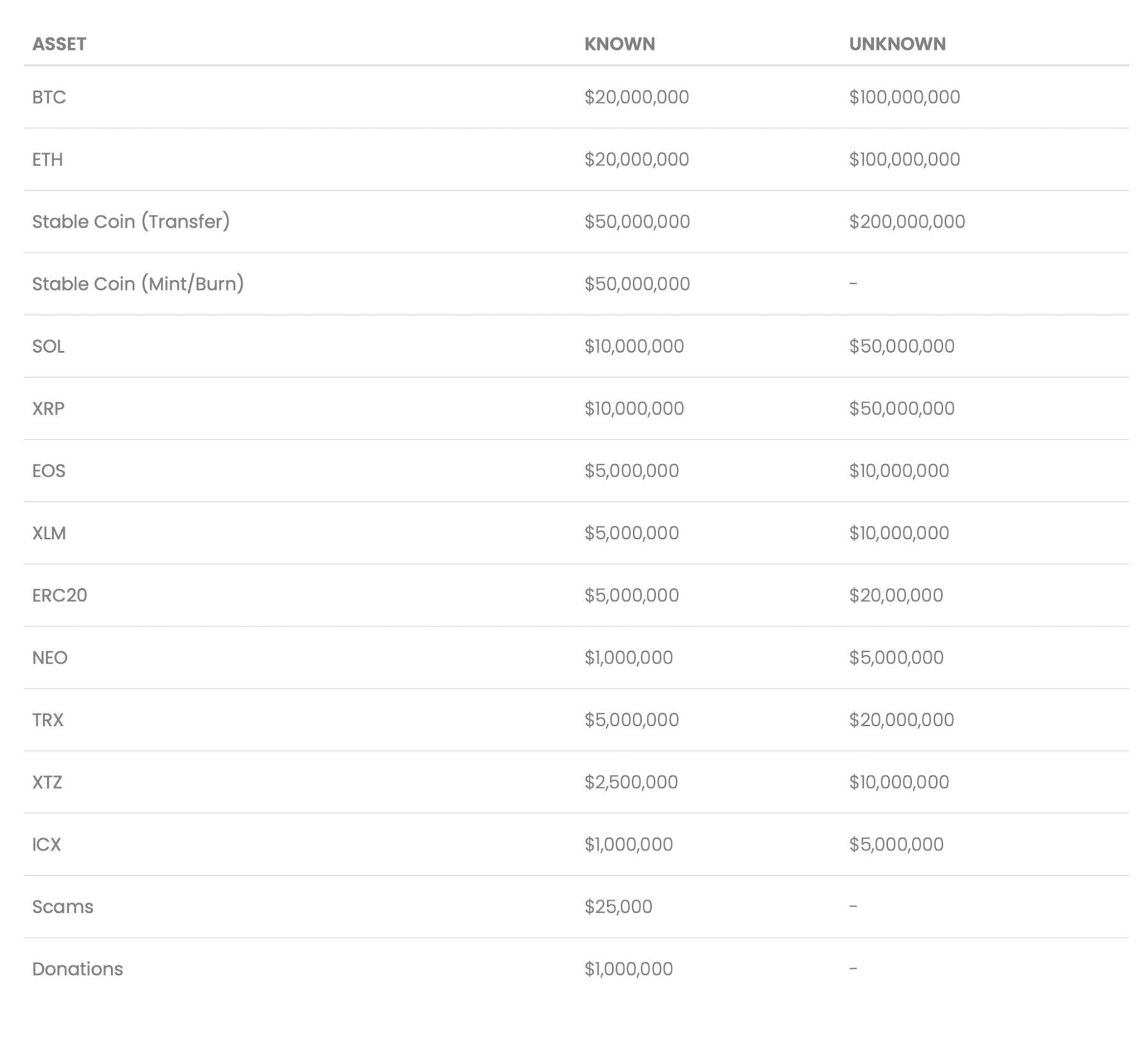

As the table below illustrates, Whale Alert posts an alert whenever a minimum US dollar amount of crypto is moved, with the threshold varying according to coin and according to whether the holder of the address sending the amount is known.

The reasoning behind tracking such transfers is basically twofold: 1) a whale is arguably better placed to know when a cryptocurrency is going to rise or fall in price; and 2) a whale can sell or buy enough of a given crypto to influence its price.

Other accounts operating along similar lines are ClankApp (@ClankApp), Ðogecoin Whale Alert (@DogeWhaleAlert) and WhaleStats (@WhaleStats), while there are similar trackers on Telegram (e.g. WhaleBot Alerts) and with their own websites.

With all of these accounts, the idea is that if a whale moves a significant amount of crypto to an exchange, they’re preparing to sell it. Accordingly, you should (at least in theory) prepare to sell your own crypto, assuming that a significant dip below its current price would put you at a loss.

A Whale Alert tweet indicating that BTC has been taken off Coinbase. Source: Twitter

Conversely, alerts of whales moving cryptocurrencies off of exchanges is often taken as a sign that larger investors have begun stockpiling the cryptos in question (occasionally as part of ‘buying the dip’). Basically, the assumption here is that moves off of an exchange mean that a whale has just bought a given crypto and expects it to rise in price over the medium- and/or long-term.

In this latter case, traders may assume that it’s a good time to buy any crypto that has been taken off of exchanges.

Crypto Whales Don’t Always Know More than Retail Investors

While the prevalence of such alert accounts implies that monitoring whales can often be useful, just how useful is it?

There isn’t a massive amount of empirical evidence addressing this question, but some formal studies have started to emerge in recent months. One interesting paper — published on arXiv in October of last year — did actually find that whale-alert tweets can predict bitcoin volatility, with the authors concluding that the model they built using such tweets “outperforms existing state-of-the-art models when forecasting extreme volatility spikes for Bitcoin.”

However, there’s a massive catch here, which is that the use of alert tweets in the above model is only the tip of the model. The authors used such tweets in conjunction with CryptoQuant data (e.g. on-chain analytics, exchange and miner data), while such data was processed using “a deep learning Synthesizer Transformer model,” meaning AI.

In other words, the paper found that alert tweets are useful only when combined with a wealth of other data by a deep learning-capable AI, and only when predicting “extreme volatility spikes.” Because of this, it would be stretching it to claim that the paper proves simply following whale transfers on their own can help normal retail traders predict when to buy and sell.

In fact, it arguably gets even worse, because some analysts have even claimed that whales can use the popularity of alerts to trick the market. That is, knowing that people pay attention to whale alerts, they can intentionally move a large amount of cryptocurrency to an exchange, wait for the market to fall, and then buy more of their chosen crypto at a discount. This, at least, has been claimed by such experts as CryptoQuant founder and CEO Ki Young Ju, who has previously described such a strategy as a form of “psyops” conducted by whales against retail investors.

Source: Twitter

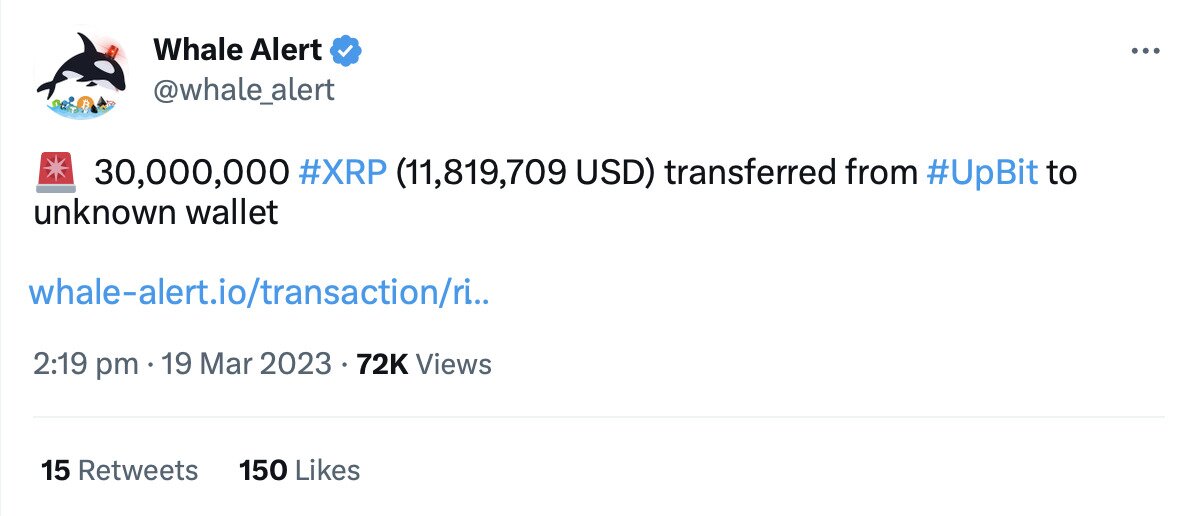

Taking isolated whale transfers in isolation can certainly mislead investors, since even whales are often inconsistent and inaccurate in terms of their movements. For example, the past couple of days have seen two multimillion dollar transfers of XRP by whales, one from an exchange (Upbit) and one to an exchange (Binance). Clearly, one of these large investors is making a mistake, but which one?

Indeed, much like retail investors, whales are also susceptible to false or misleading information, sudden whims and intuitions, as well as losses of nerves (not to mention financial strains that may force them to sell too early). Because of this, trusting any single or any handful of whale transfers is possibly a recipe for making a rash decision.

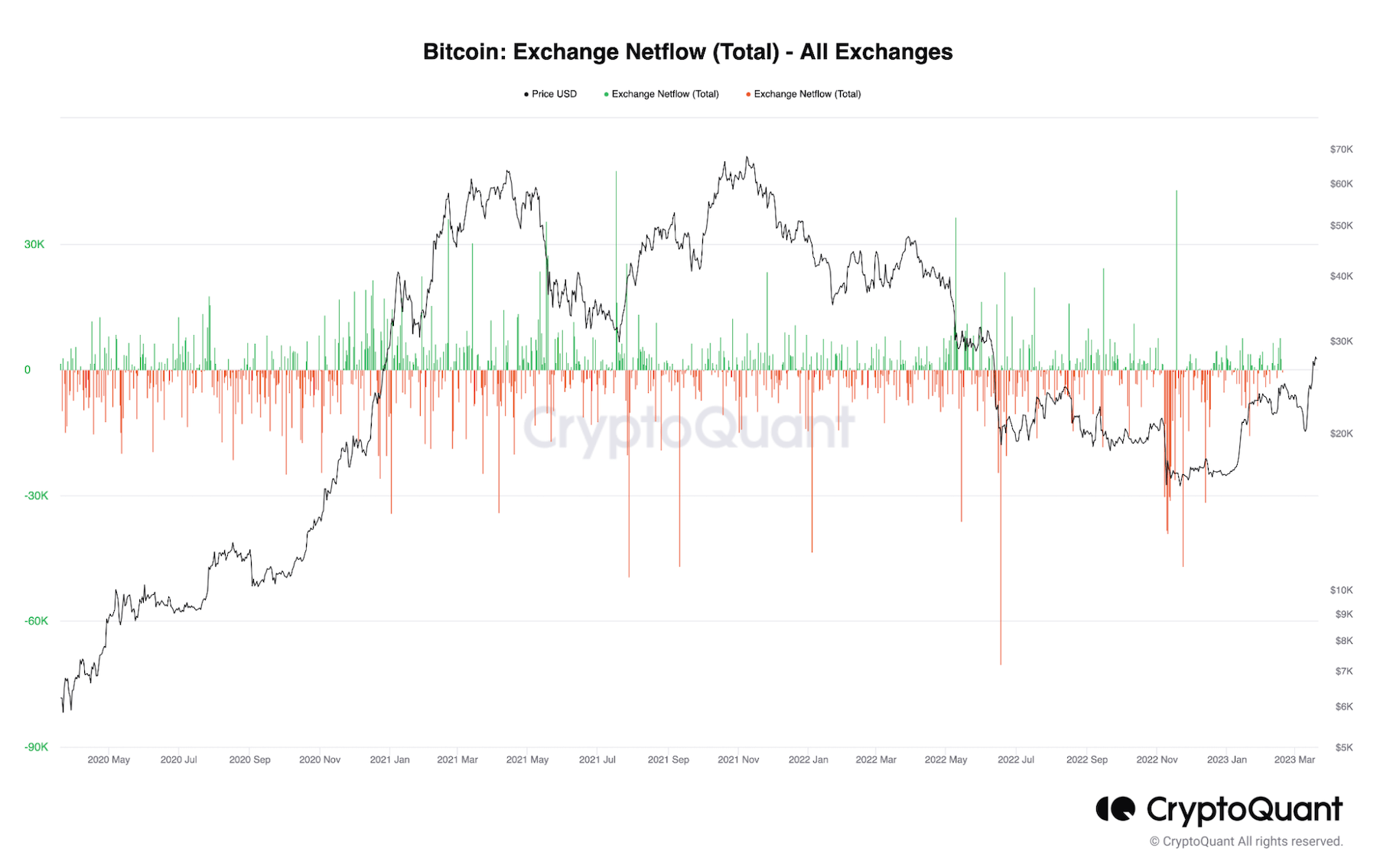

Net exchange flow data can in some cases be a useful way of predicting big movements. Source: CryptoQuant

Instead, traders would be advised to look at the bigger picture, with certain analytical firms (e.g. CryptoQuant) making available net exchange flow data, which represents how much crypto has been deposited with or withdrawn from trading platforms. Big inflows — which consist of hundreds if not thousands of large transfers — can often happen just before big selloffs, making this kind of data worth watching.

The existence of such data points to the overriding lesson here, which is that investors and traders really need to do their own research when looking to make buying/selling decisions. Rather than focusing on ‘whales’ and looking at isolated pieces of evidence, they need to consider multiple data points as a whole, something which helps to correct for possible biases or distortions in any single piece of information.

Perhaps more importantly, they simply need to stick to a long-term strategy and ignore anything that might disturb it. This could mean a dollar-cost averaging approach, or it could mean buying low and waiting to make a specific profit before cashing out. Either way, it almost certainly doesn’t mean selling your holdings just because someone moved millions of bitcoin to an exchange with the apparent (but not confirmed) intention to dump it.