- >News

- >Ethereum 2.0 Still Needs 80% More Deposits to Launch By Next Month

Ethereum 2.0 Still Needs 80% More Deposits to Launch By Next Month

Ethereum 2.0 is on its way, but you’d be forgiven for not noticing. On November 4, the Ethereum Foundation announced the release of its contract deposit address, enabling users interested in the new proof-of-stake (PoS) network to deposit the ethereum that will get it up and running. However, as of writing, this address has received only 18% of the 524,288 ETH it will need to activate the platform’s launch.

Ethereum 2.0 had been penciled in for a December 1 launch, but with only 95,648 ETH sent to its deposit address — and with daily deposits slowing down — it now seems that this date will be pushed back and that its launch will be delayed yet again.

Where does this leave Ethereum 2.0? Well, in the medium-to-long term a delay of a few weeks or so doesn’t make a massive difference in itself to the platform’s chances of success. However, with Bitcoin steadily increasing its dominance of the cryptocurrency market, the initial migration to Ethereum 2.0 may be slowed down and dulled by peak BTC excitement, something which may undermine or weaken its longer term growth.

Ethereum 2.0 Deposits Stalling Amid Bitcoin Bull Market

According to data compiled by Dune Analytics, there are just under 95,648 ETH in Ethereum 2.0’s deposit address (as of writing). This is roughly 18% of the 524,888 ETH threshold needed to launch the system, a proportion reached after the address has been open for two weeks.

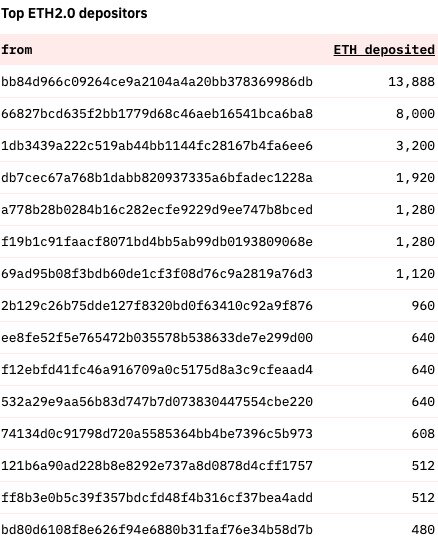

18% may be a disappointing percentage in itself, but it becomes even more underwhelming when viewed in the context of two other important facts. Firstly, there are a relatively small number of unique depositors, with the requirement being that there has to be at least 16,384 individual validators (in addition to a minimum of 524,888 ETH). One address has deposited 13,888 ETH while two others have deposited 8,000 ETH and 3,200 ETH, which represents a massive percentage of the total amount committed.

Source: Dune Analytics

The third highest depositor is in fact Vitalik ‘Ethereum Founder’ Buterin, who made 100 deposits of 32 ETH into the Ethereum 2.0 deposit contract since it opened. This isn’t a particularly great advertisement for the platform, insofar as it indicates a shortfall of interest that the platform’s founder has to compensate for himself.

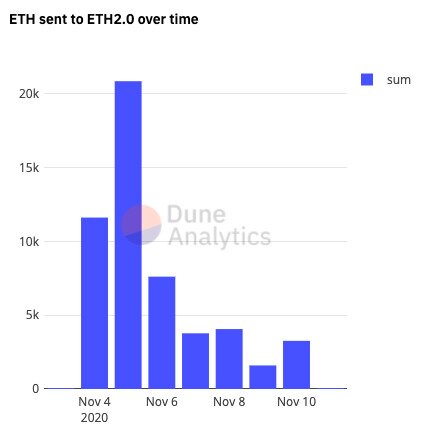

Likewise, daily deposits into the contract have declined since November 4. They peaked at 20,864 ETH on November 5, but have declined substantially since, hitting a low of 1,596 on November 9.

Source: Dune Analytics

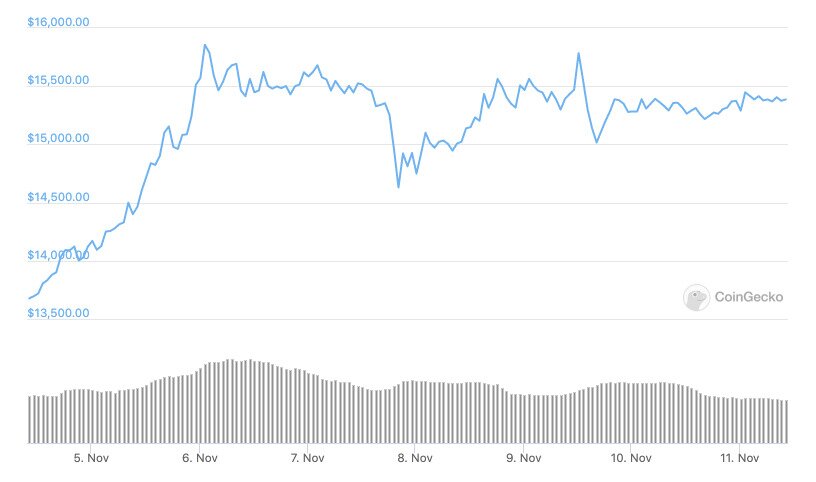

Interestingly, the big fall in deposits between November 5 and 6 coincides with a pretty substantial surge in the bitcoin market. On November 4, when the Eth2 deposit contract went live, one bitcoin was worth around $13,677, according to data from CoinGecko. It then jumped by 13.3% to $15,500 by the end of November 5, before peaking at $15,855 early on November 6 and staying above $15,000 pretty much ever since.

Source: CoinGecko

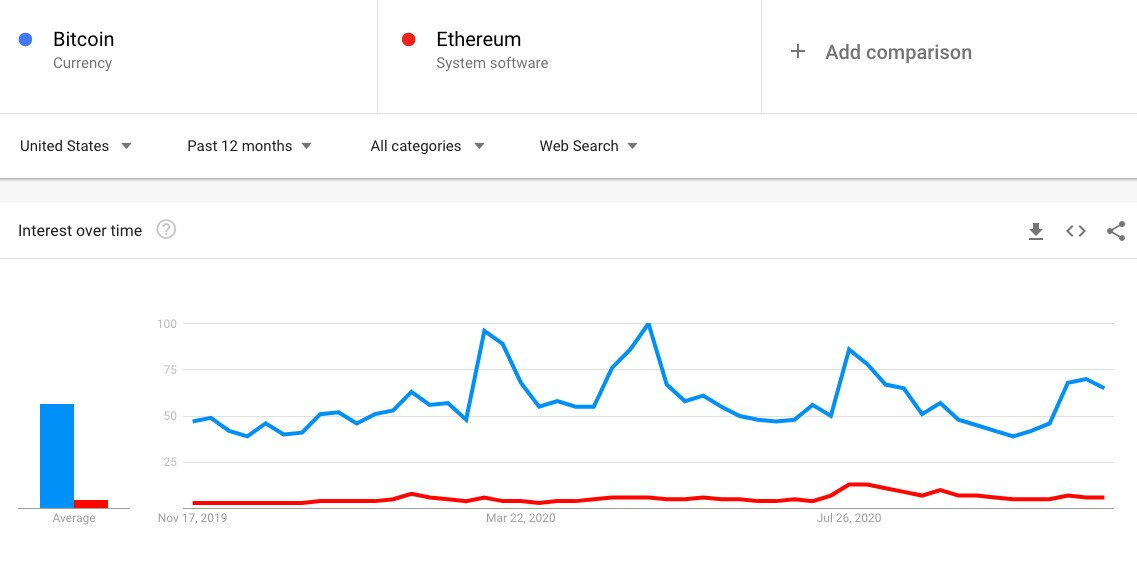

In other words, a rush to buy bitcoin may have suppressed interest in Ethereum 2.0. This suspicion is supported by Google Trends data, which shows a climb in interest in “Bitcoin” at the end of October. This is when interest in “Ethereum” was flatlining, having enjoyed a relative peak at the end of July and in August, when the Ethereum 2.0 validator testnet was launched and the price of ethereum rose amid Eth2 anticipation.

Source: Google

When Will ETH 2.0 Finally Launch?

Bitcoin and Ethereum have long been seen as rivals, even if they address different problems and areas of activity. And it seems that Bitcoin’s recent ascents are damping enthusiasm for Ethereum 2.0 to an extent, at least insofar as some market participants may currently feel that they’re better off buying bitcoin rather than buying ethereum to stake in Eth2.

Assuming that interest in staking remains fairly muted, when can we actually expect Ethereum 2.0 to go live? It now seems unlikely that the December 1 target will be met, although after a long line of earlier delays, the network will be able to launch once the 524,288 ETH target — spread among 16,384 unique validators — has been reached.

In a Reddit AMA (Ask-Me-Anything) thread posted in July of this year, Ethereum Foundation researcher Justin Drake suggested an earliest possible launch date of January 3, 2021. This was based on the need for an operational bug bounty program and an incentivized “attacknet,” both of which would ideally need to be running for two to three months prior to launch.

Significantly, a bug bounty — and attacknet — program for Ethereum was announced on October 9 by developer Danny Ryan. Two months on from this date would be December 9, while three months would be January 9. Combined with the relatively slow arrival of deposits, this makes Justin Drake’s prediction of a January launch seem pretty realistic.

Source: Twitter

What Proof-of-Stake Means for Ethereum and Crypto

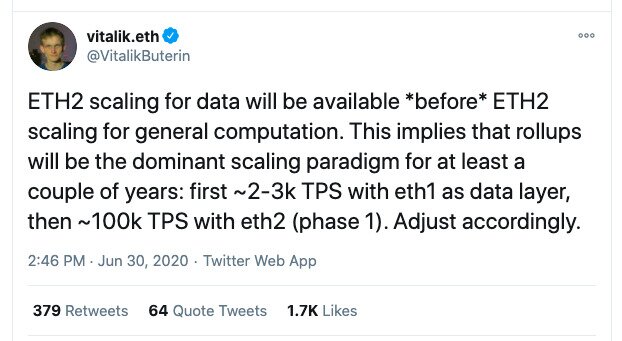

Delays aside, Ethereum 2.0 does indeed promise to give Ethereum and the wider crypto ecosystem a significant boost. Thanks to moving to a proof-of-stake consensus mechanism (as opposed to an intensive proof-of-work version), Ethereum will be able to handle a much higher throughput of transactions. According to Vitalik Buterin, this will be somewhere in the region of 100,000 transactions per second, once Ethereum 2.0 is fully operational and has moved beyond its launch phase.

Source: Twitter

This will make a big difference. The rise of DeFi (decentralized finance) has been hampered to an extent in recent months by the high transaction fees imposed on users by the Ethereum network, which in its current form cannot handle larger workloads. High fees have even been blamed for falls in the price of many native tokens used by DeFi platforms.

But with Ethereum 2.0 firmly in place, there should in theory be no technical limit to how far DeFi can grow. This will help encourage further investment into the sector, which in turn will push up the prices of cryptocurrencies used in DeFi, which is — or will be — pretty much every token in the crypto market.