- >News

- >Crypto Bulls Cheer as Fed Signals Pause in Rate Hikes After Latest Increase

Crypto Bulls Cheer as Fed Signals Pause in Rate Hikes After Latest Increase

The Federal Reserve has raised interest rates yet again, with the central bank moving its funds rate to the 5.00% and 5.25% range, its highest level since mid-2007. Such hikes have become almost commonplace over the past year or so, with post-Covid and post-Ukraine inflation putting the Fed in an increasingly hawkish mood. Yet while they have almost come to be expected in recent months, they haven’t stopped having a negative effect on the cryptocurrency market, which overall fell slightly in the days leading up to the latest Federal Open Market Committee meeting on May 2 and 3.

However, this meeting also brought some good news for crypto, which is that the FOMC has indicated that the latest hike could be the last for a while. Because with banks failing as a result of rising rates-falling bond prices, and with the US government approaching a possible debt default, analysts and economists have been arguing for several weeks now that the Fed needs to change strategy.

This is ultimately why news of the latest hike has actually helped cryptocurrency prices, which recovered on the day of the Fed’s announcement after falling a little over the weekend. And in the longer term, today’s increase also potentially signals the beginning of a new, more expansionary period in US and global economics, one which could give birth to the next crypto bull market.

The Federal Reserve Softens Its Stance on Rate Hikes

Announcing the move to a funds rate of 5%-5.25%, the Federal Reserve issued a statement in which it suggested it would be willing to make a U-turn on policy in the event of high interest rates having (or rather, continuing to have) negative economic effects. This qualified statement stands in contrast to the more definite language it used in its March FOMC statement, in which it took a more certain tone that rate hikes would be necessary.

A key paragraph in its latest statement read, “The Committee will closely monitor incoming information and assess the implications for monetary policy. In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

This newfound willingness to take greater stock of economic conditions is a key turning point for the Fed, and even though it has brought in yet another rate increase, it’s interesting to note that crypto responded positively to the central bank’s latest statement. Major cryptocurrencies are up by anything between 0.5% and 1.5% in the hour following the publication of the statement, and some (e.g. bitcoin and ethereum) had gained modestly in the 24 hours preceding the conclusion of the FOMC’s meeting, in anticipation of a softened stance.

Bitcoin’s price over the last 30 days. Source: CoinGecko

Despite the rate hike, Powell’s statement is probably among the best pieces of news crypto has received all year. Yes, the market as a whole has gained by 47% since January 1, but it remains down by 59% compared to its record-high total cap of $3 trillion, set back in November 2021. And it has suffered precisely because the Fed has jacked up rates on an almost monthly basis since early 2022, a policy which has not only hurt cryptocurrency prices, but also the stock market.

Put simply, rate increases have dampened investor confidence, given that higher rates hurt company earnings (because of the higher cost of debt) and also make saving more attractive. Because of this, less money has flowed towards stocks and other assets in the past year and a half, which is evident in the declining values of stock indices and cryptocurrencies.

But now, with the Fed indicating that it may go in the opposite direction, investors are likely to become more confident and perhaps a little more bullish, in that they will expect company earnings to grow, meaning more money being pumped into the stock market and — by extension — other markets.

This is basically why some cryptocurrencies rallied on the day of the hike’s announcement, since investors are beginning to think we’re at the beginning of the end of this period of ‘quantitative tightening.’ This suspicion is also supported by news coming out elsewhere in the world, with signs suggesting that the European Central Bank will also slow down its rate hikes now that inflation is improving in the Eurozone. Something similar also applies in the United Kingdom, where the Bank of England’s chief economist has also revealed that the central bank will start easing off the monetary brakes.

When Next Crypto Bull Market?

Of course, it may still be some time before a shift in the Fed’s monetary policy results in a significant improvement in the cryptocurrency market and the prices of bitcoin and other digital assets. This is for various reasons.

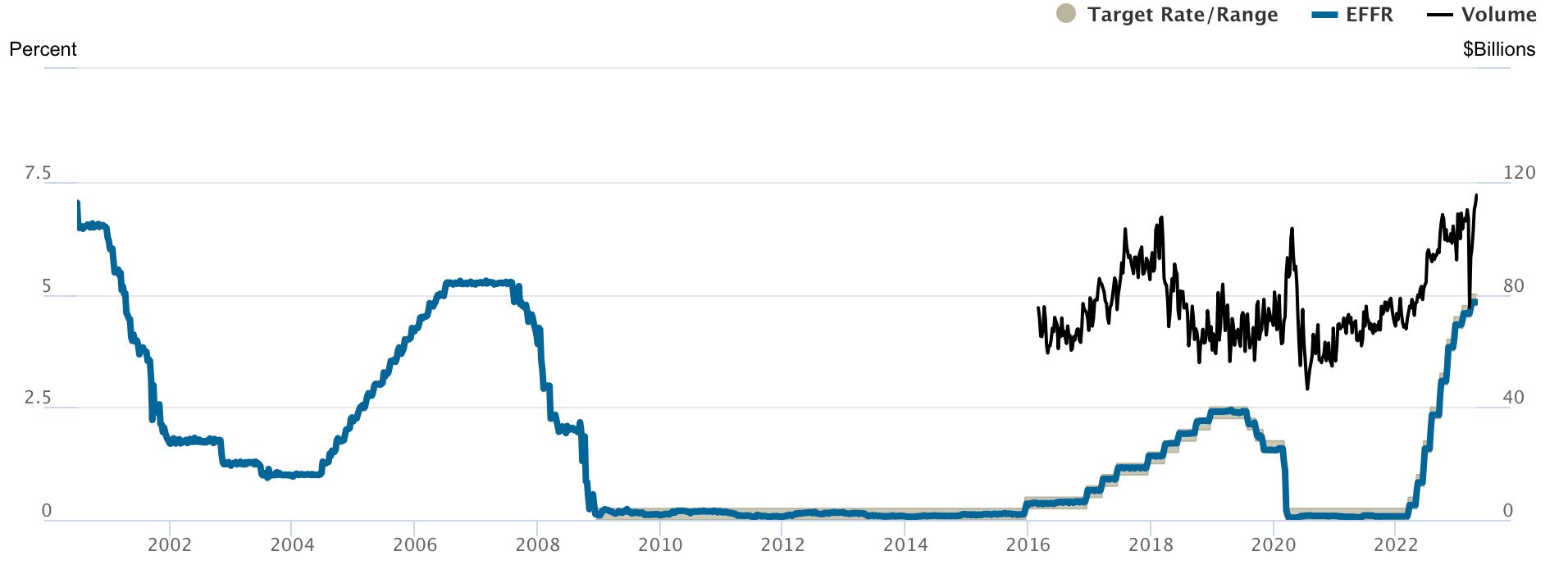

The effective federal funds rate (blue) since 2000. Source: Federal Reserve Bank of New York

Firstly, even though the Federal Reserve has signaled a willingness to stop and eventually reverse its rate hikes, it will still be some time before its funds rate declines from the current level of 5-5.25% to where it was a year ago (0.75-1%). As such, interest rates are still going to be relatively high for at least another year, with the Organisation for Economic Cooperation and Development (OECD) warning of just this very likelihood in its Economic Outlook Interim Report it published in March.

Its authors wrote, “Monetary policy needs to remain restrictive until there are clear signs that underlying inflationary pressures are lowered durably. Further interest rate increases are still needed in many economies, including the United States and the euro area. With core inflation receding slowly, policy rates are likely to remain high until well into 2024.”

In other words, interest rates aren’t going to go from 5% to 1% in a month, with the ‘return to normal’ likely to be a very gradual process. By extension, cryptocurrency prices are going to mount a similarly gradual recovery, in line with the kinds of increases the market has enjoyed since the beginning of the year. Remember that 2021’s highs happened in the context of rock-bottom interest rates and quantitative easing (which pumped around $4.5 trillion into the US economy alone between 2020 and 2022), with something like the reverse being the case at the moment.

But once the global economy recovers from recent bank failures and inflationary shocks, and once interest rates eventually decline to more moderate levels, 2024 could end up being a very good year for the cryptocurrency market. Because with the next Bitcoin halving due next year, history has shown that the next bull market may not be too far away.