- >News

- >Five of the Best Cryptos to Buy in 2023

Five of the Best Cryptos to Buy in 2023

It’s safe to say 2022 will go down as a bad year for pretty much every major cryptocurrency in the market, from Bitcoin to BitDAO. This was largely for macroeconomic reasons, with rising inflation and interest rates severely depressing investor sentiment. Yet as for the cryptocurrencies themselves, things often changed for the better, with Ethereum’s Merge and Cardano’s Vasil among the biggest upgrades of last year. These developments showed that a bear market doesn’t mean the end of growth for crypto, which is now even better placed to ride an expanding global economy than it was during the last bull market.

Given that the market likely bottomed out last year, 2023 could end up being a very positive year for crypto, especially if the macroeconomic picture improves. As such, we’ve put together a selection of the five best crypto to buy in 2023. This list has been compiled under the assumption that the bear market may continue for a few months yet, but that conditions may become more bullish in later months, helping more than a few coins to post significant gains.

As always this article is not financial advice and investing in crypto is inherently risky so proceed with caution.

Bitcoin (BTC)

Yes, bitcoin (BTC) may be the obvious choice here, but that’s for very good reasons. As the first cryptocurrency in the market, BTC benefits from significant network effects, while its hard cap and deflationary tokenomics make it the most bankable digital asset over the longer term.

It’s worth remembering that bitcoin has attracted the most institutional and corporate investment, with an October 2022 BIS report finding that banks worldwide own over $9 billion in cryptocurrency, with 56% of this being in bitcoin or bitcoin-based derivatives (compared to 32% for ethereum and ethereum-based derivatives). Likewise, corporations such as Tesla and MicroStrategy bought large amounts of BTC in previous years, something no other cryptocurrency can boast.

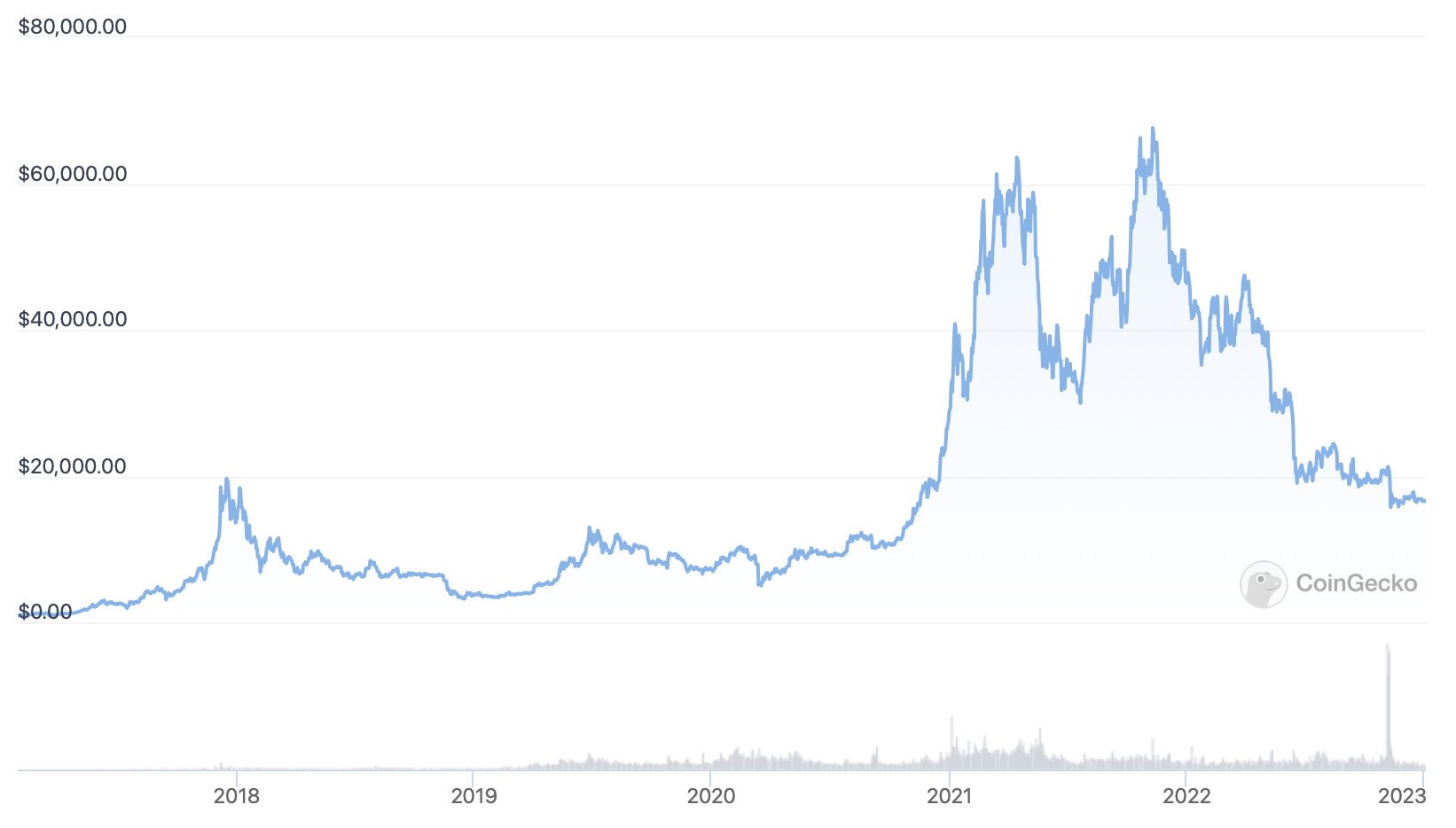

Bitcoin’s price since mid-2017. Source: CoinGecko

Not only is bitcoin the most attractive long-term investment prospect in the cryptocurrency market, but it did enjoy a number of notable developments over the course of 2022. This includes the ongoing growth of its layer-two Lightning Network (expanding its capacity from 3,311 to 5,158 BTC last year), the launch of the Machankura mobile-payment app in Africa, and the release of the Taro protocol on the Lightning Network (enabling for the tokenization of assets on Bitcoin).

Lastly, history has shown that BTC’s dominance tends to increase during bear markets, which it has done over the past few months. Not only that, but that it tends to lead new bull markets, making it arguably the best investment during downturns.

Ethereum (ETH)

Ethereum is another obvious choice for obvious reasons, with its blockchain comfortably remaining the biggest layer-one smart contract platform in the cryptocurrency ecosystem in terms of total value locked in.

Just looking at the numbers, Ethereum’s total value locked in stands at $23 billion, compared to $4 billion for its nearest rival, BNB Chain. This accounts for 59% of the entire crypto/DeFi ecosystem, a percentage that’s likely to increase now that Ethereum has completed its shift to a proof-of-stake consensus mechanism, something which will make it more scalable and efficient in the long run.

On top of this, the Merge and recent updates (e.g. EIP 1559) look set to make ethereum (ETH) deflationary. That’s because EIP 1559 introduces a burn of transaction fees, while the move to PoS means that less new ETH is minted.

Source: Twitter

Combined with its own network effects, Ethereum is in a very strong position to continue expanding, which means that ETH is one of the best-placed cryptocurrencies to ride a new bull market.

Lido DAO (LDO)

Lido DAO recently became the biggest DeFi platform in the cryptocurrency ecosystem. This is in terms of total value locked in (i.e. the amount of crypto stored on its platform), which currently stands at $6.17 billion, putting it ahead of nearest rival MakerDAO and also ahead of every layer-one blockchain besides Ethereum (on which it runs).

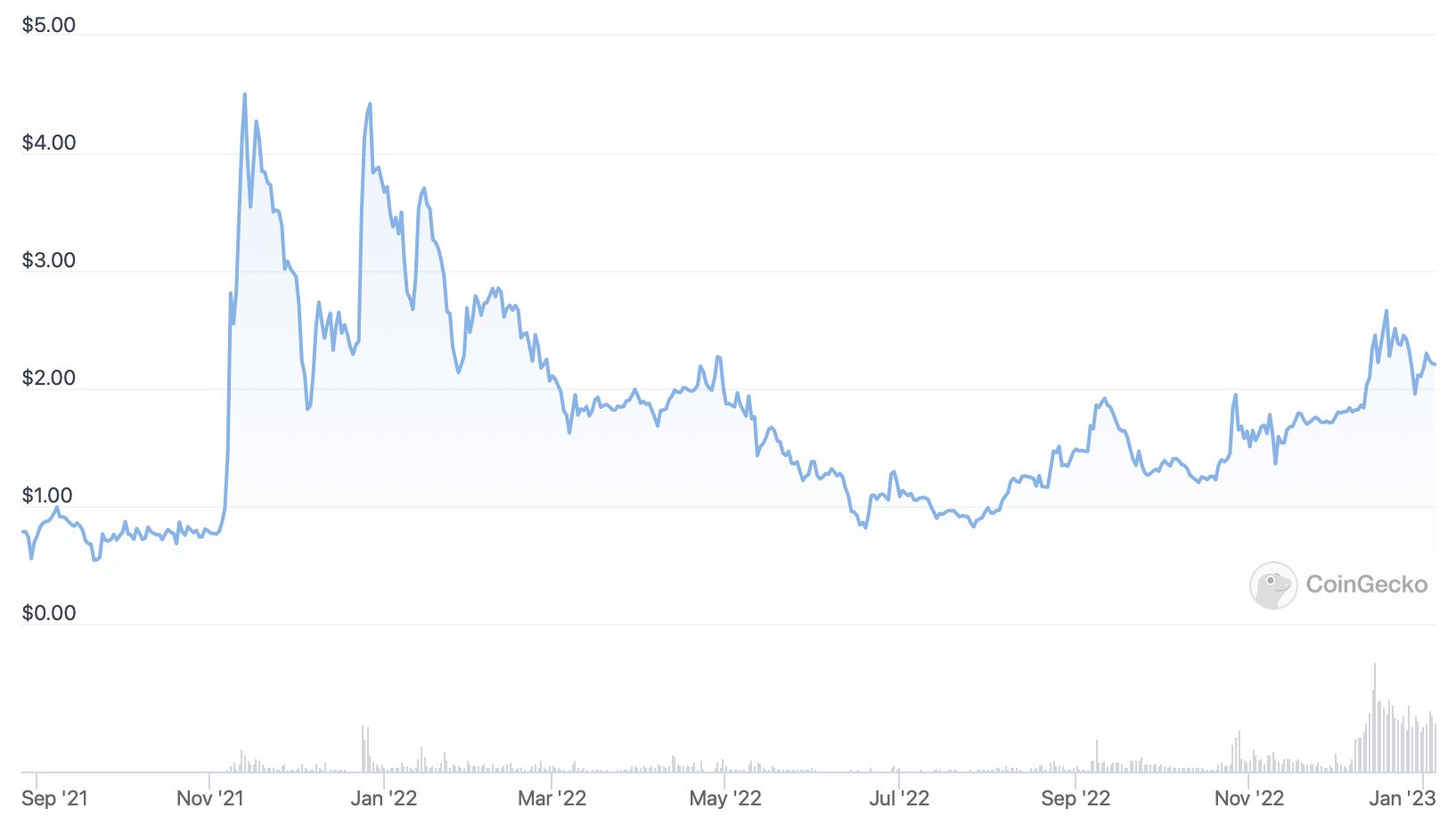

LDO’s price chart over the past 12 months. Source: CoinGecko

The reason why Lido DAO has grown so large is that it’s by far and away the most popular staking service for ethereum staking. As mentioned above, Ethereum transitioned to a proof-of-stake consensus mechanism in September, with most holders using Lido to stake their ETH and earn staking yields. It’s in this context that LDO has benefited, with the native token having various use cases within the Lido network. This includes as a governance token that grants the right to vote on development proposals and the use of Lido DAO’s treasury, while it can also be used to pay transaction and network fees, with Lido also paying LDO out as rewards for certain kinds of staking.

Lido DAO became even more popular from December onwards, when Ethereum developers confirmed that stakers could begin withdrawing their staked ETH from around March of this year. This has apparently caused a rush to get on Lido, with the ongoing bear market making staking seem more attractive. As such, expect LDO to have a big 2023.

Toncoin (TON)

TON is the native token of The Open Network, a proof-of-stake blockchain that was originally founded by Telegram. While the popular social messaging app spearheaded the blockchain, it was sued by the SEC in 2019 and settled with the securities regulator in 2020, agreeing to reimburse the $1.2 billion it had raised in an initial coin offering.

TON’s entire price history. Source: CoinGecko

Following the case, Telegram relinquished control of The Open Network, with its development community taking over. Fast forward to the present day and The Open Network is gaining significant traction, with Telegram itself announcing in November that it will launch Fragment, an auction platform (for Telegram usernames) that runs on The Open Network. It followed up this bullish announcement with another in December, when it revealed a feature whereby users can sign up for an account on its app by paying TON, rather than by entering their telephone numbers.

TON rallied following these announcements, with the reason being that they suggested that Telegram — with its 700 million active monthly users — may integrate further with The Open Network.

Monero (XMR)

Monero (XMR) is the dark horse of the cryptocurrency market, and in more ways than one. On the one hand, its status as the biggest privacy coin by market cap (by a long margin) means that it will help legitimate users and criminals alike evade surveillance, for better and for worse. On the other hand, the combination of its genuine utility with a lack of fashionable meme-y-ness means that it often passes under the radar of many investors.

Monero’s price chart over the past year. Source: CoinGecko

Monero’s use case gained a boost last August when the US Treasury sanctioned Tornado Cash, a mixing service that provides cryptocurrency holders with anonymity. It also sanctioned another mixing service, Blender.io, in July of that year, suggesting that the days of mixing services may be numbered. However, privacy coins as a group rose in value as a result, and while XMR’s price has now fallen by 7.8% compared to where it was since the Tornado Cash ban (on August 8), it has held up very well compared to bitcoin and ethereum, for instance, which are down by 27% and 26% over the same period.

Honorable Mentions

Ripple (XRP) – could rally massively if Ripple wins its case against the SEC, although this is a big ‘if.’

Dogecoin (DOGE) – may benefit from Twitter integration, if Elon Musk’s early hints are to be believed.

Cardano (ADA) – often enjoys the most development activity of any major network, and may be grossly undervalued relative to its long-term potential.

Polygon (MATIC) – the biggest layer-two scaling solution for Ethereum, so likely to benefit from Ethereum’s dominance and growth.

Internet Computer (ICP) – another layer-one network that has lots of development potential, but has yet to realize such potential in a big rally.