- >News

- >Crypto Goes Green? Ethereum’s Merge Reduces Energy Use By a Stunning 99%

Crypto Goes Green? Ethereum’s Merge Reduces Energy Use By a Stunning 99%

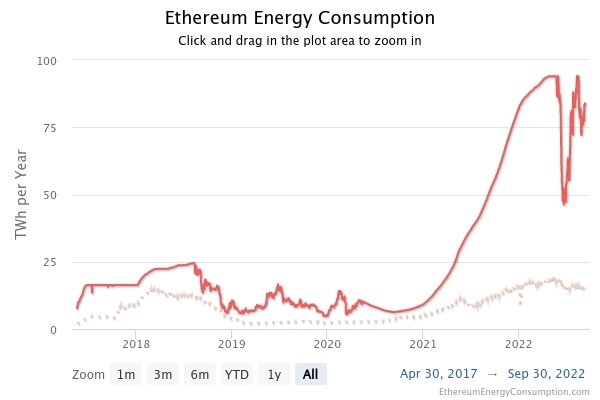

Ethereum’s long-awaited Merge is complete, and aside from being a testament to the dedication and ingenuity of its developers, it also represents a massive leap forward for the cryptocurrency sector’s environmental impact. Prior to the Merge, Ethereum consumed around 83.89 TWh of electricity each year, equivalent to the consumption of a medium-sized country such as Finland. Now, its shift to a proof-of-stake consensus mechanism has reduced this footprint by 99.95%, to 0.01 TWh.

This is a massive seachange for Ethereum and crypto in general, for a variety of important reasons. Not only does it make the validation of Ethereum’s blockchain more accessible to more participants, but it will reduce its carbon footprint at a time of rising global temperatures, in the process helping to improve crypto’s reputation in the eyes of the general public.

Needless to say, this could be a big factor in the gradual acceptance of cryptocurrencies over time, and could help remove lots of the regulatory and governmental resistance currently confronting blockchain technology. As such, Ethereum’s Merge could be one very important step on the road to crypto becoming mainstream.

Ethereum’s Merge and Why Proof-of-Stake Needs Less Energy

The Ethereum Foundation has been planning to shift Ethereum to a proof-of-stake consensus mechanism since at least 2016, and the designs of its developers have changed and evolved over time, meaning that Ethereum PoS as conceived back in 2016 (and even earlier) is different from how it has now been implemented.

Nonetheless, the basics are easy enough to grasp. In the past, Ethereum validated transactions and new blocks through miners who used mining equipment that crunched large sets of numbers. Now, the network will use validators who simply stake ethereum (ETH) in favor of the blocks they choose to validate. All they need to perform this are conventional computers running the latest Ethereum software, which is where the energy reductions come into the picture.

Ethereum’s energy consumption pre-Merge (in TW/h per year). Source: Digiconomist

Validating blocks on the basis of which receive the most staked ETH might initially seem risky, but committing money does deter dishonest behavior. That’s because Ethereum 2.0 (as the new new proof-of-stake Ethereum used to be known) requires a minimum stake of at least 32 ETH, meaning that validators risk losing a considerable sum of money if they’re found to be staking dishonestly. And that’s exactly what happens to dishonest validators, with their staked ETH being destroyed.

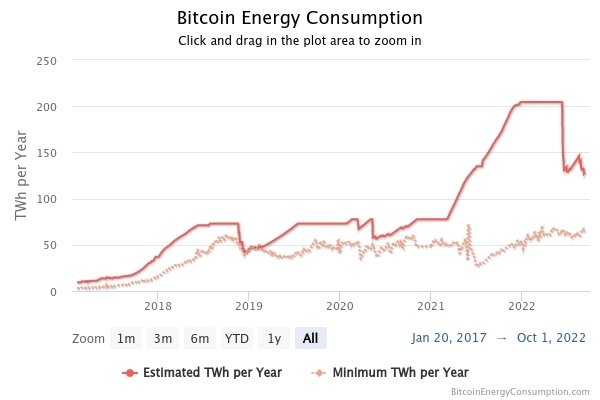

It’s also worth pointing out that once you get rid of proof-of-work and expensive, energy-intensive mining equipment, you also get rid of the financial incentive to invest in even more powerful mining equipment, and so on. As the sector has seen with Bitcoin and other proof-of-work coins, an arms race tends to develop between miners to see who can source the most powerful mining chips and — by extension — receive the most block rewards. This is a recipe for environmental disaster, with Bitcoin’s energy consumption rising as a result.

Source: Digiconomist

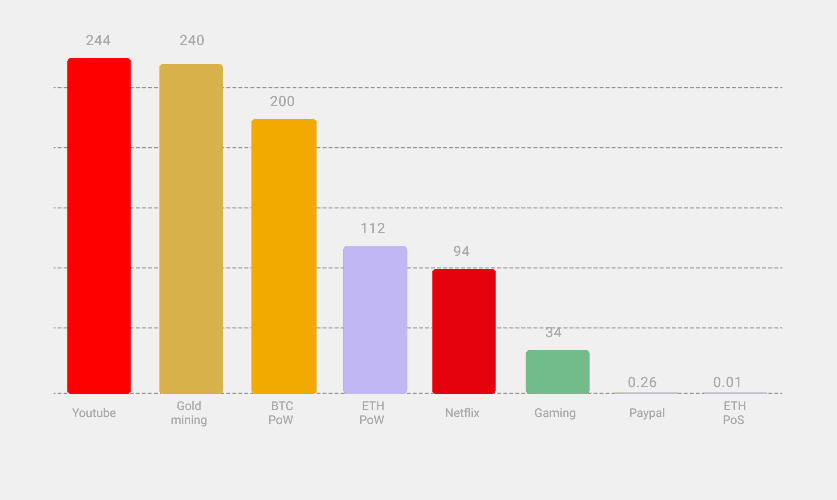

With the Merge, Ethereum has done away with Antminers, Whatsminers and other powerful mining chips, with the only things now consuming energy being its mining algorithm and the (ordinary) computers that run it. As a result, Ethereum isn’t only less energy-intensive than Bitcoin and its former PoW self, but also less wasteful than Netflix and PayPal.

Source: Ethereum.org

On a practical level, this will incentivize more participation in Ethereum’s network. This is because, in the past, anyone who wanted to validate blocks and receive mining rewards had to invest in increasingly expensive mining equipment and facilities, something which may have been a deterrent.

For instance, the production cost of a single bitcoin currently stands at just under $27,000, according to data from Capriole Investments, implying that miners are currently losing money relative to the bitcoin price right now. This isn’t something Ethereum validators will have to worry about, since the cost of validating transactions for them will now be extremely low, and likely to be more consistently profitable.

Bitcoin price (green) set against total production costs (purple). Source: TradingView/Capriole Investments

What Improved Green Credentials Mean for Ethereum and Crypto

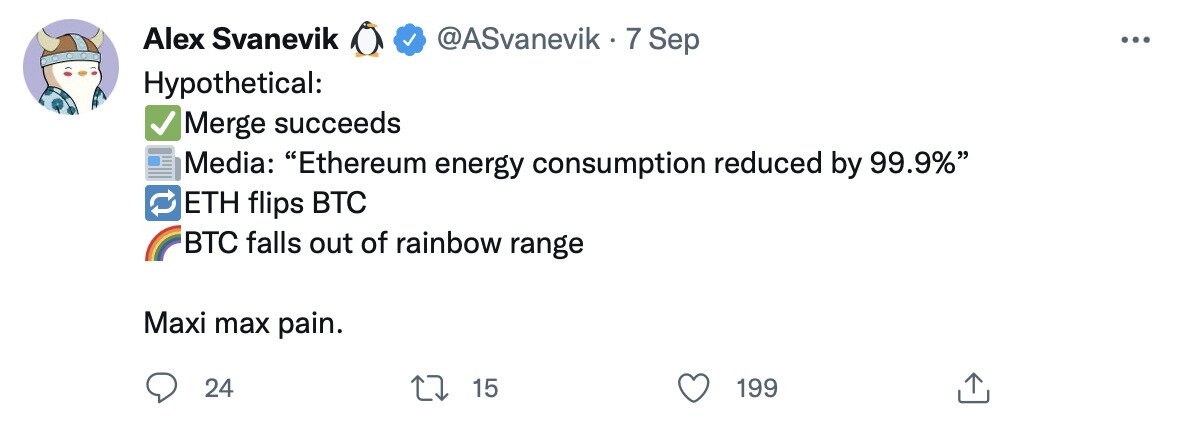

It probably comes as no surprise that people within and without the Ethereum community are very excited about the 99.9% drop in energy consumption. Indeed, boasts related to Ethereum’s move to proof-of-stake have become a semi-regular fixture on Crypto Twitter.

Source: Twitter

In fact, it’s not only on Twitter that you can find commentary regarding Ethereum’s historic Merge. The mainstream media is also increasingly paying attention to the move to proof-of-stake, with a growing number of serious media outlets publishing pieces that all seem to agree that said move is of massive importance for crypto.

For instance, The Economist published an article on September 6 titled, “The future of crypto is at stake in Ethereum’s switch.” In particular, the publication agreed that the Merge will make Ethereum more energy efficient and also set it on the path to becoming more useful and scalable.

One significant passage of this article declared that the “effect on [carbon] emissions will be as though, overnight, the Netherlands had been switched off … More important still, the merge will, if successful, suggest that Ethereum has the capacity for self-improvement, opening the door to more sweeping changes.”

Later in the article, The Economist’s author goes on to acknowledge that “the merge will be a step towards a much more useful technology,” and that upgrades following the shift will be “aimed at improving scale and efficiency,” including the later introduction of sharding.

What Will the World Make of Ethereum’s New Energy Efficient Design?

It’s not just financial outlets weighing in on the new, more energy efficient Ethereum. The left-leaning Guardian published a similar article in late August, in which (once again) the 99% reduction in energy consumption is the headline draw. It includes approving statements from economist Alex de Vries, who publishes energy consumption estimates for Bitcoin and Ethereum under the name ‘Digiconomist,’ and who has become one of Bitcoin’s most vocal public critics.

He told the paper, “They could cut off a huge chunk of their power demand. I will be working on quantifying that more accurately but at least 99% (probably even 99.9%) reduction should be achievable.”

Such media outlets have hardly been vocal supporters of crypto up until now, so their positive reporting about the Merge represents a highly significant change in attitude. What’s also significant is that this reporting is coupled with ongoing criticism of Bitcoin and its continuing reliance on the more energy-intensive proof-of-work consensus mechanism.

As The Guardian’s article concluded, “The bitcoin network uses 130TWh of electricity a year, De Vries estimates, a sum that will be increasingly difficult to defend if the [E]thereum blockchain demonstrates that the same capabilities can be achieved in an environmentally friendly manner.”

In addition to Ethereum’s migration to proof-of-stake, Bitcoin’s continued dependence on PoW comes at a time of exorbitantly high energy bills for much of the developed world. This fact hasn’t been neglected by commentators working within crypto.

Source: Twitter

It actually seems that Ethereum’s shift to PoS will help provide impetus for an attack of sorts on Bitcoin and proof-of-work. This isn’t only evident in articles from university researchers that declare “a global regulatory crackdown on proof-of-work mining is required,” but also on preliminary steps from governments (including the US Government) to regulate cryptocurrency energy consumption and carbon emissions.

However, it’s highly speculative as to whether Ethereum’s move will have the ultimate effect of forcing a similar change on Bitcoin. This could potentially happen, especially if coupled with regulatory and governmental moves that make PoW unwelcome in most major nations, and it would undoubtedly make crypto even greener than it will now be following the Merge. Nonetheless, given just how protective most Bitcoin supporters and maximalists are of proof-of-work, it seems unlikely at the moment.

On the other hand, what’s more likely is that growing pressure on Bitcoin will encourage its miners to lean more heavily on renewables as their source of energy. This process has already been underway over the past few years, with the latest and most authoritative study on energy use in Bitcoin mining — the University of Cambridge’s Global Cryptoasset Benchmarking Study — showing that 76% of Bitcoin miners used renewable energy (to varying degrees) as part of their energy mix in 2020, up from 56% in 2019.

The latest version of this study found that 39% of all bitcoin mining is powered by green energy, so there is definitely room for improvement here. That said, more recent data from the (admittedly interested) Bitcoin Mining Council revealed that this had risen to 58.5% by Q4 2021. But with Ethereum’s embrace of proof-of-stake putting further pressure on Bitcoin, this percentage could rise even further in the coming years, adding to the narrative that crypto is fuelling investment in renewable sources of energy.

The Merge Could Shift Sentiment Surrounding Crypto

At the end of the day Ethereum’s transition to PoS is a big win for Ethereum and the wider cryptocurrency industry. By changing public attitudes towards crypto, it will potentially encourage more people to engage with the space.

This is hinted at by perceptions of NFTs, Web3 and the metaverse. When these first gained prominence in 2021, they were met with a tidal wave of negativity surrounding their potential environmental impact, seeing as how most NFTs and Web3/metaverse platforms were running on Ethereum.

Just look at pieces published in 2021 in such prominent places as Wired, The New York Times, The Verge, Time, CBS, The Independent, The Guardian and CNN, all of which despaired at the cost of NFTs in terms of energy consumption and carbon emissions. Seeing as how Ethereum — and its layer-two solutions — account for roughly 63% of the entire crypto ecosystem in terms of total value locked in, such criticisms aren’t really going to be valid anymore. Not least when the other 37% is mostly covered by rival platforms (e.g. Avalanche, Tron and Solana) that were already proof-of-stake.

While the effect won’t be immediate, it’s already apparent that a change in attitudes and perceptions has already begun. The mainstream media will become less critical of crypto and more supportive over time, and the upshot of this is that more individuals and businesses may feel inclined to enter crypto in one way or another.

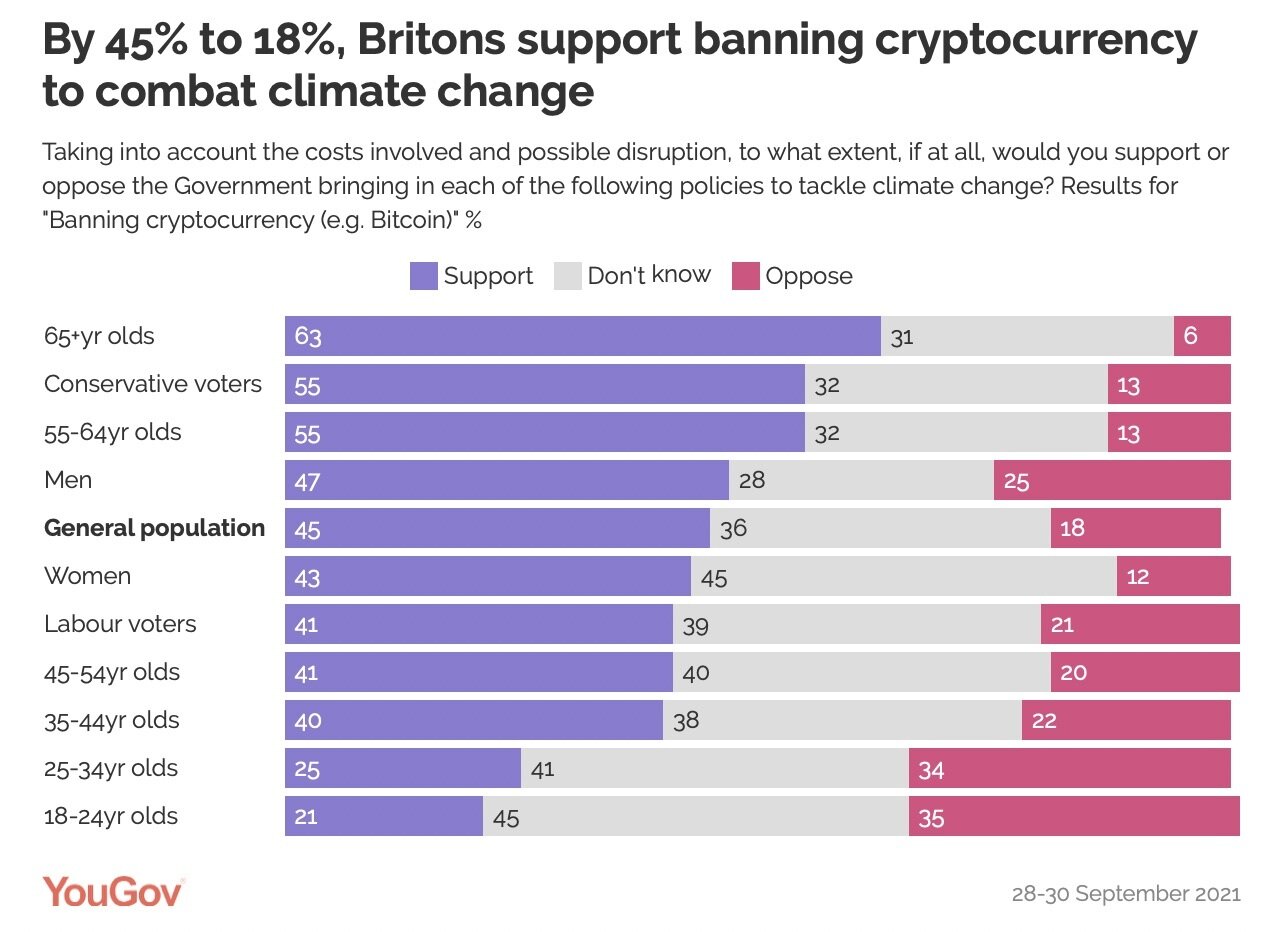

That climate concerns have deterred involvement in crypto is evidenced in a small number of surveys that have been conducted on the subject to date. For instance, an October 2021 poll conducted in the UK by YouGov found that Britons supported banning cryptocurrency to combat climate change, by a majority of 43% to 18%.

Source: YouGov

This shows that climate concerns have had an impact on cryptocurrency investment among the general public, while it has also undoubtedly been a concern for institutional investors. That’s because ESG (environmental, social and governance) investing has become increasingly common in recent years, meaning that many corporate and institutional investors that follow ESG guidelines (and that’s most of them) are likely to have been turned off Bitcoin (and Ethereum) by the environmental impact of PoW. According to an EY survey from November 2021, around 74% of institutional investors reported that they will divest from companies that fail on ESG measures.

Similarly, the European Central Bank published a report in July of this year warning that the “functioning of certain crypto-assets (like bitcoin) uses a disproportionate amount of energy that clashes with public and private environmental policies and environmental, social and governance (ESG) objectives.”

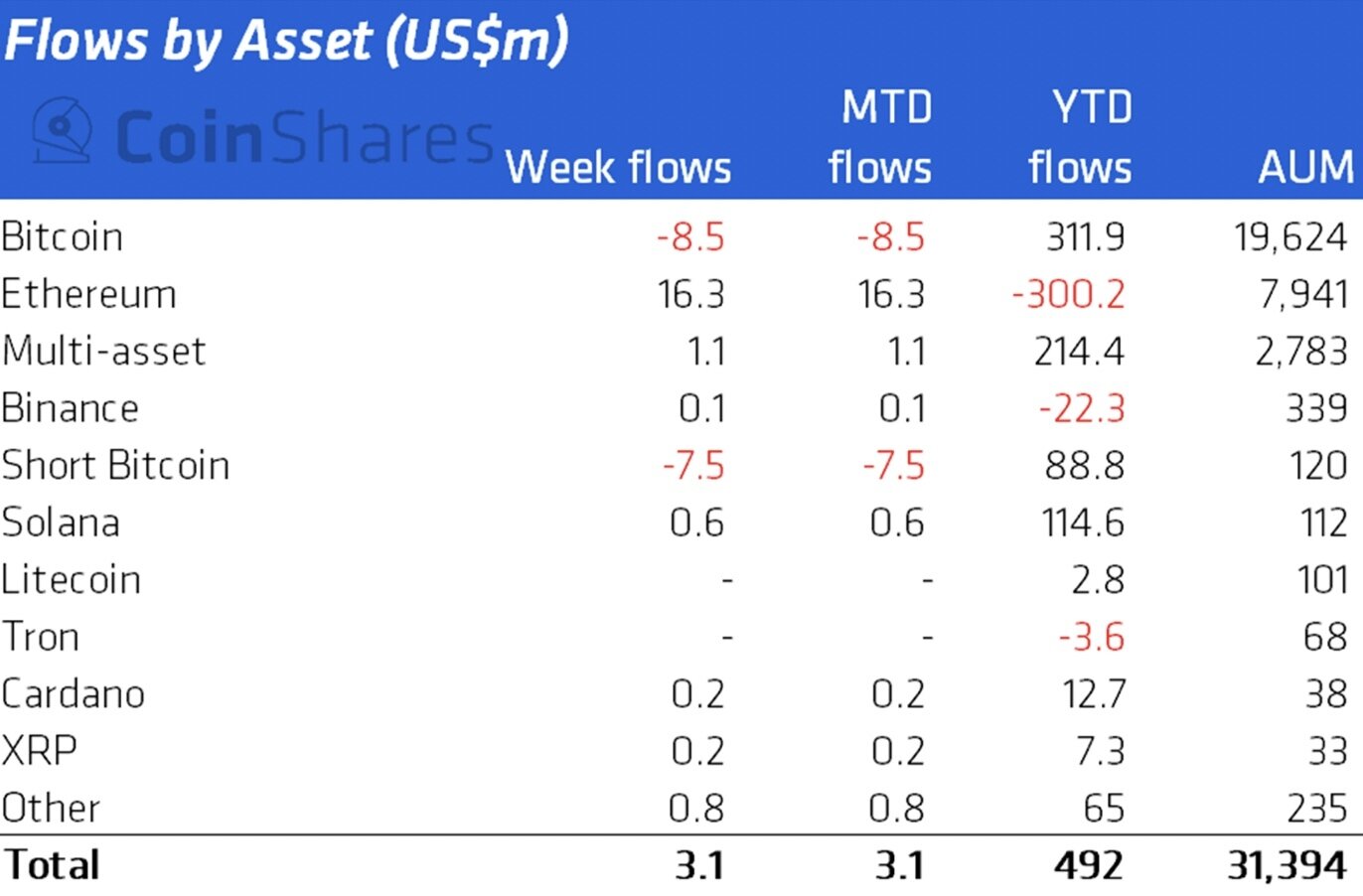

In other words, PoW was likely an obstacle to more institutional investment in Ethereum in the recent past. This is no longer the case, with institutional investors already increasing their investment in ethereum in the weeks prior to the Merge.

According to an August report from CoinShares, institutions piled into ethereum at a time when they were leaving bitcoin, with the cryptocurrency enjoying seven weeks of consecutive inflows (totalling $159 million at the time). Of course, bitcoin does remain the biggest cryptocurrency in terms of associated assets under management by institutions, but this recent difference in fortunes over the past couple of months points to a very different future.

The chart shows that ethereum saw net monthly inflows at a time when bitcoin had net outflows. Source: CoinShares

As some Ethereum supporters have been suggesting for a while, the Merge could help bring about the much-ballyhooed ‘flippening,’ whereby ethereum becomes a bigger cryptocurrency than bitcoin in terms of market capitalization and other metrics. If this were to happen, it would potentially improve crypto’s public image even more, insofar as the biggest coin in the space would be much greener than the previous biggest.

Source: Twitter

Ethereum’s Place in History

It’s worth stressing that what Ethereum has achieved with the Merge is more or less unprecedented in history. This may sound like an overly grandiose claim, but it’s rare that a major platform — which accounts for $35.26 billion in total value (with a record high of over $110 billion) — overhauls itself to the point where its energy consumption drops by a staggering 99%.

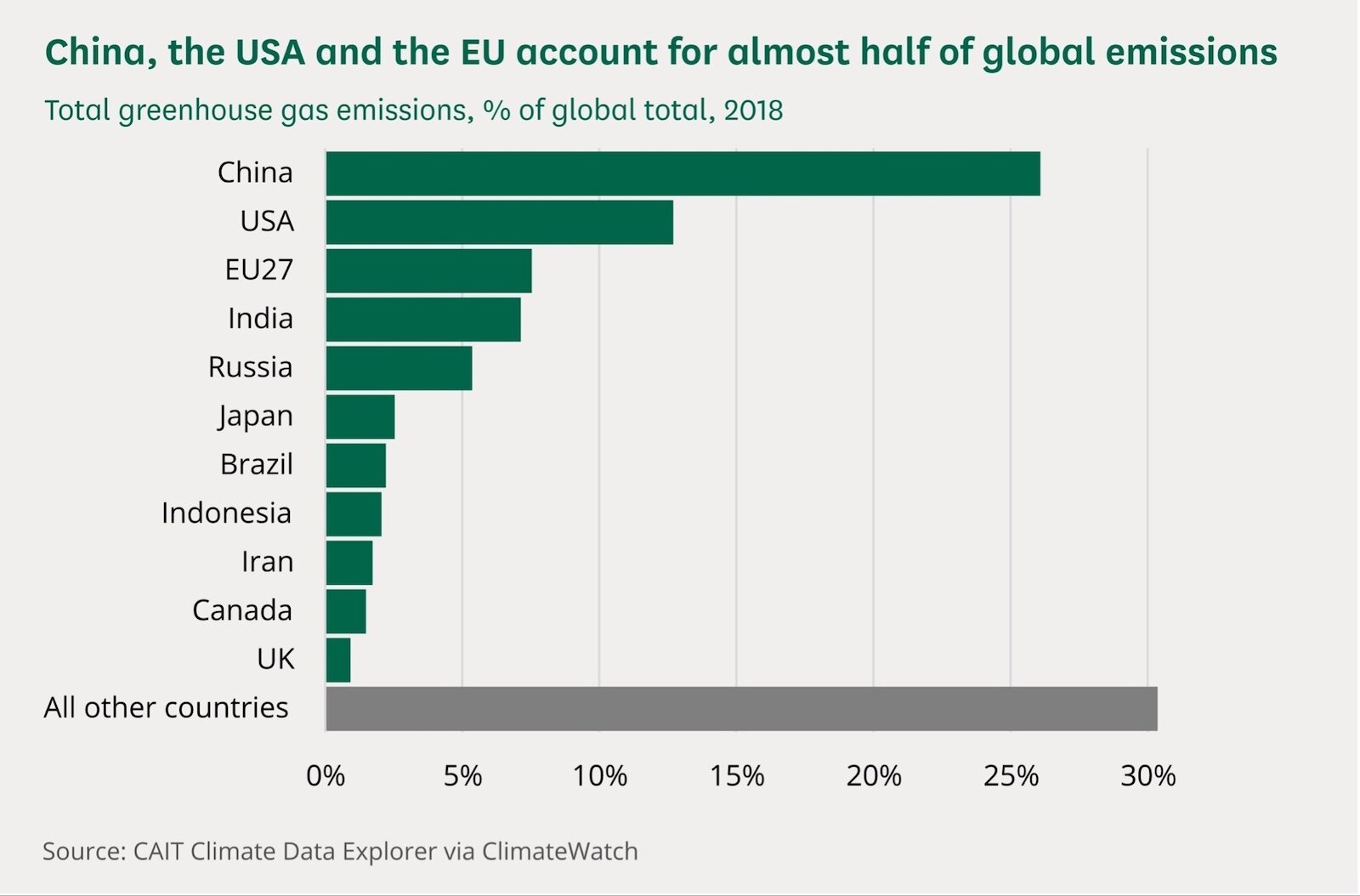

Obviously, the specific nature of blockchain technology — and the alternative approach offered by proof-of-stake consensus — makes such a dramatic reduction more manageable, but it still looks impressive when contrasted with other attempts at green-ification elsewhere in the world. To take possibly the starkest example, global carbon emissions continue to break new records every single year (with the unsurprising exception of 2020), despite the scientific consensus surrounding global warming and the public groundswell of support for taking some kind of meaningful action.

Looking at specific nations, many advanced economies have set themselves the task of becoming ‘carbon neutral’ by 2050, yet still remain some way away from achieving this goal. The UK is set to fall short of a target to reduce its CO2 emissions by 57% (compared to 1990 levels) by 2030, with the country needing another 32% reduction before this decade comes to a close, although the government is predicting only a 10% reduction.

Source: CAIT/UK Parliament

Plenty of major corporations have also set net zero targets for the end of this decade (e.g. Apple, Microsoft), while a few have already achieved such an aim (e.g. Facebook, Salesforce). Regardless, they won’t reduce their total energy consumption by 99%, something which makes Ethereum’s achievement seem all the more impressive and singular (although other coins are already PoS).

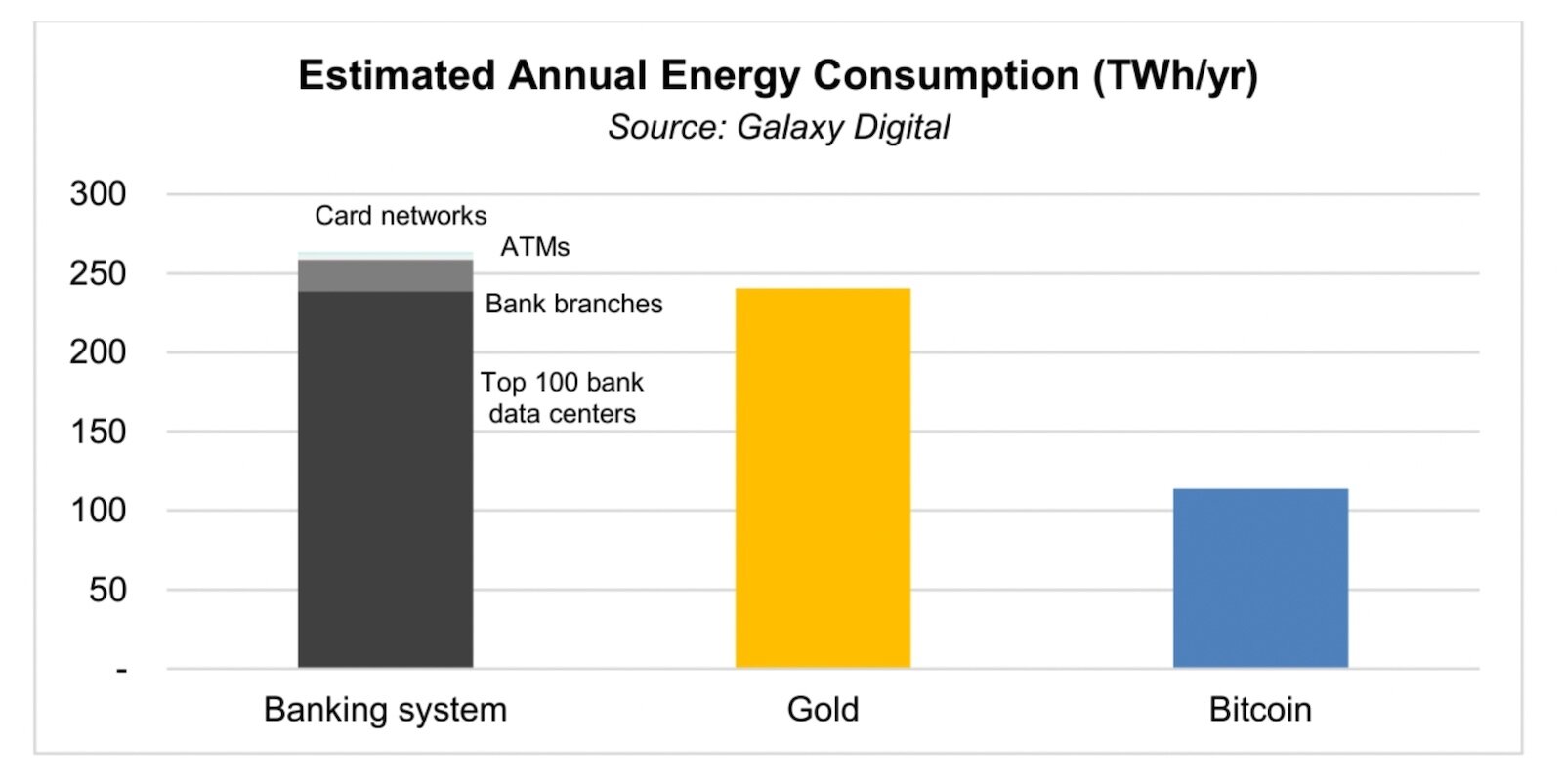

Ethereum’s Merge is such an important event in environmental terms that, not only will it put pressure on Bitcoin to use more renewables (and possibly contemplate its own change of consensus mechanism), but it could also put pressure on other areas of the economy in the years to come. This includes the global banking system, which according to a 2021 report from Galaxy Digital, consumes around 263.72 TWh of electricity per year. This is more than double Bitcoin’s consumption, and more than triple Ethereum’s pre-Merge energy usage.

Source: Galaxy Digital

The interesting point here is that, by using proof-of-stake, Ethereum could ultimately help exert pressure on the financial sector (and other sectors) to adopt more efficient technologies.

This includes blockchains such as Ethereum. In this respect, it’s significant to note that a report from the IMF published in April concluded that “DeFi has the potential to offer financial services with even greater efficiency […] DeFi has the lowest marginal cost compared with incumbents in both advanced and emerging market economies, indicating the highest cost-efficiency.”

And seeing as how Ethereum is the biggest platform for DeFi apps, it seems that its historic move to proof-of-stake lays an all-important foundation for crypto’s further infiltration into the mainstream. Yes, the Merge is only just the beginning of a long process of making Ethereum more scalable and efficient. However, it’s arguably the most important step of all, since it shows that major improvements to a major blockchain platform can and should be done.