- >News

- >Case of Ex-Microsoft Employee Shows You Can’t Escape Tax with Bitcoin

Case of Ex-Microsoft Employee Shows You Can’t Escape Tax with Bitcoin

It was only a few years ago that large numbers of people used to think Bitcoin was anonymous. Since you could have a bitcoin wallet without attaching any personally identifying information to it, the thinking among many was that you could receive and send bitcoin without anyone else — even national governments — being any the wiser. This assumption would explain the short-lived popularity of the Silk Road marketplace, through which people spent bitcoin on drugs and other illicit products, believing that the use of the cryptocurrency would keep them safe from the law.

How wrong such assumptions were. We now know that Bitcoin isn’t really anonymous, particularly when its use is linked to identifiable accounts. Still, this doesn’t stop some people from using the cryptocurrency to hide illicit activities and avoid paying tax, which is something we found out (yet again) with the recent case of the ex-Microsoft employee who has been jailed for nine years.

As this case shows, even using mixing services to obscure the source of funds isn’t effective in escaping the long arm of the law. But as surveys and ongoing warnings indicate, the general population of cryptocurrency users still think they can use bitcoin to escape paying all of the tax they owe.

Attempting to Use Bitcoin to Hide Illicit Activity and Escape Tax

First charged in 2019, Ukranian former Microsoft employee Volodymyr Kvashuk used his position as a tester to steal Microsoft e-gift cards between 2016 and 2018 and to sell them online. He initially did this through his own account, but then moved to hacking into the accounts of colleagues, eventually accumulating more than $10 million in sales, which he would use to purchase bitcoin through a variety of accounts and exchanges.

By 2018, Microsoft had noticed suspicious transactions related to its testing team, of which Kvashuk was a part. However, it was only when Kvashuk filed his tax returns for 2018 that his scheme began to unravel. He’d declared in his tax return that the bitcoin he’d received — and then sold for millions of dollars — had been a gift, arousing the Inland Revenue Service’s suspicions.

IRS Analyzed Bitcoin Blockchain to Catch Kvashuk

To cut a very long story short, the IRS conducted forensic analysis of the Bitcoin blockchain, tracing the bitcoin deposited into Kvashuk’s account back to peer-to-peer exchange Paxful and to a mixing service (Chipmixer.com) that processes multiple transactions from multiple parties at the same time (in order to obscure who is sending what).

Thanks to such evidence, the IRS was able to accumulate enough evidence to convict Kvashuk of not only theft and money laundering, but also of two counts of tax evasion. He was sentenced to nine years in jail on November 9, and also ordered to pay $8,344,586 in restitution.

“Kvashuk’s criminal acts of stealing from Microsoft, and subsequent filing false tax returns, is the nation’s first Bitcoin case that has a tax component to it,” said IRS-CI Special Agent in Charge Ryan L. Korner.

“Simply put, today’s sentencing proves you cannot steal money via the Internet and think that Bitcoin is going to hide your criminal behaviors. Our complex team of cybercrimes experts with the assistance of IRS-CI’s Cyber Crimes Unit will hunt you down and hold you accountable for your wrongdoings,” he added.

The IRS and HMRC Are Coming for Coinbase Users

This is a highly educational case for anyone tempted to attempt tax evasion via Bitcoin. Kvashuk was an engineer, and knew a number of ‘tricks’ (VPNs, mixing services, P2P exchanges) which he believed would keep him anonymous, yet the IRS was able to identify him and trace the bitcoin he had failed to declare.

His is a lesson other Bitcoin users would do well to learn, since it seems that a significant minority of these users have been tempted to use the cryptocurrency to pay less tax. For example, LendEDU conducted a survey of bitcoin investors back in late 2017, near the peak of the famous bull run to $20,000. A total of 36% of the respondents said they planned not to report any cryptocurrency gain or loss on their tax returns.

This is a pretty incredible percentage, especially in the context of a big bull market in which lots of people made lots of profit. And while the proportion of willing tax dodgers may have declined in the three years since 2017, it still seems like a non-negligible number of cryptocurrency owners are tempted to escape tax via Bitcoin, at least if the sheer number of warnings are a reliable indicator of anything.

For instance, the IRS infamously mailed stern letters to over 10,000 American crypto holders in July 2019, warning of stiff penalties and even asking some to formally declare that they’re in compliance with tax rules. Something similar happened that same year in the UK, with Britain’s tax office (HMRC) demanding user info from numerous crypto-exchanges.

Fast forward to this year, and Coinbase’s UK users were told by the exchange that it would be passing on their details to HMRC.

Source: Twitter

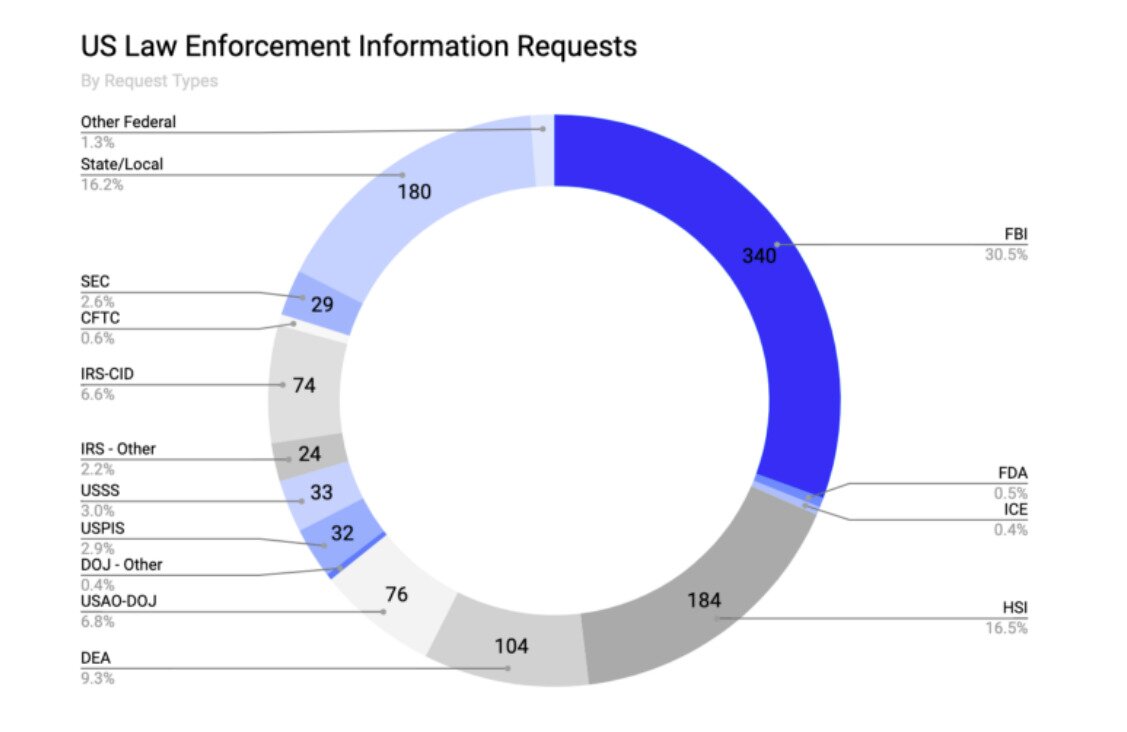

Meanwhile, Coinbase told its American (and global) users in October that it’s increasingly complying with information requests submitted by government agencies, including tax agencies.

Source: Coinbase

In response, the American law firm Klasing Associates quickly wrote a blog post declaring that the “IRS is coming after Coinbase users,” and that the news should be “a major wake-up call to taxpayers who have failed to report virtual currency held in this or another exchange in years past.”

It should be, as should the case of the ex-Microsoft employee. It’s clear that the IRS and other tax agencies are becoming more proactive in tracking potential tax cheats, using more sophisticated monitoring technologies to trace cryptocurrency flows, while also simply becoming more familiar with how the cryptocurrency market works. So if you think that Bitcoin or crypto allows you to play fast and loose with your nation’s tax laws, it might be wise to think again.