- >News

- >What Are the Biggest Obstacles to Widespread Cryptocurrency Adoption?

What Are the Biggest Obstacles to Widespread Cryptocurrency Adoption?

Adoption is the holy grail of crypto. While the likes of Bitcoin and Ethereum have been steadily gaining in users and price over the past few months, they still remain a long way from enjoying widespread mainstream adoption.

Why is this? In this article, we propose and examine the five most significant factors keeping crypto and mainstream adoption apart.

From scaling problems to the opposition of governments, they all indicate that cryptocurrencies still have a long way to before they’ll be widely used. They also reveal that a large number of elements need to fall into place before mainstream adoption arrives, and that it’s not enough to rely on rising crypto prices.

Bad Reputation

Let’s be honest, cryptocurrencies still have a bad reputation. Economists continue to denounce Bitcoin as a “scam” and “pyramid scheme” in 2020, while mainstream journalists associate cryptocurrency more with crime, fraud and hacks than anything else.

The negative perception of crypto wasn’t helped by July’s Twitter breach, where cybercriminals hacked into the accounts of high-profile public figures and used them to ask for Bitcoin. This association with crime doesn’t reflect well on cryptocurrency, reinforcing the idea that it has no ‘real use’ outside of the criminal underworld.

Source: Twitter

Then there’s the whole shadow cast over cryptocurrency by suggestions of market manipulation and wash-trading. This is particularly the case with the stablecoin Tether (USDT), which has faced class-action lawsuits and been investigated by the New York Attorney General, among other things. Accusers suggest that Tether has been used to inflate cryptocurrency prices.

As a whole, these perceptions — rightly or wrongly — likely deter the general public from investigating cryptocurrency further. The average person on the street may fear losing money if they enter crypto, particularly if much of the market is ‘fake’. In turn, businesses shy away from accepting crypto as a means of payment. And so on, keeping crypto adoption at a restricted level.

Governmental Opposition

Governments. Governments don’t particularly like cryptocurrency, largely because it threatens their monopoly over money. If a cryptocurrency such as Bitcoin were to replace a preexisting fiat currency as the main (or only) form of money within a nation, that nation’s government and central bank would be unable to issue new money. This would seriously undermine a government’s ability to expand the money supply during periods of economic contraction, which would arguably make that government less able to maintain economic and political stability.

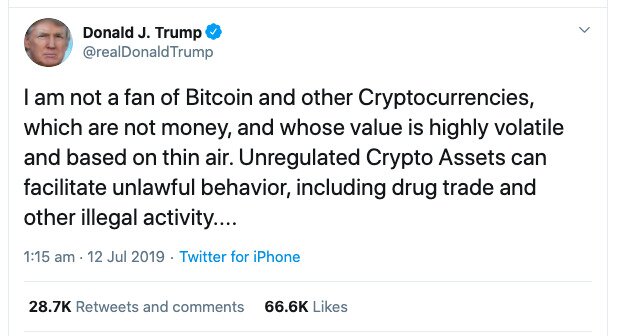

It’s therefore little wonder that most governments have taken a very cautious view of cryptocurrency. G7 finance ministers have long warned that cryptocurrencies could destabilize the global economy, while even Donald Trump has argued that cryptos aren’t really money.

Source: Twitter

Many governments have also proposed legislation and guidelines which restrict crypto in some way. Russia recently passed a law that prevents cryptocurrencies from being used to purchase goods and services. An even more restrictive law is being drafted in India.

At the same time, very few national governments have taken legislative action to actively encourage cryptocurrency use. Without such support, it’s unlikely that the general public will flock to crypto en masse.

Scaling

Assuming a better reputation and governmental tolerance (or support), many cryptocurrencies would still face another highly important problem: the inability to scale.

This is one of Bitcoin’s biggest problems. It can handle roughly 28 transactions per second thanks to the SegWit upgrade, yet this is still much fewer than the 65,000 Visa claims it can handle as its maximum theoretical capacity. It’s nowhere near the level that would be required for Bitcoin to become a widely adopted currency.

Bitcoin’s second-layer solution, the Lightning Network, is still under development and testing. It promises theoretically unlimited instant transactions to be processed off-chain, before being resent to the Bitcoin blockchain. However, there’s no clear roadmap for when it might be widely available, with security researchers regularly finding bugs in its code.

Something similar goes for other cryptocurrencies based on proof-of-work consensus, like Bitcoin. That said, an increasing number of cryptos are now based around proof-of-stake consensus mechanisms, with Ethereum planning a switch to a PoS mechanism at some point later in 2020. These are much better at scaling, yet their particular properties and weaknesses aren’t yet fully known, with research unearthing vulnerabilities on a semi-regular basis.

Pseudo-Cryptocurrencies

Another big problem are digital currencies, whether these are central bank digital currencies (CBDCs) or private digital currencies such as Facebook’s Libra. While these may potentially increase public awareness of decentralized cryptocurrencies such as Bitcoin, they may also reduce demand for them.

This is the view of a number of economists. Monash University’s John Vaz recently declared that Libra remains the main threat to Bitcoin, while inveterate crypto-skeptic Nouriel Roubini has suggested that “central bank digital currencies will destroy bitcoin.”

The main threat posed by CBDCs and private digital currencies like Libra is that they will be centralized and, by extension, more scalable and more regulable. This will make them usable in the eyes of relevant governments and financial authorities, who will push them on the public. In the process, appetite for real cryptocurrencies may end up being reduced.

The U.S. Dollar

Lastly, we come to perhaps the biggest obstacle: the dominance and strength of the US dollar. Bitcoin was famously created in the aftermath of the financial crisis of 2007-8, as a response to excessive money printing and unending inflation. Champions of Bitcon and other fixed-supply cryptocurrencies argue that their deflationary cryptos are more attractive than fiat currencies such as the US dollar, which don’t store value as well.

However, so far the US dollar hasn’t suffered the kind of collapse that many Bitcoiners are counting on. While weaker currencies such as the Venezuelan bolivar have fallen dramatically and opened doors for Bitcoin, the US dollar and other major world currencies are holding firm.

With the coronavirus pandemic still raging and US-China tensions rising, the world seems to be becoming increasingly unstable. It’s therefore not certain that the US dollar can escape significant inflation in the long run. But for now, inflation has been low for several years, and that’s another big reason why we haven’t seen a massive flight to crypto. Yet.