- >News

- >How Bad Is the Silvergate Bankruptcy for the Cryptocurrency Market?

How Bad Is the Silvergate Bankruptcy for the Cryptocurrency Market?

Silvergate Bank looks like it may be the next big cryptocurrency firm to go bankrupt. Last week, the crypto-friendly lender delayed the publication of its annual financial report, citing a need to evaluate its ability to continue operating as a business. Shares in Silvergate have since fallen by 60%, while a growing number of exchanges — including Coinbase, Gemini and Bitstamp — have cut their financial ties with the bank, hoping to head off any market concerns that they may be exposed to contagion.

With Silvergate now suspending its cryptocurrency payments network, the Silvergate Exchange Network, serious concerns have begun to mount that it’s only a matter of time before the lender files for bankruptcy protection. The cryptocurrency market has already begun reacting to this possibility, in that its total cap has fallen by 6% since the news of Silvergate’s difficulties broke.

If the bank does go bankrupt, it would likely cause further losses, while there could be serious knock-on effects for the rest of the industry. This isn’t only in terms of price falls, but also in terms of other banks being willing to do business with cryptocurrency firms. However, it seems that most former clients of Silvergate have had no trouble in finding new banking partners, while it’s arguable that the market remains near a bottom, so bigger price falls are unlikely.

Why Silvergate Bank is Facing Potential Bankruptcy

Silvergate Bank has faced a number of financial challenges in the past few months, which together could potentially bring it down. First of all, it suffered a spate of withdrawals in the wake of the FTX collapse in November, with reports suggesting that these withdrawals amounted to as much as $8 billion.

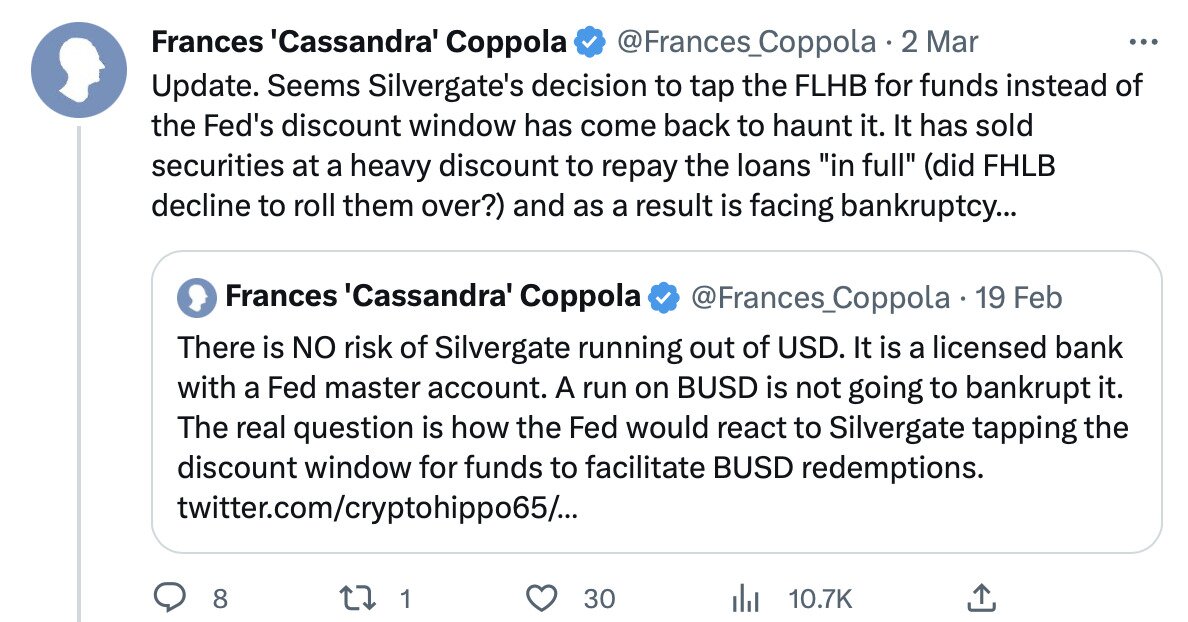

In order to honor these withdrawals, Silvergate had to sell around $5.2 billion in assets it held, doing so at a loss of around $718 million. It also took out a loan worth $4.3 billion from the Federal Home Loan Bank of San Francisco, which Silvergate has had to repay early.

Source: Twitter

The repayment of this loan was achieved by Silvergate selling yet more of its assets, likely at another loss. As such, it has found itself in a precarious financial position, as indicated by last week’s news that it’s delaying the publication of its annual results in order to weigh up its own viability. (It also had to repay $9.9 million to creditors of BlockFi.)

On top of this, it has suspended its Silvergate Exchange Network, meaning that it has effectively stopped doing business with crypto-exchanges and other related platforms. It says this is a “risk-based decision,” something which likely means that it wants to assure any prospective future creditors (if any are forthcoming) that it has stopped dealing with a volatile sector, namely crypto.

The Effect on Crypto

In response to all of this drama, cryptocurrency prices have taken a battering. Bitcoin (BTC) is down by 5% since the news of Silvergate’s troubles broke, as is ethereum (ETH) and numerous other major coins.

Bitcoin’s price over the past seven days. Source: CoinGecko

It’s likely that their troubles will only worsen if Silvergate does indeed file for bankruptcy. This is for two central reasons.

On the one hand, there may be considerable exposure to the bank within the wider cryptocurrency market and industry. Already, a number of firms and platforms have offered reassurance that their exposure to the embattled lender is minimal, yet their protestations cannot be taken as guarantees of anything.

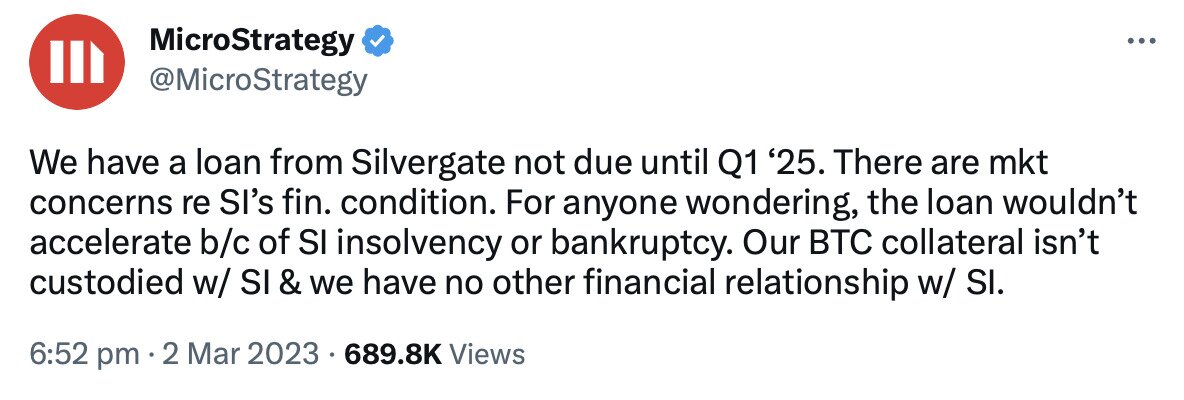

In the case of MicroStrategy, for instance, it has an outstanding $205 million loan from Silvergate. It quickly moved to suggest that repayment of this loan wouldn’t accelerate in the event of a Silvergate bankruptcy, yet its tweet on this met with some plausible questioning.

Source: Twitter

This highlights the difficulties that Silvergate’s collapse could cause, with MicroStrategy owning more bitcoin (roughly 132,500) than any other publicly listed company. Yet the bank’s crisis throws up another big issue for crypto, which is that it may make it harder for exchanges and other platforms to secure banking services in the future.

Why? Well, because as commentators have pointed out, the nature and volatility of the cryptocurrency market means that providing banking services to crypto-exchanges can be very risky. Even though it had no direct exposure to FTX, Silvergate suffered when its customers — exchanges — sought $8 billion in withdrawals following FTX’s collapse. In turn, these exchanges were requesting withdrawals because their own customers — investors — were looking to get their money back during a steep market downturn.

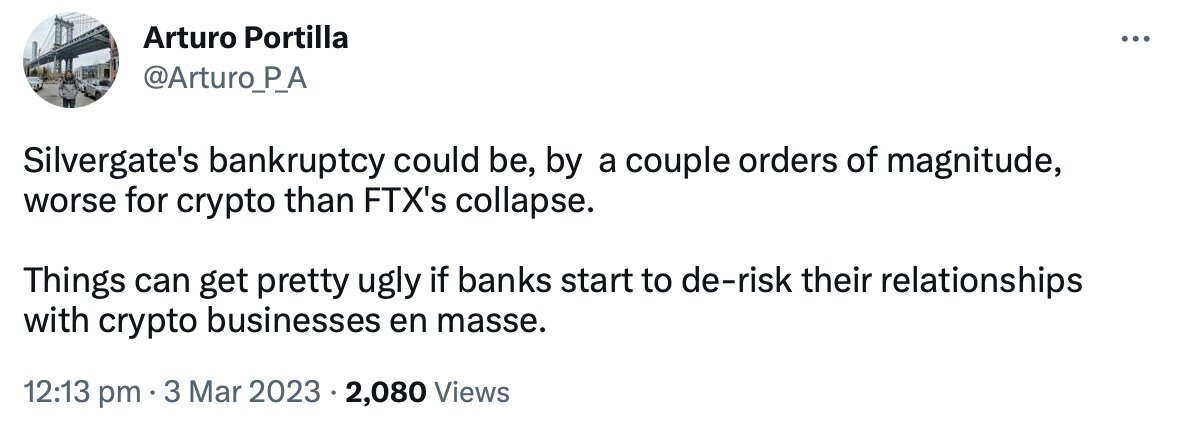

Source: Twitter

As fintech-focused lawyer Arturo Portilla noted on Twitter, banks may choose to refuse to do business with exchanges, while banks that already provide services to trading platforms may choose to end doing so. This could make it extremely hard for the industry and market to operate.

Indeed, some banks had already been reducing their exposure to crypto in recent weeks. Most notably, Signature Bank had announced in December that it would reduce its crypto-related deposits by $8 billion, to $10 billion. It had also announced that it would cease processing SWIFT fiat transactions of less than $100,000 for individuals of less than $100,000, something which caused Kraken to stop using the bank earlier this month for certain services.

This is significant because, in the wake of Silvergate’s troubles, it seems that many exchanges are seeking to move to Signature. This includes Coinbase, yet with the bank recently deciding to limit its crypto-related deposits, it’s questionable as to whether every exchange that has left Silvergate can make the same move as Coinbase.

Crypto Weathers Another Winter

It’s arguable that the damage of any eventual Silvergate Bank bankruptcy has already been done, in that the market has priced in a collapse and that exchanges have already moved banks. Indeed, given that the overall market remains 64% down from its all-time high of $3 trillion, it still remains pretty close to a bottom, even if it has picked up a little since the start of the year.

In other words, it’s arguable that there’s not much that a bankruptcy can do to prices that the recent news hasn’t already done. As for the issue of exchanges securing stable banking relationships, this is a thornier issue, especially in light of how the Federal Reserve and other regulators in the US have recently warned banks against crypto-related platforms and clients.

This is where regulation comes in. In the US, the EU and various other parts of the developed world, lawmakers are moving increasingly close to introducing comprehensive cryptocurrency legislation. While people within crypto view regulation suspiciously, it’s arguably needed if the industry is to be integrated more sustainably and securely into the wider global economy.

And make no mistake, such regulation is coming. This is why, even if some exchanges may find it difficult to secure banking services, the legitimate ones will increasingly find it more straightforward in the not-too distant future. And with this development, the risk of fear-induced market downturns will be significantly smaller.