- >News

- >Do The Best Crypto Exchanges Charge the Highest Fees?

Do The Best Crypto Exchanges Charge the Highest Fees?

Fees do not predict the quality or level of service cryptocurrency exchanges offer. New data from Arcane Research shows that fees vary widely between the top crypto exchanges, yet reviews of these same exchanges indicate that high fees don’t correlate strongly with high review scores.

In other words, you don’t always get what you pay for with crypto exchanges. You may pay higher fees with certain platforms, but this doesn’t always equate to a better or more reliable user experience.

So why pay higher fees? Some higher fee exchanges may offer certain services or features that appeal more to particular traders, such as more responsive customer service. It also seems as though high-fee exchanges may invest more in cybersecurity, at least judging by the record of past hacks.

Lower Fees, Not Lower Quality

Published earlier in July, Arcane Research’s The State of Crypto Trading Fees report makes for some eye-opening reading. It’s most notable finding is that the two most popular crypto exchanges in the world – Coinbase and Binance – are at opposite ends of the trading-fee spectrum.

Its authors wrote, “How can Coinbase be one of the most popular exchanges, and at the same have the highest fee level for new customers? And why is Binance giving new customers 80% lower fees than both Coinbase and Bitstamp?”

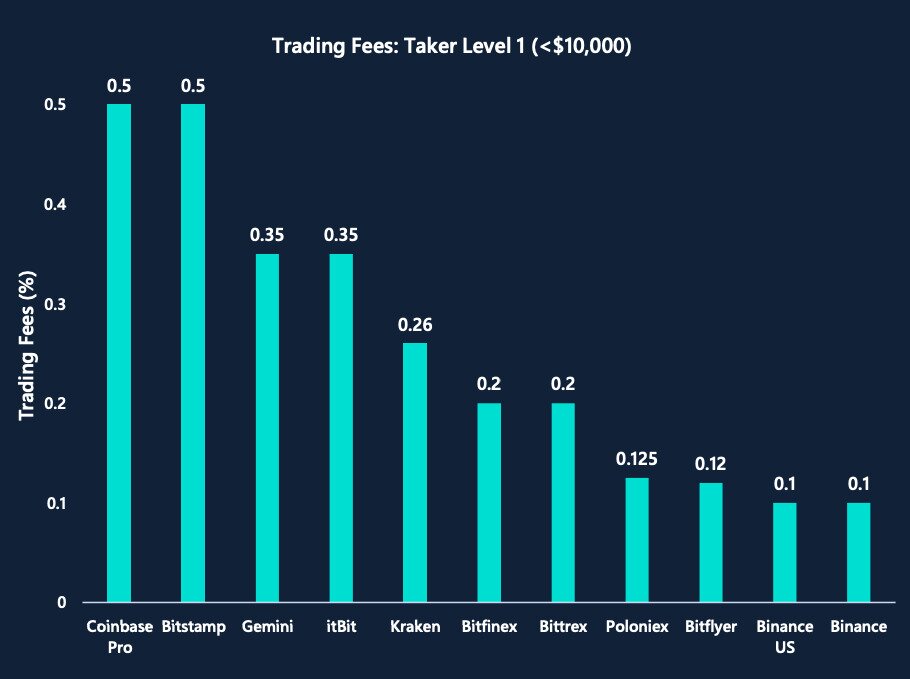

As the table below illustrates, taker fees across the ten biggest exchanges are spread quite evenly. Binance (and Binance US) boast the lowest fees, while Coinbase Pro and Bitstamp charge the highest fees.

Source: Arcane Research

Does this mean that Binance is the worst crypto-exchange and Coinbase Pro and Bitstamp are the best? Well, no.

CryptoVantage’s own crypto exchange reviews award Coinbase five stars out of five, suggesting that it justifies its higher fees. The thing is, Kraken – which sits in the middle in terms of fees – is another five star-rated exchange, while Binance is very close with four-and-a-half stars.

Being cheaper doesn’t mean that an exchange is significantly worse. As Arcane goes on to explain, there are various business reasons for lower fees, so they aren’t (or aren’t always) indicative of cutting back on services or features.

The biggest reason for differences in fees is trading volume. “The higher the volume, the lower the fees,” writes Arcane Research, which also adds that as “trading volume grows, we expect lower and more similar fees across the exchanges.”

Different Business Models

Another big reason for lower fees is business strategy, with some crypto exchanges offering lower fees simply to out-compete rivals and take customers away from them.

“Binance US is underbidding the fees of their competitors as a newcomer strategy,” says the report, which also notes that ItBit has recently been offering negative maker fees to traders in order to attract new business. Gemini has also cut its trader and maker fees from 1% to to 0.35% and 0.25%, respectively.

Exchange tokens are also another factor which enable lower fees. Such tokens not only provide exchange customers with discounts, but they generate revenue for the exchanges which issue them. This is the case with Binance and its BNB token, as well as Bitfinex and its UNUS SED LEO token. It’s also the case Poloniex and TRON, which Poloniex is able to offer discounts on due to its links with Tron’s Justin Sun, who is part of an investor group that acquired Poloniex last year.

One final factor is the flexibility that comes from not offering fiat-crypto trading pairs. By allowing customers to buy crypto with fiat (and vice versa), exchanges subject themselves to greater regulatory oversight. According to Arcane Research, by not providing fiat-crypto pairs, this makes “alternative income streams more feasible and available, such as listings of new cryptocurrencies, leveraged products and derivatives trading.”

Fees Don’t Always Equal Quality, But Sometimes They Do

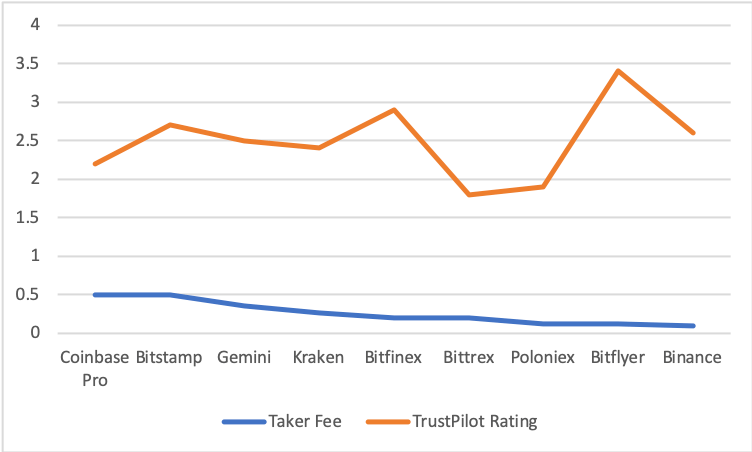

It’s possible to create a graph comparing fees against customer satisfaction scores. In this case, we’ve taken ratings from Trustpilot. These may not be entirely reliable (since some of the reviews posted for exchanges clearly aren’t genuine), but they cover all of the ten exchanges featured in Arcane’s research (except ItBit).

Source: TrustPilot, Arcane Research, Simon Chandler

Taking the Trustpilot customer review scores at face value, it becomes apparent that there’s no clear or strong correlation between high fees and the level of reported customer satisfaction. In fact, the average Trustpilot rating for the nine exchanges above is 2.48, a score which the low-fee Bitflyer and Binance surpass, but which Coinbase fails to match.

Still, higher trading fees may manifest themselves in other ways than online customer reviews. In our review of Coinbase, we note that it has “Great customer service,” something which not every crypto exchange can claim.

We also note that Coinbase requires significant identity verification. We actually list this as a con in the review, but it indicates that Coinbase takes KYC, AML and regulation very seriously, something which may ultimately benefit cryptocurrency and the crypto industry in the long run.

It’s also interesting to note that Coinbase claims to have never been hacked. It certainly hasn’t suffered any high-profile or public hack in its history (although reports suggest it suffered a smaller, $250,000 phishing attack in 2013), while Binance suffered a $40 million hack as recently as 2019 (Bitstamp was last hacked in 2015). This may ultimately be a result (in part) of its fees, which may allow it to finance cybersecurity efforts to a greater degree than rivals.

Ultimately, higher fees may allow a crypto exchange to offer a number of things that aren’t immediately noticeable to customers. However, the difference in fees may not last for much longer, since Arcane Research concludes its report by predicting that average fee levels will be pushed down. It writes, “competition between exchanges will intensify, and the battle for liquidity will lead exchanges to reduce their margins in order to attract new customers.”

A good thing for customers. And a good thing for crypto.