- >News

- >Here’s Why Binance Coin Surged By Over 450% in a Month

Here’s Why Binance Coin Surged By Over 450% in a Month

While bitcoin and ethereum generally garner the lion’s share of attention in the crypto world, other tokens have also been performing well in recent weeks and months. In fact, certain tokens have even been outperforming the two biggest cryptocurrencies, with Binance Coin (BNB) being one of the strongest performers.

Binance’s very own cryptocurrency — which grants discounts on Binance trading fees and can also be staked in the Binance Smart Chain — has risen by over 70% in 14 days, over 450% in a month, and by more than 1,000% in a year. These short/medium-term rises put both ethereum and bitcoin to shame, yet the question is: why has BNB risen by so much, and is its impressive growth sustainable?

The answer to the first question mostly relates to the unfortunate surge in Ethereum transaction fees, which have skyrocketed recently and made using various DeFi platforms prohibitive for some traders. As for the second question, it’s unlikely that BNB will continue outperforming ethereum (or bitcoin) in the longer term, since with the eventual arrival of Ethereum 2.0, the high ETH fees which have boosted BNB should cease being an issue.

High Ethereum Gas Fees Push Users to Binance Smart Chain

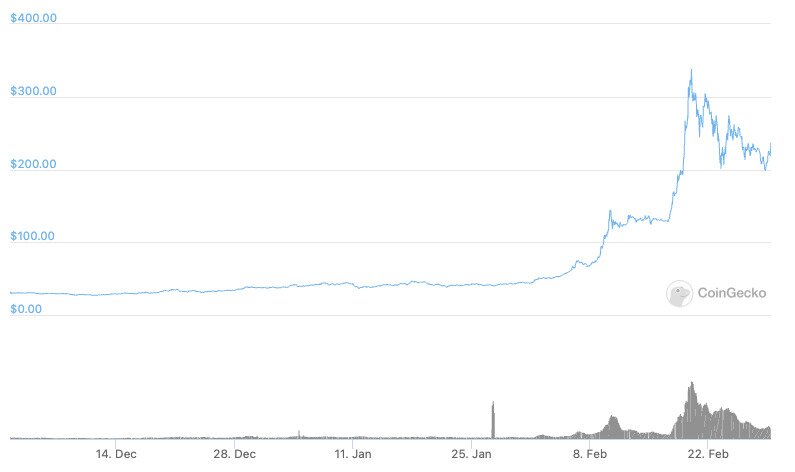

Let’s put things in some perspective. Binance coin has started from a relatively low base, which has enabled it to grow proportionally stronger than ethereum (and bitcoin). As the chart below indicates, BNB’s price was about $30 at the beginning of December, but has since risen by 683%, to $235 (as of writing).

Source: CoinGecko

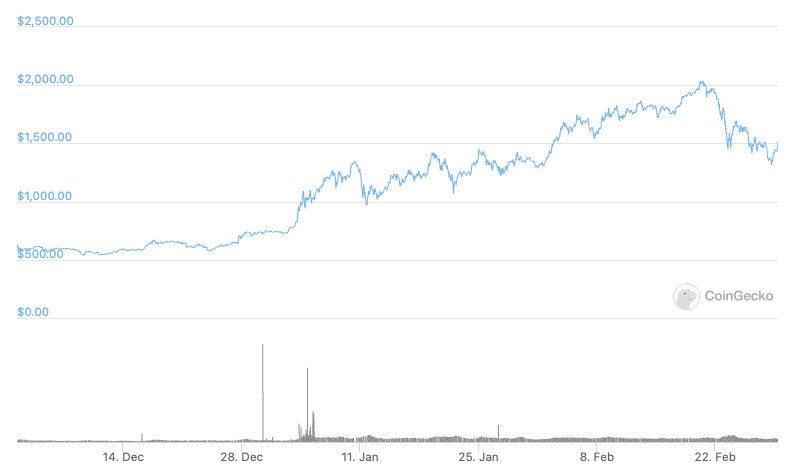

As for ethereum, it has also had a good 90 days, but nowhere near as good (in percentage terms) as BNB. It has risen from about $600 at the beginning of December to $1,505 on March 1, making for a climb of 150%.

Source: CoinGecko

So why has BNB pumped? Three words: ethereum gas fees. Actually, let’s add a fourth word: DeFi.

Because DeFi has become increasingly popular in recent months, ethereum has risen, yet because ethereum’s rising price and popularity has led to a surge in transaction fees, DeFi users have begun looking for other, cheaper alternatives. And they’ve found the Binance Smart Chain, which hosts a number of now-popular DeFi platforms.

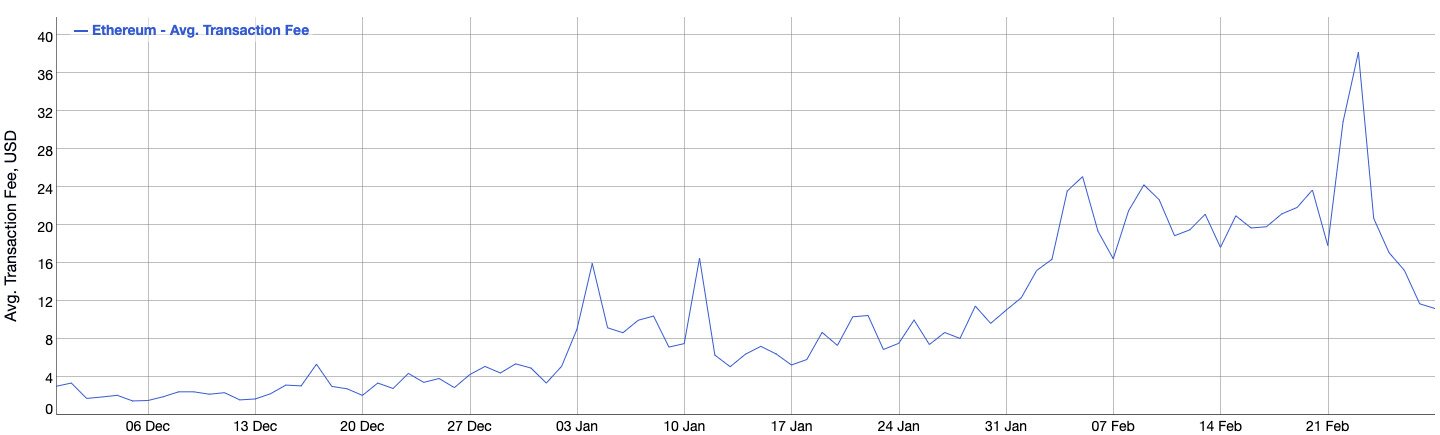

The chart below shows that average Ethereum transaction fees hit an all-time high of $38.21 on February 23, having risen by over 1,000% since the beginning of December.

Source: BitInfoCharts

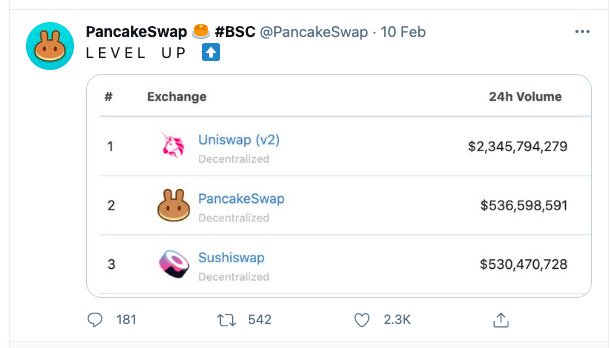

And funnily enough, BNB hit its all-time high only a few days before this date, reaching $339 on February 19. It was also only a week or so before, on February 10, that PancakeSwap — a decentralized exchange on Binance Smart Chain — overtook the Ethereum-based SushiSwap in terms of 24-hour volume.

Source: Twitter

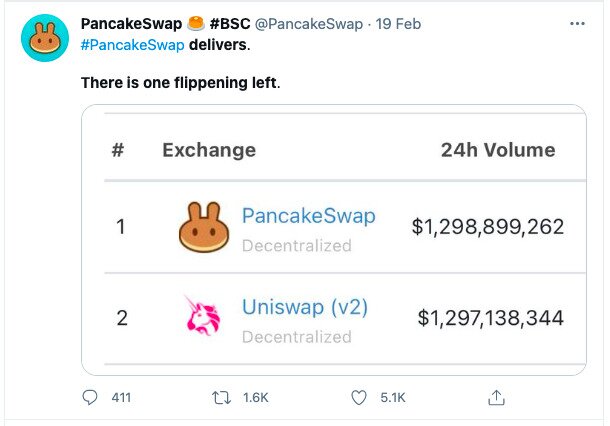

On February 19 — the day BNB hit its all-time high — PancakeSwap even went so far as overtaking Uniswap as the biggest decentralized exchange in terms of daily volume.

Source: Twitter

Put simply, because the Binance Smart Chain became more popular, so too did Binance coin. That’s because BNB is used not only to pay fees on BSC, but also for staking, since BSC uses a “proof-of-staked-authority” consensus mechanism (with validators staking BNB to confirm transactions).

So the more in demand BSC becomes, the more in demand BNB becomes. Indeed, in recent weeks posters on Reddit have increasingly inquired about how they can stake their BNB on BSC in order to earn interest.

Rewards And Promotions

High Ethereum transaction fees aren’t the only reason BNB has risen strongly, however. Aside from a growing interest in staking (which has obviously increased in tandem with the rising fortunes of BNB and BSC), it’s worth pointing out that Binance Smart Chain and many of the platforms on it have been promoted a little more aggressively than their Ethereum equivalents.

Starting with PancakeSwap, Binance notes on its own Academy site that the DEX is very much like Ethereum’s SushiSwap, except that it “also incorporates many other features that let you earn rewards.”

If we’re being highly cynical, we could translate “rewards” as ‘inducements’ or — more bluntly — ‘bribes’ to get users to move over to PancakeSwap. For example, PancakeSwap doesn’t only let you exchange tokens with other users, but also lets users stake a variety of cryptocurrencies in order to earn CAKE tokens. They can even stake their CAKE tokens to earn… even more CAKE tokens.

Source: Binance Academy

Binance doesn’t clarify the underlying economics of this system of staking and rewards, but given that it is the biggest exchange in the world, we assume its deep pockets allow it to fund such financial incentives for its growing base of users (at least for now).

Such rewards aren’t uncommon within the Binance Smart Chain ecosystem. For instance, in November 2020, when BSC had only just begun its quest to rival Ethereum, Binance launched a $240,000 rewards pool in which participants could “Earn Free Tokens.”

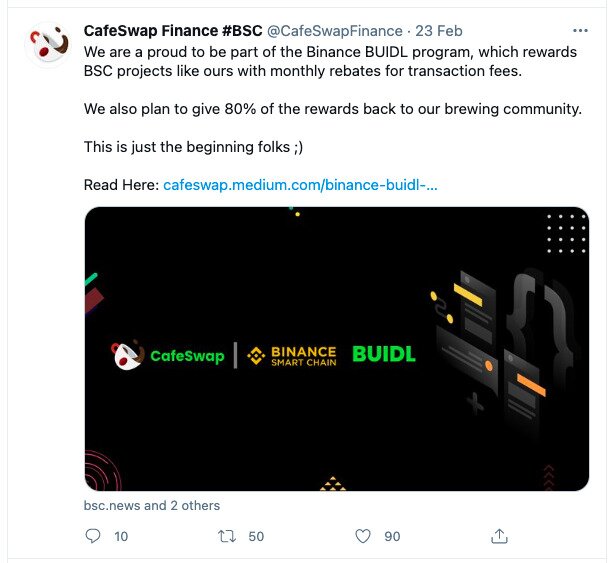

Similarly, the recently launched CafeSwap Finance noted on Twitter that it’s “part of the Binance BUIDL program, which rewards BSC projects like ours with monthly rebates for transaction fees.” It added that, thanks to such help, it “plans to give 80% of the rewards back to our brewing community.”

Source: Twitter

We also see something very similar with a recent YieldPANDA giveaway in which participants can “Win 300000 FREE TOKENS,” as well as with another PancakeSwap giveaway in December.

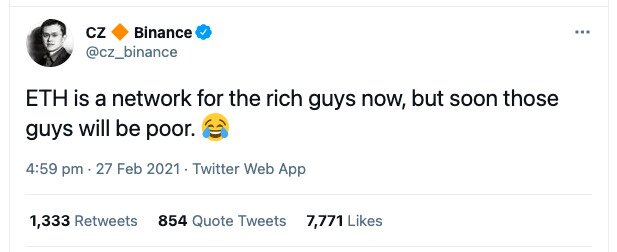

But it’s not only the financing of rewards for new users that is helping attract new converts. The CEO of Binance, Chanpeng Zhao, has himself been on the promotional warpath, particularly when it comes to promoting BSC at the direct expense of Ethereum.

Source: Twitter

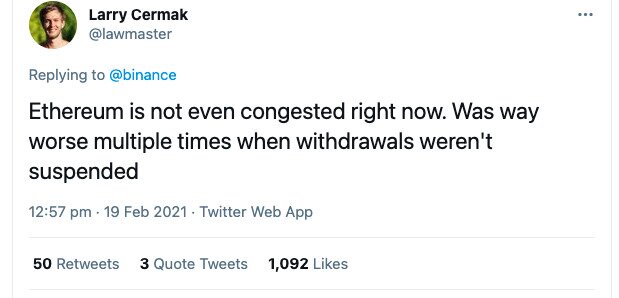

In fact, members of the Ethereum were left aghast on February 19, when Binance actually froze withdrawals of ethereum and ERC-based tokens due to “high network congestion.” Many assumed this was merely a cheap shot at Ethereum.

Source: Twitter

Binance did this again on February 23, raising further eyebrows and potentially making Ethereum look bad in the eyes of anyone tempted to start using BSC-based platforms.

Sustainability

Taken together, high Ethereum fees and the aggressive promotion of Binance Smart Chain have helped push Binance coin to new heights. However, it’s not certain that this situation can continue indefinitely.

For one, high ETH fees will be ended with the continued rollout of Ethereum 2.0, which moves Ethereum to a proof-of-stake consensus mechanism and thereby increases scalability and reduces costs (while increasing demand for ETH due to staking). This will remove much of the impetus to migrate to BSC, particularly when the Ethereum-based DeFi ecosystem still dwarfs its BSC-based equivalent.

At the same time, you’d assume that Binance can’t continue throwing money at BSC and its platforms forever. Yes, it has enviable finances, but if Ethereum’s move to ETH 2.0 succeeds in warding off much of the BSC challenge, it wouldn’t make sense to continue promoting BSC at the same level. As such, you’d probably find fewer people giving Binance Smart Chain a try.

In turn, you’d find BNB rising less spectacularly. Though for now it’s certainly enjoying a healthy surge. It has also certainly given the Ethereum development community renewed impetus in bringing ETH 2.0 to fruition.