- >News

- >Will Millennials Turn to Cryptocurrency as Generational Wealth Transfer Begins?

Will Millennials Turn to Cryptocurrency as Generational Wealth Transfer Begins?

The cryptocurrency revolution is taking place right before our eyes. Some have even called it the greatest transfer of wealth the world has ever seen. While this fact has yet to be seen, the foundation has been laid. As of right now, an estimated 17,000 new millionaires have been created as a result of the monolithic rise of bitcoin. As the price of bitcoin increases, this number is only expected to increase as well.

The significance of the establishment of digital currency cannot be understated. Cryptocurrency is a global phenomenon, and previous great wealth transfers have typically been confined to a particular demographic, or geographic region. The global nature of cryptocurrency means the whole world can watch as the next great transfer of wealth unfolds.

The Next Generational Wealth Transfer

The next big transfer of wealth is generational. The children of baby boomers are set to inherit trillions of dollars from their parents. While estimates vary, the number stands between 18 and 68 trillion. Within the next 30 years, much of the wealth that has been amassed and hoarded by baby boomers will be passed on to a younger demographic. There are many predictions as to what the outcome of such a wealth transfer will look like. I believe that a certain percentage of the financial assets transferred to the younger generation will be funneled directly into cryptocurrency investments. Young people are not as interested in the stock market or traditional investments.

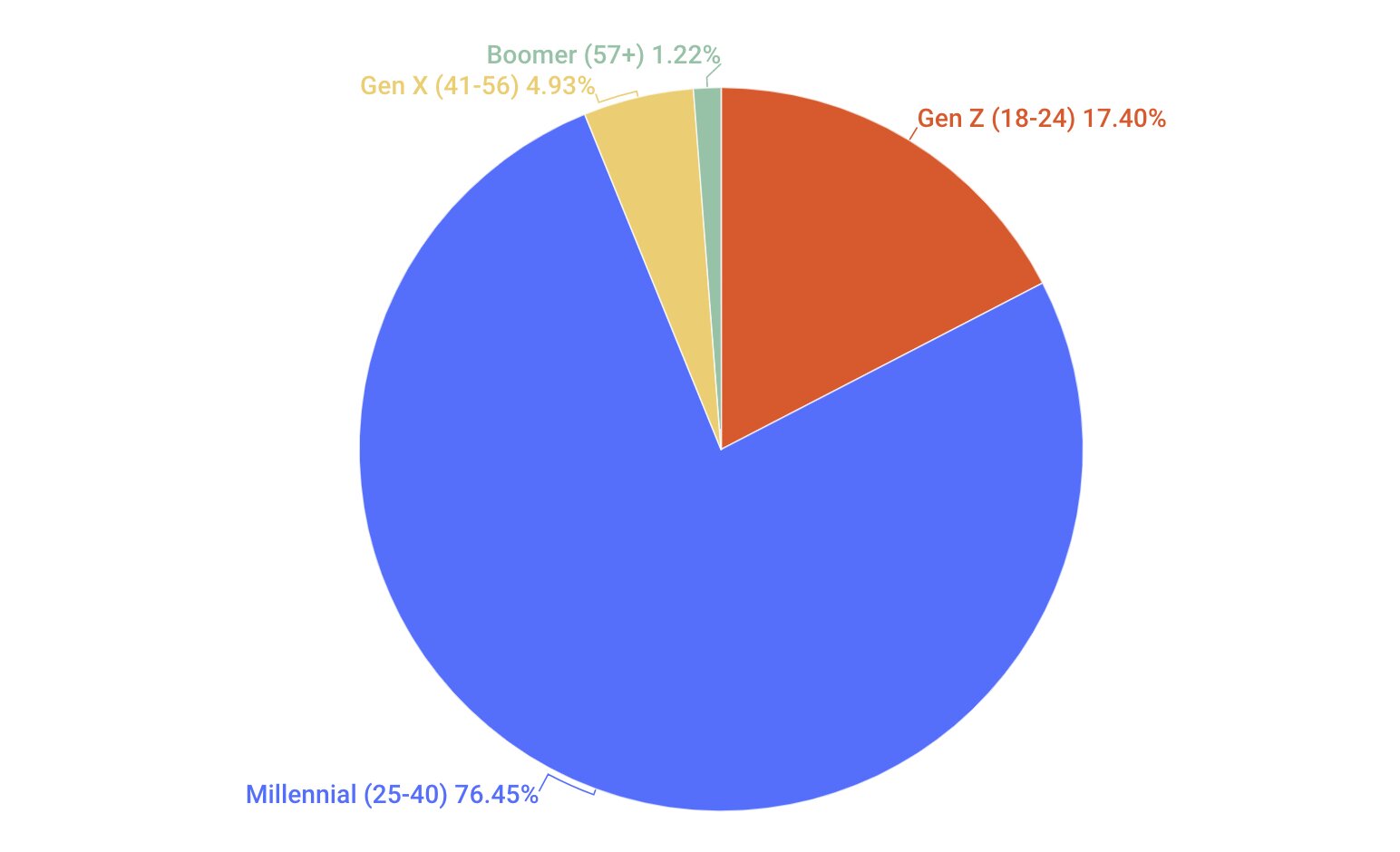

According to a study by Stilt, roughly 94% of crypto investors are Millennials or Gen Z.

A growing number of young people are turning to cryptocurrency as a means of growing and securing wealth. This is for a variety of reasons. The first fact is that young people are in a better life position to take greater risks than their elders. Bitcoin as a retirement plan doesn’t sound too bad if your retirement is 30+ years away. The second fact is that millennials have lived through two economic crises wherein traditional “stable” asset classes such as housing crumbled. This fostered an extreme and deep amount of mistrust in the established financial institutions.

Millennials are very turned onto anything that represents the breakaway from business as usual. Cryptocurrency manages to offer them exactly that. The financial and political values offered by cryptocurrencies such as bitcoin resonate much more deeply with the younger generation. So don’t be surprised if a swath of young people turn their inheritance into cryptocurrency.

The Bitcoin Millionaires of Today

There have already been a great number of millionaires created from the rise of cryptocurrency. I fully expect to see this trend continue as more and more people get turned onto the potential of bitcoin.

Erik Finman is the youngest known bitcoin millionaire. Erik is now 21, and has a number of different accomplishments to his name. He is most well known for taking a $1,000 gift from his grandparents, and buying only bitcoin with it. This further backs up the previous point that young people will turn money received from old people into cryptocurrency. Erik has now amassed about 401 bitcoin, which is equivalent to about $4 million dollars worth. Today, Erik has built and launched several startups including a multi-million dollar cryptocurrency company.

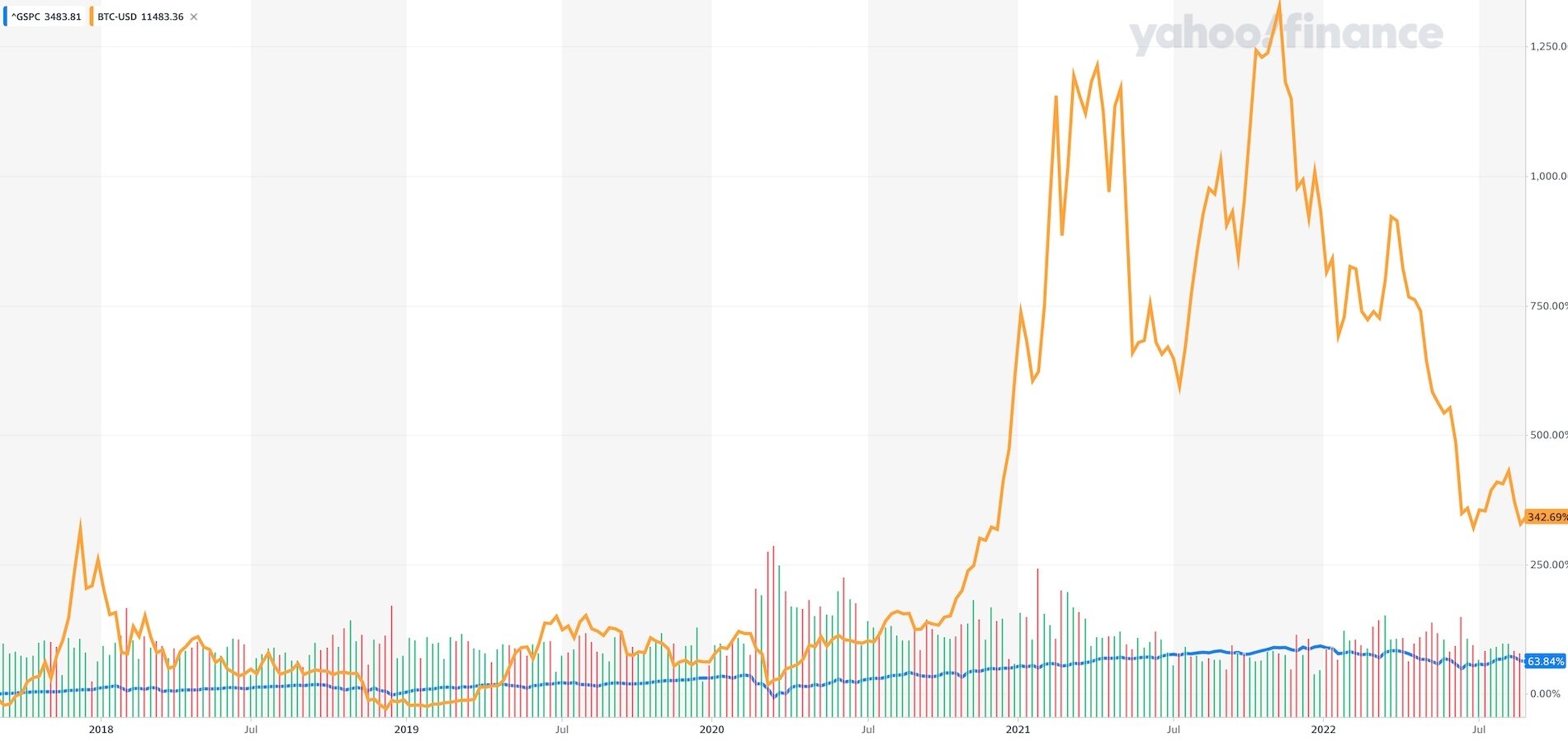

Despite a recent pullback, BTC still produced bigger gains than the S&P500 over the last five years. Source: Yahoo Finance

The other bitcoin millionaires worth mentioning are the Winklevoss Twins. You may know them from the Facebook lawsuit where they won $65 million dollars. They invested $11 million of their winnings into bitcoin in 2013. They became the first bitcoin billionaires in 2017 during the great cryptocurrency bubble. Since then, they have built their own proprietary cryptocurrency exchange called Gemini.

Those Who Benefit from Crypto, Tend to Reinvest in Crypto

Both Erik Finman and the Winklevoss twins have benefited immensely from investing in cryptocurrency. Their situations are unique and characteristic of the “best case scenario”. However, there are smaller scale stories popping up all over the internet. The thread that connects each of the stories is what these people decided to do once they became rich. You may think that if you became a millionaire overnight, you would buy the first flight to Hawaii. Spend your days lounging on the beach, spending your bitcoin bit by bit. Each one of these people that got rich from cryptocurrency had something more to give back to the community. They all reinvested in the long term success of the global project.

What these people have in common, is that they are early investors. In order to be an early investor in bitcoin, two things had to be true.

- You had to know about cryptocurrency around/before 2013.

- You had to be crazy enough to invest a decent amount of money in something weird.

There was no guarantee that bitcoin would work in the early stages of its journey. So it is not surprising that early investors that got rich in a short span of time would reinvest in the thing that got them rich in the first place. The earliest investors in bitcoin invested because of its potential, and because they believe it would work. Peter Saddington is quoted saying this about bitcoin:

“What solidified my confidence that this is worth investing in is that the code is based on math. It can’t be turned off”

This indicates a fundamental belief in the underlying system, rather than the potential to get rich. Ironically there are several notable individuals who have built generational wealth in crypto because of that philosophy. Ultimately, the belief in the system is what will propel bitcoin and other cryptocurrencies into mass adoption.

Wealth Transfer Because Cryptocurrency Actually Works

This generational wealth transfer signifies much more than just the older generation dying out. It represents a shift in beliefs, values, and power. This is playing out in a variety of ways on the world stage. Whether that is protests, mass organization on social media platforms, or the prolific rise of cryptocurrency. Many of these movements that we see play out last several months, and in some cases a year or more.

Cryptocurrency is unique because its existence itself is a protest against the current financial paradigm. It is the longest running peaceful protest against the establishment. Other protests die out because they lack organization, or leadership, or a common goal. Cryptocurrency is, and has been working for over a decade now, because it actually works.

For the first time in history, people have the ability to voluntarily transfer their wealth into a system that actually serves them. By design, cryptocurrency is coordinated, organized, and aimed at accomplishing a goal: Wealth transfer and financial revolution.