- >News

- >Credit Suisse: How Would Another Banking Crisis Affect Bitcoin and Crypto Prices?

Credit Suisse: How Would Another Banking Crisis Affect Bitcoin and Crypto Prices?

Another day, another crisis. This time, it’s the turn of Credit Suisse, which startled markets over the weekend when its CEO Ulrich Koerner attempted to reassure staff that the Swiss bank had sufficient capital and liquidity to settle its liabilities. While this claim may be entirely true, the mere fact that Koerner had to make it heightened earlier speculation that the institution is in trouble, so on the following Monday its stock price plunged by more than 10%.

Koerner offered his remarks ahead of the announcement of a restructuring plan for Credit Suisse, which will be unveiled alongside the publication of the bank’s latest financial results at the end of October. Combined with his statement, this incoming restructuring plan — as well as the new record high in the cost of insuring the bank — have raised more than a few strong suspicions that Credit Suisse could fail. And when you add similar problems for Deutsche Bank (and other institutions), the prospect of another banking crisis has become all-too real.

How would bitcoin and cryptocurrency prices react to another financial crisis? Well, the short answer is that they would most likely fall even further than they already have in 2022, yet given the nature of a severe banking meltdown, we may see some consolidation around bitcoin as a relative safe haven. While this would no doubt be very bad for investors and crypto in general, it needs to be argued that, despite the recent noises, the probability of a Credit Suisse collapse and another banking crisis remains very low.

Credit Suisse, Deutsche Bank and Other Major Institutions in Precarious Financial Condition?

While the possibility of another major banking crisis has (perhaps unsurprisingly) received most attention in the crypto media, a variety of serious analysts have been raising warning flags about the health of various major financial institutions.

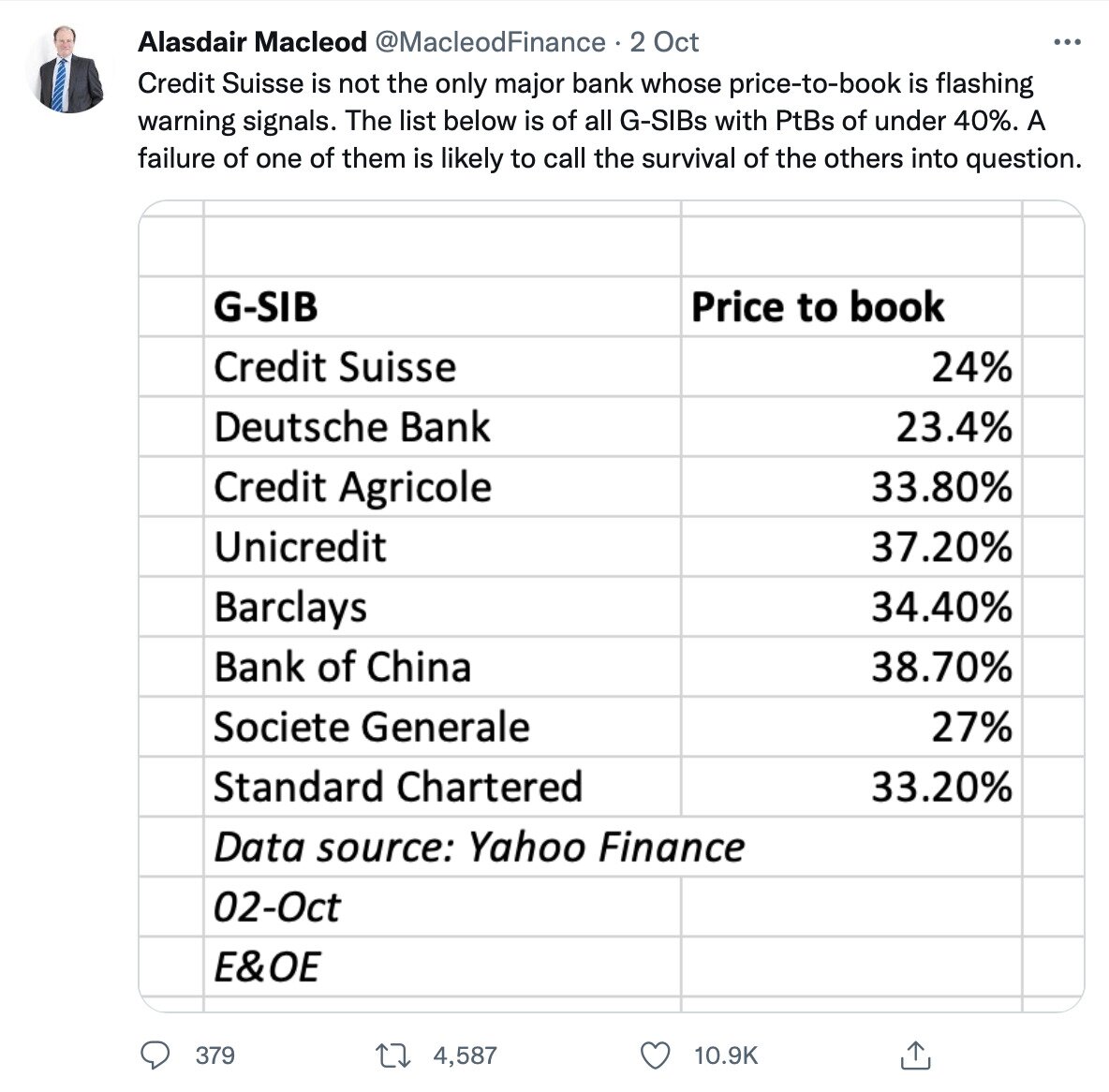

Alasdair Macleod — the head of research for precious metal investment consultancy Goldmoney — took to Twitter recently to point out that Credit Suisse’s price-to-book ratio (the ratio of its stock price to its actual value as a company with assets and liabilities) was dangerously low. In fact, not only is Credit Suisse’s price-to-book ratio below 40% (at 24%), but so is the same ratio for seven other major financial institutions, including Deutsche Bank, Barclays, Unicredit, Standard Chartered and Société Générale.

Source: Twitter

This is worrying insofar as a low price-to-book ratio indicates that the market has little demand for the stock of any company with such a ratio. And why do investors have such little demand for the stock of a bank? Well, possibly because they fear it may not do very well in the future.

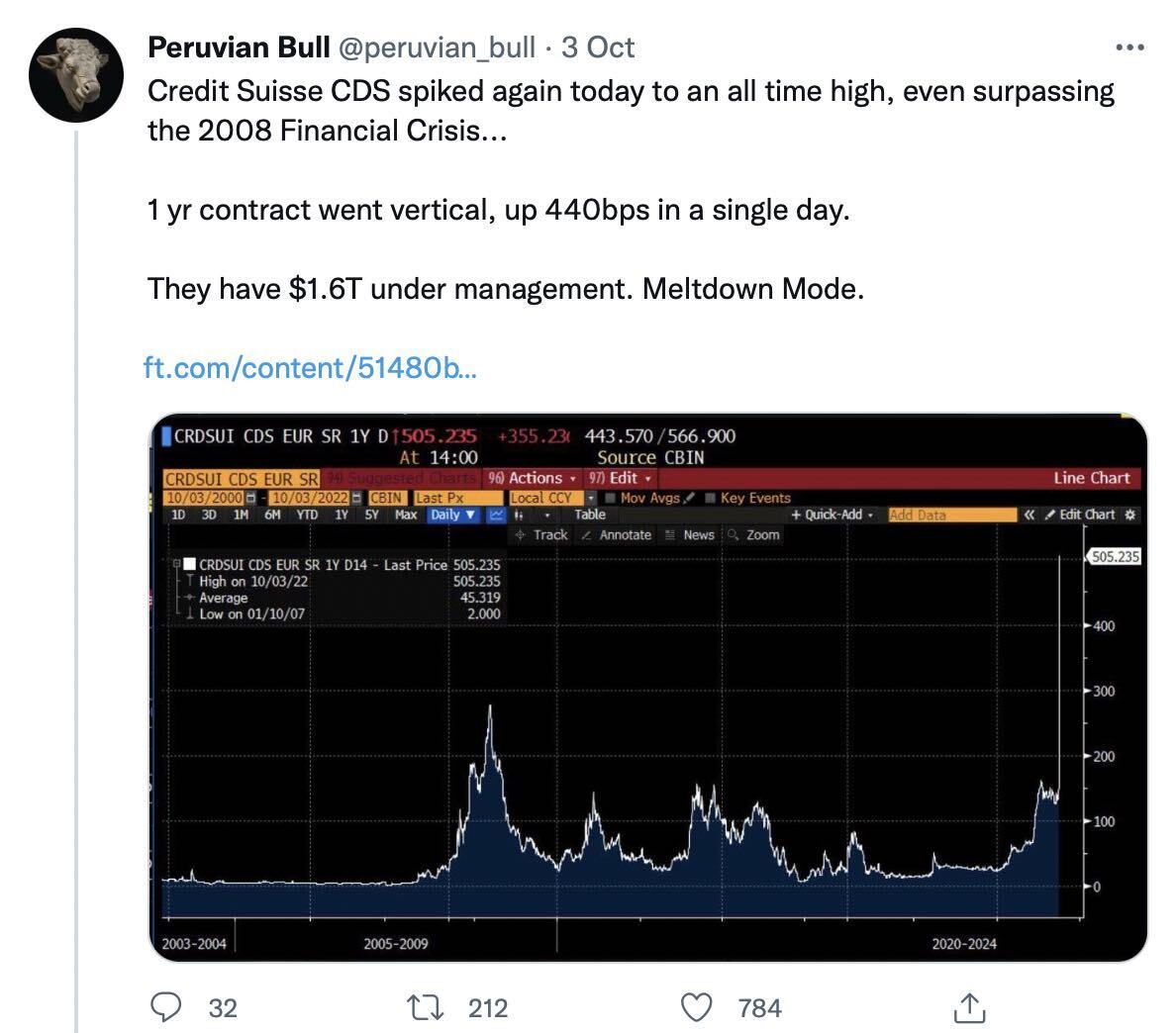

This is backed up by what happened to the cost of credit default swaps (CDSes) of Credit Suisse. CDSes are basically insurance contracts that pay out in the event of the failure of the company they’re associated with, and in the case of Credit Suisse, the cost of a CDS for it reached an all-time high on Monday.

Source: Twitter

To make the picture look even worse, a number of commentators have also pointed out just how large Credit Suisse is, and how systemically important it is to the global financial system. Much the same goes for Deutsche Bank, as well as the other institutions mentioned above.

For example, investor Graham Stephan tweeted that the combined assets under management of Deutsche Bank and Credit Suisse now totals around $2.8 trillion, which is four times more than the assets of Lehman Brothers, which infamously ‘brought down’ the world’s economy when it failed in 2008.

Basically, if you spend enough time on Twitter and other social networks, you may quickly form the impression that the global financial system is on the brink of another collapse. And when you combine this with other negative financial and economic happenings in recent months (e.g. high inflation and interest rates), it really does create the sense (however reliable) of a system on the edge.

What Would Another Banking Crisis Do to Bitcoin and Crypto Prices?

While the cryptocurrency market has never lived through a full-blown banking crisis of the kind seen in 2007 and 2008, the Covid-19 pandemic of 2020 provides more than a glimpse of what we can expect.

To begin with, the onset of a crisis would most likely bring big falls in cryptocurrency prices. The bitcoin price fell from just over $10,000 in February 2020 to as low as $3,000 in March of that same year, as lockdowns kicked in and as investors feared the shutdown of the global economy.

Bitcoin’s price in 2020. Notice the sudden drop in March. Source: CoinGecko

However, what’s interesting is that major central banks commenced large-scale quantitative easing, with the Federal Reserve pumping trillions into financial markets. This program of asset purchasing/money creation happened to precede stock markets — and the cryptocurrency market — reaching all-time highs.

As such, if we do witness Credit Suisse and/or any other major bank getting into serious trouble, there remains a real chance that central banks would resume some form of quantitative easing. This injection of liquidity into markets would therefore have likely have the effect of propping up bitcoin and cryptocurrency prices.

Of course, the effect may not be immediate, and investors may see bitcoin and other coins priced at severe discounts for several months. They may also witness consolidation around bitcoin during a banking crisis, since during previous bull markets bitcoin’s dominance has historically tended to increase.

What Crisis?

The thing is, while there are certainly fault lines running at various points along the global economy, the chances of Credit Suisse defaulting on its debt and collapsing are pretty slim.

Remember that Lehman Brothers had a debt-to-equity ratio of anything between 30-60 to 1 in the months leading to its demise in 2008. By contrast, Credit Suisse had a debt-to-equity ratio of 3.43 in the three months to June 30 of this year, with this figure declining in the previous months and quarters. Similarly, its previously quarterly also reported that it has a common equity tier one ratio — reflecting its financial resilience — of 13.5%, which is within its target of 13-14%.

While this author doesn’t have a direct insight into what’s happening at Credit Suisse at this precise moment in time, the mere fact that Credit Suisse is undergoing a restructuring should also be taken as a reassuring sign. So too should the fact that, as a systemically important financial institution, it’s legally required to maintain adequate capital ratios.

Sure, such factors alone can’t provide a 100% guarantee that nothing seriously bad is going to happen in the next few weeks or months. But they should at least calm the nerves of investors, who can at least sleep soundly (for now) that their cryptocurrency holdings aren’t going to plunge vertically.